Australia Edible Grocery Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Consumer Demographics, and Region, 2026-2034

Australia Edible Grocery Market Overview:

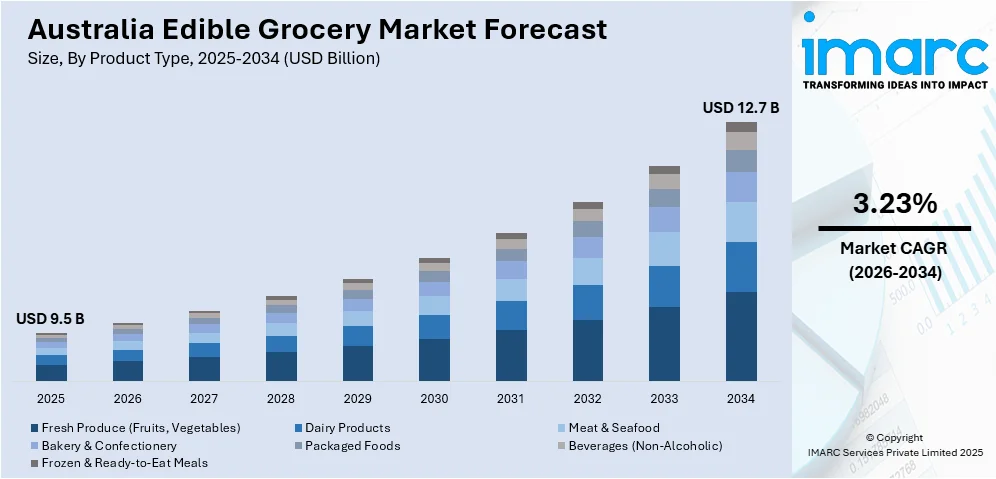

The Australia edible grocery market size reached USD 9.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 12.7 Billion by 2034, exhibiting a growth rate (CAGR) of 3.23% during 2026-2034. The rising consumer demand for fresh and organic foods, expanding e-commerce industry, innovative packaging solutions, growing health awareness, diverse product offerings, and increasing preference for convenience-driven grocery solutions are some of the key factors impelling the Australia Edible Grocery Market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.5 Billion |

| Market Forecast in 2034 | USD 12.7 Billion |

| Market Growth Rate 2026-2034 | 3.23% |

Australia Edible Grocery Market Trends:

The Shift Toward Health and Wellness Products

The growing consumer focus on health and wellness, driven by increasing awareness of the link between food choices and overall health, is significantly contributing to the market expansion. Business operations now focus on developing natural, organic, along with minimally processed products in response to consumer demands for healthier choices. Customers actively search for food products without artificial additives or preservatives while looking for items containing less than high sugar content. Businesses that operate supermarkets along with specialty stores now offer more health-focused items because customers are demanding gluten-free products and plant-based and low-calorie options. Moreover, as consumers are seeking added health benefits from their everyday grocery purchases, the growing popularity of functional foods, such as those fortified with vitamins, minerals, or probiotics, is further fueling the Australia edible grocery market share.

To get more information on this market Request Sample

Expansion of Online Grocery Shopping

The shift toward e-commerce, primarily driven by convenience and enhanced delivery options, is fueling the market demand. Websites enable consumers to explore a diverse range of items, evaluate costs, and make purchases conveniently from the comfort of their own homes. Innovations in delivery logistics, such as same-day and contactless delivery, are boosting the appeal of online grocery shopping. Retailers are heavily investing in user-friendly mobile apps and personalized shopping experiences integrated with artificial intelligence (AI). Additionally, subscription services and meal kits are emerging as popular choices, as they are offering pre-portioned, ready-to-eat (RTE) ingredients delivered directly to consumers' doorsteps. This trend is prominent among younger demographics and urban dwellers with busy lifestyles, which is creating a positive Australia edible grocery market outlook.

Preference for Sustainable and Locally Sourced Products

Environmental consciousness and the growing awareness about sustainability and eco-friendly practices are increasingly influencing purchasing decisions, which is aiding the market growth. This shift toward sustainability is driving consumers to seek products with sustainable packaging, reduced carbon footprints, and locally sourced ingredients. Retailers are responding by highlighting locally produced items in their stores and emphasizing sustainable practices, such as recyclable packaging and carbon-neutral logistics. Some brands are adopting innovative approaches, including partnerships with local suppliers and introducing zero-waste initiatives. The growing interest in ethical consumerism is also encouraging businesses to adopt transparent supply chains, which is boosting the demand for edible groceries in Australia.

Australia Edible Grocery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, distribution channel, and consumer demographics.

Product Type Insights:

- Fresh Produce (Fruits, Vegetables)

- Dairy Products

- Meat & Seafood

- Bakery & Confectionery

- Packaged Foods

- Beverages (Non-Alcoholic)

- Frozen & Ready-to-Eat Meals

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fresh produce (fruits, vegetables), dairy products, meat & seafood, bakery & confectionery, packaged foods, beverages (non-alcoholic), and frozen & ready-to-eat meals.

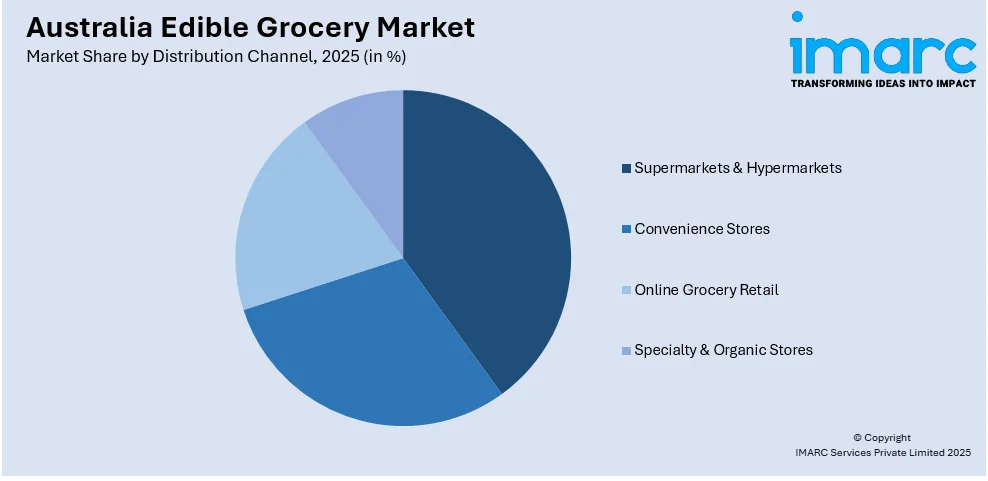

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Grocery Retail

- Specialty & Organic Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets & hypermarkets, convenience stores, online grocery retail, and specialty & organic stores.

Consumer Demographics Insights:

- Household Consumption

- Foodservice & Hospitality Sector

A detailed breakup and analysis of the market based on the consumer demographics have also been provided in the report. This includes household consumption and foodservice & hospitality sector.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Edible Grocery Market News:

- In January 2024, Australia's v2food acquired the plant-based ready meal brand Soulara, marking a strategic move to diversify its offerings in the growing plant-based food sector. This acquisition marked a significant step in supporting the demand for sustainable, plant-based options.

- In August 2024, Too Good To Go, the world’s largest surplus food marketplace, was officially launched in Melbourne, aiming to reduce Australia’s food waste by connecting consumers with surplus food from businesses at a reduced price, thereby benefiting the environment.

Australia Edible Grocery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fresh Produce (Fruits, Vegetables), Dairy Products, Meat & Seafood, Bakery & Confectionery, Packaged Foods, Beverages (Non-Alcoholic), Frozen & Ready-to-Eat Meals |

| Distribution Channels Covered | Supermarkets & Hypermarkets, Convenience Stores, Online Grocery Retail, Specialty & Organic Stores |

| Consumer Demographics Covered | Household Consumption, Foodservice & Hospitality Sector |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia edible grocery market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia edible grocery market on the basis of product type?

- What is the breakup of the Australia edible grocery market on the basis of distribution channel?

- What is the breakup of the Australia edible grocery market on the basis of consumer demographics?

- What is the breakup of the Australia edible grocery market on the basis of region?

- What are the various stages in the value chain of the Australia edible grocery market?

- What are the key driving factors and challenges in the Australia edible grocery market?

- What is the structure of the Australia edible grocery market and who are the key players?

- What is the degree of competition in the Australia edible grocery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia edible grocery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia edible grocery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia edible grocery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)