Australia Electric Iron Market Size, Share, Trends and Forecast by Function, Product, Application, Distribution Channel, and Region, 2026-2034

Australia Electric Iron Market Summary:

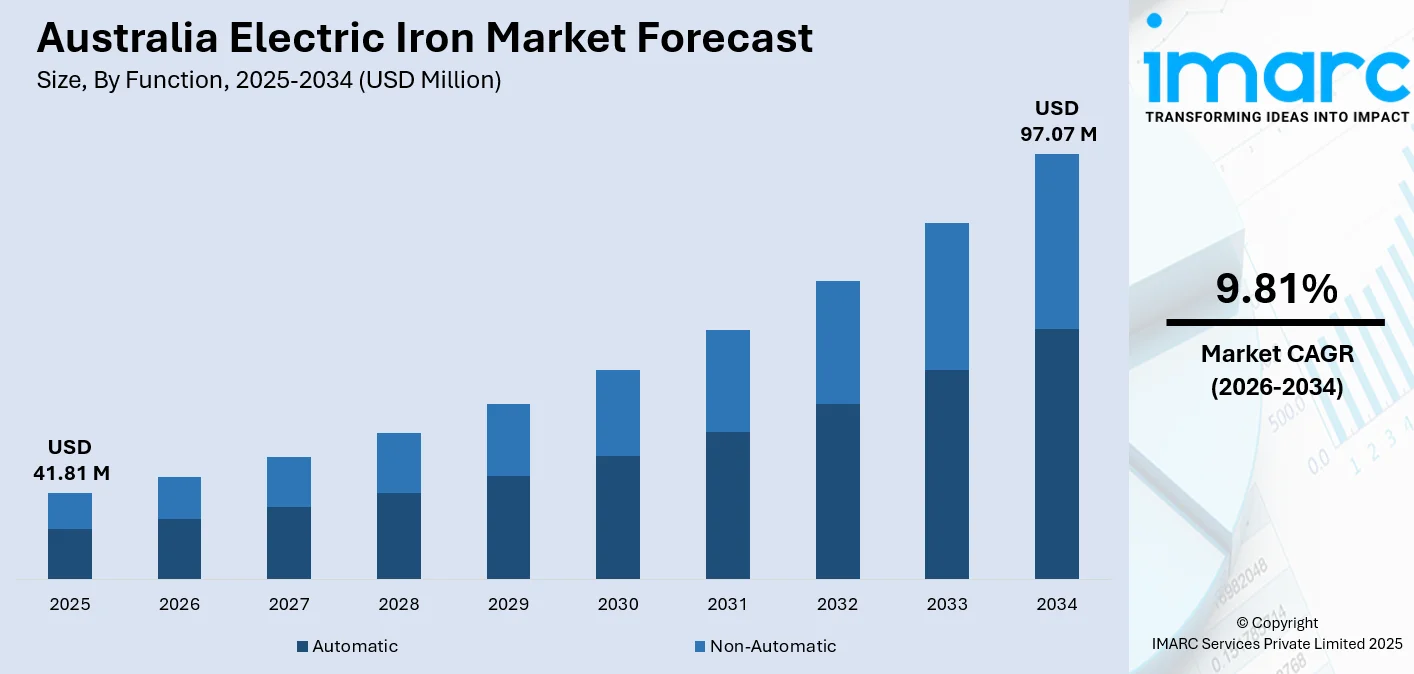

The Australia electric iron market size was valued at USD 41.81 Million in 2025 and is projected to reach USD 97.07 Million by 2034, growing at a compound annual growth rate of 9.81% from 2026-2034.

The market is driven by rising household formation and construction activity across the country, coupled with growing consumer preference for convenient garment care solutions. Increasing adoption of advanced automatic steam irons with safety features, energy-efficient technologies, and multifunctional capabilities is accelerating replacement cycles among residential users. The expansion of e-commerce platforms and specialty retail channels has improved product accessibility, while rising disposable incomes enable consumers to invest in premium-quality ironing solutions. These factors collectively contribute to the Australia electric iron market share.

Key Takeaways and Insights:

- By Function: Automatic dominates the market with a share of 62% in 2025, driven by latest safety functions, which comprise auto-shutoff technology, as well as accurate temperature sensors, which entice consumers who value safety.

- By Product: Steam leads the market with a share of 64% in 2025, owing to better wrinkle removal performance with high steam output and suitability with different fabrics.

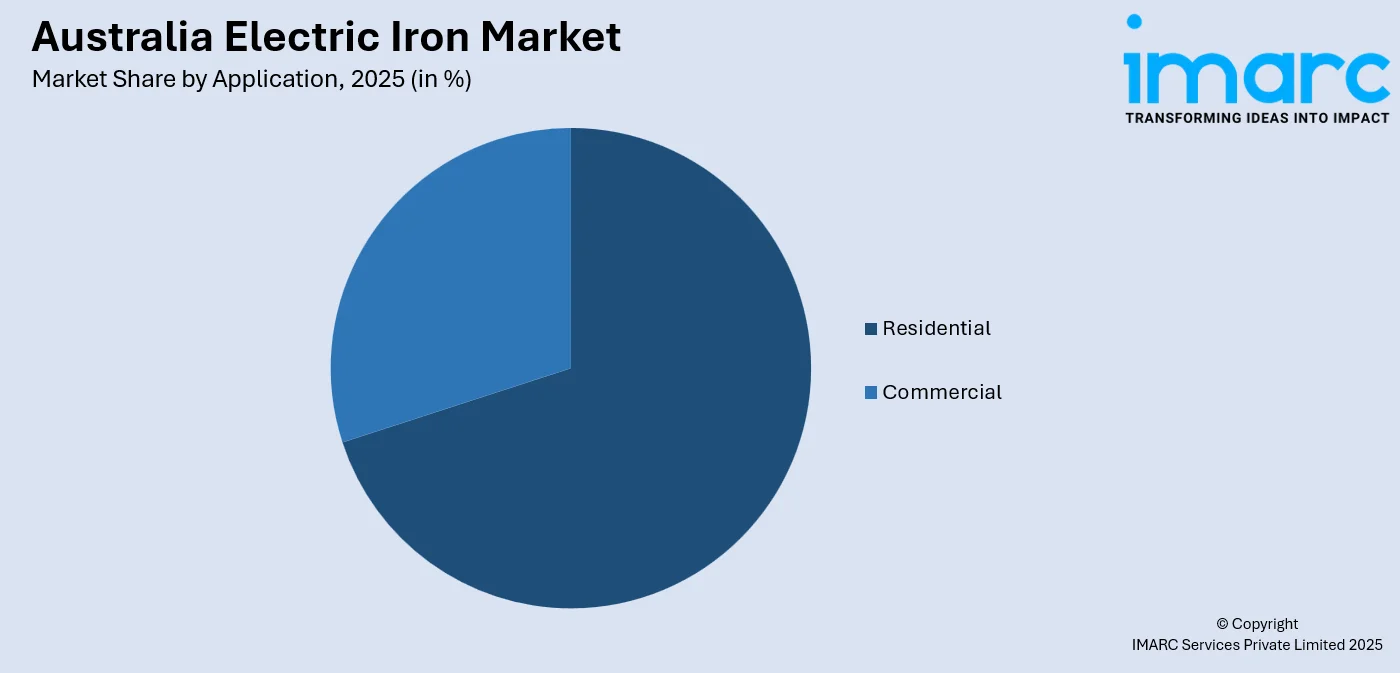

- By Application: Residential represents the largest segment with a market share of 70% in 2025, driven bystrong household demand driven by urbanization, smaller living spaces, and preference for convenient at-home fabric maintenance.

- By Distribution Channel: Offline dominates the market with a share of 55% in 2025, owing to consumer preference for hands-on product assessment and in-store demonstrations from specialty retailers.

- By Region: Australia Capital Territory & New South Wales leads the market with a share of 32% in 2025, driven by concentration of high population, rising disposable incomes, and strong urbanization across Sydney metropolitan regions.

- Key Players: The Australia electric iron market exhibits moderate competitive intensity, with established multinational appliance manufacturers competing alongside regional distributors across multiple price segments, focusing on product innovation, safety features, and energy efficiency.

To get more information on this market Request Sample

The Australia electric iron market is advancing as households embrace modern garment care technologies that combine convenience, safety, and performance. According to reports, 1.8 Million electric smoothing irons were consumed in Australia during 2024, underscoring strong household reliance on garment care appliances despite declining domestic production. Moreover, growing consumer awareness about fabric care, rising preference for professional-quality results at home, and increasing urbanization are strengthening market adoption. Manufacturers are responding by introducing irons with enhanced steam capabilities, automatic temperature adjustment, and improved energy efficiency. The integration of smart features such as motion sensors, auto shut-off functionality, and intelligent fabric detection systems has transformed consumer expectations for garment care appliances. Australian households increasingly prioritize appliances offering worry-free operation with consistent results across various fabric types. The broader trend of established brands expanding their product portfolios in the Australian market reflects evolving consumer expectations for advanced garment care solutions that deliver consistent, professional-quality results while prioritizing household safety, energy conservation, and user convenience across both residential and commercial applications.

Australia Electric Iron Market Trends:

Integration of Smart Technology and Automatic Features

The Australia electric iron market is experiencing significant transformation through the integration of smart technology and automatic safety features that enhance user convenience. Manufacturers are incorporating motion sensors, automatic temperature adjustment, and intelligent fabric detection systems that optimize performance while preventing damage to delicate materials. Auto shut-off functionality has become a standard expectation among Australian consumers prioritizing household safety, automatically deactivating heating elements when irons remain stationary for extended periods. Digital displays indicating optimal temperature readiness and fabric-specific settings reduce guesswork during ironing sessions, delivering consistent professional-quality results without requiring manual adjustments throughout the garment care process.

Rising Demand for Multifunctional Steam Technology

Steam technology continues to evolve as consumers seek versatile garment care solutions suitable for modern lifestyles. In October 2025, LG Electronics Australia launched the LG 5 Garment TrueSteam™ Styler featuring built‑in steam and handheld steamer functionality to refresh clothes without a traditional iron, reflecting rising demand for convenient steam‑based care. Contemporary steam irons are designed to function as both traditional horizontal irons and vertical steamers for hanging garments, curtains, and upholstery. Advanced features including powerful steam bursts, anti-drip systems, and self-cleaning mechanisms address consumer demands for low-maintenance, high-performance appliances. The growing preference for steam-based solutions reflects broader awareness about fabric care benefits and the desire for professional-quality results without incurring professional service costs.

Shift Toward Energy-Efficient and Compact Designs

Australian households are increasingly prioritizing energy efficiency and space-saving considerations when purchasing electric irons. Rising electricity costs across the nation have heightened consumer sensitivity toward energy consumption, driving preference for models featuring rapid heat-up times that minimize power usage during warming cycles. Growing environmental awareness encourages selection of irons equipped with energy-saving modes and efficient steam generation systems that deliver superior performance while reducing electricity consumption. The ongoing shift toward urban compact living arrangements has significantly boosted demand for lightweight, ergonomic electric irons accommodating limited storage spaces in apartments and smaller residences.

Market Outlook 2026-2034:

The Australia electric iron market is positioned for steady revenue growth throughout the forecast period as household formation expands and consumer preferences evolve toward technologically advanced garment care solutions. Increasing urbanization, rising disposable incomes, and growing awareness about fabric maintenance are expected to sustain demand across residential and commercial segments. The expansion of e-commerce channels and specialty retail networks will enhance product accessibility, while manufacturer investments in safety features, steam technology, and energy efficiency will drive premium product adoption and support consistent growth. The market generated a revenue of USD 41.81 Million in 2025 and is projected to reach a revenue of USD 97.07 Million by 2034, growing at a compound annual growth rate of 9.81% from 2026-2034.

Australia Electric Iron Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Function |

Automatic |

62% |

|

Product |

Steam |

64% |

|

Application |

Residential |

70% |

|

Distribution Channel |

Offline |

55% |

|

Region |

Australia Capital Territory & New South Wales |

32% |

Function Insights:

- Automatic

- Non-Automatic

Automatic dominates with a market share of 62% of the total Australia electric iron market in 2025.

Automatic commands the largest share of the Australia electric iron market, fueled by growing consumer preference for appliances that simplify garment care. Advanced sensors intelligently adjust heat based on fabric type, preventing damage to delicate materials. Enhanced safety features, such as auto-shutoff mechanisms, deactivate the heating element when idle, reducing fire risks. These innovations cater to households prioritizing convenience and protection, reflecting an increased emphasis on reliable, worry-free ironing solutions in modern Australian homes.

Evolving lifestyles continue to drive adoption of automatic irons, as consumers seek time-saving solutions without compromising garment quality. By automatically regulating temperature and steam output, these appliances ensure consistent results across diverse fabrics, eliminating the need for manual adjustments. Despite their premium positioning, Australian households show strong willingness to invest in automatic irons that offer long-term durability, superior performance, and enhanced safety, underscoring the segment’s alignment with consumer expectations for efficiency, convenience, and reliability.

Product Insights:

- Dry

- Steam

Steam leads with a share of 64% of the total Australia electric iron market in 2025.

Steam commands market dominance through its superior wrinkle-removal capabilities and versatile functionality that meets diverse garment care needs. Steam technology enables effective pressing of heavy fabrics, delicate materials, and everything in between by combining heat with moisture penetration for professional-quality results. In June 2025, Home Beautiful Australia highlighted the Tefal Ultraglide Plus and Philips PerfectCare 8000 steam irons as top performers, praised for efficient wrinkle removal, advanced steam control, and safety features. Australian consumers have embraced steam irons for their ability to handle various textile types, from cotton shirts to wool suits, without requiring extensive manual adjustment.

Product innovation continues to strengthen segment performance as manufacturers introduce features including powerful steam bursts for stubborn creases, anti-drip systems preventing water marks, and self-cleaning mechanisms that extend product lifespan. The growing awareness about proper garment care and its impact on clothing longevity has encouraged households to invest in steam irons offering professional-grade capabilities. Additionally, the segment benefits from the broader home appliance trend favoring appliances that simplify household tasks while delivering superior outcomes.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential exhibits a clear dominance with a 70% share of the total Australia electric iron market in 2025.

The residential dominates the Australia electric iron market driven by strong household demand for personal garment care appliances. Rising urbanization, with the majority of Australians residing in urban areas, has created substantial demand for convenient at-home fabric maintenance solutions. Smaller living spaces in apartment complexes have increased preference for compact, multifunctional irons that deliver professional results without requiring dedicated laundry rooms. According to reports, Australia approved 18,406 dwellings, with private apartments up 34.1%, reflecting urban household growth and driving demand for compact, multifunctional residential appliances like electric irons.

Growing household formation and ongoing residential construction continue to drive momentum in this segment. Expanding building activity and home development create steady demand for household appliances. Additionally, alterations and additions reflect continuous investment in home improvements, often including appliance upgrades. The rise of work-from-home arrangements has heightened the focus on personal presentation, prompting households to prioritize high-quality garment care equipment that delivers convenience, safety, and professional results for everyday use.

Distribution Channel Insights:

- Online

- Offline

Offline leads with a market share of 55% of the total Australia electric iron market in 2025.

Offline maintains market leadership through consumer preference for hands-on product assessment before purchase. Specialty appliance retailers, department stores, and home goods outlets offer demonstration opportunities that allow consumers to evaluate iron weight, grip comfort, and feature accessibility prior to purchase decisions. The importance of physical retail presence in the Australian appliance market is highlighted by ongoing partnerships between major brands and established retailers. For instance, in June 2025, French luxury brand De Dietrich opened its first Australian flagship Experience Centre in Rozelle, Sydney, underscoring the growing role of physical showrooms in premium appliance engagement.

It benefits from immediate product availability, eliminating waiting times associated with delivery schedules and enabling instant gratification for consumers requiring urgent replacements. In-store staff provide personalized recommendations based on individual requirements, fabric types, and budget considerations, enhancing the overall purchasing experience. After-sales support including warranty services, product demonstrations, and accessory availability further strengthens offline channel appeal. Additionally, consumers can physically compare multiple models’ side-by-side, facilitating informed decision-making that builds confidence in premium product investments across residential applications.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales dominates with a market share of 32% of the total Australia electric iron market in 2025.

Australia Capital Territory & New South Wales represents the largest regional market for electric irons, benefiting from substantial population concentration across Sydney metropolitan regions and the national capital territory. Strong employment opportunities and elevated household incomes support premium appliance purchases among urban professionals prioritizing quality garment care solutions. The region's extensive retail infrastructure provides consumers convenient access to diverse product offerings through established multi-brand store networks and expanding e-commerce fulfilment capabilities serving both metropolitan and surrounding regional communities effectively.

Growing household formation rates and sustained residential construction activity continue expanding the consumer base for household appliances throughout the region. Corporate office concentrations in Sydney's central business district create consistent demand for professional appearance maintenance among white-collar workers requiring well-pressed wardrobes. The region's cosmopolitan lifestyle and fashion-conscious consumer base drive preferences for technologically advanced electric irons featuring premium capabilities. Additionally, strong retail competition across major shopping precincts ensures competitive pricing and promotional offers that encourage appliance upgrades among existing households.

Market Dynamics:

Growth Drivers:

Why is the Australia Electric Iron Market Growing?

Robust Residential Development and Growing Household Base

The Australia electric iron market is experiencing robust growth driven by expanding residential construction activity and increasing household formation across the country. Australia maintains millions of residential dwellings creating a substantial installed base for household appliances. According to sources, Australian retail turnover climbed 7.0%, with household goods sales up 10.1%, highlighting strong consumer spending on home and appliance categories, including garment care equipment. Building approvals have demonstrated significant growth, while alterations and additions activity reflects ongoing home improvement investment. This construction activity generates consistent demand for household appliances including electric irons as new households require essential garment care equipment, ensuring sustained long-term demand across all regions.

Increasing Adoption of Feature-Rich Smart Appliances

Australian consumers are demonstrating increased willingness to invest in technologically advanced household appliances that offer enhanced convenience, safety, and performance. The integration of smart home technology, automatic features, and energy-efficient designs has elevated consumer expectations for garment care appliances. Motion-sensing technology, automatic temperature adjustment, and intelligent fabric detection systems have transformed basic ironing into a convenient, worry-free experience. In 2024, Samsung’s Australians @ Home Smart Living Report found 47 % of Australians consider AI-enabled features a priority when purchasing new appliances, reflecting rising demand for intelligent, connected household devices.

Expansion of Digital Commerce and Multi-Channel Retailing

The expansion of e-commerce platforms and omnichannel retail strategies is improving market accessibility and driving consumer adoption. Online shopping has gained significant momentum with millions of Australian households now purchasing online, supported by enhanced logistics infrastructure, competitive pricing, and convenient delivery options. Moreover, total online sales have demonstrated consistent growth, reflecting sustained digital adoption across consumer categories. Retailers are integrating online and offline channels to provide seamless purchasing experiences, product comparisons, and flexible fulfilment options encouraging consumer spending.

Market Restraints:

What Challenges the Australia Electric Iron Market is Facing?

Competition from Alternative Garment Care Solutions

The market faces competitive pressure from alternative garment care solutions including garment steamers, steam closets, and professional dry-cleaning services. Compact garment steamers have gained popularity among younger consumers prioritizing speed and convenience over traditional ironing methods. These alternatives appeal to households with limited storage space or those seeking quick fabric refreshing without traditional ironing setup requirements.

High Cost of Premium Feature Products

Premium electric irons incorporating advanced features including smart technology, automatic systems, and enhanced steam capabilities command higher price points that may deter price-sensitive consumers. During periods of economic uncertainty and cost-of-living pressures, households may delay appliance upgrades or select basic models over feature-rich alternatives. This price sensitivity limits premium segment penetration despite strong consumer interest in advanced capabilities.

Extended Product Lifecycle and Replacement Delays

Electric irons typically offer extended product lifecycles, reducing replacement frequency and limiting natural demand cycles. Durable construction and reliable performance mean households may retain existing appliances for extended periods, particularly when basic ironing functionality remains adequate. Economic factors and budget constraints can further extend replacement timelines, moderating overall market growth potential.

Competitive Landscape:

The Australia electric iron market is characterized by moderate competitive intensity with established multinational appliance manufacturers competing alongside regional distributors and specialty brands. Market participants focus on product differentiation through technological innovation, safety feature enhancement, and energy efficiency improvements to capture consumer attention. Strategic partnerships with major retailers and expansion of distribution networks remain key competitive tactics. Companies are investing in marketing campaigns emphasizing convenience, fabric care quality, and household safety to drive brand preference. The growth of e-commerce has intensified price competition while enabling smaller brands to access consumers directly, creating dynamic market conditions that encourage continuous product development and promotional activity.

Recent Developments:

- In August 2025, Einsen launched Australia’s first fully automated smart ironing system via Kickstarter, offering professional-grade garment care in under 60 seconds with app-controlled intelligent fabric treatment, superheated steam, and dynamic pressure control, marking a significant innovation in household appliance automation.

Australia Electric Iron Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Automatic, Non-Automatic |

| Products Covered | Dry, Steam |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia electric iron market size was valued at USD 41.81 Million in 2025.

The Australia electric iron market is expected to grow at a compound annual growth rate of 9.81% from 2026-2034 to reach USD 97.07 Million by 2034.

Automatic held the largest Australia electric iron market share driven by advanced safety features including auto shut-off technology and precise temperature sensors appealing to safety-conscious Australian households seeking convenient garment care solutions.

Key factors driving the Australia electric iron market include expanding residential construction and household formation, rising consumer preference for technologically advanced appliances with automatic and safety features, and growth of e-commerce and omnichannel retail distribution improving market accessibility.

Major challenges include competition from alternative garment care solutions such as garment steamers, high costs of premium feature products during economic uncertainty, extended product lifecycles reducing replacement frequency, and price sensitivity among budget-conscious consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)