Australia Electric Fuse Market Size, Share, Trends and Forecast by Type, Voltage, End Use, and Region, 2025-2033

Australia Electric Fuse Market Size and Share:

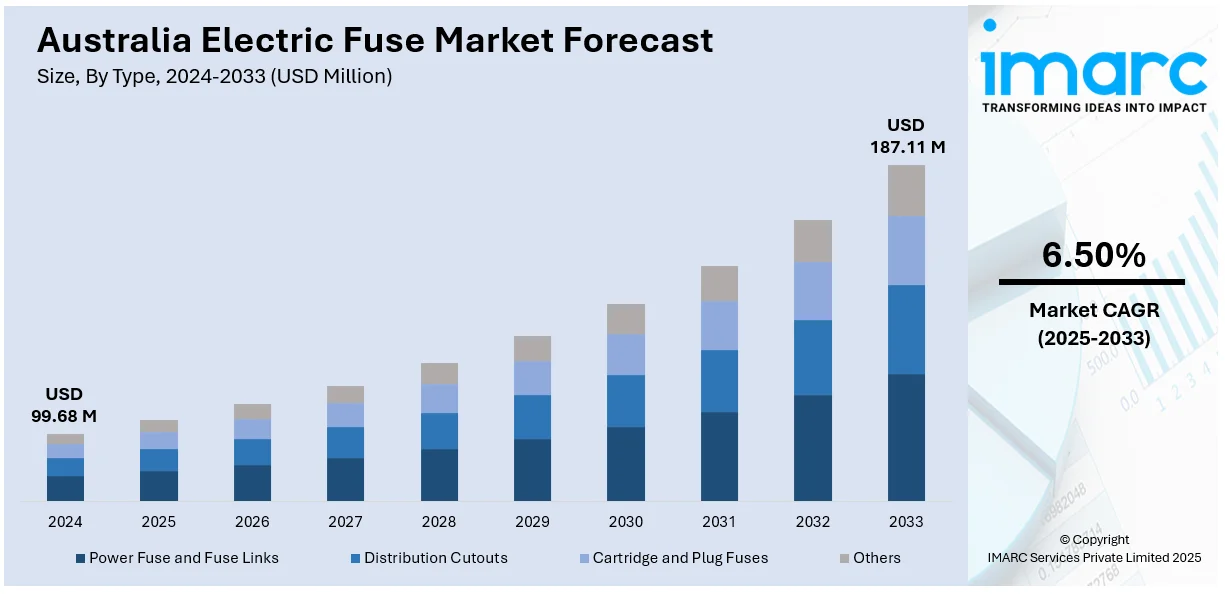

The Australia electric fuse market size reached USD 99.68 Million in 2024. Looking forward, the market is expected to reach USD 187.11 Million by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The market continues to grow due to rising demand for electrical safety in both the household and industrial sectors. Moreover, major factors include increased electrical infrastructure development and the adoption of improved fuse technology. Again, sectors focused on improving the protection and reliability of electrical systems are expected to increase Australia electric fuse market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 99.68 Million |

| Market Forecast in 2033 | USD 187.11 Million |

| Market Growth Rate 2025-2033 | 6.50% |

Key Trends of Australia Electric Fuse Market:

Growing Demand for Electrical Safety in Australia

Increased need for electrical safety in multiple industries is among the key drivers of the Australian electric fuse market. Increased industrialization and construction activities have increased demand for sophisticated electrical systems, where protective devices are needed. Residential and commercial buildings need fuses to protect electrical systems from overloads, short circuits, and other dangers. Further, the focus of the Australian government on developing infrastructure and integrating the smart grid has also helped the electric fuse market. Apart from the growth in infrastructure, growth in high-performance fuses with enhanced specifications like greater current carrying capacity and heat resistance is driving demand. The efforts of manufacturers towards more investment in research and development for enhancing fuse efficiency and lifespan are also enhancing demand. This technology, combined with growing electrical safety knowledge, is propelling the growth of the Australian market for electric fuses. As industrial action increases and safety standards rise, the market scenario is optimistic.

To get more information on this market, Request Sample

Technological Advancements Driving the Market

Technological innovations have emerged as a major force behind the electric fuse market in Australia, with increased demand for more efficient, long-lasting, and smaller fuse solutions. The availability of intelligent fuses with microprocessor-based protection systems has caused a more automated and secure method of protecting electrical systems. These fuses are capable of real-time detection of fault conditions, enhancing the efficiency of power management and minimizing electrical equipment damage. With increasing reliance on automation and digitization across Australian industries, demand for technologically sophisticated fuse systems is ever on the rise. Also, the growing acceptability of renewable energy resources like solar power has created the need for new types of special fuses, which can tolerate dynamic loads and provide stable operation of the system. These developments are serving to address the requirements of contemporary power systems where ordinary fuses could prove inadequate. Further, the inclusion of fuses into smart grid systems provides greater monitoring and diagnostic functions, which enable improved fault detection and scheduling for maintenance. This pattern of incorporating advanced technology in fuse systems supports the changing demands of industries, thereby increasing Australia electric fuse market growth.

Growth Drivers of Australia Electric Fuse Market:

Renewable Energy Adoption and Grid Modernization

Australia's move towards a sustainable energy future has spurred a fast-growing demand for solar farms, wind farms, residential rooftop PV systems, and battery storage installations. These renewable systems tend to operate on direct current (DC) and need extremely reliable, fast-acting protection devices. This evolution has spurred a huge demand for DC-rated fuses, which must be able to handle high voltage as well as interrupt fault currents satisfactorily. Apart from that, the incorporation of renewable energy into grid infrastructure requires next-generation fuse technologies that prevent instability, safeguard sensitive equipment, and minimize downtime. As the government keeps putting money into clean energy projects as well as grid modernization initiatives, the function of electric fuses becomes even more significant in protecting both grid-connected and off-grid renewable installations in residential, commercial, and utility markets.

Infrastructure Expansion Across Sectors

Australia is experiencing substantial infrastructure growth driven by investments in utilities, transportation, manufacturing, and construction. This development is increasing the load on existing electrical systems, requiring advanced overcurrent protection to ensure uninterrupted operations and protect sensitive electrical components. Electric fuses, with their fast response time and cost-efficiency, are essential in managing the risks associated with expanding low- and medium-voltage networks. From metro rail systems and smart city projects to industrial automation and data centers, the demand for fuse-based protection is rising. Furthermore, government-backed infrastructure upgrades and large-scale urban development initiatives are fueling consistent fuse adoption. As diverse industries digitize and electrify their operations, the need for robust and dependable circuit protection devices like electric fuses continues to grow steadily across the nation.

Rising Electricity Usage and Safety Focus

The increasing electrification of homes, offices, and industrial facilities in Australia has raised the importance of electrical safety. As electricity consumption rises due to smart appliances, electric vehicles, HVAC systems, and automated industrial equipment, the risk of overcurrents, short circuits, and equipment damage also escalates. To mitigate these risks, residential, commercial, and industrial users are increasingly relying on electric fuses for reliable circuit protection. In addition, strict safety regulations and building codes enforced by regulatory bodies are mandating the installation of overcurrent protection devices. Fuses, with their simplicity, cost-effectiveness, and high fault-clearing capability, have become a preferred solution. Their ability to provide immediate protection in the event of faults helps prevent electrical fires, system failures, and costly damage, reinforcing their market relevance.

Opportunities in Australia Electric Fuse Market:

Smart Fuse Integration and IoT Capabilities

The increasing adoption of smart grid infrastructure and industrial automation across Australia is generating demand for intelligent fuse systems capable of delivering real-time diagnostics, predictive maintenance, and remote monitoring. These smart fuses are embedded with sensors and communication technologies that allow end users to track circuit behavior, identify early signs of faults, and make proactive maintenance decisions. This reduces downtime, enhances safety, and extends the lifespan of electrical equipment. For manufacturers, this shift toward digitalization opens up lucrative opportunities to develop fuse solutions that integrate seamlessly with building management systems, SCADA platforms, and IoT networks. As industrial facilities and utilities seek smarter, more responsive electrical protection systems, the demand for advanced fuse products with IoT functionality is expected to grow significantly in the coming years.

Protection Requirements in Renewable and Battery Systems

Australia’s accelerating shift toward renewable energy and decentralized power systems is driving the need for specialized fuse solutions tailored to solar, wind, and energy storage technologies, which is further boosting the Australia electric fuse market demand. Applications such as solar PV arrays, inverters, and energy storage systems (ESS), including battery-based microgrids, require fuses that can handle high DC currents and rapid fault interruption. As installations grow in both scale and complexity, safety and reliability become critical, making high-performance fuses a key component in ensuring system integrity. These fuses are designed to protect sensitive equipment from overloads and short circuits while maintaining energy efficiency. The increasing adoption of rooftop solar, off-grid systems, and commercial battery storage across residential and industrial sectors presents a significant opportunity for fuse manufacturers to provide purpose-built solutions for clean energy applications.

Product Innovation Using Advanced Materials

Technological innovation in materials science is opening new possibilities for the electric fuse industry in Australia. Emerging fuse designs now feature cutting-edge materials such as graphene, ceramics, and biodegradable polymers, which enhance conductivity, reduce response time, and minimize environmental impact. These materials enable the development of ultra-fast, compact, and self-healing fuses that offer greater energy efficiency and reliability compared to traditional models. With rising emphasis on sustainability and eco-friendly manufacturing, there’s growing demand for fuses that not only perform better but also align with green standards and circular economy principles. This evolving trend offers manufacturers a competitive edge through differentiation and innovation. As industries and utilities increasingly seek lighter, safer, and environmentally conscious solutions, advanced material-based fuse products are set to become a central growth area in the market.

Challenges Facing Australia Electric Fuse Market:

Competition from Circuit Breakers

One of the major challenges facing the electric fuse market in Australia is the growing preference for circuit breakers across a wide range of applications. Circuit breakers provide the advantage of being reusable, easily resettable after a fault, and more convenient in terms of maintenance. Their flexible performance, longer lifespan, and ability to integrate with smart monitoring systems make them an attractive choice for residential, commercial, and industrial users alike. Additionally, circuit breakers are often seen as a more cost-effective long-term solution, especially in systems that experience frequent overloads or maintenance requirements. As newer models offer compact designs and enhanced automation features, the competitive pressure on traditional fuse-based solutions is intensifying, limiting fuse market penetration in some key application segments.

Supply Chain Volatility and Raw Material Costs

The electric fuse market in Australia is increasingly affected by global supply chain disruptions and price volatility of essential raw materials such as copper, aluminum, zinc, and ceramics. These materials are crucial for producing quality fuses, and any fluctuation in their availability or cost can significantly impact manufacturing schedules and pricing strategies. Recent global events, trade disruptions, and logistical delays have made it harder for manufacturers to maintain stable production and meet delivery timelines. According to the Australia electric fuse market analysis, the rising costs of transportation and energy further exacerbate the situation, putting pressure on profit margins and leading to higher prices for end users. As the market demands more advanced and reliable fuse solutions, managing raw material risks has become a critical challenge for producers operating in an increasingly unpredictable economic environment.

Skilled Labor Shortages and Installation Delays

Australia’s expanding renewable energy and infrastructure sectors are placing enormous pressure on the country’s skilled labor force, especially certified electricians and technicians responsible for installing and maintaining protection systems. The shortage of trained personnel is creating significant delays in project execution, particularly in rural and high-growth regions. This labor gap not only hampers the timely deployment of electric fuses in new solar farms, commercial buildings, and industrial plants but also slows maintenance and upgrades in existing installations. As demand for electrification and automation rises, the workforce shortfall is becoming a bottleneck for the entire electrical components market. Without adequate technical support and timely installations, the reliability and safety of electrical systems could be compromised, posing a serious challenge to market expansion efforts.

Australia Electric Fuse Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, voltage, and end use.

Type Insights:

- Power Fuse and Fuse Links

- Distribution Cutouts

- Cartridge and Plug Fuses

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes power fuse and fuse links, distribution cutouts, cartridge and plug fuses, and others.

Voltage Insights:

- Low Voltage

- Medium Voltage

The report has provided a detailed breakup and analysis of the market based on the voltage. This includes low voltage and medium voltage.

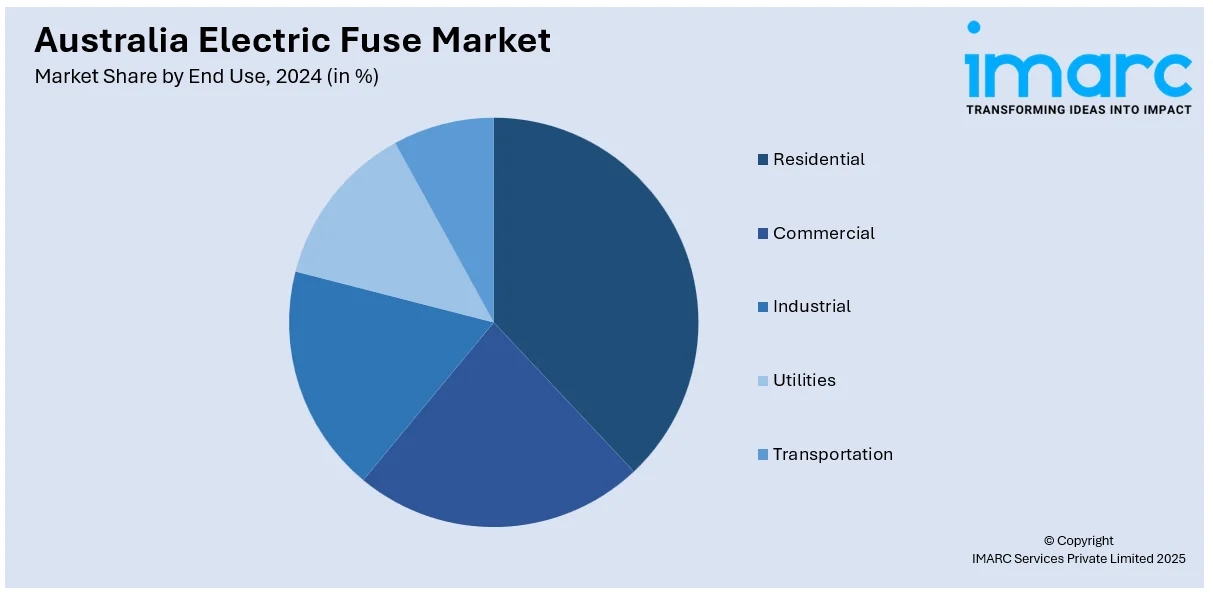

End Use Insights:

- Residential

- Commercial

- Industrial

- Utilities

- Transportation

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, industrial, utilities, and transportation.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electric Fuse Market News:

- May 2025: SCHOTT launched lead-free SEFUSE battery fuses, offering a sustainable and safer solution for lithium-ion battery applications. This innovation supports compliance with future RoHS regulations and enhances design flexibility, positively impacting the electric fuse industry by promoting environmentally friendly and efficient battery protection solutions.

- June 2024: NOJA Power showcased its new EcoLink product at Australian Energy Week. This fuse-link mounted reclosing circuit breaker, designed for enhanced network reliability, marked a significant advancement in electric fuse technology, particularly in rural and remote areas.

Australia Electric Fuse Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Power Fuse and Fuse Links, Distribution Cutouts, Cartridge and Plug Fuses, Others |

| Voltages Covered | Low Voltage, Medium Voltage |

| End Uses Covered | Residential, Commercial, Industrial, Utilities, Transportation |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electric fuse market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electric fuse market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electric fuse industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric fuse market in Australia was valued at USD 99.68 Million in 2024.

The Australia electric fuse market is projected to exhibit a CAGR of 6.50% during 2025-2033.

The Australia electric fuse market is projected to reach a value of USD 187.11 Million by 2033.

Key trends in the Australia electric fuse market include rising adoption of smart, IoT-enabled fuses for predictive maintenance, growing demand for high-performance DC fuses in renewable energy systems, and a shift toward compact, eco-friendly designs using advanced, sustainable materials for modern electrical applications.

The major growth factor fueling the market is the expansion of solar and battery-storage installations driving demand for DC-rated fuses in grid modernization projects. Scaling infrastructure in utilities, construction, manufacturing, and transport fuels requires overcurrent protection. Rising electrification and stricter safety regulations push residential, commercial, and industrial users to adopt reliable fuse-based protection.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)