Australia eDiscovery Market Size, Share, Trends and Forecast by Component, Deployment Type, Industry Vertical, End User, and Region, 2025-2033

Australia eDiscovery Market Overview:

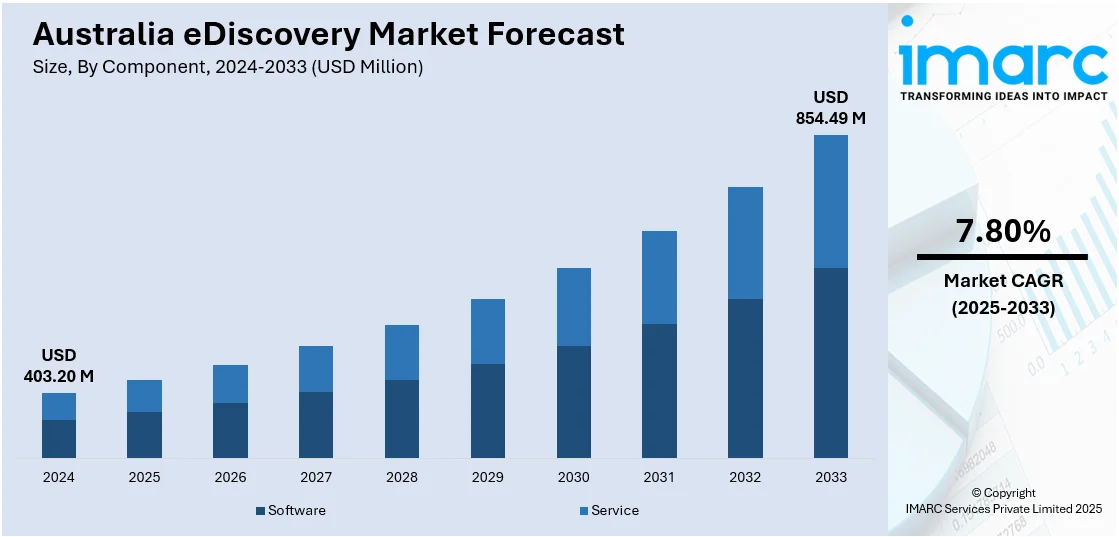

The Australia eDiscovery market size reached USD 403.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 854.49 Million by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. The increase in litigation, regulatory update, and industry digitalization are factors stimulating the market growth. Organizations are dealing with more electronic records, which is creating demand for products that enable automation of legal review, data preservation, and compliance. The most significant drivers include growing volumes of enterprise data, surging privacy requirements, and rapid cloud adoption. Apart from this, trends of remote working, government inquiries, expansion in legal outsourcing, expansion of unstructured data, requirement for reducing legal expenditure, and development of legal analytics are factors propelling the Australia eDiscovery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 403.20 Million |

| Market Forecast in 2033 | USD 854.49 Million |

| Market Growth Rate 2025-2033 | 7.80% |

Australia eDiscovery Market Trends:

Rising Enterprise Data Volumes

The exponential growth in data generated by Australian enterprises is a primary driver shaping the eDiscovery market. Organizations across industries are producing vast amounts of digital records through emails, messaging apps, cloud-based platforms, and document management systems. This surge in unstructured data makes traditional review methods inefficient and costly. Legal teams now require scalable eDiscovery solutions that can handle large data sets while ensuring accuracy and speed. As per the sources, in March of 2024, Morae broadened its e-discovery capabilities in Australia through the release of RelativityOne, an AI-powered secure cloud platform with abilities to deliver against increasing nationwide legal data requirements. Moreover, as companies expand their digital operations, especially through hybrid work models, the volume of electronically stored information (ESI) relevant for litigation, compliance, and investigations continues to rise, which is further fostering the Australia eDiscovery market growth. eDiscovery tools equipped with filtering, indexing, and advanced search capabilities help in narrowing down relevant material quickly, reducing review time and costs.

To get more information on this market, Request Sample

Increased Regulatory Scrutiny and Compliance Requirements

The Australia eDiscovery market is being rigorously influenced by escalating regulatory demands, particularly related to data privacy, corporate regulation, and managing electronic documents. Policies such as the Privacy Act 1988, and imminent reform chances within review under the Attorney-General's regime, are compelling businesses to maintain open, accurately recorded records of information. Additionally, authorities and related regulative institutions increasingly expect corporations to ensure conformity to norms on managing data, preserving records, and reporting standards. In legal settings, being unable to create accurate digital records can result in fines or loss of reputation. Legal and compliance organizations are therefore turning towards eDiscovery solutions with secure, auditable, and defensible processes.

Growth in Cross-Border Litigation and International Arbitration

Australia's growing involvement in cross-border legal matters is creating demand for eDiscovery platforms that are compatible with global data standards and workflows. Global companies, especially those in sectors like mining, finance, and pharmaceuticals, often get involved in litigation or arbitration that spans borders. Such cases require the legal teams to store and produce data across jurisdictions while complying with different privacy and data transfer regulations. This complexity has made it all the more necessary for advanced eDiscovery platforms that are capable of multi-language processing, time-zone normalization, and safe international data handling. Australian law firms and corporates are also increasingly engaging with international counsel, which means interoperable solutions to enable effortless collaboration and defensible disclosure processes. According to the reports, in September 2023, Reveal joined forces with CDFS Australia to amplify AI-fueled eDiscovery and digital investigation services, accelerating legal data analysis for corporate and legal clients throughout the APAC region. Furthermore, global disputes also involve higher stakes, which makes mature data analysis capabilities all the more necessary to support case strategy.

Australia eDiscovery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment type, industry vertical, and end user.

Component Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and service.

Deployment Type Insights:

- On-premises

- Cloud-based

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises, cloud-based, and hybrid.

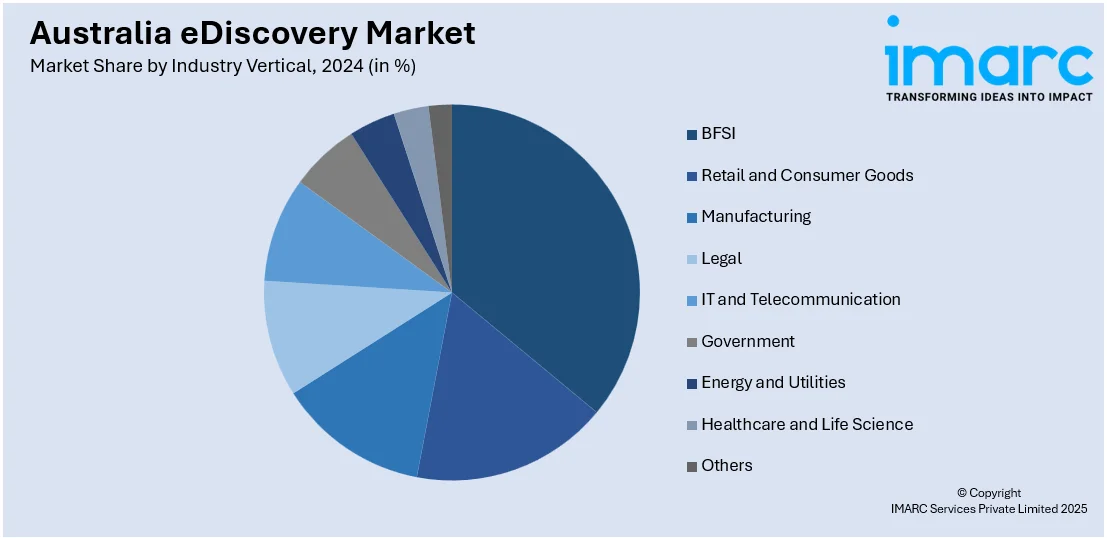

Industry Vertical Insights:

- BFSI

- Retail and Consumer Goods

- Manufacturing

- Legal

- IT and Telecommunication

- Government

- Energy and Utilities

- Healthcare and Life Science

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, retail and consumer goods, manufacturing, legal, IT and telecommunication, government, energy and utilities, healthcare and life science, and others.

End User Insights:

- Government/Federal Agencies, Legal and Regulatory Firms

- Enterprises

The report has provided a detailed breakup and analysis of the market based on the end user. This includes government/federal agencies, legal and regulatory firms and enterprises.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia eDiscovery Market News:

- In November 2024, Consilio completed the rollout of its eDiscovery services in Australia by opening two new data centers in Sydney and Melbourne. This expansion offers comprehensive legal consulting services, including data processing, hosting, document review, and legal advisory, to corporate and law firm clients in the region.

- In June, Relativity announced its global rollout of aiR for Review, its GenAI-driven eDiscovery solution, which will become available in Australia, the US, and Europe in Q3. Faster and more accurate document review is guaranteed with this tool, taking eDiscovery operations to a higher level of consistency and quality in both legal and corporate spaces.

Australia eDiscovery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployment Types Covered | On-premises, Cloud-based, Hybrid |

| Industry Verticals Covered | BFSI, Retail and Consumer Goods, Manufacturing, Legal, IT and Telecommunication, Government, Energy and Utilities, Healthcare and Life Science, Others |

| End Users Covered | Government/Federal Agencies, Legal and Regulatory Firms, Enterprises |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia eDiscovery market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia eDiscovery market on the basis of component?

- What is the breakup of the Australia eDiscovery market on the basis of deployment type?

- What is the breakup of the Australia eDiscovery market on the basis of industry vertical?

- What is the breakup of the Australia eDiscovery market on the basis of end user?

- What is the breakup of the Australia eDiscovery market on the basis of region?

- What are the various stages in the value chain of the Australia eDiscovery market?

- What are the key driving factors and challenges in the Australia eDiscovery?

- What is the structure of the Australia eDiscovery market and who are the key players?

- What is the degree of competition in the Australia eDiscovery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia eDiscovery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia eDiscovery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia eDiscovery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)