Australia Energy Efficient Transformers Market Size, Share, Trends and Forecast by Type, Cooling Type, Efficiency Level, Application, and Region, 2026-2034

Australia Energy Efficient Transformers Market Overview:

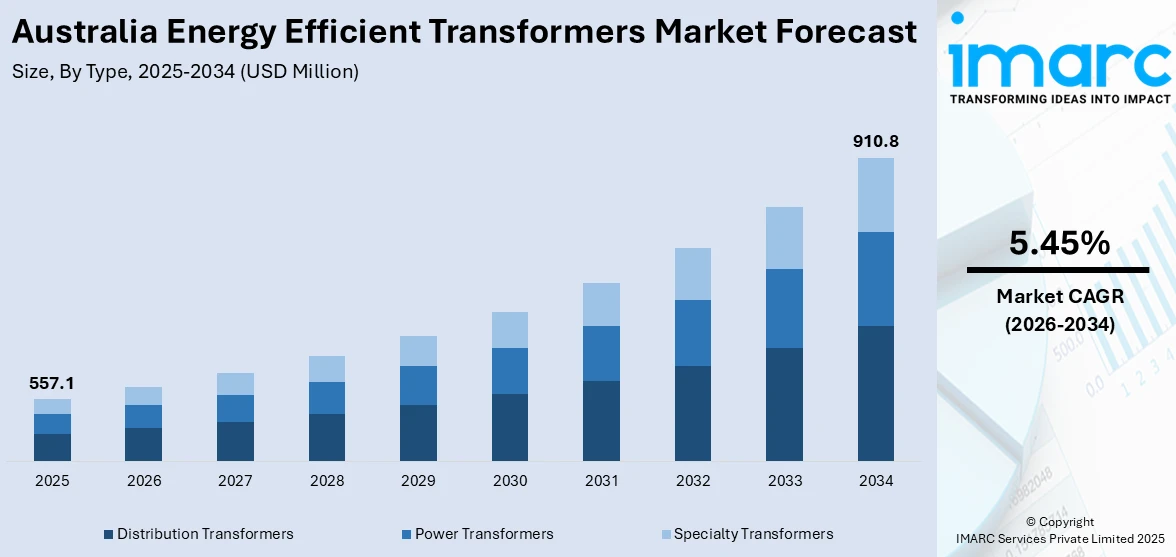

The Australia energy efficient transformers market size reached USD 557.1 Million in 2025. Looking forward, the market is projected to reach USD 910.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.45% during 2026-2034. The market is influenced by growing energy use, the growing adoption of renewable power, and governmental efforts towards promoting energy efficiency. Technological innovation and upgrading old grid infrastructure further increase Australia energy efficient transformers market share across different industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 557.1 Million |

| Market Forecast in 2034 | USD 910.8 Million |

| Market Growth Rate 2026-2034 | 5.45% |

Key Trends of Australia Energy Efficient Transformers Market:

Integration of Renewable Energy Sources

Australia’s shift to renewable energy like solar and wind is driving demand for energy-efficient transformers. Integrating these variable sources into the grid requires advanced transformers to manage fluctuating inputs and maintain stability. These transformers enhance power transmission efficiency and reduce losses. As renewable capacity grows, so does the market for efficient transformers. For instance, in May 2024, Hitachi Energy partnered with AusNet on the Golden Plains Wind Farm project in Victoria, Australia, to advance the nation's renewable energy transition. As part of the collaboration, Hitachi Energy is delivering two 850 MVA 500kV power transformers to facilitate grid connection. The wind farm, with a total capacity of 1,330 MW, is expected to generate 4,000 GWh of clean electricity annually, enough to power more than 765,000 homes. Additionally, the project aims to reduce carbon dioxide emissions by 4.5 million tons each year, significantly contributing to Australia’s commitment to achieving net-zero emissions.

To get more information on this market Request Sample

Adoption of Smart Grid Technologies

The application of smart grid technologies is transforming Australia's energy infrastructure, creating a high demand for energy-efficient transformers. Smart grids leverage digital communication and automation to monitor and control the transmission of electricity, making it possible to respond in real time to varying energy needs and supply situations. Transformers that integrate smart features, including IoT sensors and sophisticated monitoring systems, are pivotal in this environment. They offer useful information that helps in predictive maintenance, improves operational efficiency, and minimizes energy losses. Incorporation of these technologies is a crucial step in modernizing electrical grid and increasing energy efficiency, hence driving the Australia energy efficient transformers market growth. For instance, in January 2025, two 335-tonne transformers arrived in Victoria to connect the SEC’s massive Melbourne Renewable Energy Hub battery to the grid. The project will deliver 1.6 GWh of storage, enough to power 200,000 homes during peak periods. A unique 500 kV underground cable will link the site to the grid. Co-owned with Equis Australia, the hub includes 444 battery units and has employed over 790 people. It marks a key milestone in strengthening Victoria’s renewable energy infrastructure.

Advanced Transformer Materials and Designs

The need for high-efficiency transformers in Australia is increasingly influenced by advancements in materials and design technologies. Manufacturers are integrating low-loss cores, amorphous steel, and enhanced insulation systems to minimize energy losses, improve thermal performance, and extend the lifespan of transformers. These innovations enhance efficiency while helping to decrease overall electricity consumption and reduce carbon emissions, which aligns with sustainability objectives. There is a growing interest from industrial, commercial, and utility sectors in such technologically advanced solutions to optimize energy use and cut operational costs. Moreover, modern designs enable transformers to manage greater loads while ensuring reliability, a crucial factor for expanding urban infrastructure and integrating renewable energy. The rising awareness about long-term cost reduction and regulatory compliance is boosting Australia energy efficient transformers market demand for these advanced materials and designs.

Growth Drivers of Australia Energy Efficient Transformers Market:

Rising Energy Costs

The increasing electricity prices in Australia are forcing utilities, industries, and commercial entities to focus on energy efficiency in their operations. Sectors that consume a lot of energy, in particular, are experiencing higher operational costs, leading to the adoption of energy-efficient transformers aimed at minimizing energy losses and reducing electricity expenses. These transformers optimize energy use and enhance system reliability and performance. As businesses search for budget-friendly solutions to address rising energy costs, the demand for modern, efficient transformer technologies is on the rise. Moreover, the emphasis on long-term savings and sustainable operations is driving significant investments in energy-efficient electrical infrastructure, highlighting this as a crucial factor in the Australia energy efficient transformers market.

Government Regulations and Standards

Government initiatives and regulatory frameworks in Australia are increasingly emphasizing energy conservation and the reduction of carbon emissions within the power sector. Policies and standards mandate that utilities and industrial operators implement high-efficiency transformers that adhere to strict performance criteria. These measures are intended to advance national sustainability objectives and promote responsible energy use. According to Australia energy efficient transformers market analysis, compliance with these regulations serves as a primary motivator for transformer manufacturers and end-users to upgrade their existing systems. Incentives and mandatory efficiency standards encourage adoption and stimulate innovation in low-loss materials and advanced designs, bolstering market growth while supporting environmental and economic goals.

Modernization of Aging Electrical Infrastructure

A significant portion of Australia’s electrical infrastructure consists of outdated transformers that tend to be inefficient, costly to maintain, and susceptible to energy losses. Industrial facilities, utilities, and urban power networks are currently updating or replacing these obsolete units with energy-efficient transformers. Modern transformers enhance performance, reduce energy wastage, and have longer operational lifespans, addressing both reliability and sustainability issues. The shift towards modernization is accelerating due to urban growth, industrial progress, and the incorporation of renewable energy sources, all of which necessitate reliable and efficient components for the grid. Consequently, the replacement and upgrading of old transformers is generating considerable demand, making infrastructure modernization a key driver for the Australia energy efficient transformers market.

Australia Energy Efficient Transformers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on type, cooling type, efficiency level, and application.

Type Insights:

- Distribution Transformers

- Power Transformers

- Specialty Transformers

The report has provided a detailed breakup and analysis of the market based on the type. This includes distribution transformers, power transformers, and specialty transformers.

Cooling Type Insights:

- Oil-Cooled Transformers

- Dry-Type Transformers

A detailed breakup and analysis of the market based on the cooling type have also been provided in the report. This includes oil-cooled transformers and dry-type transformers.

Efficiency Level Insights:

- Low-Efficiency Transformers

- High-Efficiency Transformers

- Ultra-High-Efficiency Transformers

The report has provided a detailed breakup and analysis of the market based on the efficiency level. This includes low-efficiency transformers, high-efficiency transformers, and ultra-high-efficiency transformers.

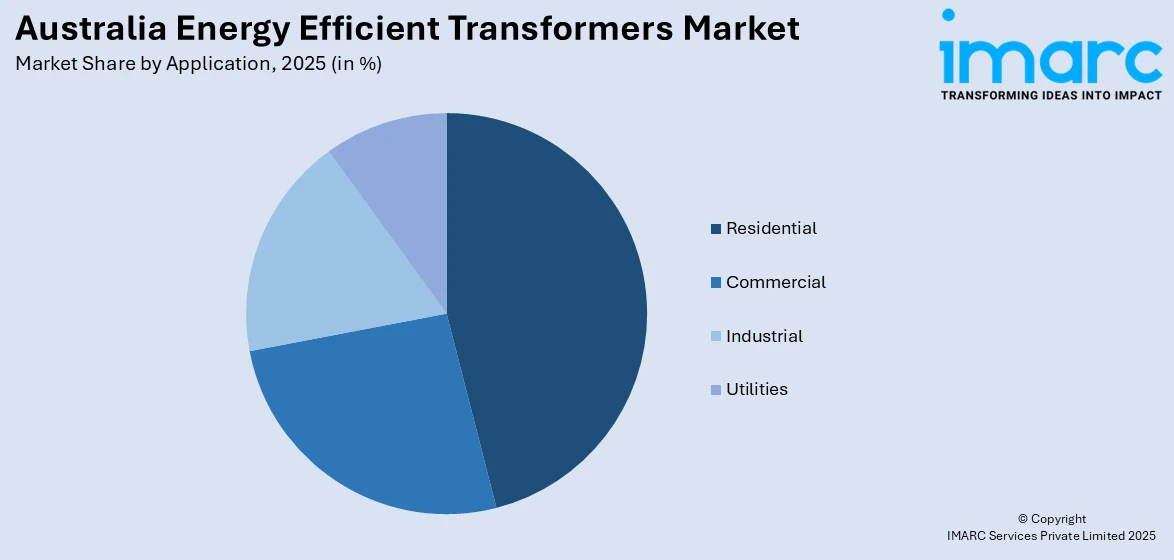

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

- Utilities

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, industrial, and utilities.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Energy Efficient Transformers Market News:

- In April 2025, Ingeteam was awarded contracts by European Energy to supply technology for two upcoming solar power projects in Australia—the 106 MW Lancaster plant in Victoria and the 31 MW Mulwala plant in New South Wales. Together, these facilities are projected to produce 255 GWh of electricity annually, sufficient to power approximately 54,000 households. As part of the agreement, Ingeteam will deliver 77 INGECON SUN inverters along with 22 transformer stations, contributing significantly to Australia’s ongoing shift toward renewable energy sources.

- In April 2025, EnergyConnect began power transmission in western Australia, marking a major step in the nation's energy transition. The 900 km interconnector links the grids of New South Wales, South Australia, and Victoria, enhancing energy stability and enabling renewable energy transfer. Stage one allows 150 MW transfers, scaling to 800 MW upon completion.

Australia Energy Efficient Transformers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Distribution Transformers, Power Transformers, Specialty Transformers |

| Cooling Types Covered | Oil-Cooled Transformers, Dry-Type Transformers |

| Efficiency Levels Covered | Low-Efficiency Transformers, High-Efficiency Transformers, Ultra-High-Efficiency Transformers |

| Applications Covered | Residential, Commercial, Industrial, Utilities |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia energy efficient transformers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia energy efficient transformers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia energy efficient transformers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The energy efficient transformers market in Australia was valued at USD 557.1 Million in 2025.

The Australia energy efficient transformers market is projected to exhibit a compound annual growth rate (CAGR) of 5.45% during 2026-2034.

The Australia energy efficient transformers market is expected to reach a value of USD 910.8 Million by 2034.

The market is witnessing increased adoption of low-loss and amorphous steel transformers, integration with smart grids, and deployment in renewable energy projects. Focus on sustainability, regulatory compliance, and retrofitting aging infrastructure are also shaping the demand for high-efficiency transformer solutions.

Rising energy costs, stringent government energy efficiency regulations, and modernization of aging electrical infrastructure are driving market growth. Expansion of renewable energy projects, technological advancements in transformer materials, and corporate sustainability initiatives are further boosting the adoption of energy-efficient transformers across Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)