Australia Electric Vehicle Aftermarket Size, Share, Trends and Forecast by Replacement Part, Propulsion Type, Vehicle Type, Certification, Distribution Channel, and Region, 2025-2033

Australia Electric Vehicle Aftermarket Overview:

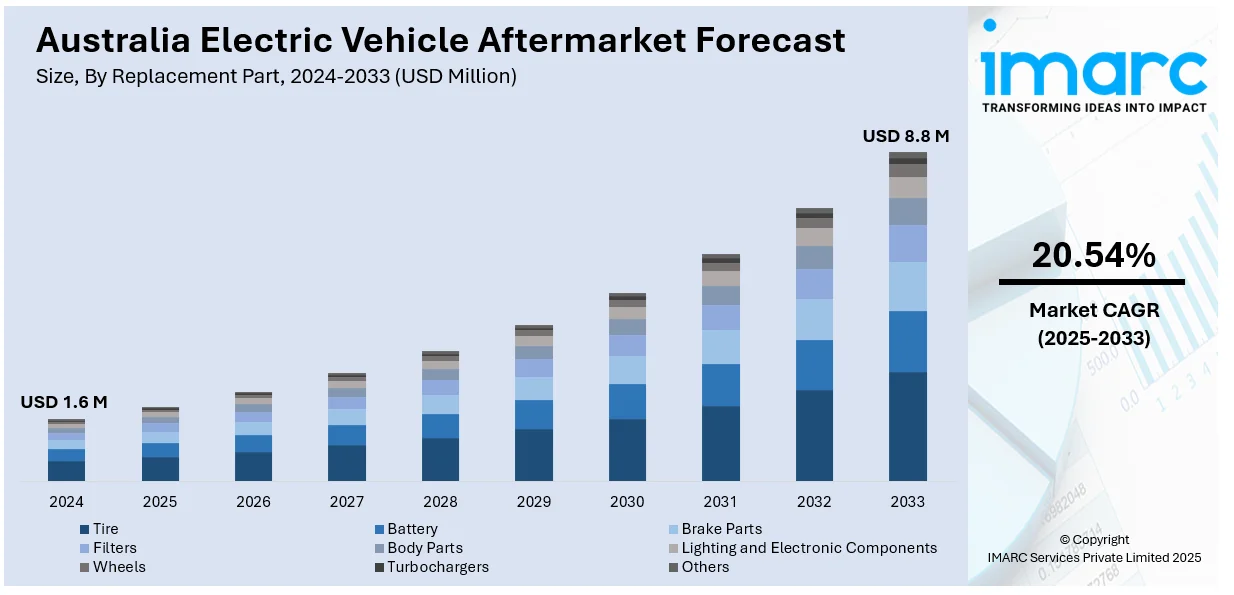

The Australia electric vehicle aftermarket size reached USD 1.6 Million in 2024. Looking forward, the market is expected to reach USD 8.8 Million by 2033, exhibiting a growth rate (CAGR) of 20.54% during 2025-2033. The market is expanding with rising EV adoption, premium brand entries, and increased consumer demand for advanced servicing, diagnostics, and retrofit solutions. Growth is driven by new EV model launches, fleet conversions, and infrastructure investments supporting sustainable mobility and long-term vehicle maintenance needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Million |

| Market Forecast in 2033 | USD 8.8 Million |

| Market Growth Rate 2025-2033 | 20.54% |

Key Trends of Australia Electric Vehicle Aftermarket:

Rising Focus on Consumer-Centric Experience

Australia’s electric vehicle aftermarket is moving toward a more customer-focused approach, with companies now investing in touchpoints that directly engage buyers. Brands are creating interactive platforms to strengthen user relationships beyond the initial sale. This trend reflects the growing importance of in-person experience, digital integration, and convenient access to services. As the market matures, more EV players are choosing physical hubs that offer both product exposure and post-sale service touchpoints. Dealerships and service centers are increasingly acting as brand experience zones where test drives, diagnostics, upgrades, and customer support are all housed under one roof. In December 2024, XPENG opened its 3,000-m² headquarters in Sydney, featuring hands-on test drives and advanced tech showcases. The location near Sydney Airport allows easy access, making it a strategic move to improve service delivery and customer engagement. This expansion raised the brand’s visibility and built a stronger foundation for localized support, a critical need for EV buyers in the region. Such physical investments are driving a shift toward experience-driven service delivery in the aftermarket space. As electric vehicles become mainstream, ensuring strong customer support through infrastructure and accessibility is likely to remain a key growth factor in the Australian EV aftermarket.

To get more information on this market, Request Sample

Sustainability and Brand Differentiation as Growth Pillars

Sustainability is emerging as a core value shaping the electric vehicle aftermarket in Australia. Companies are designing launch experiences and service strategies that align with environmentally responsible branding. This focus on eco-conscious design, technology, and presentation helps in establishing long-term brand loyalty and aftermarket trust. Visual appeal, brand storytelling, and green messaging are being used to deepen consumer connection and drive engagement beyond the vehicle purchase. This strategy supports aftermarket segments like EV parts recycling, green servicing, software upgrades, and battery second life solutions. In November 2024, Inchcape launched DEEPAL Australia with an immersive event at Bondi Beach, unveiling the S07 electric SUV. The launch highlighted DEEPAL’s emphasis on sustainable design, reuse, and innovation, supported by an elaborate tech-led showcase. These efforts reflect how brands are using sustainability as a product feature as well as a service differentiator in the aftermarket. Consumers increasingly look for brands that maintain consistency in their green vision across product life cycles, including post-sale service. This approach is shaping how the aftermarket evolves in terms of both consumer expectations and operational practices. As buyers become more environmentally conscious, aligning aftermarket offerings with sustainability goals will be key to staying competitive in the Australian EV space.

Growth Drivers of Australia Electric Vehicle Aftermarket:

Government Policy Support and Infrastructure Growth

One of the most important drivers of growth in the Australian electric vehicle aftermarket is government support at federal and state levels to drive EV take-up and infrastructure deployment faster. Several state-level incentives, including rebates, stamp duty concessions, and registration rebates, are promoting new EV sales while also driving demand for continued services and aftermarket goods. As public charging networks for EVs grow along major transport routes and city centers, faith in the practical use of EVs is increasing, thereby spurring the need for a larger population of electric vehicles to require ongoing aftermarket maintenance. Government investment in technician training, battery recycling initiatives, and standards development is also creating the foundation for an orderly and scalable EV aftermarket. This policy context supports business confidence for aftermarket service providers and motivates them to invest in EV-compatible workshops, diagnostics, and parts distribution for local needs. These concerted policies serve as a catalyst for developing a mature, responsive aftermarket ecosystem across the country.

Skill Transition in Automotive Trades and Workshop Modernization

Another key driver of Australia's EV aftermarket growth is the shifting skill base in the nation's automotive servicing industry. As servicing conventional internal combustion engines becomes less relevant, Australia's TAFE schools, independent workshops, and dealership networks are presently upskilling to manage the distinctive requirements of electric vehicles. This encompasses training in high-voltage system management, battery diagnostics, and EV-specific safety procedures. Workshops in metropolitan as well as regional towns are making investments in insulated tools, digital platforms, and staff certifications to stay ahead in the changing scenario. This skill transformation is technical and strategic, with service providers redesigning their offerings to add EV charging solutions, software updates, and energy efficiency consultancy. In a nation as geographically extensive and decentralized as Australia, this contemporary updating of trade capabilities guarantees that EV owners, no matter the region, have access to competent aftermarket care. It also creates new jobs and fosters the expansion of localized EV servicing ecosystems.

Connected Services Ecosystem and Digital Innovation

The third strong enabler transforming Australia's EV aftermarket comes from the adoption of digital and connected technologies that facilitate better maintenance, diagnosis, and customer interaction. The merging of onboard telematics, vehicle-software updates, and IoT-driven diagnostics enables the aftermarket to provide predictive maintenance, virtual service, and remote diagnosis, greatly enhancing response time and customer convenience. Australians, particularly those in outer or rural areas with less physical access to service, gain an advantage from these digital-first arrangements, which minimize downtime and travel time. Internet-based scheduling platforms for service, part availability monitoring, and subscription management further increase participation among tech-oriented EV owners. This digital transformation in the aftermarket increases service accuracy, decreases operational costs, and improves owner satisfaction by making proactive, connected support possible. As EVs gain momentum throughout Australia, the aftermarket is entering a new era characterized by integration, intelligence, and customer-focused tech delivery, marking the industry's transition from legacy servicing to data-driven, digitally enabled ecosystem.

Australia Electric Vehicle Aftermarket Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on replacement part, propulsion type, vehicle type, certification, and distribution channel.

Replacement Part Insights:

- Tire

- Battery

- Brake Parts

- Filters

- Body Parts

- Lighting and Electronic Components

- Wheels

- Turbochargers

- Others

The report has provided a detailed breakup and analysis of the market based on the replacement parts. This includes tire, battery, brake parts, filters, body parts, lighting and electronic components, wheels, turbochargers, and others.

Propulsion Type Insights:

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

- Plug-in Hybrid Electric Vehicles

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes battery electric vehicles, hybrid electric vehicles, fuel cell electric vehicles, and plug-in hybrid electric vehicles.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

Certification Insights:

- Genuine Parts

- Certified Parts

- Uncertified Parts

The report has provided a detailed breakup and analysis of the market based on the certification. This includes genuine parts, certified parts, and uncertified parts.

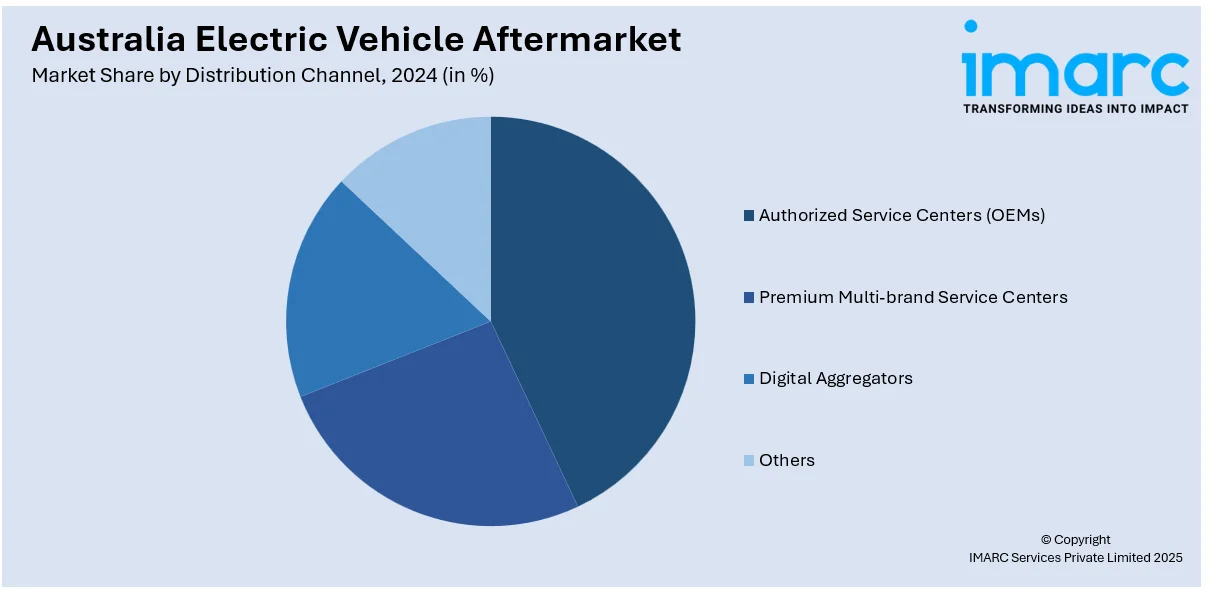

Distribution Channel Insights:

- Authorized Service Centers (OEMs)

- Premium Multi-brand Service Centers

- Digital Aggregators

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes authorized service centers (OEMs), premium multi-brand service centers, digital aggregators, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electric Vehicle Aftermarket News:

- March 2025: MG launched its premium EV brand IM in Australia, introducing the IM5 sedan and IM6 SUV. This expanded the high-end EV segment, boosting aftermarket demand for advanced components, diagnostics, and servicing solutions aligned with premium electric vehicle standards and evolving consumer expectations.

- March 2025: Australian EVS launched advanced EV conversion kits for the 4×4 market, including e-kit 4 and e-kit 6. This expanded aftermarket opportunities for classic and off-road vehicles, driving demand for specialized parts, workshop installations, and zero-emission upgrades across Australia's automotive restoration segment.

Australia Electric Vehicle Aftermarket Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Replacement Parts Covered | Tire, Battery, Brake Parts, Filters, Body Parts, Lighting and Electronic Components, Wheels, Turbochargers, Others |

| Propulsion Types Covered | Battery Electric Vehicles, Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, Plug-In Hybrid Electric Vehicles |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Certifications Covered | Genuine Parts, Certified Parts, Uncertified Parts |

| Distribution Channels Covered | Authorized Service Centers (OEMs), Premium Multi-Brand Service Centers, Digital Aggregators, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electric vehicle aftermarket from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electric vehicle aftermarket.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electric vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia electric vehicle aftermarket was valued at USD 1.6 Million in 2024.

The Australia electric vehicle aftermarket is projected to exhibit a CAGR of 20.54% during 2025-2033.

The Australia electric vehicle aftermarket is expected to reach a value of USD 8.8 Million by 2033.

The Australia electric vehicle aftermarket trends include rising demand for EV-specific parts, expansion of mobile and remote diagnostics, and integration of software-based services. Digital platforms and connected services are also reshaping customer engagement and long-term vehicle maintenance.

The Australia electric vehicle aftermarket is driven by growing EV adoption, supportive government policies, and widespread infrastructure development. Additionally, increased consumer demand for sustainable and tech-enabled solutions fuels expansion, positioning the sector for long-term growth across urban and regional areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)