Australia Elevator and Escalator Market Size, Share, Trends and Forecast by Type, Service, End Use, and Region, 2026-2034

Australia Elevator and Escalator Market Overview:

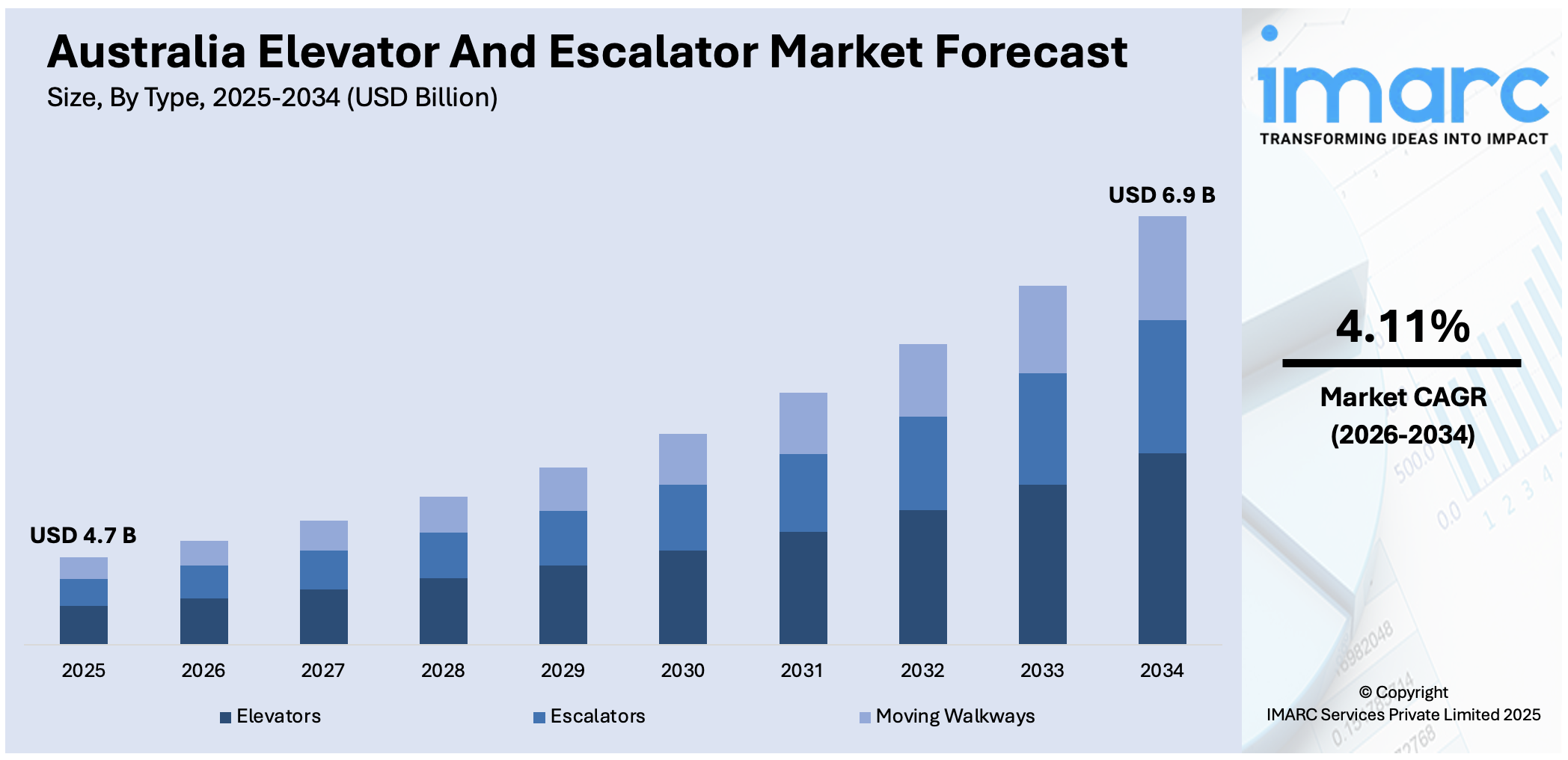

The Australia elevator and escalator market size reached USD 4.7 Billion in 2025. Looking forward, the market is expected to reach USD 6.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.11% during 2026-2034. The market is increasing steadily as a result of urbanization, infrastructure development, and amplifying demand in residential and commercial markets, underpinned by modernization initiatives and smart technology adoption in new installations and upgrading of existing buildings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.7 Billion |

| Market Forecast in 2034 | USD 6.9 Billion |

| Market Growth Rate 2026-2034 | 4.11% |

Key Trends of Australia Elevator and Escalator Market:

Rising Demand for Modernization Across Urban Infrastructure

Australia is observing a consistent movement towards modernizing elevator and escalator systems, especially in the aging urban infrastructures. While commercial buildings and residential complexes evolved in the later part of the 20th century are coming to the closure of their operation efficiency, real estate owners are investing more and more in enhancing vertical transportation systems. This incorporates replacing old pieces of equipment, enhancing energy efficiency, and introducing smart technologies like predictive maintenance and real-time monitoring. These modernization initiatives not only improve passenger safety and convenience but also comply with national sustainability goals. Further, more stringent compliance requirements have encouraged facility managers to give high priority to equipment complying with the latest regulations. Australia elevator and escalator market outlook indicates this trend, with continuous demand expected for advanced retrofitting solutions that prolong system life and lower operational costs. The focus on long-term value and performance improvement continues to influence procurement strategies in residential, commercial, and public infrastructure sectors. For instance, in October 2024, TK Elevator installed 190 new elevator and escalator equipment for the recently opened Sydney Metro City Line, boosting commuter mobility in Australia's largest urban rail network, along with the Australia elevator and escalator market demand.

To get more information on this market Request Sample

Integration of Smart Technologies in Vertical Mobility Solutions

The convergence of digital and smart technologies is revolutionizing the elevator and escalator market in Australia. Touchless controls, Internet of Things (IoT) based performance monitoring, artificial intelligence (AI) based traffic analysis, and cloud-based maintenance scheduling are becoming popular in new installations and modernizations. These are especially appreciated in high-density urban developments, where building managers are keen on smooth, secure, and data-driven vertical mobility solutions. Intelligent elevators with destination control systems can minimize waiting times and streamline energy usage. Additionally, end users increasingly look for easy-to-use features like voice commands, mobile app support, and customized user interfaces. Australia elevator and escalator share is slowly turning towards solutions integrating conventional reliability and cutting-edge digital infrastructure. For example, in January 2025, KONE unveiled the Next Generation High-Rise MiniSpace™ DX elevator in Australia, launching new space-efficient and energy-saving vertical transportation technology in Melbourne Square's BLVD tower, where it made its world premiere. Furthermore, as increasingly intelligent and networked buildings become more prevalent, demand for intelligent mobility systems is set to continue as a distinguishing driver of equipment choice, impacting supplier products and investment strategies within residential, hospitality, and office buildings.

Growth in High-Rise Residential and Mixed-Use Developments

Continuous urban growth, especially in large cities like Sydney, Melbourne, and Brisbane, has prompted an upsurge in high-rise residential and mixed-use developments. These require efficient and reliable vertical transportation systems that can service high passenger numbers while ensuring regular service quality. Developers are specifying high-speed elevators and energy-saving escalators to satisfy the functional requirements of these buildings. Mixed-use developments, where residential, retail, hospitality, and office space are merged, demand specialized elevator and escalator arrangements that strike a balance between performance, safety, and people flow management. Australia elevator and escalator market growth is strongly related to this type of building construction, evidencing a persistent demand for versatile and expandable mobility solutions. Moreover, architectural designs that focus on aesthetics and space efficiency have led manufacturers and installers to provide compact but high-performance equipment suited to contemporary project requirements, further shaping procurement and design standards throughout the industry.

Growth Drivers of Australia Elevator and Escalator Market:

Urbanization & High‑Rise Development Driving Vertical Mobility

Australia's persistent urbanization, especially in cities such as Sydney, Melbourne, Brisbane, and Perth, keeps the demand for elevators and escalators in new constructions and redevelopment works going strong. With increasing city density, developers are building high-rise residential skyscrapers and mixed-use precincts to maximize land use, which naturally call for sophisticated vertical transportation systems. Australia-specific plans like long-term metropolitan planning strategies and state-financed infrastructure expansions reflect the country's vision for integrated, vertical cityscapes. These projects incorporate elevators and escalators within transit stations, metro centers, and intermodal terminals, reemphasizing vertical mobility as a cornerstone of contemporary city planning. Additionally, Australia's aggressive immigration and population is attracting a more youthful, working-age population which further fuels rising demand for urban residential housing and commercial buildings that need efficient vertical access solutions. Therefore, the synergy of urban densification, public transport growth, and population trends is creating a thriving environment for elevator and escalator installations in Australia's expanding cities.

Regulatory Pressure & Sustainability Mandates

According to the Australia elevator and escalator market analysis, strict energy and safety standards are defining the future of the industry through regular retrofits and technology refreshes. By national safety law, vertical transportation systems get periodic inspections, providing a constant stream of maintenance and equipment modernization opportunities. National environmental targets—mirroring green building certifications—are also forcing building owners to implement energy-saving features such as regenerative drives, LED lighting, and compact, motor-room-less traction systems. Australia's innovation-driven programs and investment enable the adoption of intelligent, low-energy vertical solutions that fit within wider decarbonization strategies. The push for emission reduction in commercial buildings—particularly in big cities such as Melbourne and Sydney—highlights a robust national drive toward sustainability-driven infrastructure. These green and regulatory structures enhance building performance and spur the elevator and escalator industry through enhanced demand for next-generation systems. Consequently, modernization is hence an imperative, reinforcing the aftermarket for sophisticated solutions on residential, commercial, and public buildings nationwide.

Smart Technology Integration & Touchless Innovation

Australia's elevator and escalator industry is adapting to digital transformation, incorporating IoT sensors, AI-operated traffic control, and cloud-based predictive maintenance systems on new and refurbished installations. Through high-rise buildings and public architecture, intelligent elevators are being engineered to optimize traffic movement, save energy, and improve safety through real-time diagnostics and fault detection. Following heightened hygiene sensitivity, touchless technology such as mobile app controls, gesture panels, and voice commands is being introduced as a standard feature of new commercial and healthcare buildings. There is also increasing demand for destination-control systems, especially in high-traffic transport hubs and occupancy-driven office skyscrapers, where they enhance efficiency and user experience at peak hours. This trend is supplemented by smart city projects being implemented in urban cities, which focus on smooth connectivity and automation of public infrastructure. As Australia becomes more advanced in its built environment, smart vertical mobility solutions are no longer an extravagance but an integral part of forward-looking architecture.

Opportunities of Australia Elevator and Escalator Market:

Expansion in Regional Infrastructure and Transit-Oriented Projects

The most promising opportunity in the elevator and escalator market in Australia is in regional infrastructure development, especially through public transport and urban connectivity. Melbourne, Sydney, and Brisbane are all rapidly building out rail and metro systems, frequently adding vertical transport systems to new stations and interchanges. Outside of metro areas, regional towns also are enjoying state and federal investment in transit-oriented developments that need elevators and escalators within transit centers, pedestrian bridges, and public buildings. This offers a clear opportunity for manufacturers and installers to move outside the traditional urban core. Moreover, Australia's distinctive geography which blends high-density urban environments and spread-out rural settings, requires flexible elevator and escalator options that accommodate multiple capacities, environments, and maintenance access requirements. The growing emphasis on access to public infrastructure also requires vertical transportation systems to achieve inclusivity requirements, creating long-term government and private sector project opportunities.

Growth in Aged Care and Healthcare Sector

Australia's aging population is placing strong demand on the health and aged care sectors, both of which offer good opportunities for the elevator and escalator industry. With the nation investing in hospitals, retirement villages, assisted living facilities, and health precincts, there is a greater need for safe and accessible vertical mobility systems. These are being constructed or upgraded with emphasis placed on accessibility and safety, such as broader elevator cabins, smoother ride quality, and sophisticated control systems specifically designed for mobility-impaired individuals. Suburban and rural aged care facilities, for example, are increasing in size to respond to increasing demand, opening new market segments to suppliers and service providers. The Australian healthcare industry is also fueled by government programs aimed at enhancing hospital infrastructure, particularly in fast-developing states such as Queensland and Western Australia.

Digital Retrofit and Smart Building Integration

Australia's high demand for smart building technology is creating significant opportunity in retrofitting and digital integration. Much of Sydney's and Melbourne's existing high-rise building stock, especially in central business districts, is being digitally upgraded to meet contemporary sustainability and efficiency requirements. Retrofitting elevators and escalators with IoT-ready components, touchless controls, energy-saving, and remote diagnostic systems is increasingly prevalent. Owners of buildings are trying to upgrade old vertical transportation infrastructure without completely replacing current systems, providing a niche but expanding market for partial upgrades and the installation of modular components. Australia's positioning in the lead for green building certifications and intelligent infrastructure development also encourages the use of digitally connected elevator systems that can be synchronized with building management software. For global and local elevator players, this trend presents an opportunity for tech-driven collaboration, aftermarket offerings, and long-term maintenance agreements.

Challenges of Australia Elevator and Escalator Market:

High Operation Costs and Skilled Labor Shortages

High operation costs, especially in terms of skilled labor and maintenance services, is one of the principal challenges facing the elevator and escalator industry in Australia. Australia boasts some of the world's highest salaries, and skilled technicians trained in latest-generation elevator technologies, particularly those with digital controls and energy-saving systems, which are both rare and costly. Regional locations are especially hit, where qualified staff are thin on the ground, causing maintenance and installation jobs to be delayed. Moreover, companies are forced to fly in experts from major cities, adding further expense to projects. This creates a bottleneck for maintenance of equipment in outlying areas, which is a special issue considering the vast and low-population nature of much of the land. Furthermore, compliance and regulatory standards are rigorous and necessitate recurring certification and training, putting further pressure on an already restricted workforce. These issues complicate it further for companies to expand or work on large, multi-site projects without major investment in logistics and training.

Import Dependence and Supply Chain Vulnerabilities

Geographical remoteness of Australia poses tremendous supply chain difficulties for the escalator and elevator sector. The equipment, particularly essential parts such as motors, control units, and safety features, are largely sourced from Europe or Asia. Foreign manufacturing carries with it the reliance on considerable imports, which creates delays, particularly in times of global disruptions such as trade embargoes, harbor congestion, or geo-political tensions. Local warehousing and assembly facilities are scarce, hence even minor repairs could be postponed if the parts must be imported. Overseas procurement lead times can delay construction timetables and raise project risks. Moreover, foreign exchange volatility and increased shipping costs impose additional financial burdens on businesses that already operate on thin margins. In less developed regions of Australia, heavy machinery transport is even more challenging. Such logistical challenges specifically impair the country's capacity for continuous service delivery and expose Australia to global supply chain volatility in an extra way.

Regulatory Complexity and Market Fragmentation

Regulating Australia can be highly challenging for elevator and escalator companies. There is a patchwork of building codes, safety procedures, and compliance standards in each state and territory, resulting in a patchwork of regulation. To national or multinational corporations, this diversity means varying business practices and technical specifications to accommodate jurisdictions, driving costs and administrative complexity higher. For example, whereas one state's priority might be strict earthquake resistance, another will be preoccupied with energy efficiency or accessibility. This inconsistency causes problems during manufacturing, design, and installation operations. Further, building owners generally lack awareness about changing compliance requirements, placing an increased burden on service providers to provide legal compliance. These issues are compounded in refurbishment operations, where older structures need to be upgraded to current codes without interference with regular business activities. The requirement for extremely localized knowledge, along with different levels of enforcement, makes regulatory complexity an ongoing issue specific to the Australian market.

Australia Elevator and Escalator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, service, and end use.

Type Insights:

- Elevators

- Escalators

- Moving Walkways

The report has provided a detailed breakup and analysis of the market based on the type. this includes elevators, escalators, and moving walkways.

Service Insights:

- New Installation

- Maintenance and Repair

- Modernization

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes new installation, maintenance and repair, and modernization.

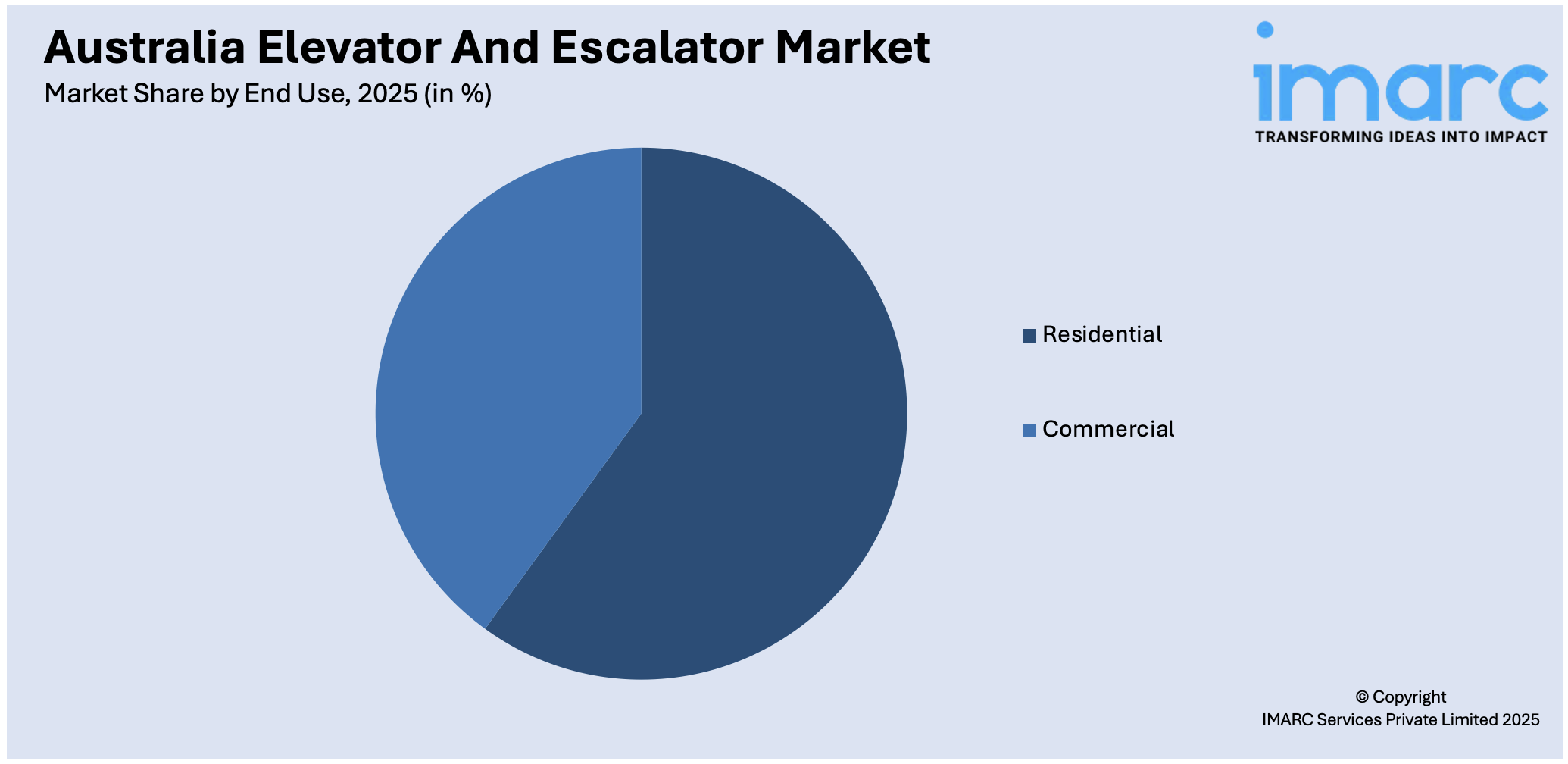

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Offices

- Hospitality

- Mixed Block

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. this includes residential and commercial (offices, hospitality, mixed block, others).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Brilliant Lifts Sydney

- Fuji Elevators Australia

- Hitachi, Ltd.

- KONE Corporation

- Otis Australia

- Schindler Lifts Australia Pty Ltd

- Shotton Lifts

- TK Elevator

Australia Elevator and Escalator Market News:

- In May 2024, KONE announced the acquisition of Orbitz Elevators’ service operations in Australia and full business in New Zealand. The move strengthens KONE’s presence in the South-Pacific elevator and escalator market. Orbitz’s Papua New Guinea unit remains independent. Both firms will operate separately until integration is complete.

Australia Elevator and Escalator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Elevators, Escalators, Moving Walkways |

| Services Covered | New Installation, Maintenance and Repair, Modernization |

| End Uses Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Brilliant Lifts Sydney, Fuji Elevators Australia, Hitachi, Ltd., KONE Corporation, Otis Australia, Schindler Lifts Australia Pty Ltd, Shotton Lifts, TK Elevator, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia elevator and escalator market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia elevator and escalator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia elevator and escalator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia elevator and escalator market was valued at USD 4.7 Billion in 2025.

The Australia elevator and escalator market is projected to exhibit a CAGR of 4.11% during 2026-2034.

The Australia elevator and escalator market is expected to reach a value of USD 6.9 Billion by 2034.

Major drivers of Australia elevator and escalator market include urban growth, high-rise residential and commercial complexes, infrastructure development, and the increasing aged population. Government spending on transportation projects and smart cities, along with growing demand for energy-efficient and accessible vertical mobility solutions, continues to drive market growth and needs for modernization.

Australia elevator and escalator industry is moving toward energy-efficient, smart technologies, with urbanization, sustainability, and ageing infrastructure driving the trend. There is increasing demand for modernization, touchless operation, and digital connectivity, particularly in high-rise buildings and transport centers. Green building compliance and safety improvements continue to influence product innovation and service designs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)