Australia Eco Friendly Cement Market Size, Share, Trends and Forecast by Type, Raw Material, Application, End User, and Region, 2025-2033

Australia Eco Friendly Cement Market Overview:

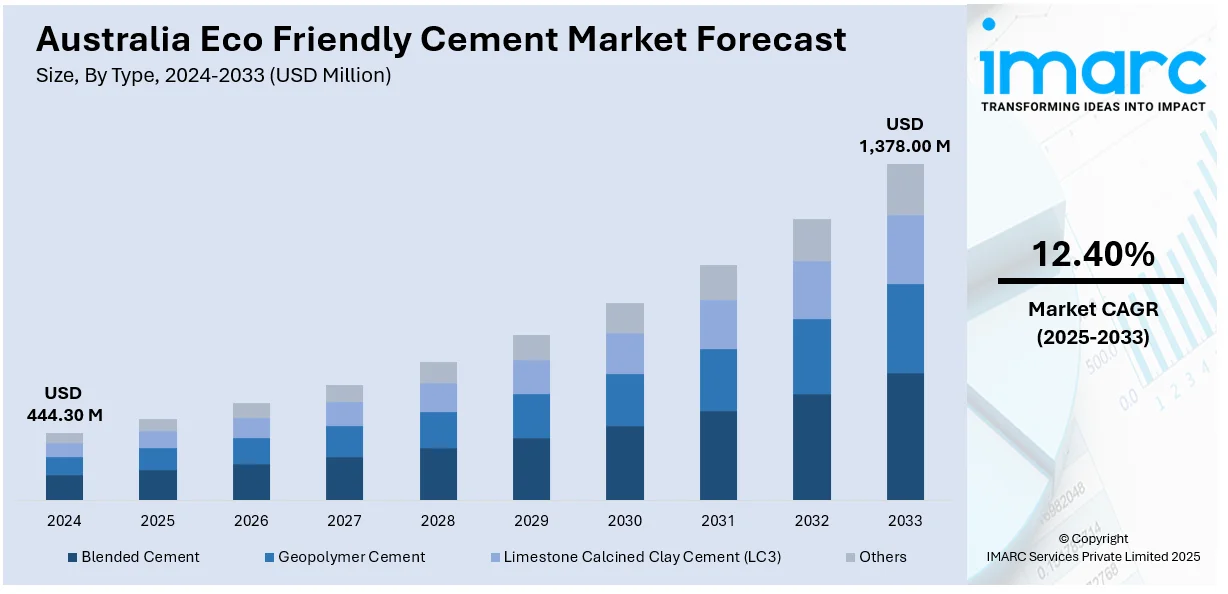

The Australia eco friendly cement market size reached USD 444.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,378.00 Million by 2033, exhibiting a growth rate (CAGR) of 12.40% during 2025-2033. The market includes the increasing environmental regulations aimed at reducing carbon emissions, growing demand for sustainable construction materials, and rising government support through funding and incentives. Technological advancements enabling the use of industrial by-products and alternative fuels also boost Australia eco friendly cement market share. Additionally, heightened awareness of climate change and the construction industry’s carbon footprint encourages adoption of greener cement options, making sustainability a central focus for manufacturers and developers across Australia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 444.30 Million |

| Market Forecast in 2033 | USD 1,378.00 Million |

| Market Growth Rate 2025-2033 | 12.40% |

Australia Eco Friendly Cement Market Trends:

Integration of Industrial By-Products in Cement Production

Australia is increasingly employing industrial by-products such as fly ash, slag, and aluminosilicate waste in cement manufacturing to minimize the environmental footprint of conventional clinker-based procedures. What were formerly waste materials are now being reused to minimize carbon emissions and align with circular economy objectives. By substituting part of the clinker a key source of carbon di oxide (CO₂) emissions these by-products contribute to reducing the carbon footprint of cement production. Alliances between cement and mining industries are leading this sustainable practice forward, encouraging the efficiency of resources and minimizing waste. This transition not only helps in preserving natural resources but is also supported by national policies to decarbonize heavy industries. Due to this, the use of industrial waste products is a key force behind the Australia's green cement market growth.

To get more information on this market, Request Sample

Government Incentives and Funding for Sustainable Practices

The Australian government is playing a vital role in promoting eco-friendly cement production by providing substantial funding and incentives aimed at modernizing manufacturing facilities. The Railton facility of Cement Australia is a prime example; it received $52.9 million to switch from coal to alternative fuels including biomass and waste-derived materials, resulting in a considerable yearly emission reduction of 107,000 tonnes. This financial support encourages the cement industry to adopt sustainable practices, helping meet stricter environmental regulations and carbon reduction targets. Beyond environmental benefits, government backing stimulates innovation, infrastructure upgrades, and economic growth, contributing to job creation within the green construction sector. By advancing this sustainable industrial transformation, Australia is facilitating the broader implementation of environmentally responsible cement production practices, thereby reaffirming its commitment to lowering the carbon footprint of heavy industries and contributing to the nation’s net-zero emissions objectives.

Development of Sustainable Cement Alternatives

Australia is leading the way in creating sustainable alternatives to cement using new research that involves the use of waste materials to save carbon emissions. Researchers are looking at using agricultural and organic wastes like coffee grounds to create biochar and other additives to strengthen concrete without using conventional cement. As cement manufacturing is energy-intensive and contributes significantly to CO₂ emissions, such alternatives provide a cleaner option with increased performance and durability advantages. This transition comes as part of an increasing emphasis on circular economy principles, where waste is converted into valuable materials for use in the construction sector. Through reducing the use of virgin materials and encouraging waste reuse, Australia is advancing in environmentally friendly construction. These developments emphasize the nation's dedication to green innovation and sustainability in the construction industry, to the benefit of both environmental objectives and sustainable economic stability.

Australia Eco Friendly Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, raw material, application, and end user.

Type Insights:

- Blended Cement

- Geopolymer Cement

- Limestone Calcined Clay Cement (LC3)

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended cement, geopolymer cement, limestone calcined clay cement (LC3), and others

Raw Material Insights:

- Fly Ash

- Slag

- Silica Fume

- Recycled Aggregates

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes fly ash, slag, silica fume, recycled aggregates, and others.

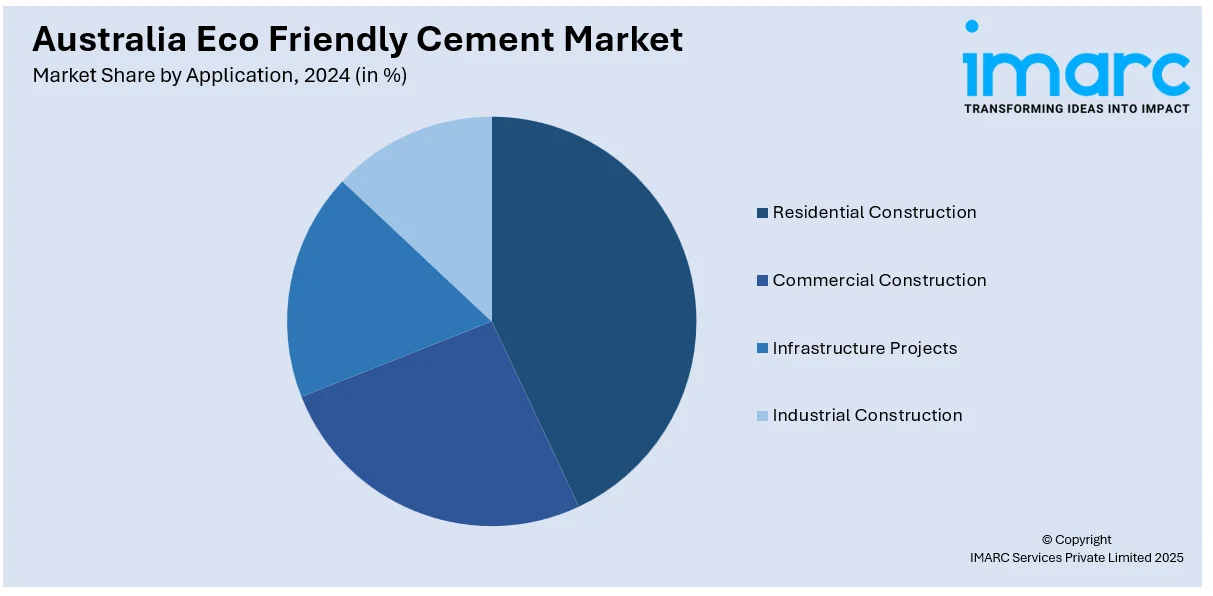

Application Insights:

- Residential Construction

- Commercial Construction

- Infrastructure Projects

- Industrial Construction

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential construction, commercial construction, infrastructure projects, and industrial construction.

End User Insights:

- Government and Public Sector

- Private Contractors

- Individual Home Builders

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes government and public sector, private contractors, and individual home builders.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Eco Friendly Cement Market News:

- In March 2025, The new Low Carbon Cement product from Cement Australia was formally introduced at the Independent Hardware Group (IHG) conference in Adelaide in 2025. The biggest independent hardware group in Australia, IHG, distributes well-known brands like Home Hardware and Mitre 10. The event attracted around 1,700 delegates and 450 stores. Cement Australia was also recognized as the Best Build Supplier of 2024, highlighting its leadership in sustainable building materials.

- In January 2025, Cement Australia and Holcim collaborated on the Yitpi Yartapuultiku Cultural Centre in South Australia, using Cement Australia's GreenCem technology to reduce concrete’s embodied carbon. GreenCem replaces up to 80% of cement with Australian-sourced fly ash and slag, maintaining strength while cutting carbon emissions by up to 38%. Cement Australia emphasizes ongoing innovation in low-carbon concrete to meet community and environmental expectations without compromising construction performance.

Australia Eco Friendly Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended Cement, Geopolymer Cement, Limestone Calcined Clay Cement (LC3), Others |

| Raw Materials Covered | Fly Ash, Slag, Silica Fume, Recycled Aggregates, Others |

| Applications Covered | Residential Construction, Commercial Construction, Infrastructure Projects, Industrial Construction |

| End Users Covered | Government and Public Sector, Private Contractors, Individual Home Builders |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia eco friendly cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia eco friendly cement market on the basis of type?

- What is the breakup of the Australia eco friendly cement market on the basis of raw material?

- What is the breakup of the Australia eco friendly cement market on the basis of application?

- What is the breakup of the Australia eco friendly cement market on the basis of end user?

- What is the breakup of the Australia eco friendly cement market on the basis of region?

- What are the various stages in the value chain of the Australia eco friendly cement market?

- What are the key driving factors and challenges in the Australia eco friendly cement market?

- What is the structure of the Australia eco friendly cement market and who are the key players?

- What is the degree of competition in the Australia eco friendly cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia eco friendly cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia eco friendly cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia eco friendly cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)