Australia Electric Scooters Market Size, Share, Trends and Forecast by Drive, Battery, Product, Battery Fitting, End Use, and Region, 2025-2033

Australia Electric Scooters Market Overview:

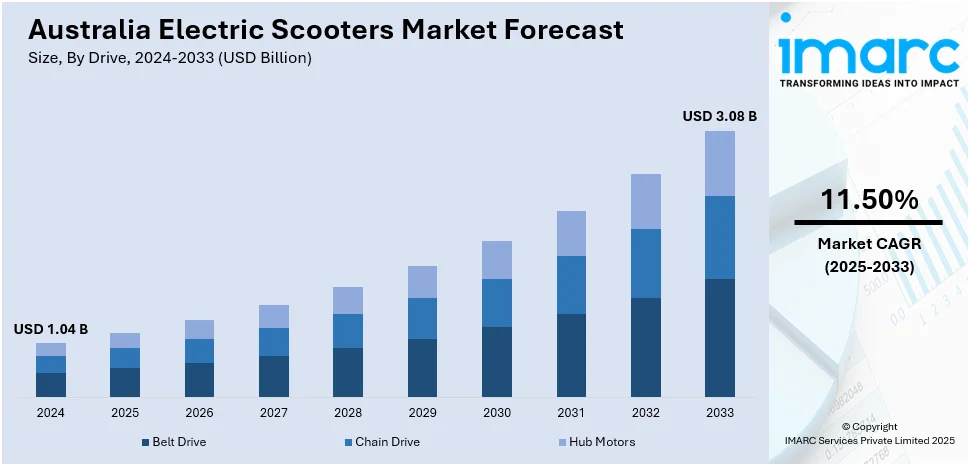

The Australia electric scooters market size reached USD 1.04 Billion in 2024. Looking forward, the market is expected to reach USD 3.08 Billion by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The market is expanding significantly due rapid urbanization, growing traffic in big cities, and government programs like subsidies and lower registration costs. As electric scooters are less expensive to operate than conventional vehicles, they have also become a desirable alternative as a result of rising fuel prices. For short-distance travel, electric scooters provide a practical solution that makes it easy for users to maneuver through crowded areas, which is further increasing the Australia electric scooters market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.04 Billion |

| Market Forecast in 2033 | USD 3.08 Billion |

| Market Growth Rate 2025-2033 | 11.50% |

Key Trends of Australia Electric Scooters Market:

Expansion of Shared E-Scooter Services

Australia's e-scooter market is on the rise, especially in shared mobility services. Firms such as Lime and Neuron have also spread their business beyond large cities like Sydney and Melbourne, launching e-scooter-sharing schemes to smaller cities and regional centers. This is prompted by the identification of the need for easy mobility in these regions. The popularity of e-scooter-sharing in big cities has proven the feasibility of such services, leading to additional investment and expansion. The presence of e-scooters offers citizens and tourists a green and effective means of transport, diminishing car dependency and alleviating traffic congestion. With improving infrastructure supporting the use of e-scooters, such as the creation of exclusive lanes and parking lots, the popularity of shared e-scooter usage is likely to pick up, lending a general boost to the electric scooter market in Australia.

To get more information on this market, Request Sample

Integration of Smart Technology

The incorporation of smart technology into electric scooters is a prominent trend in the Australian market. Manufacturers are adding features like sensors with AI, real-time diagnostics, and pedestrian detection systems to improve safety and user experience. For example, some e-scooters come with cameras and sensors that are capable of pedestrian detection, much like the sensing capabilities of intelligent cars. Moreover, developments in battery technology are making power sources more efficient and long-lasting, helping tackle issues of range anxiety and charging frequency. These technology advancements enhance the performance and safety of e-scooters, while they also cater to tech-oriented consumers who demand better features in their transport options. With the increasing demand for intelligent mobility solutions, adoption of these technologies in products is likely to be at the forefront, influencing the Australia electric scooters market growth.

Regulatory Developments and Safety Concerns

The regulatory environment for electric scooters in Australia is evolving to address safety issues and increasing usage of these items. To address the increased incidence of fires caused by low-quality lithium-ion batteries, the New South Wales government has imposed severe limits on the sale of e-bikes, e-scooters, hoverboards, and e-skateboards. Beginning February 2025, suppliers of non-compliant products may face fines of up to $825,000. The move is meant to promote compliance with globally accepted product standards and plug loopholes that have seen substandard batteries reach the market. Safety issues have also been raised by e-scooter accidents and battery fires, which have led to calls for increased regulation and improved education on safe use. With continued market growth, innovation will have to be balanced against safety and regulatory compliance to guarantee sustainable industry development of electric scooters in Australia.

Growth Drivers of Australia Electric Scooters Market:

Urbanization and Traffic Congestion Relief

As Australia’s major cities experience accelerating urban population growth, the demand for compact and efficient modes of transport continues to rise. Electric scooters have emerged as a viable mobility solution, particularly for short-distance travel within densely populated metropolitan areas. Their nimble structure allows users to bypass traffic bottlenecks while reducing reliance on overburdened public transport networks. For daily commuters, students, and city dwellers, e-scooters offer a time-saving and cost-effective alternative to traditional vehicles. Their ease of parking, lower maintenance needs, and suitability for short urban commutes make them increasingly attractive. As congestion intensifies in cities like Sydney, Melbourne, and Brisbane, electric scooters are becoming a preferred choice for those seeking flexible, last-mile transit options that align with evolving urban infrastructure.

Rising Environmental Consciousness

Amid growing concern over environmental sustainability and rising fuel prices, Australians are actively seeking greener transport alternatives. Electric scooters offer a zero-emission solution that aligns with national and corporate climate goals, particularly in urban areas focused on reducing carbon footprints. Individuals seeking eco-friendly commuting options and businesses exploring sustainable delivery methods are adopting e-scooters to meet environmental objectives. These vehicles contribute to improved air quality and reduced noise pollution while helping users avoid the environmental downsides of traditional motor vehicles, which is a major factor driving the Australia electric scooters market demand. The growing emphasis on environmental, social, and governance (ESG) standards among corporations is also encouraging investment in clean mobility options. As climate change mitigation becomes a national priority, the appeal of electric scooters as part of a low-emission urban transport system continues to expand.

Enhanced Battery Performance and Affordability

Technological advancements in battery design, particularly in lithium-ion technology, are significantly enhancing the performance and affordability of electric scooters. Newer models now offer extended range per charge, faster recharging, and greater durability, making them more dependable for daily use. Simultaneously, falling battery prices are helping manufacturers reduce the retail cost of e-scooters, widening their accessibility to a larger consumer base. These developments are particularly beneficial for commuters, students, and small businesses seeking reliable, low-cost urban mobility. Longer battery life also boosts user confidence in completing daily commutes without range anxiety. With improvements in power efficiency, weight reduction, and battery safety, electric scooters have become more attractive not only for personal use but also for commercial and delivery applications in Australia's evolving micromobility landscape.

Opportunities of Australia Electric Scooters Market:

Integration into Delivery and Logistics

The ongoing surge in e-commerce and on-demand services is unlocking new applications for electric scooters in last-mile delivery and urban logistics. Companies, particularly in food delivery and courier services, are adopting lightweight, battery-powered scooters to optimize short-distance transportation. These vehicles present a cost-effective, environmentally conscious alternative to fuel-powered bikes or cars, especially in congested city zones. Their maneuverability, lower maintenance costs, and minimal emissions offer operational benefits while aligning with sustainability targets. This shift is enabling micro-logistics models that rely on compact, agile mobility solutions, especially for high-frequency drop-offs in dense areas. As logistics providers seek faster, greener, and more efficient methods for urban distribution, the use of electric scooters presents a compelling value proposition beyond their traditional role in personal commuting.

Expansion into Regional and Suburban Areas

Although electric scooter usage initially flourished in Australia’s major metros like Sydney, Brisbane, and Melbourne, market momentum is increasingly shifting toward regional towns and suburban corridors. According to the Australia electric scooters market analysis, factors such as improved road infrastructure, local council trials, and growing commuter demand are driving this geographic expansion. Residents in suburban areas are showing interest in e-scooters as a flexible alternative to cars and inconsistent public transport services. The availability of more robust and longer-range models also supports travel needs in less densely populated zones. As awareness spreads and regulatory clarity improves, smaller cities and towns are becoming attractive markets for shared mobility operators and personal scooter vendors. This regional uptake significantly broadens the addressable market and introduces new business models tailored to semi-urban and outer-urban environments.

Rise of Personal Foldable and Recreational Scooters

Portable and foldable e-scooters designed for individual users are seeing rising demand in Australia, especially among students, young professionals, and tourists. These models cater to consumers who prioritize convenience, portability, and affordability. Their compact design allows easy integration into multimodal travel, such as combining scooter use with public transport, while also supporting recreational use on bike paths and leisure trails. With lightweight frames and simplified folding mechanisms, these scooters are ideal for short commutes, weekend excursions, or inner-city exploration. As lifestyle preferences shift toward mobility solutions that are both fun and functional, foldable scooters are becoming part of the broader consumer tech ecosystem. Their increasing visibility in retail and e-commerce channels is helping expand adoption beyond strictly utilitarian or urban-centric users.

Challenges of Australia Electric Scooters Market:

Insufficient Scooter Infrastructure

While the popularity of electric scooters is on the rise, most Australian cities still lack the necessary infrastructure to support their safe and efficient use. Dedicated scooter lanes, designated parking areas, and accessible charging points remain limited, forcing riders to share space with pedestrians or vehicles. This not only increases the likelihood of accidents and congestion but also restricts user convenience and confidence. Without well-defined paths and supportive facilities, scooters often become a source of disruption rather than a solution for urban mobility. The absence of infrastructure also discourages municipalities from endorsing large-scale adoption, slowing integration into public transport networks. Addressing these physical and operational gaps is critical to ensuring that e-scooters can function as a sustainable and mainstream mode of transportation.

Fragmented State Laws and Compliance Confusion

The inconsistent regulatory landscape across Australian states poses a major hurdle for electric scooter adoption. Each state and territory has its own set of rules regarding speed limits, age restrictions, helmet usage, and permissible riding zones, resulting in widespread confusion among consumers and retailers. This fragmentation makes it difficult for e-scooter companies to roll out national services or marketing campaigns and complicates enforcement for local authorities. Consumers often face uncertainty about where and how they can ride legally, reducing confidence and hindering daily use. For businesses, the lack of uniformity introduces legal risks and compliance burdens, particularly for shared mobility providers operating across borders. Harmonizing legislation and establishing consistent, nationwide standards are essential to building user trust and unlocking the full market potential of e-scooters in Australia.

Safety Incidents and Public Backlash

Growing incidents of e-scooter-related accidents, including head injuries and hospitalizations, have triggered public concern and media scrutiny. Cases of reckless riding, lack of helmet usage, and scooters being operated on footpaths or in pedestrian zones have fueled negative sentiment, especially in high-density areas. This has led to trial pauses or restrictions in cities like Melbourne and Perth, with authorities citing safety as a primary concern. Such backlash is affecting the reputation of e-scooters as a safe mode of transport and slowing regulatory support for broader deployment. Public pressure has also led to calls for stricter enforcement and improved rider education. Unless safety perceptions improve through better rider behavior, infrastructure, and rules, community resistance may continue to limit widespread acceptance and long-term growth.

Government Initiatives of Australia Electric Scooters Market:

State-Level Micro-Mobility Action Plans

Australian states are proactively developing frameworks to regulate and support the growth of electric scooters. New South Wales, for example, has launched its E-Micromobility Action Plan to guide legal use in public areas. This includes pilot programs for shared scooter schemes, installation of dedicated parking spaces at key transport interchanges, and extensive community engagement to shape future legislation. These initiatives aim to address infrastructure gaps and encourage safer usage while supporting the shift toward low-emission urban mobility. By facilitating controlled trials and promoting collaboration between councils, transport agencies, and private operators, state-level action plans are laying the groundwork for broader acceptance. These strategies help bridge regulatory uncertainty and pave the way for integrating e-scooters into the mainstream transportation ecosystem.

Device Safety Standards and Battery Regulation

Growing safety concerns, particularly regarding battery-related fires, have driven Australian states to tighten product oversight. New South Wales is introducing stringent safety requirements for electric scooters and similar mobility devices, including mandatory certification and compliance with new standards starting February 2025. Retailers and importers that fail to meet these regulations face penalties of up to A$825,000. The move is a direct response to a rise in incidents linked to poorly manufactured lithium-ion batteries and unregulated devices entering the market. By setting clear compliance benchmarks, the government is not only enhancing consumer safety but also promoting higher quality across the sector. These measures are likely to influence national standards, encouraging consistent product regulation and fostering trust in e-scooter technologies among both users and local authorities.

Parliamentary Inquiries and Policy Reform Efforts

Considering increasing accidents and public concern, state governments, particularly Queensland, are actively reviewing existing e-scooter regulations. Ongoing parliamentary inquiries are evaluating critical areas such as enforcement policies, importation rules, age limits, and rider behavior. These reviews are expected to result in significant reforms, potentially introducing tiered licensing systems, compulsory helmet laws, and clearer penalties for non-compliance. Policymakers aim to balance innovation with safety, ensuring e-scooters are integrated responsibly into urban transport networks. By involving stakeholders like city councils, law enforcement, and the public in shaping these reforms, governments hope to improve accountability and public perception. These structured investigations mark a shift toward more mature and sustainable policy frameworks, promoting safer adoption while aligning micromobility with long-term transport planning goals.

Australia Electric Scooters Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on drive, battery, product, battery fitting, and end use.

Drive Insights:

- Belt Drive

- Chain Drive

- Hub Motors

The report has provided a detailed breakup and analysis of the market based on the drive. This includes belt drive, chain drive, and hub motors.

Battery Insights:

- Lead Acid

- Lithium Ion

- Others

A detailed breakup and analysis of the market based on the battery has also been provided in the report. This includes lead acid, lithium ion, and others.

Product Insights:

- Standard

- Folding

- Self-Balancing

- Maxi

- Three Wheeled

A detailed breakup and analysis of the market based on the product has also been provided in the report. This includes standard, folding, self-balancing, maxi, and three wheeled.

Battery Fitting Insights:

- Detachable

- Fixed

A detailed breakup and analysis of the market based on the battery fitting has also been provided in the report. This includes detachable and fixed.

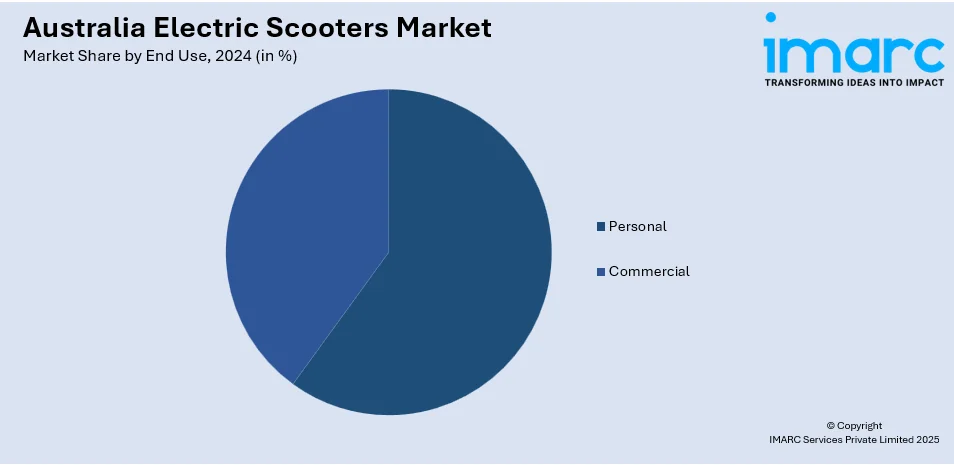

End Use Insights:

- Personal

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end use. This includes personal and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electric Scooters Market News:

- In June 2025, Perth-headquartered e-scooter manufacturer Vmoto partnered with Uber to support the rideshare giant’s goal of transitioning its European delivery fleet to fully electric vehicles by 2030. Founded by EV entrepreneur Patrick Davin, Vmoto will also launch a pilot program in London to introduce the region’s first battery-swapping network for electric mopeds and motorcycles under the collaboration.

- In August 2024, Beam Mobility allegedly deployed hundreds of unregistered “phantom” e-scooters across Australia and New Zealand to avoid local registration fees and boost profits, according to The Australian. The covert moves bypassed council approvals, raising concerns over regulatory compliance and transparency in the micromobility sector.

- In March 2024, a well-known tourist destination in southern Western Australia opted to extend its e-scooter trial, despite strong community opposition. The City of Busselton council decided, following a public survey that showed 62.4% of residents were against the continued use of e-scooters in the town, located 220km south of Perth.

Australia Electric Scooters Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drives Covered | Belt Drive, Chain Drive, Hub Motors |

| Batteries Covered | Lead Acid, Lithium Ion, Others |

| Products Covered | Standard, Folding, Self-Balancing, Maxi, Three Wheeled |

| Battery Fittings Covered | Detachable, Fixed |

| End Uses Covered | Personal, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electric scooters market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electric scooters market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electric scooters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric scooters market in Australia was valued at USD 1.04 Billion in 2024.

The Australia electric scooters market is projected to exhibit a CAGR of 11.50% during 2025-2033.

The Australia electric scooters market is projected to reach a value of USD 3.08 Billion by 2033.

Key trends in Australia's electric scooter market include the expansion of shared e-scooter services beyond major cities, increasing integration of smart technology (AI, advanced safety features), and evolving regulatory frameworks addressing safety and battery standards. There is also a growing focus on lithium-ion batteries and improved charging infrastructure.

Key growth drivers for the Australia electric scooter market include increasing environmental awareness, rising fuel prices, supportive government policies and incentives (e.g., charging infrastructure investment, legalization), rapid urbanization leading to traffic congestion, and the expansion of shared e-scooter services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)