Australia Energy Efficient HVAC Systems Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Australia Energy Efficient HVAC Systems Market Overview:

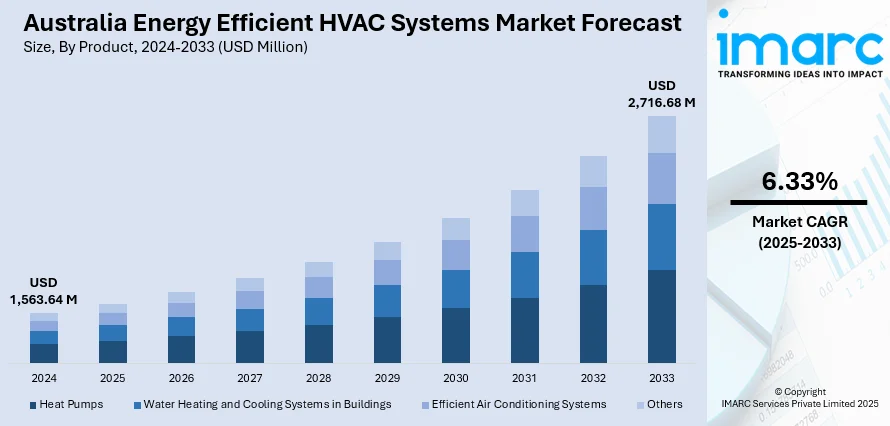

The Australia energy efficient HVAC systems market size reached USD 1,563.64 Million in 2024. Looking forward, the market is expected to reach USD 2,716.68 Million by 2033, exhibiting a growth rate (CAGR) of 6.33% during 2025-2033. Country’s energy efficiency policies, rising electricity tariffs, and consumer awareness of environmental impact are boosting demand for sustainable HVAC systems. Commercial sector retrofits, net-zero building goals, and smart technology integration further support the expansion of Australia energy efficient HVAC systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,563.64 Million |

| Market Forecast in 2033 | USD 2,716.68 Million |

| Market Growth Rate 2025-2033 | 6.33% |

Key Trends of Australia Energy Efficient HVAC Systems Market:

Expansion of Green Building Certifications

As per the Department of Climate Change, Energy, the Environment and Water, HVAC systems contribute up to 50% of energy use and 30% of water consumption in Australia’s commercial buildings. Given this substantial environmental footprint, improving HVAC efficiency has become a core focus of the country’s green building push. Certifications such as Green Star and NABERS increasingly drive the adoption of high-efficiency systems that can reduce energy usage—advanced rooftop units alone cut consumption by 17%, and reverse-cycle air conditioners offer 30–40% higher efficiency than standard models. These programs reward thermal performance, energy savings, and environmentally responsible technology choices, prompting developers and facility managers to upgrade systems to meet evolving benchmarks. This alignment between measurable system performance and certification criteria is significantly advancing Australia energy efficient HVAC systems market growth, especially within commercial real estate portfolios aiming for sustainability-led differentiation.

To get more information on this market, Request Sample

Surge in Electrification and Heat Pump Adoption

Australia is witnessing a nationwide push toward electrification, with government and state-level incentives promoting the shift away from gas-based systems. This transition has led to a marked rise in the installation of electric heat pumps, particularly in residential and small commercial settings. Heat pumps offer efficient heating and cooling, aligning well with Australia’s climate zones and sustainability objectives. The Clean Energy Finance Corporation and state schemes such as Victoria’s Energy Upgrades program have further accelerated uptake. As building codes increasingly mandate all-electric homes and offices, heat pump manufacturers are expanding their product ranges to meet evolving standards. This electrification trend is playing a pivotal role in driving Australia Energy Efficient HVAC Systems market growth, particularly through environmentally responsible retrofit solutions. For instance, in April 2025, Next Cycle launched in Australia, introducing Maxa’s advanced R290 inverter heat pump range for residential, commercial, and industrial applications. This marks a significant step toward energy-efficient HVAC and water systems, offering capacities from 6kW to 356kW with ultra-low GWP and zero ODP.

Growth Drivers of Australia Energy Efficient HVAC Systems Market:

Renewable Energy Integration and Policy Incentives Driving Market Growth

Australia's move toward adoption of renewable energy sources into its HVAC facilities has been a key driver propelling growth in the energy-efficient HVAC systems market. Solar photovoltaic adoption on residential and commercial rooftops has grown substantially over recent years, with solar-powered or solar-compatible HVAC installations becoming increasingly attractive. This is particularly important in climates like New South Wales and Queensland, where sunlight is plentiful all year, allowing HVAC systems to be able to be powered on solar energy during peak day cooling loads. In the same way, rooftop solar with smart inverters and battery storage enables buildings to charge up HVAC units when solar production is strongest, minimizing dependence on the grid. State and federal government rebates and incentives promote the take-up of high-efficiency models, particularly for structures that receive Nationwide House Energy Rating Scheme (NatHERS) minimum star ratings. This policy climate has spurred HVAC producers and distributors to innovate and create systems optimized to deliver higher seasonal energy efficiency ratios (SEER), which are necessary for an application for rebates in places such as Victoria and South Australia. In the commercial sector, energy service companies are now providing performance-based contracts based on assured savings, further fueling demand for sophisticated, energy-efficient HVAC solutions aligned with Australia's overall support for renewable integration and policy-driven market transformation.

Climate Variability and Regional Heat Load Patterns

According to the Australia energy efficient HVAC systems market analysis, the region’s unique climate variability ranging from tropical north Queensland to cooler alpine Tasmania, dictates the design and deployment of energy-efficient HVAC solutions and is a key driver of market growth. In northern climates, extended hot and humid seasons demand HVAC solutions that not only cool but also efficiently dehumidify, resulting in greater latent heat load management. Consequently, variable refrigerant flow (VRF) systems and inverter‑driven heat pumps of high latent capacity have been introduced by manufacturers for the humid tropical regions of northern Australia. By comparison, in southern regions such as Victoria and Tasmania with cool and damp winters, heat‑pump systems of high coefficient of performance (COP) for heating are increasingly demanded. This dual climatic requirement stimulates suppliers to provide modular systems able to both cool in summer and heat during winter, frequently with reversible operation and sophisticated controls. The geographically variable character of Australia's climate has also promoted use of zoning controls, smart thermostats, and demand‑controlled ventilation suited to the local weather conditions. These local climatic conditions push innovation in system design and control measures, rendering energy-efficient HVAC as an across-the-board solution and one that is customized according to local conditions, which is a major driver of market growth across Australia's diverse states and regions.

Increasing Commercial and Industrial Uptake Underpinned by ESG and Operating Efficiency

In Australia, commercial office high-rises, shopping malls, universities, and industrial plants are increasingly emphasizing energy-efficient HVAC systems as part of their overall environmental, social, and governance (ESG) initiatives, which in turn drive robust market growth. Large corporate occupiers in Sydney, Brisbane, and Perth now require landlords to show operational efficiency as part of sustainability pledges, which has driven retrofitting of existing buildings with new chiller equipment, energy recovery ventilators (ERV), and high‑efficiency air‑handling units (AHUs). The shift toward corporate net‑zero commitments has raised interest in HVAC systems that lower electrical load, save resources, and interface well with building management systems (BMS). Australian industrial applications like food processing plants, mining administrative offices, and cold storage facilities, are also turning to evaporative cooling systems and hybrid HVAC installations that utilize a combination of evaporative and mechanical cooling, making use of Australia's relatively low humidity in the inland and arid regions. This works to reduce overall energy consumption in environments in which continuous HVAC operation is common. In addition, the cooperation between HVAC vendors and energy auditing companies in Australia has facilitated performance benchmarking, which has become more available for property investors to make energy-efficient investments worthwhile through anticipated operational cost savings and improved tenant comfort. The intersection of company-level sustainability drivers, cost efficiency demands of operations, and the provision of specialized HVAC solutions designed for commercial and industrial use all drive the growth of the energy-efficient HVAC market throughout Australia.

Opportunities of Australia Energy Efficient HVAC Systems Market:

Digitalization and Smart Building Adoption as a Growth Path

Accelerating the adoption of smart building technology and digital infrastructure modernization represents one of Australia's most promising opportunities in its energy-efficient HVAC systems market. Melbourne and Sydney are among the leading cities to adopt intelligent building management systems (BMS) that make energy consumption more efficient by analyzing real-time data, preventive maintenance, and adaptive climate control. This shift makes it possible for HVAC solution providers and manufacturers to provide integrated systems that communicate with building automation platforms, adding value through remote diagnostics and optimization of performance. Australia's increased implementation of Internet of Things (IoT) technologies in residential and commercial applications promotes a marketplace where HVAC systems are likely to be part of an extended digital ecosystem. Additionally, publicly funded smart city projects in metropolitan cities like Adelaide and Brisbane further encourage the use of networked and effective climate control systems. The drive toward smarter infrastructure increases the energy savings and enables HVAC equipment to be at the heart of grid-responsive methods, making them a key asset in the vision of digitally-enabled, sustainable built environment, and further increasing the Australia energy efficient HVAC systems market demand.

Regional and Off-Grid Applications Present Unique Niches

Australia's wide geography and scattered population afford a unique opportunity for energy-conserving HVAC systems suited to regional and remote locations, especially those running off-grid or with limited energy availability. Numerous rural areas and remote mining industries encounter serious challenges in the provision of climate comfort without paying high energy bills. High-efficiency HVAC systems that are designed to work in conjunction with solar panels, thermal storage, or microgrid infrastructure can provide these sites stable climate control without depleting limited energy resources. Demand for hybrid HVAC systems that use passive cooling methods supplemented with high-efficiency mechanical systems is consistently growing in the Northern Territory, Western Australia, and regions in Queensland. There is also a growing focus on university-based design for natural refrigerants in off-grid locations to minimize environmental footprints but preserve performance in hot extremes. Organizations that can provide modular, low-maintenance, and solar-ready HVAC solutions stand to capitalize on the underserved markets. The Australian landscape and the diversity of climate also create demand patterns that vary from urban hubs, creating opportunities for niche innovation in energy-efficient HVAC that makes sense to local operational conditions.

Sustainable Housing Demand and Residential Retrofit

The Australian residential property market is another high-potential area for energy-efficient HVAC systems, especially for the retrofit segment and in line with green building demand. Much of Australia's existing housing stock, particularly in the suburbs of states such as Victoria and New South Wales, was constructed prior to the enforcement of tighter energy standards and has little in the form of contemporary insulation and HVAC options. This generates a strong demand for upgrades that include split-system heat pumps, ductless mini-splits, and intelligent thermostats capable of saving energy without compromising comfort. Initiatives for sustainable housing, including Net Zero Energy Homes and the Green Star rating for residential developments, have encouraged builders and homeowners to look for energy-efficient options. Increased energy cost has also caused homes to be more aware of long-term savings that high-performance HVAC systems bring. Furthermore, efforts such as all-electric housing developments, becoming popular in locations like Canberra and some parts of Melbourne, facilitate moving away from gas-heating to electric heat pump technology. All these combined make the residential retrofit market a fertile field for energy-efficient and sustainable HVAC suppliers.

Challenges of Australia Energy Efficient HVAC Systems Market:

High Initial Investment and Consumer Perception Barriers

High initial investment cost is one of the significant barriers to entry facing the Australian energy-efficient HVAC systems market. Though they have the potential for long-term savings, few Australian homeowners and small business owners are slow to accept energy-efficient HVAC systems because they cost more in initial capital compared to traditional units. This is true in several regional and lower-income communities where finances may take precedence over considerations of sustainability. Adding to the problem is widespread consumer ignorance regarding the long-term gains and energy performance ratings of energy-efficient systems. Australian consumers in most instances tend to prefer upfront cost savings or name recognition over lifecycle efficiency or energy performance ratings. Additionally, some users in cooler southern regions such as Tasmania and Victoria may still perceive energy-efficient HVAC, especially heat pumps as more suitable for warm climates, which adds to hesitation. Changing this perception requires sustained education efforts, accessible financing options, and clearer demonstration of return on investment, all of which are currently lacking in many parts of the Australian market.

Infrastructure Limitations and Retrofitting Constraints

Australia's aging building stock is another major barrier to deploying energy-efficient HVAC systems. Much of Australia's commercial and residential building stock, especially buildings constructed prior to the imposition of current energy codes, is not equipped to handle newer HVAC technologies without significant retrofitting. This is a main issue within cities like Sydney and Melbourne, where heritage buildings and tight urban settings tend to complicate equipment installation. Retrofitting can involve structural renovations, added insulation, and rewiring, further adding to the overall cost and intricacy of installing energy-efficient systems. Additionally, inadequate space for ductwork or outdoor components in older buildings can limit the viability of high-efficiency units like VRF systems or air-source heat pumps. In remote and regional locations, the challenge is extended to the unavailability of trained technicians for effective installation and maintenance of advanced HVAC systems, resulting in under-performance or early system breakdowns. Without scalable retrofitting solutions or enhanced infrastructure preparedness, vast chunks of Australia's built environment are hard to upgrade with energy-efficient HVAC technologies.

Supply Chain Pressures and Skilled Labour Shortages

Supply chain risks and lack of trained labor are persistent challenges to Australia's energy-efficient HVAC industry. The geographic remoteness of the country entails that much of advanced HVAC parts and systems have to be imported, resulting in longer lead times and vulnerability to international shipping interruptions. This has proven particularly challenging for newer high-efficiency models depending on specialized technologies or refrigerants not commonly found in the domestic market. Installation postponements and pricing volatility based on supply chain limitations may discourage both residential and commercial consumers from choosing energy-efficient alternatives. Furthermore, the Australian HVAC industry is also facing a dearth of technicians certified to install and maintain the next generation of smart, integrated, or hybrid HVAC systems. This problem is especially critical in rural and regional areas of the nation, where trained recruitment and training staff are few in number. With not enough labour available to facilitate installation, commissioning, and after-sales maintenance, even the latest HVAC technologies have the potential to be underutilized or inappropriately maintained, hindering wider uptake throughout the Australian marketplace.

Australia Energy Efficient HVAC Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Heat Pumps

- Water Heating and Cooling Systems in Buildings

- Efficient Air Conditioning Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes heat pumps, water heating and cooling systems in buildings, efficient air conditioning systems, and others.

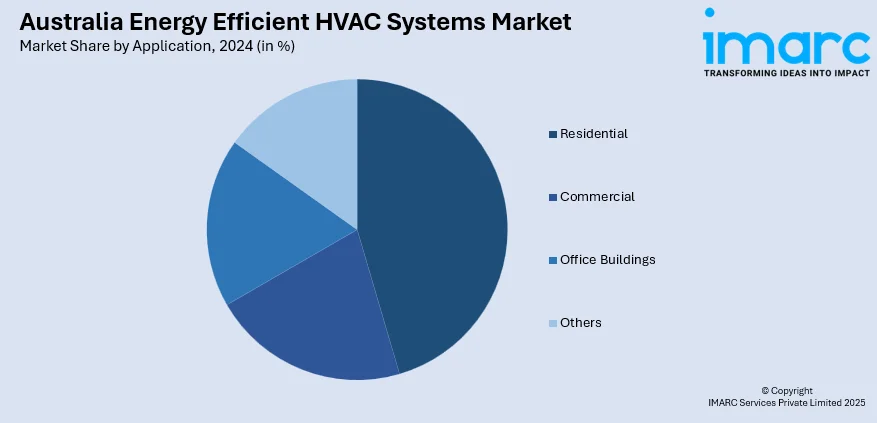

Application Insights:

- Residential

- Commercial

- Office Buildings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, office buildings, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Energy Efficient HVAC Systems Market News:

- In January 2025, Sojitz acquired a 70% stake in Climatech Group via its subsidiary Ellis Air, making it a leading HVAC contractor in Australia. Combined sales of both companies total JPY 45 billion (AUD 450 million). The move supports rising demand for energy-efficient HVAC systems, especially under NABERS standards and ahead of the Brisbane 2032 Olympics. Climatech’s expertise in large-scale commercial and data center projects across multiple regions strengthens Sojitz’s energy solutions portfolio and aligns with its net-zero and CO₂ reduction goals.

- In June 2024, Hitachi Energy announced plans to invest an additional $4.5 billion by 2027 to expand manufacturing, R&D, and digital solutions supporting the clean energy transition. Investments target transformers, HVDC, grid automation, and AI-based platforms like IdentiQ™, enabling renewable integration and grid flexibility.

Australia Energy Efficient HVAC Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Heat Pumps, Water Heating and Cooling Systems in Buildings, Efficient Air Conditioning Systems, Others |

| Applications Covered | Residential, Commercial, Office Buildings, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia energy efficient HVAC systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia energy efficient HVAC systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia energy efficient HVAC systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia energy efficient HVAC systems market was valued at USD 1,563.64 Million in 2024.

The Australia energy efficient HVAC systems market is projected to exhibit a CAGR of 6.33% during 2025-2033.

The Australia energy efficient HVAC systems market is expected to reach a value of USD 2,716.68 Million by 2033.

The Australia energy efficient HVAC market is trending toward smart, inverter-based systems, increased use of heat pumps, and integration with renewable energy sources like rooftop solar. Demand is rising for zoned climate control, low-GWP refrigerants, and all-electric solutions, particularly in urban green buildings and off-grid regional applications seeking sustainable performance.

Key drivers of the Australia energy efficient HVAC market include rising energy costs, strong government incentives, climate-focused building regulations, and growing demand for sustainable infrastructure. Urbanization, corporate ESG commitments, and advancements in renewable energy integration further encourage adoption of high-efficiency HVAC systems across residential, commercial, and industrial sectors nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)