Australia Electric Two-Wheeler Batteries Market Size, Share, Trends and Forecast by Battery Type, Vehicle Type, and Region, 2025-2033

Australia Electric Two-Wheeler Batteries Market Overview:

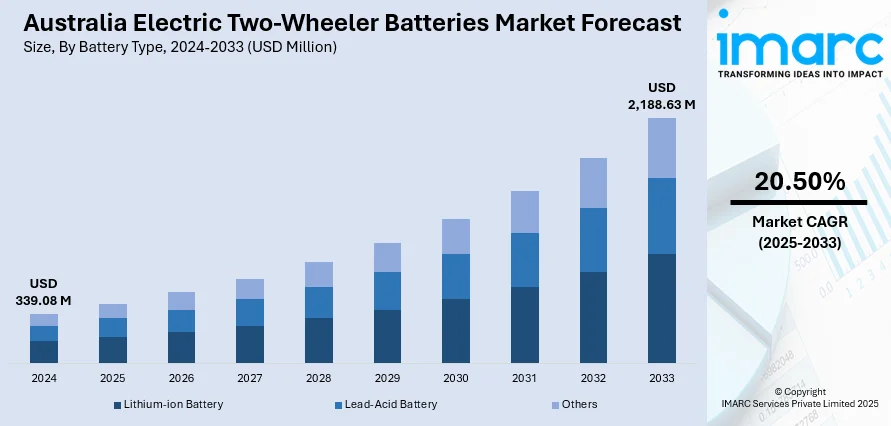

The Australia electric two-wheeler batteries market size reached USD 339.08 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,188.63 Million by 2033, exhibiting a growth rate (CAGR) of 20.50% during 2025-2033. The market is driven by rising fuel costs, stringent carbon emission norms, urban congestion, and increased adoption of electric delivery scooters. Government incentives and growing environmental awareness also support demand. These dynamics collectively contribute to the expanding Australia electric two-wheeler batteries market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 339.08 Million |

| Market Forecast in 2033 | USD 2,188.63 Million |

| Market Growth Rate 2025-2033 | 20.50% |

Australia Electric Two-Wheeler Batteries Market Trends:

Integration of Advanced Battery Chemistries

A significant trend shaping the Australia electric two-wheeler batteries market growth is the increasing adoption of advanced battery chemistries, particularly lithium-ion phosphate (LFP) and nickel manganese cobalt (NMC) technologies. These chemistries offer enhanced energy density, longer lifecycle, and better thermal stability, meeting the safety and performance needs of Australia's urban commuters and logistics fleets. Manufacturers are focusing on incorporating modular and swappable battery systems that reduce vehicle downtime and improve operational efficiency for commercial users. For instance, in August 2024, New South Wales (NSW), Australia, introduced mandatory safety regulations for e-mobility devices and their lithium-ion batteries, effective February 2025. Products like e-bikes and e-scooters must meet international standards targeting thermal stability and electrical safety. This move promotes safer chemistries like LFP and NMC, supporting Australia’s battery market upgrade.

To get more information on this market, Request Sample

Rise in Micro-Mobility and Last-Mile Delivery Solutions

The increasing popularity of micro-mobility solutions, such as electric mopeds and scooters, is another key factor influencing the Australia electric two-wheeler batteries market growth. Urban centers like Sydney, Melbourne, and Brisbane are witnessing a surge in demand for sustainable last-mile delivery options due to the exponential rise in e-commerce and food delivery services. These applications require compact, lightweight batteries that offer fast charging and high energy efficiency. Battery suppliers are responding by developing application-specific battery packs designed for quick swap capabilities and extended daily use. This trend is further supported by local government initiatives promoting cleaner transport alternatives, making two-wheeler electrification a viable solution to reduce traffic congestion and urban emissions. For instance, in July 2024, Segway-Ninebot launched its e-Motorbike series in Australia, featuring three models, the E300SE, E125S, and E110S, catering to the growing micro-mobility market. These models offer smart connectivity, removable batteries, and advanced safety features like ABS and EABS.

Australia Electric Two-Wheeler Batteries Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecast at the country/regional level for 2025-2033. Our report has categorized the market based on battery type and vehicle type.

Battery Type Insights:

- Lithium-ion Battery

- Lead-Acid Battery

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion battery, lead-acid battery, and others.

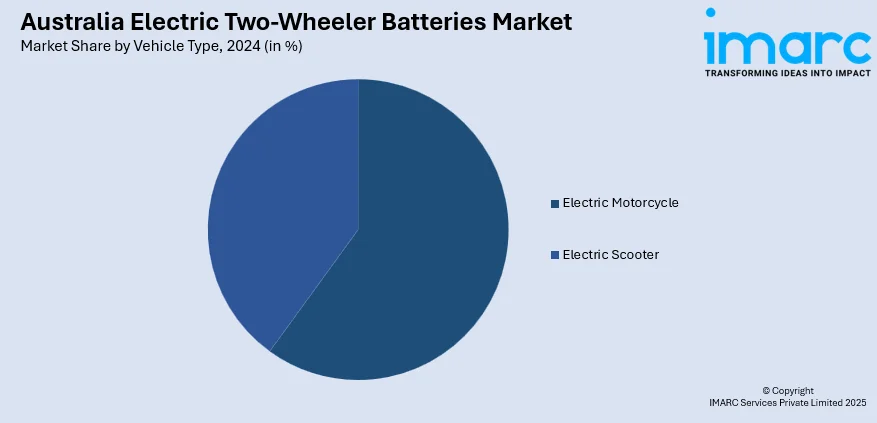

Vehicle Type Insights:

- Electric Motorcycle

- Electric Scooter

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes electric motorcycle and electric scooter.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electric Two-Wheeler Batteries Market News:

- In January 2025, Yadea, with a strong presence in Australia, launched its latest electric two-wheeler featuring advanced sodium-ion battery technology during a major event in Hangzhou, China. The new battery offers enhanced safety, sustainability, fast charging (80% in 15 minutes), and a cycle life of up to 1,500 charges. With superior cold-weather performance and reduced environmental impact compared to lithium batteries, Yadea's innovation marks a significant leap toward greener, high-performance mobility.

Australia Electric Two-Wheeler Batteries Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-ion Battery, Lead-Acid Battery, Others |

| Vehicle Types Covered | Electric Motorcycle, Electric scooter |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queenland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia electric two-wheeler batteries market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia electric two-wheeler batteries market on the basis of battery type?

- What is the breakup of the Australia electric two-wheeler batteries market on the basis of vehicle type?

- What is the breakup of the Australia electric two-wheeler batteries market on the basis of region?

- What are the various stages in the value chain of the Australia electric two-wheeler batteries market?

- What are the key driving factors and challenges in the Australia electric two-wheeler batteries market?

- What is the structure of the Australia electric two-wheeler batteries market and who are the key players?

- What is the degree of competition in the Australia electric two-wheeler batteries market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electric two-wheeler batteries market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electric two-wheeler batteries market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electric two-wheeler batteries industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)