Australia Electroplating Market Size, Share, Trends and Forecast by Type, Metal Type, End Use Industry, and Region, 2025-2033

Australia Electroplating Market Overview:

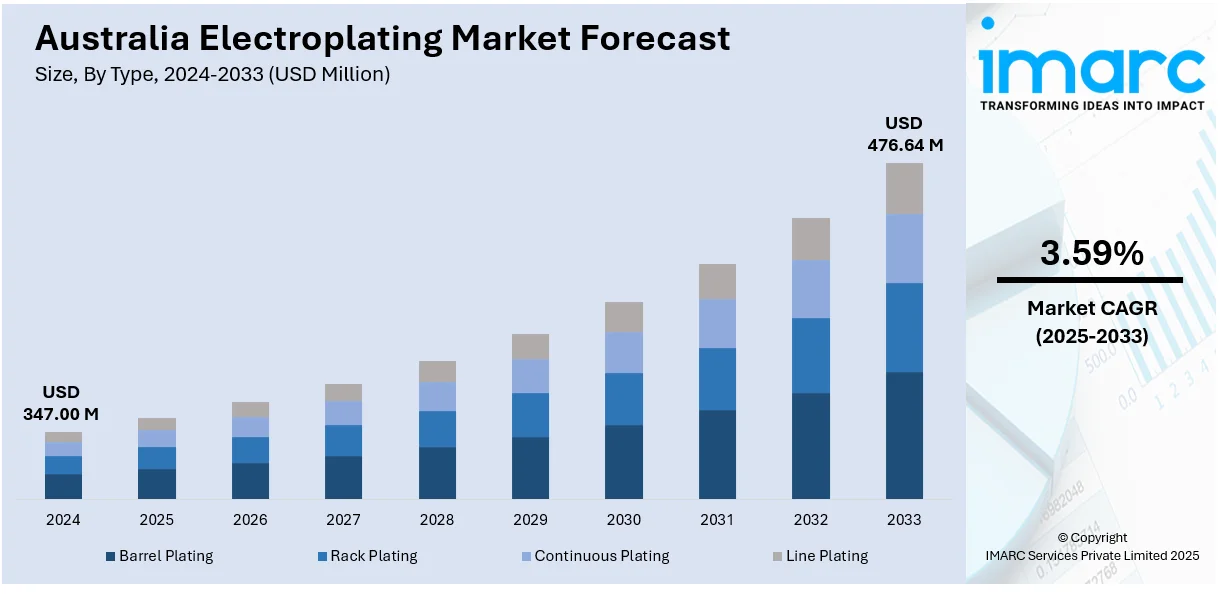

The Australia electroplating market size reached USD 347.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 476.64 Million by 2033, exhibiting a growth rate (CAGR) of 3.59% during 2025-2033. At present, with rising user expectations for high-performance vehicles, automakers are employing advanced electroplating techniques that provide improved surface finishes and longer-lasting protection. Besides this, local suppliers of electronic items are investing in advanced plating methods to meet industry needs, thereby contributing to the expansion of the Australia electroplating market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 347.00 Million |

| Market Forecast in 2033 | USD 476.64 Million |

| Market Growth Rate 2025-2033 | 3.59% |

Australia Electroplating Market Trends:

Increasing vehicle production

Presently, rising vehicle production is offering a favorable market outlook. As reported by the Australian Automotive Dealer Association (AADA), total sales of cars in 2024 hit 2,324,805 units in 2024, marking a 12.1% increase from 2023. With the automotive sector expanding to fulfill both domestic and export needs, the demand for electroplated parts is consistently increasing. Electroplating improves the longevity, resistance to corrosion, and visual attractiveness of metal components in vehicles, including bumpers, wheels, engine parts, and trim. Producers in Australia depend on electroplating to guarantee that these components adhere to quality and safety criteria while also providing a refined look. As user expectations for high-performance vehicles continue to grow, automakers are adopting advanced electroplating methods that provide enhanced surface finishes and increased durability. Additionally, the rise of electric vehicles (EVs) is contributing to higher demand for electroplated parts employed in battery systems, connectors, and other electrical components. The automotive sector’s focus on fuel efficiency and lightweight materials is further encouraging the utilization of electroplated aluminum and plastic components. As production lines are growing more automated, consistent coating quality is becoming essential, driving the demand for modern electroplating technologies. Local suppliers are investing in expanding their capacities and upgrading their plating systems to keep pace with rising orders from vehicle manufacturers.

To get more information on this market, Request Sample

Growing demand for electronic items

Rising demand for electronic items is impelling the Australia electroplating market growth. As people are purchasing smartphones, laptops, tablets, and household electronics, manufacturers continue to require electroplated parts, such as connectors, circuit boards, and casings, to ensure efficient performance and long product life. Electroplating improves electrical conductivity and surface strength, which are essential for electronic devices. The trend of miniaturization in electronics is also driving the demand for precision electroplating on small and intricate components. Additionally, with the growing adoption of smart home technologies and wearable devices, the electronics sector is thriving, catalyzing consistent demand for electroplating services. Local suppliers are investing in advanced plating methods to meet industry needs. Overall, the burgeoning consumer electronics industry is supporting the growth of the market. As per the IMARC Group, the Australia consumer electronics market size is projected to exhibit a growth rate (CAGR) of 5.30% during 2025-2033.

Increasing mining activities

Rising mining activities are driving the demand for durable and corrosion-resistant tools, machinery parts, and equipment used in harsh mining environments. According to the Australian Bureau of Statistics, mineral exploration investment grew by 1.3% in 2024. Electroplating enhances the surface properties of metal components, making them more resistant to wear, friction, and chemical exposure. As mining operations are expanding to meet worldwide demand for minerals and metals, the need for electroplated parts in drilling equipment, conveyor systems, and structural components is growing steadily. Mining companies seek longer-lasting and low-maintenance solutions, which electroplated products provide. The harsh conditions in mining areas require materials with extended service life, and electroplating helps achieve that. This is encouraging local manufacturers and service providers to employ advanced plating technologies.

Australia Electroplating Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, metal type, and end use industry.

Type Insights:

- Barrel Plating

- Rack Plating

- Continuous Plating

- Line Plating

The report has provided a detailed breakup and analysis of the market based on the type. This includes barrel plating, rack plating, continuous plating, and line plating.

Metal Type Insights:

- Gold

- Zinc

- Platinum

- Copper

- Nickel

- Chromium

- Others

A detailed breakup and analysis of the market based on the metal type have also been provided in the report. This includes gold, zinc, platinum, copper, nickel, chromium, and others.

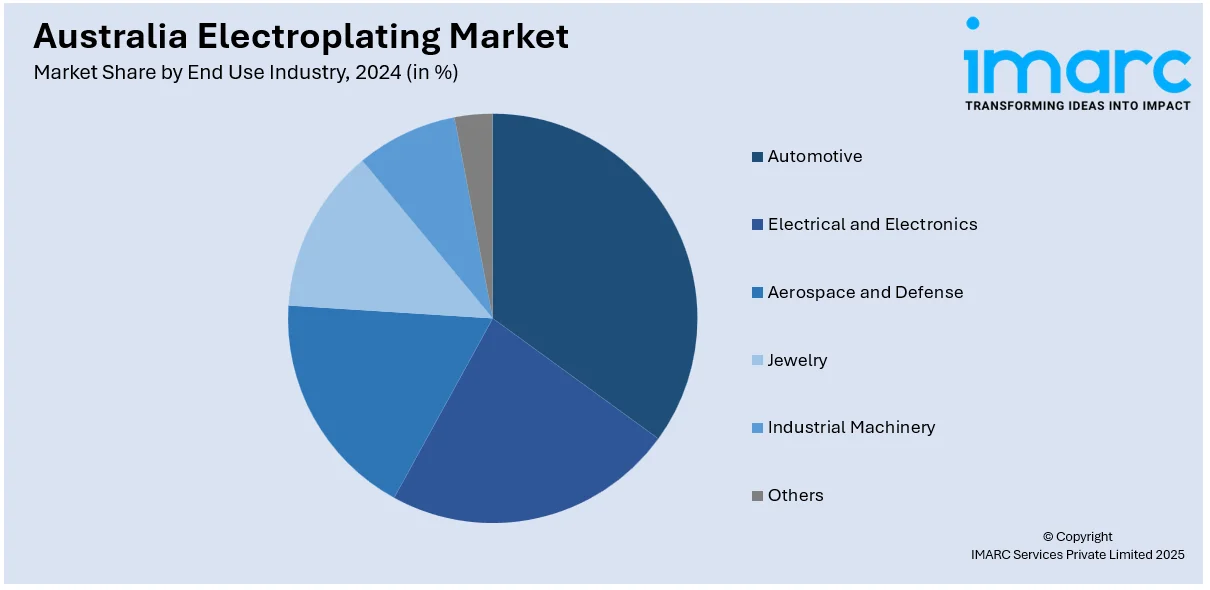

End Use Industry Insights:

- Automotive

- Electrical and Electronics

- Aerospace and Defense

- Jewelry

- Industrial Machinery

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, electrical and electronics, aerospace and defense, jewelry, industrial machinery, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Electroplating Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Barrel Plating, Rack Plating, Continuous Plating, Line Plating |

| Metal Types Covered | Gold, Zinc, Platinum, Copper, Nickel, Chromium, Others |

| End Use Industries Covered | Automotive, Electrical and Electronics, Aerospace and Defense, Jewelry, Industrial Machinery, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia electroplating market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia electroplating market on the basis of type?

- What is the breakup of the Australia electroplating market on the basis of metal type?

- What is the breakup of the Australia electroplating market on the basis of end use industry?

- What is the breakup of the Australia electroplating market on the basis of region?

- What are the various stages in the value chain of the Australia electroplating market?

- What are the key driving factors and challenges in the Australia electroplating market?

- What is the structure of the Australia electroplating market and who are the key players?

- What is the degree of competition in the Australia electroplating market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia electroplating market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia electroplating market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia electroplating industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)