Australia Endpoint Security Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Vertical, and Region, 2025-2033

Australia Endpoint Security Market Overview:

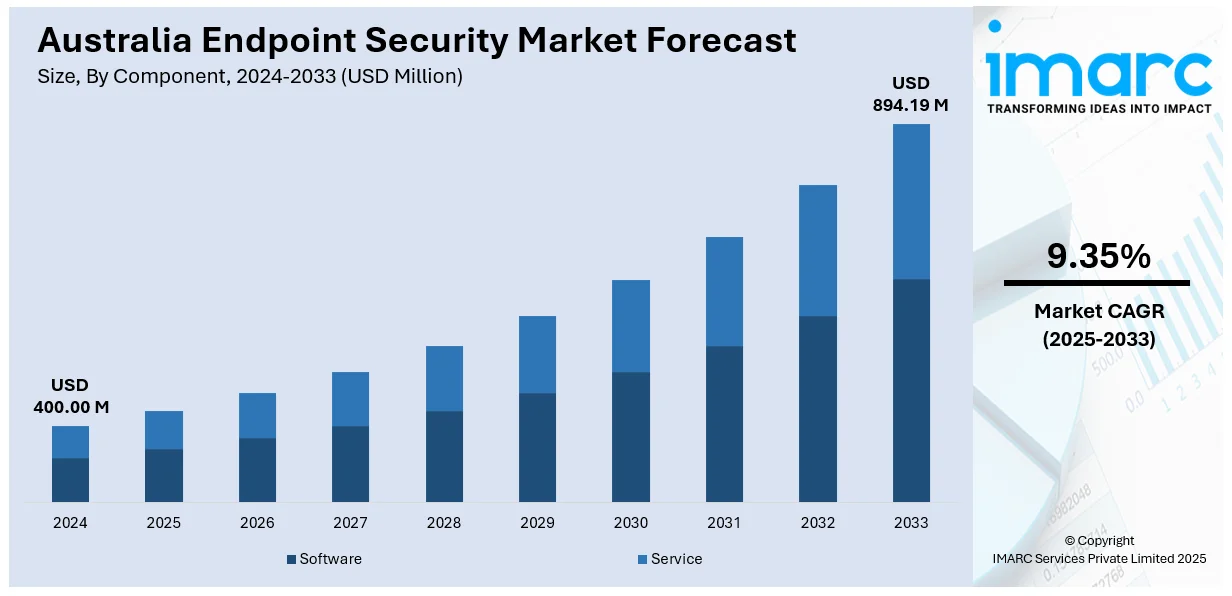

The Australia endpoint security market size reached USD 400.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 894.19 Million by 2033, exhibiting a growth rate (CAGR) of 9.35% during 2025-2033. The market is driven by growing cyber threats, cloud-based solution adoption, and rising ransomware attacks. Organizations are increasingly adopting sophisticated technologies such as artificial intelligence (AI) and machine learning (ML) in their endpoint security systems to improve threat detection and response. Market prospects are positive, with aggressive demand for scalable, effective, and proactive security products to protect endpoints in different industries driving the expanding Australia endpoint security market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 400.00 Million |

| Market Forecast in 2033 | USD 894.19 Million |

| Market Growth Rate 2025-2033 | 9.35% |

Australia Endpoint Security Market Trends:

Improved Cloud-Based Endpoint Security Solutions Adoption

Australia's growing cloud adoption trend has impacted endpoint security hugely. With more businesses shifting to the cloud, the demand for strong cloud-based security solutions has amplified. Cloud-based endpoint security offers companies greater flexibility, scalability, and cost savings, along with real-time threat detection and response features. The increasing incidence of cyber-attacks across Australia has further fueled the need for advanced security solutions to safeguard endpoints from ever-evolving threats. According to the reports, in March 2025, Australia enacted the Cyber Security Legislative Package 2024, with mandatory reporting of ransomware attacks, the creation of a Cyber Incident Review Board, and higher data protection standards, with a focus on compliance to evade fines. Moreover, as more and more organizations adopt hybrid work styles, cloud security products have emerged as an integral component of the endpoint security solution stack. This trend is poised to fuel the Australia endpoint security market growth, boosting the overall security posture of businesses in the region. With a widening digital presence and increasing threat horizon, the future prospect of cloud-based endpoint security in Australia is promising, posing a more agile and future-proof option.

To get more information on this market, Request Sample

Growing Ransomware Threat Boosting Endpoint Security Demand

Ransomware attacks have proven to be a serious security risk in Australia, pushing companies to implement more robust endpoint security offerings. These attacks, usually directed at vulnerable endpoints, can bring down an organization's operations, causing massive financial losses and reputational injury. As per the reports, in January 2025, Australia brought forth the Cyber Security Act 2024 with heightened cyber protections through smart device security regulations, compulsory ransomware notification, and the establishment of a Cyber Incident Review Board for greater resilience. Furthermore, the recent wave of ransomware attacks has proved that mere traditional security is no longer sufficient to safeguard mission-critical systems. As a result, Australian organizations are highly turning to advanced endpoint security solutions that provide robust threat detection, prevention, and swift response to new ransomware threats. With the threat environment constantly changing, companies are looking for endpoint security solutions that give them enhanced protection against advanced malware, ransomware, and phishing attacks. This increasing demand for proactive threat management is expected to drive growth in the Australia endpoint security market. The market is also likely to observe significant adoption as firms place high value on comprehensive and proactive endpoint protection considering emerging ransomware threats.

Incorporation of Machine Learning and AI in Endpoint Security Solutions

Incorporation of artificial (AI) and machine learning (ML) technologies into endpoint security solutions is becoming popular in Australia. The advanced technologies empower endpoint security systems to identify and respond to advanced cyber threats more effectively. AI and ML enable them to scour large volumes of data to look for abnormal trends, forecast anticipated attacks, and react in real-time, with greater protection offered than through old-fashioned security technologies. With rapidly evolving cyber dangers for Australian business, the usage of AI-enhanced endpoint defense solutions is going to increase further. The capability of ML and AI to automate threat discovery and enhance response times is changing endpoint security into a more efficient and proactive procedure. The outlook for the Australia endpoint security market indicates that future growth will significantly depend on integration with AI and ML, hence making endpoint security smarter and adaptive to new threats. This shift toward intelligent security solutions will drive innovation and lead to improved overall protection.

Australia Endpoint Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, and vertical.

Component Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and service.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises small and medium-sized enterprises.

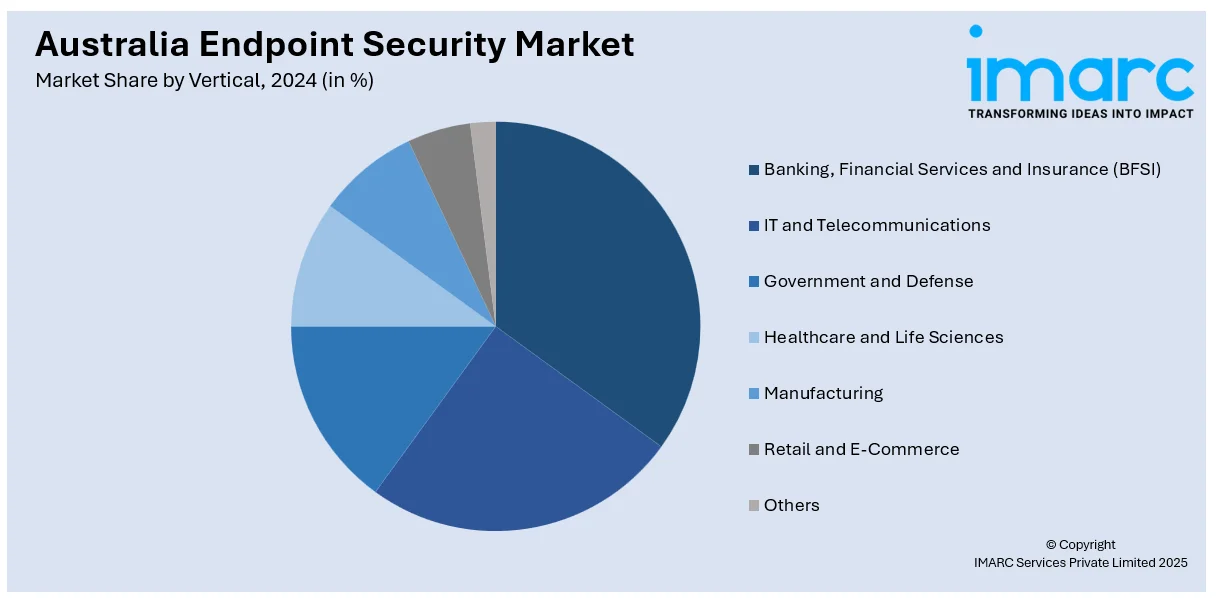

Vertical Insights:

- Banking, Financial Services and Insurance (BFSI)

- IT and Telecommunications

- Government and Defense

- Healthcare and Life Sciences

- Manufacturing

- Retail and E-Commerce

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes banking, financial services and insurance (BFSI), it and telecommunications, government and defense, healthcare and life sciences, manufacturing, retail and e-commerce, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Endpoint Security Market News:

- In August 2024, Google collaborated with Australia's national science agency to create digital tools to detect and repair software vulnerabilities in critical infrastructure. The partnership is a response to the increase in cyberattacks, making sure that organizations like hospitals, defense agencies, and energy providers are in line with local cybersecurity laws, in accordance with Australia's enhanced infrastructure protection legislation.

Australia Endpoint Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Verticals Covered | Banking, Financial Services and Insurance (BFSI), IT and Telecommunications, Government and Defense, Healthcare and Life Sciences, Manufacturing, Retail and E-Commerce, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia endpoint security market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia endpoint security market on the basis of component?

- What is the breakup of the Australia endpoint security market on the basis of deployment mode?

- What is the breakup of the Australia endpoint security market on the basis of organization size?

- What is the breakup of the Australia endpoint security market on the basis of vertical?

- What is the breakup of the Australia endpoint security market on the basis of region?

- What are the various stages in the value chain of the Australia endpoint security market?

- What are the key driving factors and challenges in the Australia endpoint security?

- What is the structure of the Australia endpoint security market and who are the key players?

- What is the degree of competition in the Australia endpoint security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia endpoint security market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia endpoint security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia endpoint security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)