Australia Electrical Wires and Cables Market Size, Share, Trends and Forecast by Type, End User and Region, 2026-2034

Australia Electrical Wires and Cables Market Overview:

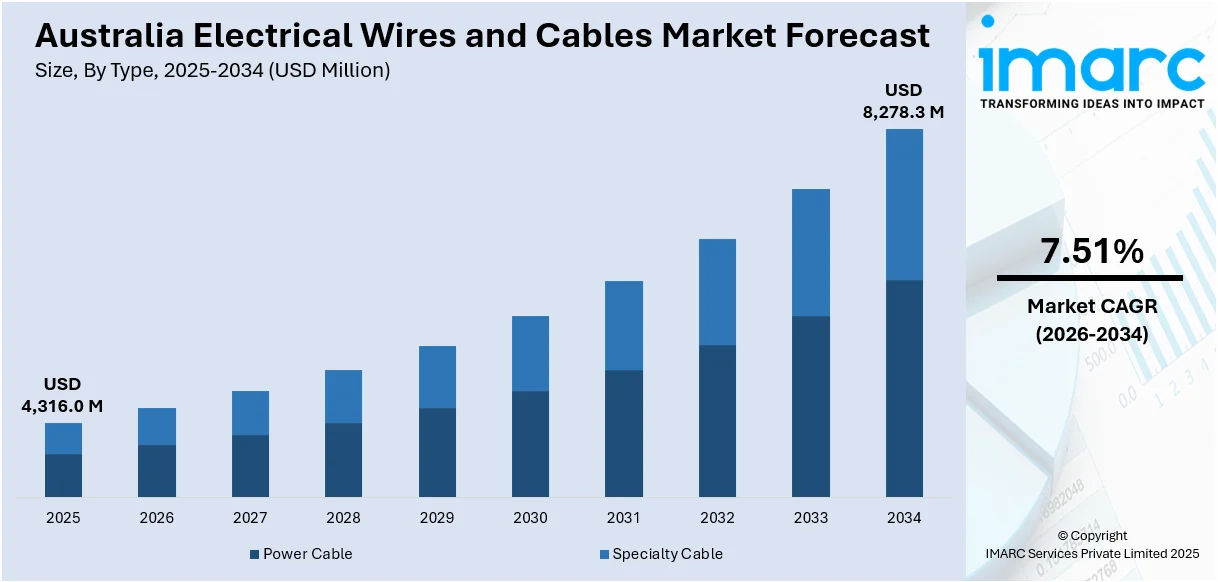

The Australia electrical wires and cables market size reached USD 4,316.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 8,278.3 Million by 2034, exhibiting a growth rate (CAGR) of 7.51% during 2026-2034. The market is fuelled by increasing infrastructure development, adoption of renewable energy resources, and growing smart grids and telecommunication network expansion. Urbanization and government policies supporting energy efficiency are further amplifying demand. The growing electrification of the transportation and building sectors is also adding to the demand for sophisticated, high-quality cabling systems. These are anticipated to be a strong influence on the expansion of the Australia electrical wires and cables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4,316.0 Million |

| Market Forecast in 2034 | USD 8,278.3 Million |

| Market Growth Rate (2026-2034) | 7.51% |

Australia Electrical Wires and Cables Market Trends:

Energy-Efficient Cable Adoption Upward Surge

Australia increasingly emphasizes environmentally friendly infrastructure, and that is fueling high demand for high-performance electrical wiring products. The trend is significantly driven by environmental regulations, energy-saving efforts, and increasing electricity prices. High-performance cables that offer improved insulation, reduced resistance, and extended service life are gaining popularity. These are largely accounted for in power cable, specialty cable segments. Usage of such energy-efficient wires is particularly prominent in power, construction, telecom industries, where mass energy transmission and uninterrupted operations are a necessity. With public and private organizations placing greater emphasis on environmentally friendly measures, markets for such cables supporting integration with renewable sources and minimizing transmission losses are set to increase. It favors the Australia electrical wires and cables market growth forecast, with energy efficiency constituting a central part of infrastructure planning in the future. The shift to wiser, greener cabling solutions is not just environmentally imperative but economically beneficial for long-term national growth.

To get more information on this market Request Sample

Growing Integration of Intelligent Cabling Systems

With Australia's progress toward digitization and intelligent infrastructure, integration of intelligent cabling systems is now an essential trend. Electric cables with the ability to support data communication, automation, and remote-control operations are increasingly on demand. This evolution is best observed in specialty cable, power cable segments with compatibility for newer technologies like IoT and real-time monitoring. These cabling systems are being widely embraced in telecom, construction, railway, power sectors for enabling connectivity, effective load management, and fault detection. Their use improves both the functionality and security of mission-critical systems, especially in high-density metropolitan areas. Additionally, the development of smart cities, energy grids, and automated infrastructure initiatives highlights the significance of technologically flexible wiring. With infrastructure advancing, the demand for cables that provide digital integration with electrical performance will inform future investment and procurement decision-making within Australia's industrial and construction systems.

Infrastructure Growth Fueling Cable Demand

Continued investment in infrastructure growth throughout Australia is having a significant effect on the electrical wires and cables market. New building developments, urban redevelopment projects, and upgrade of transport networks are creating huge demand for robust and high-performance cable systems. The demand is across both power cable, specialty cable types, depending on the magnitude and technical specifications of each project. Wires and cables are being utilized in major sectors like construction, railway, power, telecom, others, where conformity to regulations and durability over the long term are significant. The growth of renewable energy plants and the electrification of the public transport fleet also add to the sector's pace. As Australia continues its national infrastructure program, the requirement for safe, future-proof cabling solutions becomes the top priority for engineers, planners, and contractors. For instance, in March 2025, Nexans Australia broadened its MOBIWAY BOOST system with seven additional cable choices, enhancing efficiency, safety, and sustainability in electrical installation via innovative, reusable, and recyclable spool technology. Further, superior-grade cables are not only considered as materials, but as strategic investments that provide safety, efficiency, and flexibility in sophisticated infrastructure systems.

Australia Electrical Wires and Cables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Power Cable

- Specialty Cable

The report has provided a detailed breakup and analysis of the market based on the type. This includes power cable, and specialty cable.

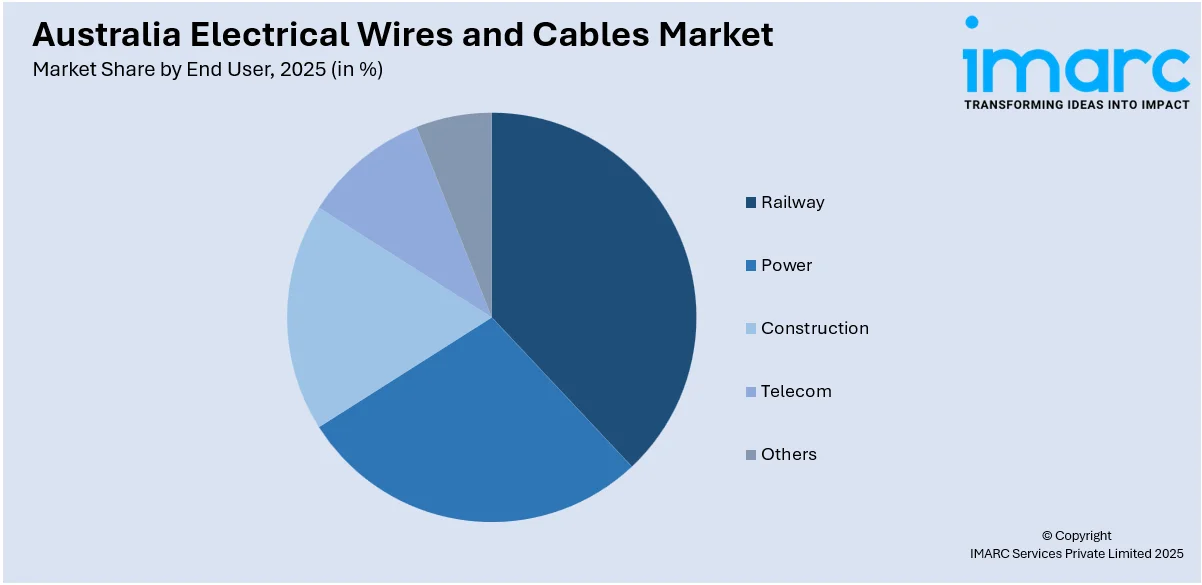

End User Insights:

Access the comprehensive market breakdown Request Sample

- Railway

- Power

- Construction

- Telecom

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes railway, power, construction, telecom, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electrical Wires and Cables Market News:

- In October 2024, EnergyConnect interconnected the electricity networks of New South Wales, Victoria, and South Australia. This 900km transmission development improves electricity reliability and enables renewable energy integration. Substation and new transmission line construction is ongoing, with completion expected by April 2025, driving Australia's sustainable energy future.

Australia Electrical Wires and Cables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Power Cable, Specialty Cable |

| End Users Covered | Railway, Power, Construction, Telecom, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia electrical wires and cables market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia electrical wires and cables market on the basis of type?

- What is the breakup of the Australia electrical wires and cables market on the basis of end user?

- What is the breakup of the Australia electrical wires and cables market on the basis of region?

- What are the various stages in the value chain of the Australia electrical wires and cables market?

- What are the key driving factors and challenges in the Australia electrical wires and cables?

- What is the structure of the Australia electrical wires and cables market and who are the key players?

- What is the degree of competition in the Australia electrical wires and cables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electrical wires and cables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electrical wires and cables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electrical wires and cables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)