Australia Electric Water Heater Market Size, Share, Trends and Forecast by Product Type, Capacity, Distribution Channel, End User, and Region, 2025-2033

Australia Electric Water Heater Market Overview:

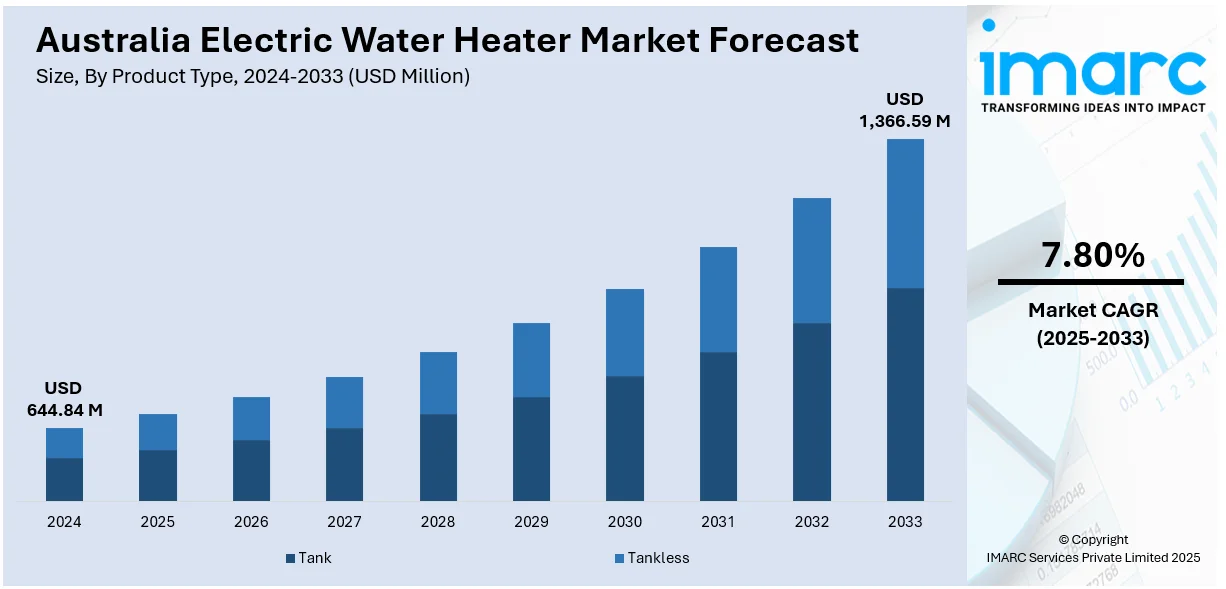

The Australia electric water heater market size reached USD 644.84 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,366.59 Million by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. The market is driven by the increasing demand for energy-efficient and environmentally friendly appliances, technological innovations improving performance and user experience, and the ongoing growth in residential and commercial construction projects. These factors contribute to a greater adoption of electric water heaters in the Australian market, further augmenting the Australia electric water heater market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 644.84 Million |

| Market Forecast in 2033 | USD 1,366.59 Million |

| Market Growth Rate 2025-2033 | 7.80% |

Australia Electric Water Heater Market Trends:

Increasing Demand for Energy-Efficient Solutions

The increase in awareness regarding energy saving and environmental friendliness has had a significant impact on the Australian market for electric water heaters. Buyers are becoming increasingly aware of their energy usage and how it affects not only the environment but their bills as well. Therefore, the demand for energy-saving devices, such as electric water heaters, is on the rise. On July 22, 2024, Rinnai Australia introduced its first Electric Continuous Flow hot water system, the Rinnai Efinity, marking a major milestone in the Australian hot water market. Available in 19 kW and 29 kW capacities, the system is designed for residential apartments and office buildings, offering precise temperature control, energy efficiency, and a slimline design. This new addition reflects the increasing demand for fully electric solutions in the Australian market, complementing Rinnai's reputation for high-quality, reliable products. Government policies, including energy-saving standards and incentives for the embracement of green technologies, have also promoted the use of products that conserve energy. Electric water heaters are especially appealing due to their capability to provide constant hot water without the need to consume more energy than conventional heating systems, thus being appealing to both residential and commercial customers. The ongoing trend towards energy efficiency is one of the significant drivers of the electric water heater market growth in Australia. Not just environment-driven, the trend is further being fueled by the necessity to minimize long-term cost of use for consumers. As a result, the growing awareness of energy-saving products combined with tighter regulatory landscapes is dictating the direction of the electric water heater industry. The Australia electric water heater market growth will likely see further momentum as consumer preferences continue to prioritize sustainability and cost efficiency.

To get more information on this market, Request Sample

Technological Advancements and Product Innovation

Ongoing innovations in water heating technologies have significantly impacted the Australian electric water heater market. Manufacturers are constantly enhancing their product offerings to increase efficiency, reduce operational costs, and improve user experience. The introduction of smart features, such as Wi-Fi connectivity and mobile app controls, has provided consumers with greater convenience, enabling remote monitoring and management of their water heating systems. Additionally, improvements in insulation and heating elements have enhanced the performance and longevity of electric water heaters. These advancements not only make the products more efficient but also address the growing demand for convenience and automation in household appliances. The integration of advanced technologies also aligns with the rising consumer demand for smarter, more connected homes. With increasing consumer reliance on innovative solutions for managing energy consumption, the electric water heater market is benefiting from rapid technological advancements. Furthermore, the ability to integrate these products with solar energy systems is creating additional value for environmentally conscious consumers. For instance, on April 19, 2024, EcoFlow launched its new air-to-water heat pump and smart immersion heater, designed to integrate with rooftop photovoltaic (PV) systems for sustainable residential heating. The PowerHeat Air-to-Water Heat Pump, available in 9 kW and 20 kW versions, offers efficiency for water heating, while the PowerGlow Smart Immersion Heater utilizes surplus solar energy, with models ranging from 3.5 kW to 9 kW. These solutions align with Australia's growing push for energy-efficient and solar-powered heating technologies, enhancing energy independence and reducing reliance on traditional methods. This combination of innovation and sustainability in electric water heater products continues to drive market expansion in Australia.

Australia Electric Water Heater Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, capacity, distribution channel, and end user.

Product Type Insights:

- Tank

- Tankless

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tank and tankless water heaters.

Capacity Insights:

- Less Than 100 Liters

- 100 to 400 Liters

- More Than 400 Liters

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes less than 100 liters, 100 to 400 liters, and more than 400 liters.

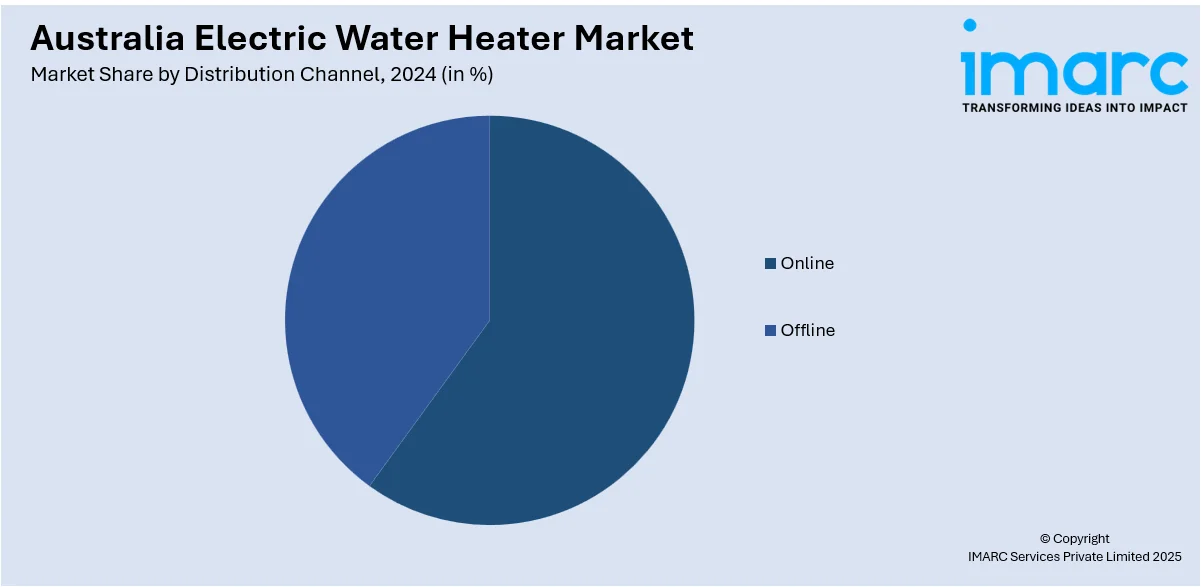

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

End User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electric Water Heater Market News:

- On October 12, 2023, Panasonic partnered with Reclaim Energy to introduce a heat-pump hot water system for the market in Australia, claiming it is up to 5X more efficient compared to traditional gas or electric heating. The CO2 Heat Pump system, which achieves a 6.1 coefficient of performance, will be available from December and is designed for both residential and commercial use. Heat pumps are gaining popularity in Australia, with installations up 70% compared to the first half of 2022, reflecting a shift towards more energy-efficient solutions.

Australia Electric Water Heater Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tank, Tankless |

| Capacities Covered | Less Than 100 Liters, 100 to 400 Liters, More Than 400 Liters |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia electric water heater market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia electric water heater market on the basis of product type?

- What is the breakup of the Australia electric water heater market on the basis of capacity?

- What is the breakup of the Australia electric water heater market on the basis of distribution channel?

- What is the breakup of the Australia electric water heater market on the basis of end user?

- What is the breakup of the Australia electric water heater market on the basis of region?

- What are the various stages in the value chain of the Australia electric water heater market?

- What are the key driving factors and challenges in the Australia electric water heater market?

- What is the structure of the Australia electric water heater market and who are the key players?

- What is the degree of competition in the Australia electric water heater market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electric water heater market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electric water heater market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electric water heater industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)