Australia Electric Motor Market Size, Share, Trends and Forecast by Motor Type, Voltage, Rated Power, Magnet Type, Weight, Speed, Application, and Region, 2026-2034

Australia Electric Motor Market Overview:

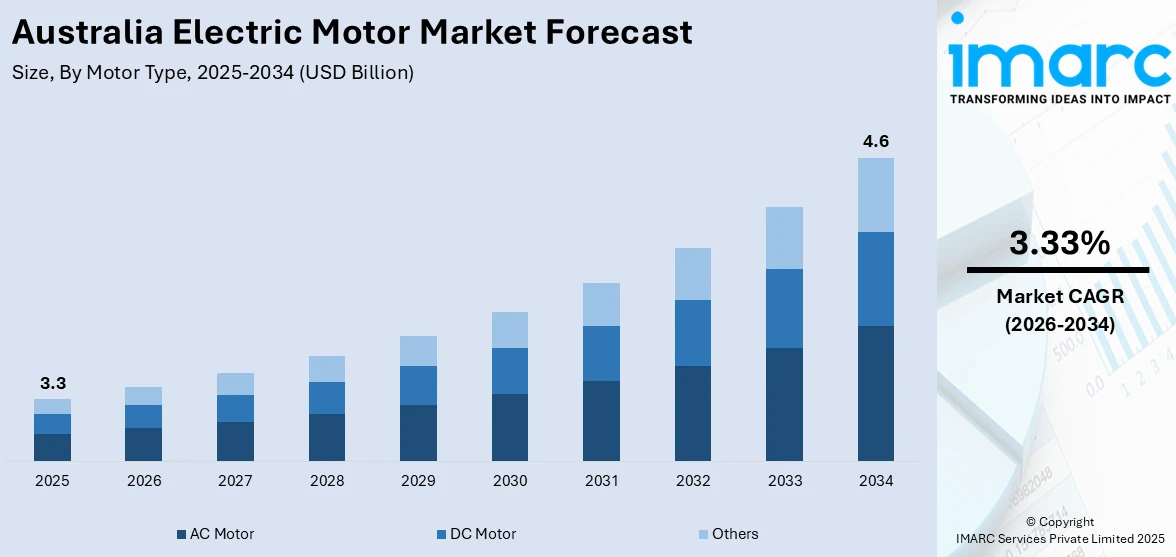

The Australia electric motor market size reached USD 3.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.6 Billion by 2034, exhibiting a growth rate (CAGR) of 3.33% during 2026-2034. Rising electric vehicle (EV) adoption, increasing use of industrial automation, integration of renewable energy sources, government-mandated energy efficiency standards, expansion of railway electrification, escalating demand from the mining industry, installation of heating, ventilation, and air conditioning (HVAC) systems, growing agricultural mechanization, and development of smart infrastructure projects across commercial and public sectors are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.3 Billion |

| Market Forecast in 2034 | USD 4.6 Billion |

| Market Growth Rate 2026-2034 | 3.33% |

Australia Electric Motor Market Trends:

Expansion of the Electric Vehicle Industry

The accelerating growth of the electric vehicle (EV) industry is significantly impacting the demand for electric motors, which is one of the primary factors boosting the Australia electric motor market growth. With government-led initiatives such as subsidies, tax incentives, and emissions targets, EV adoption is expected to rise steadily. In 2023, National Electric Vehicle Strategy (NEVS) announced its efforts to increase the supply of affordable and accessible EVs and establish the necessary infrastructure for rapid EV uptake. Electric motors serve as the core propulsion system in EVs, directly influencing vehicle efficiency, range, and performance. As automakers expand their EV offerings, component manufacturers are scaling up production capacity to meet growing needs. Additionally, the development of local charging infrastructure and partnerships with global OEMs are contributing to domestic demand. Fleet electrification in public and private sectors is another contributor, particularly in urban areas aiming to reduce transport emissions. The transition from internal combustion engines to electric powertrains is also stimulating innovation in motor designs, including permanent magnet and brushless direct current (DC) variants, tailored for vehicle applications.

To get more information on this market Request Sample

Rising Fuel Prices and Cost Competitiveness

The continuous rise in fuel prices has enhanced the financial appeal of electric alternatives for both consumers and businesses. This ongoing shift in cost structures is rendering electric motors increasingly competitive compared to conventional options, particularly within the transportation, logistics, and industrial sectors. Compared to combustion-based systems, electric motors are up to 90% efficient, less expensive to run, and require less maintenance. These benefits are growing stronger with spiking energy prices and end-user demand for long term cost savings. Additionally, switching to electric drive systems is perceived as a competitive advantage in commercial vehicle fleets, where fuel costs represent the majority of operational expenses, which is another factor contributing to the Australia electric motor market growth. Apart from this, they are also witnessing huge demand in stationary applications, like HVAC and industrial pumping systems.

Industrial Automation and Robotics Adoption

The Australian industrial sector is actively embracing automation and robotics, which is playing an important role in driving the demand for electric motors. The motors are integral in robotic arm motion control, conveyor belts, packaging machines, and computer numerical control (CNC) equipment. The key players in the food processing, mining, and manufacturing industries are actively investing in automated systems to boost productivity, reduce dependency on labor, and preserve accuracy. Moreover, the focus on the implementation of Industry 4.0, along with government policies in support of high-tech manufacturing, is accelerating the deployment of motor-driven systems across production lines. Additionally, efficiency and safety concerns are compelling firms to upgrade existing equipment with new motor-based automation technology, which is providing a positive Australia electric motor market outlook.

Australia Electric Motor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on motor type, voltage, rated power, magnet type, weight, speed, and application.

Motor Type Insights:

- AC Motor

- Induction AC Motor

- Synchronous AC Motor

- DC Motor

- Brushed DC Motor

- Brushless DC Motor

- Others

The report has provided a detailed breakup and analysis of the market based on the motor type. This includes AC motor (induction AC motor and synchronous AC motor) and DC motor (brushed DC motor and brushless DC motor), and others

Voltage Insights:

- Low Voltage Electric Motors

- Medium Voltage Electric Motors

- High Voltage Electric Motors

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage electric motors, medium voltage electric motors, and high voltage electric motors.

Rated Power Insights:

- Fractional Horsepower Motors

- Fractional Horsepower (< 1/8) Motors

- Fractional Horsepower (1/8 - 1/2) Motors

- Fractional Horsepower (1/2 - 1) Motors

- Integral Horsepower Motors

- Integral Horsepower (1 - 5) Motors

- Integral Horsepower (10 - 50) Motors

- Integral Horsepower (50 - 100) Motors

- Integral Horsepower (>100) Motors

The report has provided a detailed breakup and analysis of the market based on the rated power. This includes fractional horsepower motors (fractional horsepower (< 1/8) motors, fractional horsepower (1/8 - 1/2) motors, and fractional horsepower (1/2 - 1) motors) and integral horsepower motors (integral horsepower (1 - 5) motors, integral horsepower (10 - 50) motors, integral horsepower (50 - 100) motors, and integral horsepower (>100) motors).

Magnet Type Insights:

- Ferrite

- Neodymium (NdFeB)

- Samarium Cobalt (SmCo5 and Sm2Co17)

A detailed breakup and analysis of the market based on the magnet type have also been provided in the report. This includes ferrite, neodymium (NdFeB), and samarium cobalt (SmCo5 and Sm2Co17).

Weight Insights:

- Low Weight Motors

- Medium Weight Motors

- High Weight Motors

The report has provided a detailed breakup and analysis of the market based on the weight. This includes low weight motors, medium weight motors, and high weight motors.

Speed Insights:

- Ultra-High-Speed Motors

- High-Speed Motors

- Medium Speed Motors

- Low Speed Motors

A detailed breakup and analysis of the market based on the speed have also been provided in the report. This includes ultra-high-speed motors, high-speed motors, medium speed motors, and low speed motors.

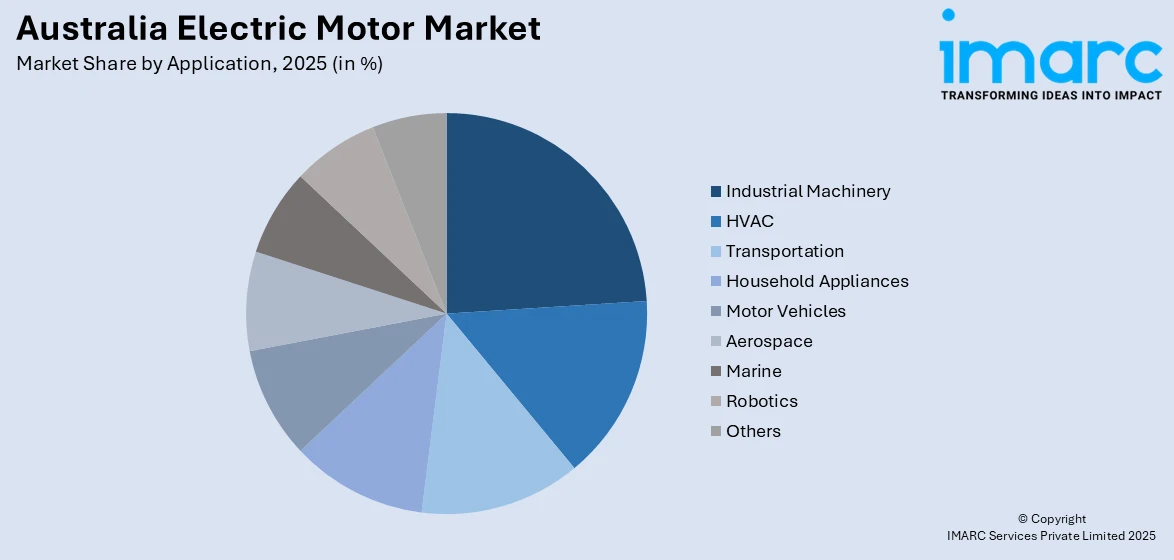

Application Insights:

Access the comprehensive market breakdown Request Sample

- Industrial Machinery

- HVAC

- Transportation

- Household Appliances

- Motor Vehicles

- Aerospace

- Marine

- Robotics

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes industrial machinery, HVAC, transportation, household appliances, motor vehicles, aerospace, marine, robotics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electric Motor Market News:

- In 2025, EMP announced a collaboration with the University of Adelaide to develop high-performance and sustainable electric motors. This partnership, supported by the Defence Trailblazer’s Accelerating Sovereign Industrial Capabilities (ASIC) program, aims to enhance Australia's sovereign manufacturing capabilities in electric motor technology.

- In 2024, TECO Electric Motors Australia expanded its operations by opening a new branch in Christchurch, New Zealand, to better serve its customers in the region

Australia Electric Motor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Motor Types Covered |

|

| Voltages Covered | Low Voltage Electric Motors, Medium Voltage Electric Motors, High Voltage Electric Motors |

| Rated Powers Covered |

|

| Magnet Types Covered | Ferrite, Neodymium (NdFeB), Samarium Cobalt (SmCo5 and Sm2Co17 |

| Weights Covered | Low Weight Motors, Medium Weight Motors, High Weight Motors |

| Speeds Covered | Ultra-High-Speed Motors, High-Speed Motors, Medium Speed Motors, Low Speed Motors |

| Applications Covered | Industrial Machinery, HVAC, Transportation, Household Appliances, Motor Vehicles, Aerospace, Marine, Robotics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia electric motor market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia electric motor market on the basis of motor type?

- What is the breakup of the Australia electric motor market on the basis of voltage?

- What is the breakup of the Australia electric motor market on the basis of rated power?

- What is the breakup of the Australia electric motor market on the basis of magnet type?

- What is the breakup of the Australia electric motor market on the basis of weight?

- What is the breakup of the Australia electric motor market on the basis of speed?

- What is the breakup of the Australia electric motor market on the basis of application?

- What is the breakup of the Australia electric motor market on the basis of region?

- What are the various stages in the value chain of the Australia electric motor market?

- What are the key driving factors and challenges in the Australia electric motor market?

- What is the structure of the Australia electric motor market and who are the key players?

- What is the degree of competition in the Australia electric motor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electric motor market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electric motor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electric motor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)