Australia Earthquake Resistant Building Materials Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Australia Earthquake Resistant Building Materials Market Overview:

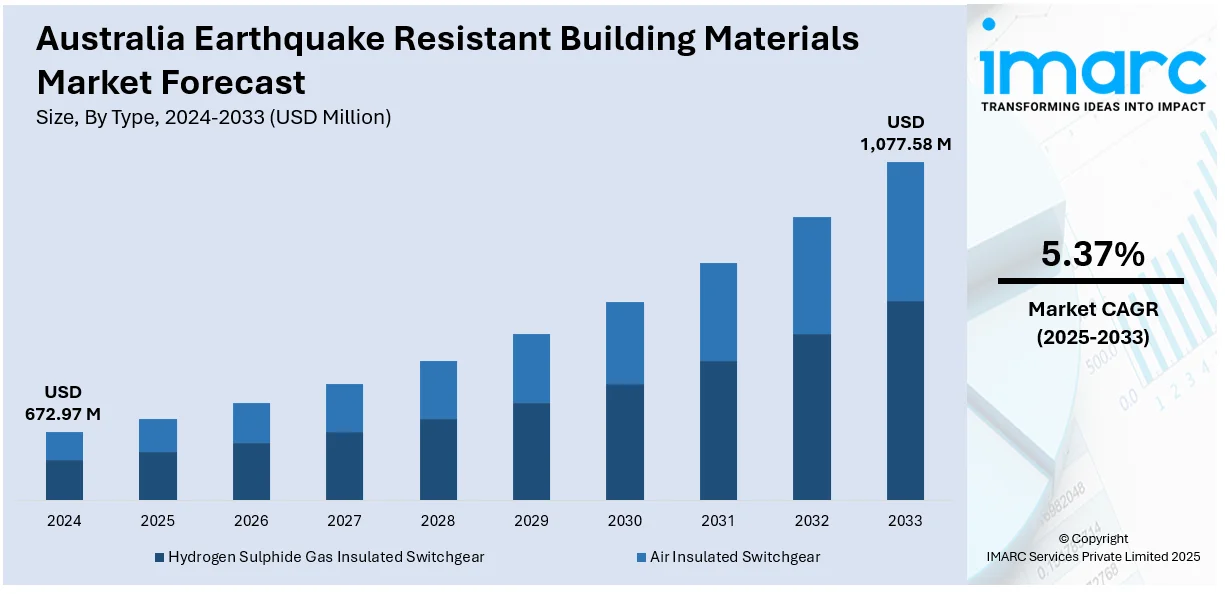

The Australia earthquake resistant building materials market size reached USD 672.97 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,077.58 Million by 2033, exhibiting a growth rate (CAGR) of 5.37% during 2025-2033. At present, property owners and investors are becoming more proactive in selecting materials that minimize damage risk, insurance costs, and potential reconstruction expenses. Besides this, government policies and updated building codes are encouraging the use of advanced materials to ensure safety in seismically active zones, thereby contributing to the expansion of the Australia earthquake resistant building materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 672.97 Million |

| Market Forecast in 2033 | USD 1,077.58 Million |

| Market Growth Rate 2025-2033 | 5.37% |

Australia Earthquake Resistant Building Materials Market Trends:

High seismic activity

High seismic activity is fueling the market growth in Australia. Several regions are experiencing moderate seismic activity, which is generating concerns about the resilience of buildings and infrastructure. As per the information provided on the official website of the Australian Government, Geoscience Australia documented more than 40 earthquakes in the Muswellbrook area from 23 August 2024 to 31 October 2024. The growing awareness is encouraging the adoption of advanced materials that enhance structural strength and flexibility. Earthquake resistant building materials, such as reinforced concrete, steel framing systems, shock-absorbing foundations, and flexible joints, are gaining traction among contractors. As seismic zones are more closely monitored, stringent building codes are being implemented to ensure safety and long-term durability. This regulatory encouragement is driving the demand for tested and certified materials that can withstand tremors. The government and private sectors are investing in research and development (R&D) activities to innovate cost-effective solutions for seismic resilience. Property owners and investors are becoming more proactive in selecting materials that reduce damage risk, insurance costs, and potential reconstruction expenses. The educational and media sectors also aid in generating public awareness, catalyzing the demand across urban and rural areas in Australia.

To get more information on this market, Request Sample

Growing infrastructure development

Rising infrastructure development is impelling the Australia earthquake resistant building materials market growth. As new buildings, bridges, and transportation networks are being developed across urban and regional areas, there is a rising emphasis on structural integrity and long-term resilience. Government policies and updated building codes are encouraging the use of earthquake resistant materials to ensure safety in seismically active zones. Builders and developers are adopting these materials to reduce future damage, minimize repair costs, and protect lives. The focus on sustainable and disaster-resilient infrastructure is further supporting the shift toward advanced building technologies. Public and private investments in infrastructure projects are driving the demand for materials, such as reinforced concrete, shock absorbers, and flexible steel. As cities are expanding and older structures are being replaced or upgraded, the utilization of earthquake resistant materials is becoming standard practice. This growing trend is strengthening the market and creating opportunities for innovations and manufacturing in the thriving construction sector. According to the IMARC Group, the Australia construction market is set to attain USD 588 Billion by 2033, exhibiting a CAGR of 4.30% from 2025-2033.

Australia Earthquake Resistant Building Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Hydrogen Sulfide Gas Insulated Switchgear

- Air Insulated Switchgear

The report has provided a detailed breakup and analysis of the market based on the type. This includes hydrogen sulfide gas insulated switchgear and air insulated switchgear.

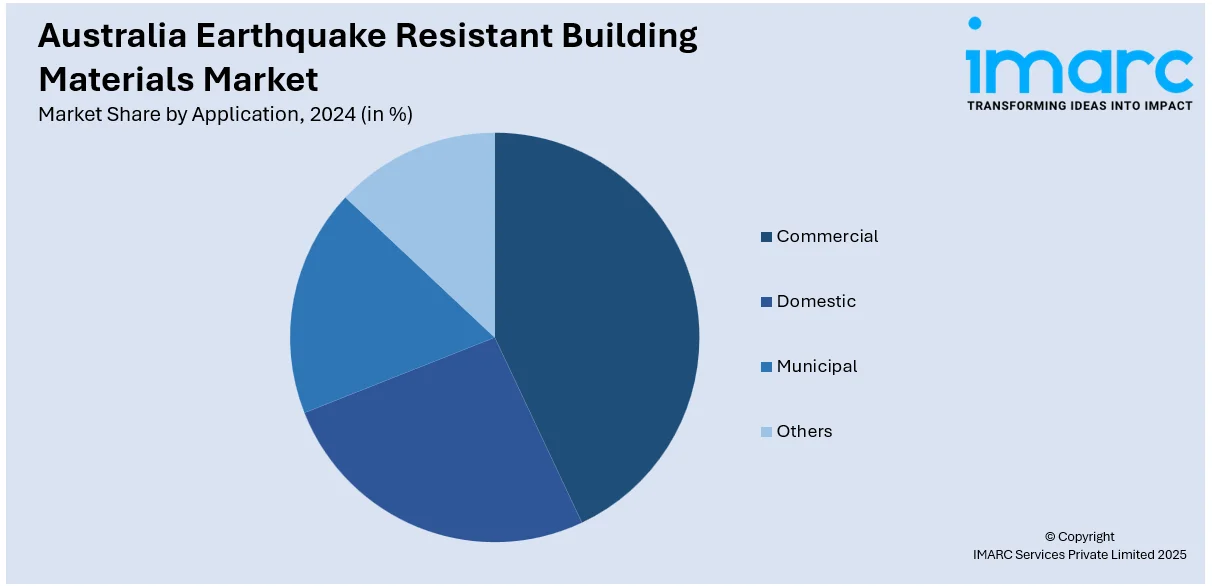

Application Insights:

- Commercial

- Domestic

- Municipal

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, domestic, municipal, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Earthquake Resistant Building Materials Market News:

- In December 2024, Dr. Anita Amirsardari, a researcher at Swinburne, spearheaded the creation of Australia’s inaugural seismic design standards for post-installed concrete fasteners, in collaboration with the Australian Engineered Fasteners and Anchors Council (AEFAC). AEFAC was engaged in formulating design guidelines for fasteners in concrete. This project was backed by SmartCrete CRC. Dr. Amirsardari's research in fasteners also encompassed additional materials that must be resistant to earthquakes. She created guidelines for timber-framed floor and roof diaphragms to withstand in-plane forces like wind and seismic loads.

Australia Earthquake Resistant Building Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydrogen Sulphide Gas Insulated Switchgear, Air Insulated Switchgear |

| Applications Covered | Commercial, Domestic, Municipal, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia earthquake resistant building materials market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia earthquake resistant building materials market on the basis of type?

- What is the breakup of the Australia earthquake resistant building materials market on the basis of application?

- What is the breakup of the Australia earthquake resistant building materials market on the basis of region?

- What are the various stages in the value chain of the Australia earthquake resistant building materials market?

- What are the key driving factors and challenges in the Australia earthquake resistant building materials market?

- What is the structure of the Australia earthquake resistant building materials market and who are the key players?

- What is the degree of competition in the Australia earthquake resistant building materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia earthquake resistant building materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia earthquake resistant building materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia earthquake resistant building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)