Australia Electric Truck Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion, Range, Application, and Region, 2026-2034

Australia Electric Truck Market Overview:

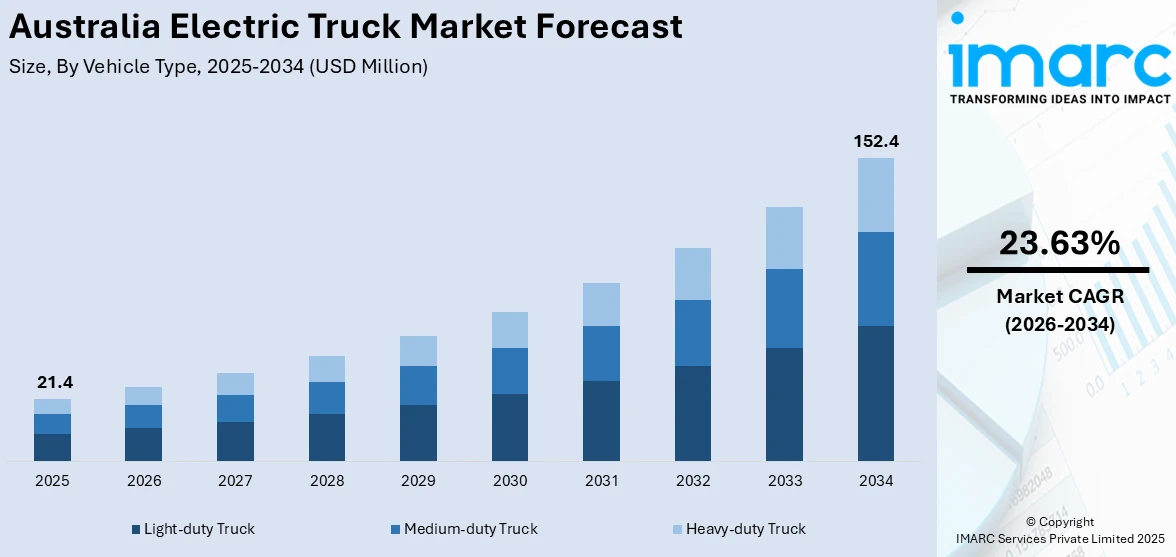

The Australia electric truck market size reached USD 21.4 Million in 2025. Looking forward, the market is projected to reach USD 152.4 Million by 2034, exhibiting a growth rate (CAGR) of 23.63% during 2026-2034. The stringent government emissions regulations, increasing adoption of sustainable transport solutions, rising fuel costs, advancements in battery technology, expansion of EV charging infrastructure, and growing investment in fleet electrification by logistics and transportation companies are expanding the Australia electric truck market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 21.4 Million |

| Market Forecast in 2034 | USD 152.4 Million |

| Market Growth Rate 2026-2034 | 23.63% |

Key Trends of Australia Electric Truck Market:

Growing Adoption of Battery Electric Trucks Due to Sustainability Goals

The increasing focus on sustainability and carbon emission reduction is driving the adoption of battery electric trucks in Australia. Government policies, such as incentives for electric vehicle purchases and investments in charging infrastructure, are accelerating this transition. For instance, an increased luxury car tax threshold of USD 89,332 for fuel-efficient vehicles, fringe benefits tax exemptions for qualified EVs, and the elimination of customs duties on EVs valued below the luxury car tax threshold are just a few of the incentives the Australian government has implemented as of March 28, 2024, to encourage the adoption of electric vehicles (EVs). Businesses in logistics and freight sectors are also prioritizing electric fleets to comply with environmental regulations and reduce operational costs associated with fuel and maintenance. Moreover, advancements in battery technology, including improved range and faster charging times, are making electric trucks more viable for long-haul applications. With major truck manufacturers introducing new electric models tailored for Australian road conditions, the market is expected to witness significant Australia electric truck market growth. The increasing availability of renewable energy sources further supports this shift, ensuring a lower carbon footprint for electric truck operations. As a result, battery electric trucks are becoming a preferred choice for companies looking to transition toward greener and more cost-efficient transportation solutions.

To get more information on this market Request Sample

Expansion of Charging Infrastructure to Support Market Growth

The expansion of charging infrastructure is playing a crucial role in the growth of the electric truck market in Australia. For instance, the Australian Government launched a USD 2.4 Million project to improve the infrastructure for electric vehicle (EV) charging on February 7, 2025. Over the course of the next two and a half years, EVX Australia, with funding from the Australian Renewable Energy Agency (ARENA), plans to install 500 charging ports and 250 kerbside chargers throughout South Australia, Victoria, and New South Wales, including regional regions like Orange, Wagga Wagga, and Goulburn. As part of the Driving the Nation program, this effort seeks to lower emissions and promote the adoption of EVs. Government initiatives and private sector investments are driving the installation of high-capacity charging stations across major highways, logistics hubs, and urban centers. These developments aim to address range anxiety and enable the widespread adoption of electric trucks in long-haul and regional freight transport. Additionally, advancements in fast-charging technology are reducing downtime, making electric trucks more efficient for commercial operations. Companies are also integrating depot-based charging solutions, ensuring a seamless transition to electric fleets. Partnerships between energy providers and truck manufacturers are further enhancing the accessibility of charging networks, which is positively influencing Australia electric truck market outlook. As the infrastructure continues to develop, electric trucks will become a more practical and scalable solution for various industries. The focus on renewable energy integration within charging networks is also helping companies achieve their sustainability targets while reducing dependence on fossil fuels.

Advancements in Battery Technology

Innovations in battery technology represent a significant trend influencing the electric truck market in Australia. Contemporary batteries provide extended driving ranges, increased energy density, and rapid charging capabilities, making electric trucks more viable for both urban and long-haul transportation. These enhancements effectively tackle major issues such as range anxiety and charging downtime that previously hindered adoption by fleet operators. As technology progresses, electric trucks are emerging as a financially viable option compared to diesel alternatives, with reduced operating and maintenance costs over time. The improved durability and efficiency of battery systems also enhance vehicle reliability, fostering greater confidence in widespread deployment. These advancements are substantially boosting Australia electric truck market demand, particularly within the commercial and logistics sectors.

Growth Drivers of Australia Electric Truck Market:

Government Incentives and Emission Targets

Government programs are crucial in promoting the use of electric trucks throughout Australia. Initiatives like rebates, tax incentives, and grants aim to reduce initial costs and motivate fleet operators to switch from diesel engines to zero-emission vehicles. Additionally, stringent emission reduction goals that align with Australia’s clean energy roadmap are driving the transport industry to adopt more sustainable solutions. Regulatory measures are also fostering the establishment of low-emission zones in urban settings, further generating demand for electric trucks in city logistics and last-mile deliveries. These policies render electric trucks more financially feasible and serve as vital instruments in achieving national climate goals and ensuring long-term sustainability.

Rising Fuel Costs

The surge in diesel fuel prices is a significant factor prompting fleet operators and logistics companies to consider electric trucks. Transportation remains heavily reliant on fuel, and rising operational costs are squeezing profits and competitiveness for businesses that depend on conventional vehicles. According to Australia electric truck market analysis, electric trucks present a financially sound option by considerably reducing energy costs, offering more stable long-term operating expenses, and lessening vulnerability to fluctuations in global fuel prices. This financial benefit is particularly appealing for large fleets engaged in logistics, freight, and delivery. With ongoing energy price variations, the attractiveness of stable and environmentally friendly electricity-powered options is likely to expedite the shift toward electric trucks.

Corporate Sustainability Goals

Corporate sustainability initiatives are increasingly becoming a key growth factor in Australia’s electric truck marketplace. Companies, especially in logistics, retail, and e-commerce sectors, face pressures to fulfill environmental, social, and governance (ESG) standards and minimize their carbon emissions. Electric trucks provide a viable solution to harmonize operational efficiency with sustainability aims. Beyond mere compliance, the transition to electric fleets enhances corporate image, attracts environmentally minded customers, and facilitates collaborations with global partners committed to low-emission supply chains. Moreover, businesses are incorporating electric trucks into their wider decarbonization efforts to bolster resilience against upcoming regulatory demands. This heightened emphasis on sustainable practices ensures that electric trucks are not merely an option but a fundamental component of business transformation toward sustainability.

Government Initiative for Australia Electric Truck Market:

Charging Infrastructure Investments

The development of charging infrastructure is a fundamental aspect of governmental efforts to enhance the adoption of electric trucks in Australia. Investments are focused on creating fast-charging networks along major highways, logistics centers, and urban locations to guarantee dependable access for both long-haul and last-mile transportation. By alleviating range anxiety and reducing downtime, these networks foster a supportive environment for fleet operators looking to move away from diesel. The government also encourages public-private partnerships to speed up the installation of charging stations and improve accessibility. Furthermore, integrating renewable energy sources contributes to sustainability and cost-effectiveness in the future. Such infrastructure investments greatly bolster the groundwork for broader acceptance of electric trucks within Australia’s transportation sector.

Fleet Transition Plans

To promote decarbonization in the transportation industry, the Australian government is enthusiastically advocating for organized fleet transition plans. These initiatives aid both public and private logistics operators in systematically retiring diesel trucks in favor of electric options. Pilot projects, financial incentives, and regulatory guidelines are being implemented to make the transition to electric fleets economically feasible and strategically sound. Authorities are also pushing for the use of electric trucks in municipal services like waste collection and public works, which sets a precedent for private sector involvement. Clear timelines and emission reduction targets help steer this transition, ensuring responsibility. These organized approaches mitigate operational risks for businesses while hastening the move toward environmentally friendly and sustainable transportation options in Australia.

Research and Innovation Funding

Funding for research and innovation is another essential governmental initiative that supports the expansion of Australia’s electric truck market. Financial assistance is being offered to universities, research institutions, and private enterprises to enhance battery technologies, charging infrastructures, and lightweight truck designs. These efforts aim to address current challenges such as range limitations, lengthy charging durations, and high vehicle prices. Support for domestic research and development also fosters local expertise, lessens reliance on imports, and paves the way for domestic manufacturing opportunities. Additionally, innovation initiatives promote collaboration among technology developers, automakers, and fleet operators to guarantee the effective application of new solutions. With continuous funding, Australia seeks to establish itself as a forerunner in cutting-edge electric truck technologies.

Australia Electric Truck Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on vehicle type, propulsion, range, and application.

Vehicle Type Insights:

- Light-duty Truck

- Medium-duty Truck

- Heavy-duty Truck

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes light-duty truck, medium-duty truck, and heavy-duty truck.

Propulsion Insights:

- Battery Electric Truck

- Hybrid Electric Truck

- Plug-in Hybrid Electric Truck

- Fuel Cell Electric Truck

A detailed breakup and analysis of the market based on the propulsion have also been provided in the report. This includes battery electric truck, hybrid electric truck, plug-in hybrid electric truck, and fuel cell electric truck.

Range Insights:

- 0-150 Miles

- 151-300 Miles

- Above 300 Miles

The report has provided a detailed breakup and analysis of the market based on the range. This includes 0-150 miles, 151-300 miles, and above 300 miles.

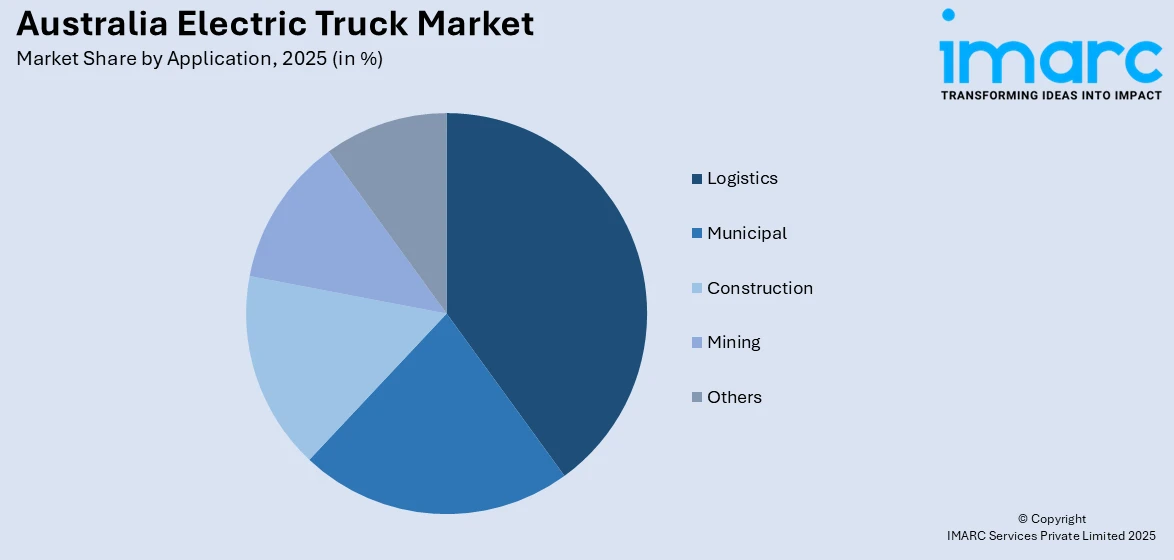

Application Insights:

Access the comprehensive market breakdown Request Sample

- Logistics

- Municipal

- Construction

- Mining

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes logistics, municipal, construction, mining, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electric Truck Market News:

- On March 5, 2025, Centurion, an Australian logistics and transportation company, stated that 20 Mercedes-Benz eActros 300 electric trucks would be deployed in the Perth metropolitan area. A 10 MWh battery energy storage system at Centurion's Hazelmere depot and a 4.4 MW rooftop solar array power these cars. 30 battery electric trucks will be added to Centurion's fleet as part of a USD 29 Million project funded by the Australian Renewable Energy Agency's Future Fuels Program.

Australia Electric Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light-duty Truck, Medium-duty Truck, Heavy-duty Truck |

| Propulsions Covered | Battery Electric Truck, Hybrid Electric Truck, Plug-in Hybrid Electric Truck, Fuel Cell Electric Truck |

| Ranges Covered | 0-150 Miles, 151-300 Miles, Above 300 Miles |

| Applications Covered | Logistics, Municipal, Construction, Mining, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electric truck market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electric truck market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electric truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric truck market in Australia was valued at USD 21.4 Million in 2025.

The Australia electric truck market is projected to exhibit a compound annual growth rate (CAGR) of 23.63% during 2026-2034.

The Australia electric truck market is expected to reach a value of USD 152.4 Million by 2034.

The Australia electric truck market is witnessing notable trends such as advancements in battery technology, expansion of fast-charging networks, and rising collaborations between manufacturers and logistics operators. Increasing preference for sustainable transport and integration of digital fleet management solutions are also shaping the market’s future outlook.

Key growth drivers include supportive government policies, incentives for clean transportation, and the push to achieve carbon neutrality. Rising fuel costs and corporate sustainability commitments are also encouraging logistics firms to adopt electric fleets. Falling battery prices and growing investments in charging infrastructure are further accelerating adoption across industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)