Australia Electric Razors Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2026-2034

Australia Electric Razors Market Summary:

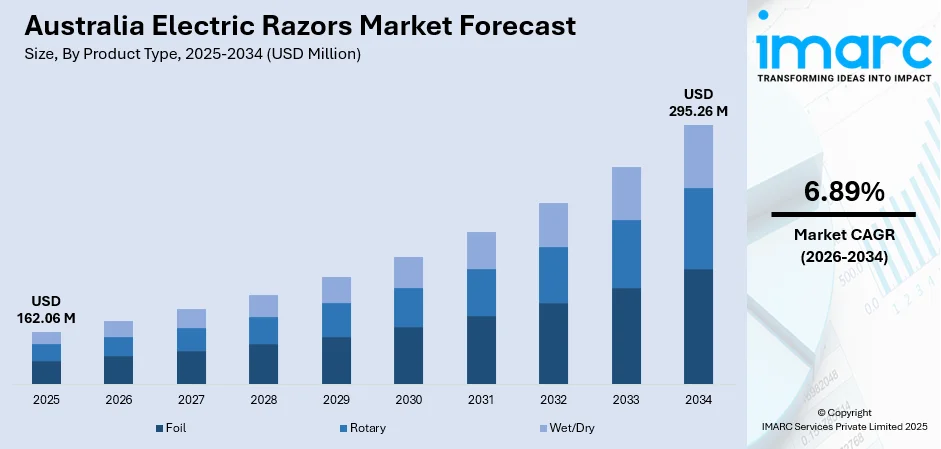

The Australia electric razors market size was valued at USD 162.06 Million in 2025 and is projected to reach USD 295.26 Million by 2034, growing at a compound annual growth rate of 6.89% from 2026-2034.

The Australia electric razors market demonstrates robust growth potential driven by rising consumer awareness regarding personal grooming and hygiene, increasing urbanization rates across metropolitan areas, and the growing influence of social media on grooming trends. The convergence of technological innovation in shaving devices, expanding e-commerce platforms, and heightened demand for premium grooming solutions is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants across the value chain.

Key Takeaways and Insights:

- By Product Type: Foil electric razors dominate the market with a share of 46% in 2025, driven by their precision shaving capabilities, reduced skin irritation, and suitability for sensitive skin types.

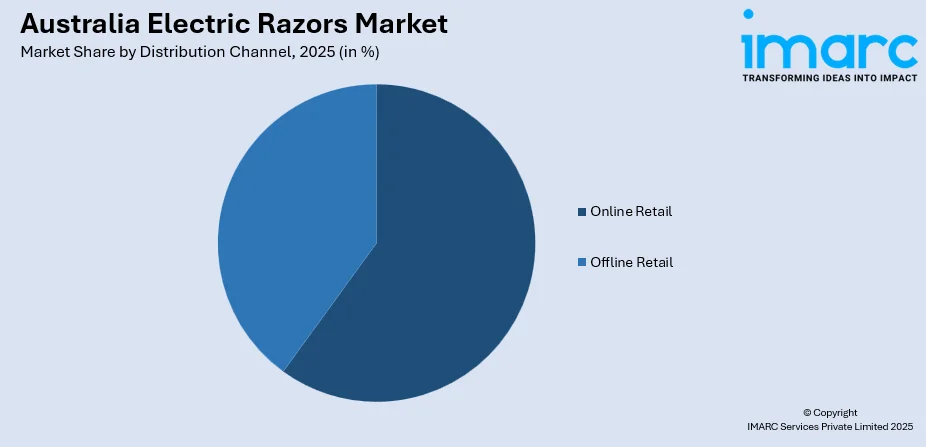

- By Distribution Channel: Online retail leads the market with a share of 55% in 2025, owing to widespread e-commerce adoption, convenience of home delivery, and extensive product comparison capabilities.

- By End User: Men represent the largest segment with a market share of 70% in 2025, fueled by evolving masculinity norms, increased focus on self-care, and growing demand for efficient grooming solutions.

- Key Players: The Australia electric razors market exhibits moderate competitive intensity, with multinational personal care corporations competing alongside emerging players across premium and value segments. Market dynamics reflect strategic positioning emphasizing advanced technology, sustainability initiatives, and omnichannel distribution capabilities.

To get more information on this market, Request Sample

The Australia electric razors market represents a dynamic segment within the broader personal care industry, characterized by continuous technological innovation and evolving consumer preferences. Australian consumers increasingly prioritize grooming and personal appearance, driving sustained demand for advanced shaving solutions that deliver convenience and performance. The male grooming segment has emerged as particularly dynamic, with men adopting comprehensive grooming routines spanning skincare, haircare, and shaving products. The market benefits from Australia's exceptional digital connectivity, with 26.1 million individuals using the internet at the start of 2025 and online penetration standing at 97.1% of the total population according to DataReportal's Digital 2025 Australia report, creating favorable conditions for digital-first grooming brands and e-commerce expansion.

Australia Electric Razors Market Trends:

Shift Toward Premium and Technology-Integrated Products

The Australia electric razors market is witnessing a transformative shift toward premium products featuring advanced technological capabilities including skin-sensitive sensors, self-adjusting blades, and AI-powered shaving optimization. Consumers increasingly demand devices that deliver salon-quality grooming results at home, driving manufacturers to integrate sophisticated features such as PowerAdapt Sensor technology that reads and responds to hair thickness in real time. In April 2025, Philips launched its i9000 series featuring AI-driven SkinIQ PRO technology with intelligent sensors that read hair density 500 times per second and automatically adapt cutting power, along with five customizable shaving modes and Active Pressure & Motion Guidance for real-time feedback, with features explicitly available in Australia and New Zealand markets.

E-commerce Expansion and Digital Retail Transformation

Digital commerce is fundamentally reshaping how Australian consumers discover and purchase electric razors, with online retail emerging as the dominant distribution channel. According to Australia Post's annual eCommerce Report, Australians spent AUD 69 Billion on online shopping in 2024, marking a 12% increase compared to the prior year, with nearly 50% of Gen Z and millennials making weekly online purchases through social media platforms. Amazon has gained significant market presence in men's grooming, holding leading online sales positions through leveraging fast delivery, curated storefronts, and subscription models. Specialty retailers like Shaver Shop have embraced omnichannel strategies, with the company recording a 102% year-on-year increase in online sales historically.

Rising Focus on Sustainability and Eco-Friendly Alternatives

Environmental consciousness is increasingly influencing consumer preferences within Australia's electric razors market, spurring innovation in sustainable product design and materials. Electric shavers are positioned as eco-friendly alternatives to disposable razors, aligning with the region's commitment to green practices and resonating with environmentally conscious consumers. Manufacturers are responding by introducing products featuring recyclable materials, biodegradable packaging, and energy-efficient designs. The trend toward sustainability extends to product longevity, with quality foil shavers designed to last up to 18 months with proper maintenance, reducing environmental impact compared to single-use alternatives.

Market Outlook 2026-2034:

The Australia electric razors market demonstrates robust growth potential throughout the forecast period, underpinned by irreversible demographic trends and evolving sociocultural attitudes toward personal grooming. The market is poised for sustained expansion as awareness increases, technological innovation accelerates, and product accessibility improves across diverse geographic and socioeconomic segments. Rising disposable incomes and growing urbanization rates continue to drive consumer investment in premium grooming products, while the rapid expansion of e-commerce platforms ensures broader market reach. The market generated a revenue of USD 162.06 Million in 2025 and is projected to reach a revenue of USD 295.26 Million by 2034, growing at a compound annual growth rate of 6.89% from 2026-2034.

Australia Electric Razors Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Foil | 46% |

| Distribution Channel | Online Retail | 55% |

| End User | Men | 70% |

Product Type Insights:

- Foil

- Rotary

- Wet/Dry

The foil electric razor segment dominates the Australia electric razors market with a share of 46% in 2025.

Foil electric razors utilize oscillating blades positioned beneath a thin, perforated metal foil that captures hair and holds it for precise cutting. This design delivers exceptional closeness while minimizing direct blade contact with skin, making foil shavers particularly advantageous for consumers with sensitive skin or those prone to irritation. The technology enables precise detailing for facial hair, trimming sideburns, and addressing hard-to-reach areas with superior accuracy compared to alternative shaving methods.

The segment's market leadership in Australia reflects multiple factors aligning with consumer preferences and lifestyle demands. Foil shavers are recognized for delivering efficient, close shaves that meet professional grooming standards, with blade speeds ranging from 7,000 to 14,000 cycles per minute for optimal cutting performance. Several premium manufacturers including Braun and Panasonic in the Australia electric razors market are offering cutting-edge, ergonomically designed products that promise salon-quality grooming results at home. In September 2024, MANSCAPED launched The Chairman Pro electric foil shaver featuring dual-head design, SkinSafe technology, waterproof construction, and LED functionality, exemplifying the ongoing innovation driving segment growth.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Online Retail

- Offline Retail

The online retail distribution channel leads the Australia electric razors market with a share of 55% in 2025.

Online retail has emerged as the dominant distribution channel for electric razors in Australia, fundamentally transforming how consumers discover, compare, and purchase grooming products. The channel benefits from Australia's high digital penetration rates and sophisticated e-commerce infrastructure, supported by widespread adoption of digital payment solutions and buy-now-pay-later services that reduce purchasing barriers. The convenience of home delivery, extensive product comparison capabilities, subscription-based models, and access to detailed customer reviews continue to drive consumer preference toward online platforms over traditional retail channels.

The digital commerce transformation directly benefits the electric razors market by improving product accessibility, reducing purchasing barriers, and addressing social concerns that may inhibit in-store purchases. E-commerce enables brands to reach beyond physical retail limitations, offering services like virtual consultations, detailed product comparisons, and subscription-based deliveries. In November 2024, Amazon opened a USD 90 Million fulfillment center in Western Sydney, adding 360 jobs and expanding capacity for consumer goods distribution. Amazon has gained significant ground in men's grooming categories, holding leading positions in online sales of razors and blades since 2023, leveraging fast delivery, curated storefronts, and personalized recommendation algorithms.

End User Insights:

- Men

- Women

The men segment holds the largest share of 70% in the Australia electric razors market in 2025.

Men constitute the dominant end-user segment for electric razors in Australia, driven by routine facial grooming requirements and evolving cultural attitudes toward male self-care and personal appearance. The growing emphasis on professional presentation in workplace environments has further reinforced grooming standards among male consumers. Social media platforms have emerged as instrumental mediums in amplifying awareness regarding male grooming, with influencers and content creators setting grooming benchmarks that compel individuals to meticulously attend to their grooming rituals to project polished professional and social images.

The men's segment benefits from powerful motors, multi-directional heads, and specialized blades designed for thick or coarse facial hair. The growing emphasis on self-care and personal grooming is increasing male investment in premium grooming devices, with brands targeting male users focusing on performance, precision, and comfort through features like app integration, skin sensitivity sensors, and advanced blade systems. In July 2024, Dove Men+Care returned as a sponsor of Australian Rugby to dispel myths that men have about taking care of themselves, highlighting the cultural shift toward normalized male grooming.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

New South Wales and Australia Capital Territory dominate the electric razors market, driven by Sydney's large metropolitan population, high disposable incomes, advanced retail infrastructure, strong e-commerce adoption, and concentration of premium grooming-conscious professionals seeking technology-integrated personal care solutions.

Victoria and Tasmania represent a significant market share, supported by Melbourne's affluent urban population, thriving retail sector, growing male grooming culture, expanding specialty electronics stores, and increasing consumer preference for premium sustainable grooming products among environmentally conscious demographics.

Queensland's electric razors market benefits from substantial population growth, tourism-driven retail activity, expanding urban centers including Brisbane and Gold Coast, warm climate encouraging regular grooming habits, and rising disposable incomes supporting premium personal care purchases among younger demographics.

Northern Territory and South Australia collectively contribute to market growth through Adelaide's established retail networks, increasing urbanization rates, growing awareness of male grooming trends, expanding online retail penetration in remote areas, and rising consumer demand for durable grooming solutions.

Western Australia's electric razors market is propelled by Perth's affluent population, strong mining sector incomes, growing male grooming consciousness, expanding specialty retailer presence, increasing e-commerce accessibility across regional areas, and rising demand for premium technology-driven personal care devices among working professionals.

Market Dynamics:

Growth Drivers:

Why is the Australia Electric Razors Market Growing?

Rising Disposable Income and Urbanization Driving Premium Product Adoption

Australia's growing disposable incomes and accelerating urbanization are fundamentally reshaping demand patterns for electric razors, enabling consumers to invest in premium grooming solutions that deliver enhanced convenience and performance. Urban consumers increasingly prefer electric shavers with features like rechargeable batteries and ergonomic handles that accommodate time-constrained grooming routines while maintaining professional appearance standards.

Digital Commerce Transformation Enhancing Market Accessibility

The explosive growth of e-commerce in Australia is dramatically improving electric razor accessibility while reducing traditional purchasing barriers related to product discovery, price comparison, and delivery convenience. The Shavers eCommerce market specifically demonstrated strong momentum, with Amazon emerging as a leading platform for grooming products through strategic investments in fulfillment infrastructure and consumer engagement. Nearly one-fifth of Australia’s population belongs to Gen Z who make weekly online purchases through social media platforms, creating new customer acquisition channels for electric razor brands leveraging influencer marketing and social commerce capabilities.

Technological Innovation Driving Product Differentiation and Consumer Demand

Continuous technological advancement in electric razor design and functionality is creating compelling value propositions that attract consumers seeking superior grooming experiences. Manufacturers are introducing sophisticated features including AI-powered sensors that adapt to hair density, flexible multi-directional shaving heads that contour to facial geometry, and integrated skin protection systems that minimize irritation. In June 2024, Xiaomi launched the Mijia Electric Shaver Dual Blade Version featuring exclusive dual-bladed technology, IPX7 waterproof rating, touch operation capability, and wet and dry usability. Premium models now offer extended battery life with cordless shaving, quick-charge functionality delivering full shaves from five-minute charges, and USB-C connectivity for modern device compatibility. These innovations position electric shavers as essential grooming investments rather than discretionary purchases.

Market Restraints:

What Challenges the Australia Electric Razors Market is Facing?

High Maintenance and Replacement Costs Limiting Adoption

The ongoing maintenance requirements and replacement costs associated with electric shavers present significant barriers to market expansion, particularly among price-sensitive consumers. Electric razors require specialized cleaning products, regular blade and foil replacements typically every 18 months, and occasional battery replacements, contributing to cumulative ownership costs that exceed initial purchase prices. These recurring expenses limit appeal among consumers seeking low-maintenance, affordable grooming options.

Competition from Traditional Razors and Disposable Alternatives

Entrenched consumer familiarity with conventional manual razors poses substantial obstacles to widespread electric shaver adoption in Australia. The relatively high price tags associated with quality electric shavers may discourage price-conscious consumers who perceive traditional grooming tools as more economically sensible. Manual razors require minimal upfront investment and no added maintenance costs, making them attractive value propositions for budget-oriented consumers.

Consumer Perception Challenges and Learning Curve Barriers

Concerns regarding durability, perceived value, and unfamiliarity with electric shaving techniques contribute to consumer hesitancy in transitioning from traditional shaving methods. Some consumers report that electric razors require multiple passes over facial areas and may not deliver the same closeness as blade razors. Overcoming these challenges requires strategic marketing emphasizing electric shaver benefits and continuous innovation to strengthen appeal and competitiveness relative to traditional alternatives.

Competitive Landscape:

The Australia electric razors market exhibits moderate competitive intensity characterized by the presence of multinational personal care corporations alongside specialized grooming retailers competing across premium and value segments. The competitive landscape is increasingly shaped by omnichannel distribution strategies, with specialty retailers like Shaver Shop operating as Australia's leading grooming retailer through integrated online and physical store presence. In August 2025, Shaver Shop reported its FY25 financial results, achieving a record gross profit margin of 45.5% with EBIT growing 2.4% to AUD 22.5 Million, while expanding its store network to multiple locations across Australia and New Zealand. Market dynamics reflect strategic positioning emphasizing technological differentiation, sustainability credentials, and personalized grooming experiences.

Recent Developments:

- October 2024: Panasonic partnered exclusively with Shaver Shop for its PV Series launch in Australia, implementing targeted messaging and product awareness campaigns alongside distribution through major electrical retailers including JB Hi-Fi and Harvey Norman.

- In January 2024, Panasonic announced its Palm Shaver featuring NAGORI, a sustainable composite material derived from sea minerals that contains up to 75% seawater minerals, reducing plastic usage by 40% compared to conventional grooming products. The trend toward sustainability extends to product longevity, with quality foil shavers designed to last up to 18 months with proper maintenance, reducing environmental impact compared to single-use alternatives.

Australia Electric Razors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Foil, Rotary, Wet/Dry |

| Distribution Channels Covered | Online Retail, Offline Retail |

| End Users Covered | Men, Women |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia electric razors market size was valued at USD 162.06 Million in 2025.

The Australia electric razors market is expected to grow at a compound annual growth rate of 6.89% from 2026-2034 to reach USD 295.26 Million by 2034.

The foil electric razor segment dominated the market with a share of 46% in 2025, driven by precision shaving capabilities, reduced skin irritation for sensitive skin, and suitability for achieving close, professional-quality shaves.

Key factors driving the Australia electric razors market include rising disposable incomes and urbanization, expanding e-commerce platforms and digital retail transformation, and continuous technological innovation in shaving devices featuring advanced sensors and multi-directional heads.

Major challenges include high maintenance and replacement costs for blades and foils, competition from traditional manual razors and disposable alternatives, consumer learning curve barriers, and price sensitivity among budget-conscious consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)