Australia Education Computing Devices Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Australia Education Computing Devices Market Overview:

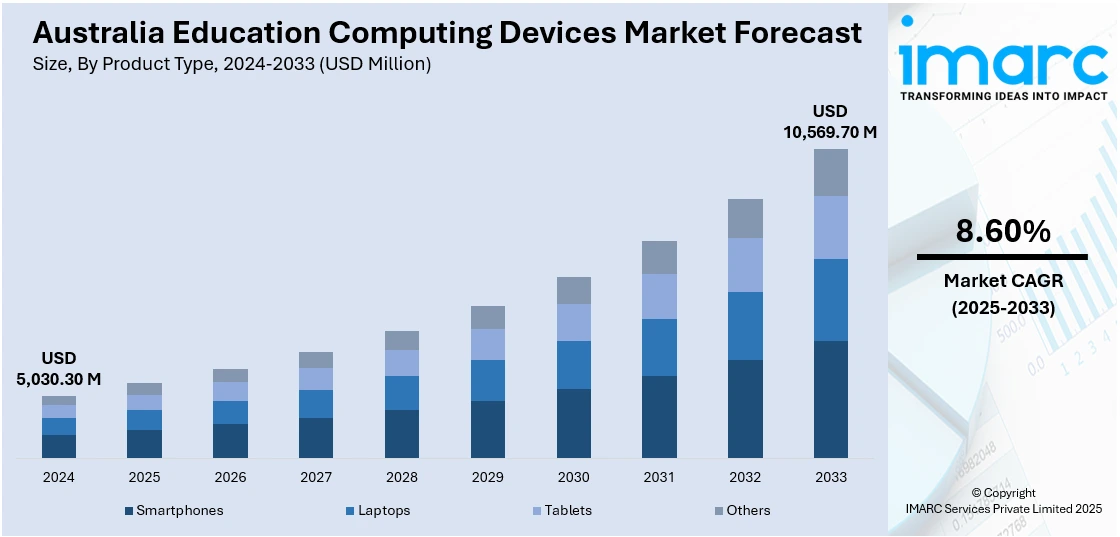

The Australia Education Computing Devices Market size reached USD 5,030.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 10,569.70 Million by 2033, exhibiting a growth rate (CAGR) of 8.60% during 2025-2033. The market is fueled by government programs, growing need for personalized and flexible learning and educational institutions investing into smartboards, interactive displays, and other emerging technologies in order to boost student learning and engagement. The popularity of online learning platforms and demand for remote education options, spurred on by the COVID-19 pandemic, have also fueled demand for stable computing devices, further increasing the Australia education computing devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,030.30 Million |

| Market Forecast in 2033 | USD 10,569.70 Million |

| Market Growth Rate 2025-2033 | 8.60% |

Australia Education Computing Devices Market Trends:

Expansion of 1:1 Device Programs

One of the key trends in Australia's education computing devices market is the universal implementation of 1:1 device programs, in which every student is issued an individual computing device. The goal of this program is to increase student participation and provide equal access to educational materials regardless of socio-economic status. Schools are increasingly spending money on low-cost and long-lasting laptops, tablets, and other computing devices to enable these programs. The increase in 1:1 device initiative is a demonstration of commitment to embedding technology into the learning space, developing digital literacy, and equipping students for the requirements of the contemporary workforce. As the need for customized learning experiences increases, the 1:1 device model will be a key driver of the future of education in Australia.

To get more information on this market, Request Sample

Integration of Cloud-Based Learning Platforms

Cloud-based learning platforms are rapidly gaining popularity in Australian schools, providing easy access to online content and collaborative resources. These platforms allow educators and students to store, access, and share educational content through any internet-connected device. The use of cloud-based solutions minimizes the need for physical infrastructure and enables real-time update and sharing of resources. Schools are embracing cloud-based learning management systems to improve flexibility, scalability, and cost-effectiveness. This move towards cloud-based environments is in line with the increasing trend of hybrid and blended models of learning, providing learners with a more personalized and accessible learning environment, and further fueling the Australia education computing devices market growth.

Focus on Digital Equity and Accessibility

Providing equal access to technology is an ongoing priority in Australia's education computing devices market. Initiatives that provide subsidized or free computers for students from poor families are being undertaken to reduce the digital divide. Organizations such as The Smith Family promote the creation of national device banks to assist students with technological disadvantage. Closing gaps is important to enable all students to equally access digital learning technologies and resources, promoting inclusiveness and equal opportunity for education in the nation.

Australia Education Computing Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Smartphones

- Laptops

- Tablets

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes smartphones, laptops, tablets, and others.

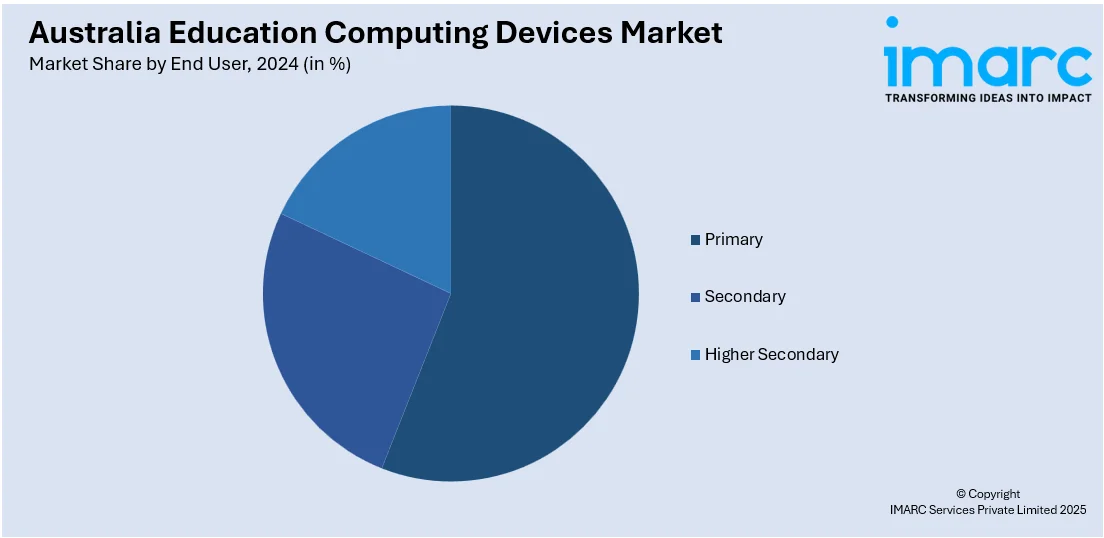

End User Insights:

- Primary

- Secondary

- Higher Secondary

The report has provided a detailed breakup and analysis of the market based on the end user. This includes primary, secondary, and higher secondary.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Education Computing Devices Market News:

- In February 2025, Dell Technologies declared the release of its latest Dell 16 Plus, Dell 14 Plus, and Dell 16 Plus 2-in-1 laptops in New Zealand and Australia. The announcement forms part of a larger effort to simplify Dell Technologies' range of devices, which are now classified into the Dell, Dell Pro, and Dell Pro Max product categories. This restructuring intends to streamline the selection process for consumers by categorizing products according to their intended use: personal, professional, or performance-related needs. These models are designed to serve a wide array of users, including students, professionals, and creative individuals who require powerful and flexible computing options. Every device comes in Ice Blue, while the Dell 16 Plus 2-in-1 is also available in Midnight Blue.

Australia Education Computing Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Smartphones, Laptops, Tablets, Others |

| End Users Covered | Primary, Secondary, Higher Secondary |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia education computing devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia education computing devices market on the basis of product type?

- What is the breakup of the Australia education computing devices market on the basis of and user?

- What is the breakup of the Australia education computing devices market on the basis of region?

- What are the various stages in the value chain of the Australia education computing devices market?

- What are the key driving factors and challenges in the Australia education computing devices market?

- What is the structure of the Australia education computing devices market and who are the key players?

- What is the degree of competition in the Australia education computing devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia education computing devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia education computing devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia education computing devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)