Australia Electrical Steel Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

Australia Electrical Steel Market Overview:

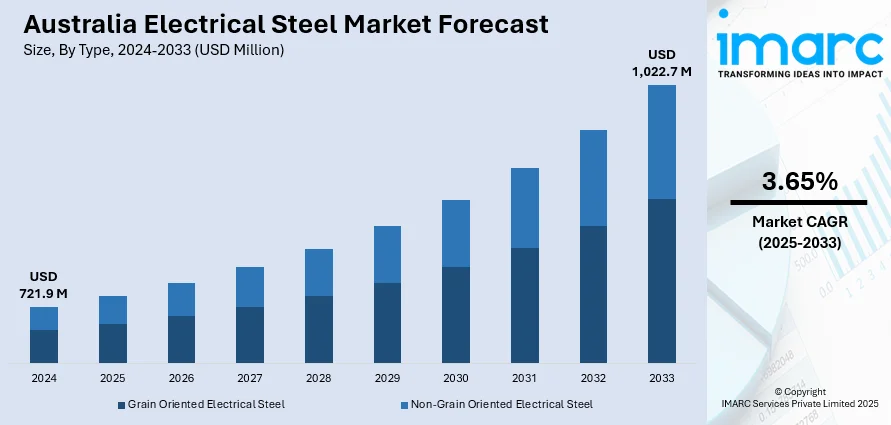

The Australia electrical steel market size reached USD 721.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,022.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.65% during 2025-2033. The escalating renewable energy projects, increasing electric vehicle (EV) adoption, surging grid modernization efforts, growing local manufacturing, rising electricity prices, expanding industrial efficiency measures, and strengthening net-zero commitments are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 721.9 Million |

| Market Forecast in 2033 | USD 1,022.7 Million |

| Market Growth Rate 2025-2033 | 3.65% |

Australia Electrical Steel Market Trends:

Renewable Energy Expansion and Demand for Grain-Oriented Electrical Steel

The push toward renewable energy, particularly in wind power generation, has significantly increased the demand for grain-oriented electrical steel (GOES), which is one of the primary factors accelerating the Australia electrical steel market growth. GOES is critical for manufacturing transformers and large generators due to its superior magnetic properties and reduced core losses. With several wind farm projects in development across regions like Victoria, New South Wales, and South Australia, the need for efficient, high-performance electrical steel has escalated. For instance, in 2025, Golden Plains Wind Farm in Victoria is Australia’s largest onshore wind project, with a planned capacity of 1.3 GW across 215 turbines. Located near Rokewood and developed by WestWind Energy, the project is estimated to generate enough power for over 750,000 homes. Moreover, national energy transition goals, supported by government initiatives such as the Renewable Energy Target (RET), continue to drive investment in utility-scale projects, which is creating a positive Australia electrical steel market outlook.

To get more information on this market, Request Sample

Growth of Electric Vehicle Market and Charging Infrastructure

The steady growth of the electric vehicle (EV) market is influencing demand for non-grain-oriented electrical steel (NGOES), primarily used in electric motors. As EV adoption climbs, supported by incentives, such as fringe benefits tax exemptions and state-level rebates, automakers and component manufacturers are increasing their requirements for high-efficiency materials. NGOES offers superior magnetic performance across variable frequencies, making it ideal for high-speed motor applications in electric cars and buses. In line with this, the rollout of EV charging stations, particularly in urban corridors and along interstate highways, is driving the need for electrical equipment, such as power converters and distribution transformers, which is further boosting the Australia electrical steel market share. Furthermore, the rise in EV production and infrastructure deployment is translating into higher electric steel consumption, particularly among original equipment manufacturer (OEMs) and infrastructure providers, which is another growth-inducing factor.

Modernization of the Power Grid and Energy Efficiency Priorities

As per the Australia electrical steel market forecast, the aging electricity grid is undergoing extensive upgrades to meet the rising demand for reliable and efficient power delivery. The integration of distributed energy resources, including rooftop solar, battery storage, and decentralized generation units, has introduced new challenges to grid stability. Moreover, transmission and distribution networks are being redesigned with advanced transformers and control systems that utilize grain-oriented electrical steel for improved efficiency and reduced losses, which is supporting the market growth. Utilities are prioritizing investments in low-loss, high-permeability cores to minimize energy waste and comply with emerging regulatory standards for energy performance. This shift is driven by environmental considerations, the need to accommodate higher electrical loads, and maintain consistent voltage levels across regions with fluctuating demand. In line with this, suppliers of electric steel are witnessing a rise in orders linked to substation upgrades, smart grid deployments, and regional energy infrastructure projects, which is accelerating the market growth.

Australia Electrical Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on type, application, and end use industry.

Type Insights:

- Grain Oriented Electrical Steel

- Non-Grain Oriented Electrical Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes grain oriented electrical steel and non-grain oriented electrical steel.

Application Insights:

- Transformers

- Motors

- Generators

- Others

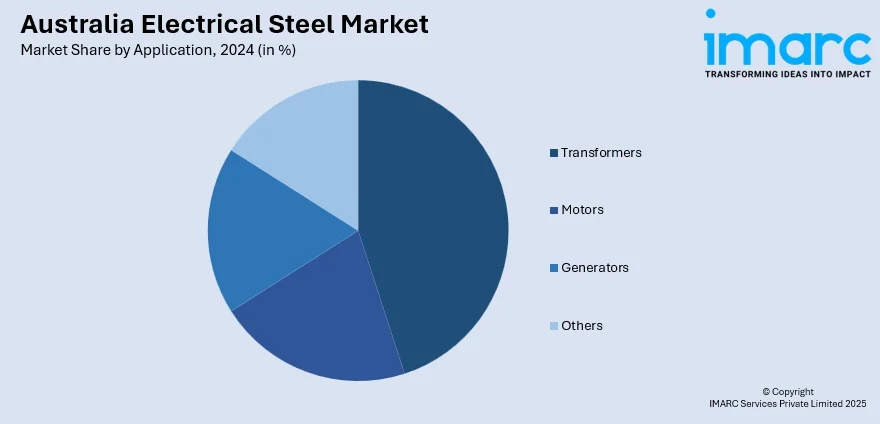

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transformers, motors, generators, and others.

End Use Industry Insights:

- Energy and Power

- Automobiles

- Household Appliances

- Building and Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes energy and power, automobiles, household appliances, building and construction, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electrical Steel Market News:

- In 2024, Greensteel Australia announced a USD 1.6 billion investment to build a state-of-the-art steel plant in Bell Bay, Tasmania. The facility will focus on producing low-emission steel using renewable energy and electric arc furnace (EAF) technology, aiming for an annual output of 1 million tons.

Australia Electrical Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Grain Oriented Electrical Steel, Non-Grain Oriented Electrical Steel |

| Applications Covered | Transformers, Motors, Generators, Others |

| End Use Industries Covered | Energy and Power, Automobiles, Household Appliances, Building and Construction, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia electrical steel market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia electrical steel market on the basis of type?

- What is the breakup of the Australia electrical steel market on the basis of application?

- What is the breakup of the Australia electrical steel market on the basis of end use industry?

- What is the breakup of the Australia electrical steel market on the basis of region?

- What are the various stages in the value chain of the Australia electrical steel market?

- What are the key driving factors and challenges in the Australia electrical steel market?

- What is the structure of the Australia electrical steel market and who are the key players?

- What is the degree of competition in the Australia electrical steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electrical steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electrical steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electrical steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)