Australia Elderly Care Products Market Size, Share, Trends and Forecast by Product, Usage, End User, and Region, 2025-2033

Australia Elderly Care Products Market Overview:

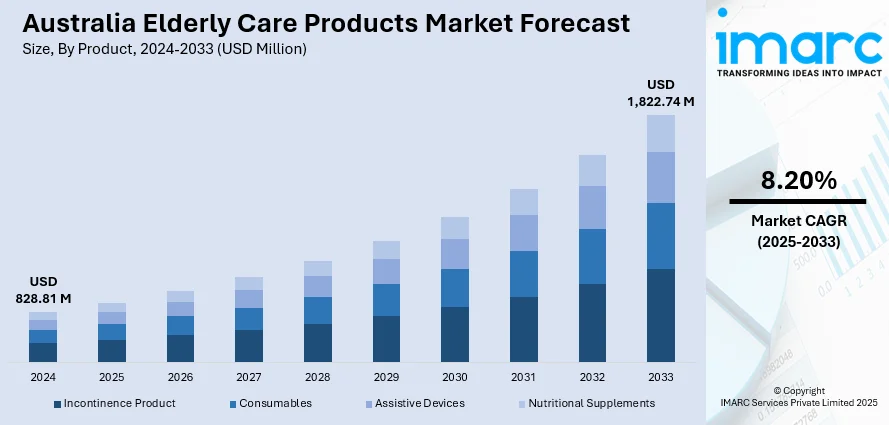

The Australia elderly care products market size reached USD 828.81 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,822.74 Million by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033. The market is experiencing major growth due to exceptional demand for natural and organic products that emphasize safety and sustainability. Technology is allowing intelligent, connected solutions for real-time monitoring of health, increasing independence and safety. Multi-functional and versatile products are also becoming popular through serving varied senior needs with utilitarian, flexible designs. These trends together fuel demand and innovation and play a major role in helping the Australia elderly care products market share to grow.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 828.81 Million |

| Market Forecast in 2033 | USD 1,822.74 Million |

| Market Growth Rate 2025-2033 | 8.20% |

Australia Elderly Care Products Market Trends:

Increased Need for Organic and Natural Elderly Care Products

The market for organic and natural ingredients in elderly care products is gaining pace continuously in Australia. Older consumers are becoming increasingly concerned about the safety of ingredients, choosing products that do not contain harsh chemicals, artificial fragrances, or additives. Natural oils, plant extracts, and hypoallergenic ingredients are favored because they are gentle on sensitive, geriatric skin. This also indicates a larger movement towards sustainable and environmentally friendly products, in line with consumer values regarding the environment. Ingredient transparency and ethical production are additional factors that drive purchasing decisions. With the development of elderly care markets, products highlighting organic and natural components become increasingly important for offering effective yet non-irritating solutions that cater to the needs of senior users. This integration maintains overall skin health while reducing side effects, which is essential to the elderly population. This is one of the key factors driving the current Australia elderly care products market growth, fueling innovation in cleaner, safer personal care solutions for the elderly. For instance, in March 2025, Bunnings launched over 2,500 assisted-living products, including smart locks, doorbell cameras, toilet safety handles, access ramps, anti-slip mats, and mobility scooters, boosting the Australia elderly care products market.

To get more information on this market, Request Sample

Advances in Smart and Connected Elderly Care Solutions

Integration of technology is transforming elderly care products in Australia with the inclusion of smart and connected features. Sensors and IoT-enabled devices make real-time monitoring of health possible, including monitoring heart rate, mobility, and medication taking. All these advancements improve safety through fall alerts or abnormal health trend alerts that serve as reassurance to both the elderly population and caregivers. Smart technologies enable increased independence, enabling senior citizens to carry on with their daily routines independently while having timely interventions when needed. This trend mirrors the greater place digital health is taking in personal care, coupling conventional product capabilities with sophisticated monitoring features. With these intelligent solutions being more affordable and easier to use, they command high value in the market. Such technological advancement is one of the major drivers of Australia elderly care products growth, given that consumers place emphasis on multi-functional and adaptive systems that merge convenience with health control.

Emphasis on Multi-Functional and Adaptive Elderly Care Products

Multi-functionality and flexibility have become essential trends in Australia's elderly care products market. Products integrating multiple functionalities like mobility aids with ergonomic adjustment or hygiene products with adjustable components, fulfill the complex and dynamic needs of elderly consumers. Flexible designs increase usability by accepting adjustment of physical capabilities over time, minimizing the requirement for frequent replacement and ensuring long-term value. This flexibility is particularly significant because it allows older adults to preserve independence while coping with complicated care needs using fewer products. Moreover, multi-functional solutions frequently help to simplify caregiving regimens and enhance overall comfort and safety. The trend toward these comprehensive, functional designs indicates the market demand for effective and user-friendly innovations. This increasing demand for flexible products is a powerful driver of Australia elderly care products growth, prompting manufacturers to emphasize flexible, rugged, and inclusive care solutions for geriatric consumers.

Australia Elderly Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, usage, and end user.

Product Insights:

- Incontinence Product

- Consumables

- Assistive Devices

- Nutritional Supplements

The report has provided a detailed breakup and analysis of the market based on the product. This includes incontinence product, consumables, assistive devices, and nutritional supplements.

Usage Insights:

- Home Care

- Chronic Illness Care

A detailed breakup and analysis of the market based on the usage have also been provided in the report. This includes home care and chronic illness care.

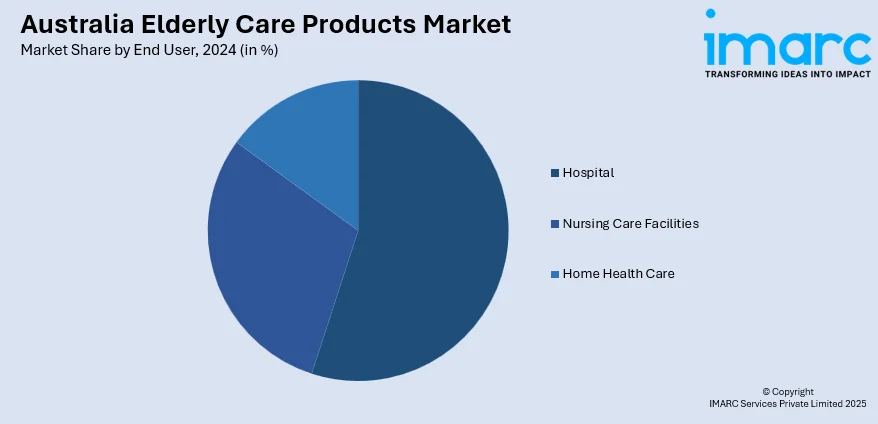

End User Insights:

- Hospital

- Nursing Care Facilities

- Home Health Care

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospital, nursing care facilities, and home health care.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Elderly Care Products Market News:

- In February 2025, AlayaCare introduced its AI-powered Client Intelligence Suite in Australia, strengthening elderly care products through enhanced risk prediction and minimized hospitalizations in home care. The innovative software assists Australian aged care providers in optimizing care delivery and filling out the expanding Australia elderly care products market with smarter, technology-facilitated solutions.

Australia Elderly Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Incontinence Product, Consumables, Assistive Devices, Nutritional Supplements |

| Usages Covered | Home Care, Chronic Illness Care |

| End Users Covered | Hospital, Nursing Care Facilities, Home Health Care |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia elderly care products market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia elderly care products market on the basis of product?

- What is the breakup of the Australia elderly care products market on the basis of usage?

- What is the breakup of the Australia elderly care products market on the basis of end user?

- What is the breakup of the Australia elderly care products market on the basis of region?

- What are the various stages in the value chain of the Australia elderly care products market?

- What are the key driving factors and challenges in the Australia elderly care products?

- What is the structure of the Australia elderly care products market and who are the key players?

- What is the degree of competition in the Australia elderly care products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia elderly care products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia elderly care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia elderly care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)