Australia Energy Storage Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Australia Energy Storage Market Summary:

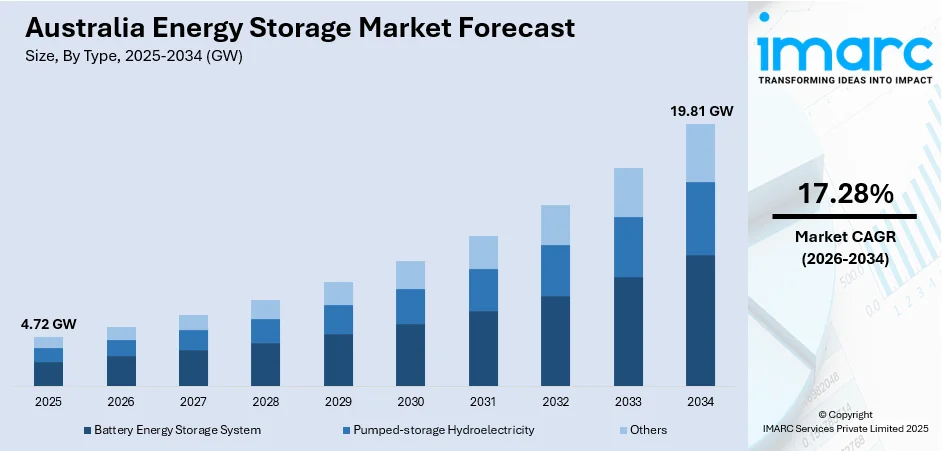

The Australia energy storage market size reached 4.72 GW in 2025 and is projected to reach 19.81 GW by 2034, growing at a compound annual growth rate of 17.28% from 2026-2034.

The Australia energy storage market is witnessing strong growth, driven by the accelerating adoption of renewable energy and the rising need for grid stability. Government initiatives supporting clean energy, combined with declining battery technology costs, are creating favorable investment conditions. Additionally, increasing electricity demand from residential, commercial, and industrial sectors is boosting deployment of storage infrastructure, further strengthening market development and expanding Australia energy storage market share.

Key Takeaways and Insights:

-

By Type: Battery Energy Storage System (BESS) dominates the market with a share of 70.08% in 2025, driven by the technology's superior flexibility, rapid response capabilities, and compatibility with renewable energy integration across utility and residential applications.

-

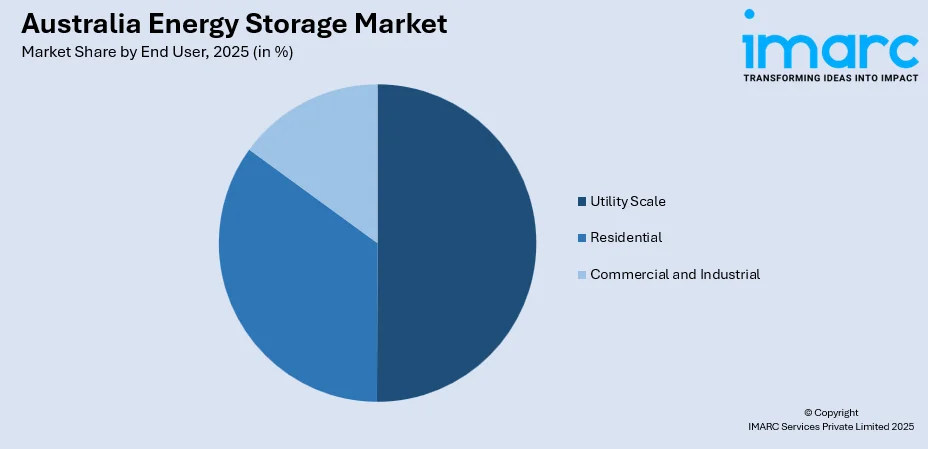

By End User: Utility scale leads the market with a share of 50.12% in 2025, owing to large-scale renewable energy projects requiring substantial storage capacity, grid stabilization requirements, and government incentives supporting utility-level infrastructure development.

-

By Region: Australia Capital Territory & New South Wales represents the market with a share of 26% in 2025, driven by concentrated industrial activity, progressive renewable energy policies, substantial population density, and significant investments in grid modernization projects.

-

Key Players: The Australia energy storage market exhibits a moderately consolidated competitive landscape, with established international technology providers competing alongside domestic energy infrastructure developers. Market participants are focusing on strategic partnerships, capacity expansion, and technological innovation to strengthen their market positioning and capture emerging opportunities.

To get more information on this market Request Sample

The Australia energy storage market is experiencing robust growth, driven by the country’s ambitious renewable energy targets and the critical need for a stable, reliable power supply. Increasing deployment of solar and wind energy has created strong demand for storage solutions that can address intermittency issues and maintain grid reliability. As per sources, in February 2025, Energy Vault began construction of a 200 MW/2-hour battery energy storage system at ACEN Australia’s New England Solar project, marking its first large-scale BESS deployment in New South Wales. Moreover, supportive government initiatives, rising consumer interest in energy self-sufficiency, and growing investments across residential, commercial, and utility-scale sectors are further accelerating market expansion. Advances in battery technology, coupled with declining manufacturing and installation costs, are improving the economic viability of energy storage systems. These factors are collectively fostering broader adoption across diverse end-user segments, reinforcing Australia’s energy storage infrastructure and strengthening its market presence amid the transition to a low-carbon, sustainable energy ecosystem.

Australia Energy Storage Market Trends:

Integration of Advanced Battery Technologies

The Australia energy storage market is witnessing significant adoption of next-generation battery technologies that offer enhanced energy density, longer cycle life, and improved safety profiles. Lithium-ion batteries continue to dominate installations while emerging alternatives are gaining traction for specific applications. Research and development efforts are focused on optimizing battery performance for Australian climatic conditions, particularly addressing heat management challenges. In November 2025, ARENA announced $7.86 Million funding to Li-S Energy to advance lithiumsulfur battery cell manufacturing in Geelong, supporting Australia’s next-generation energy storage capabilities. These technological improvements are enabling more efficient energy capture and dispatch, supporting the broader integration of renewable energy sources into the national grid infrastructure.

Expansion of Virtual Power Plant Networks

Virtual power plant initiatives are emerging as a transformative trend in the Australia energy storage market, connecting distributed residential and commercial storage assets into coordinated networks. A per sources, In June 2025, Enel X launched the first virtual power plant under the NSW Government’s Electricity Infrastructure Roadmap, providing coordinated grid capacity from distributed resources to support peak demand. Further, these aggregated systems enable collective participation in energy markets while providing grid stabilization services. Advanced software platforms are facilitating real-time monitoring and optimization of distributed storage resources. This approach maximizes the value of individual installations while contributing to overall grid resilience and supporting the transition toward a more decentralized energy system architecture.

Growing Focus on Hybrid Renewable-Storage Projects

The Australia energy storage market is experiencing increased development of integrated renewable generation and storage facilities. Co-located solar or wind projects with battery storage are becoming preferred configurations for new installations. According to sources, in 2025, the 128 MWdc solar + 55 MW/220 MWh DCcoupled Cunderdin hybrid project in Western Australia reached full commercial operation, integrating colocated solar and battery storage to enhance grid stability. Further, this hybrid approach optimizes land utilization, reduces infrastructure costs, and enhances overall project economics. Developers are leveraging shared grid connection points and streamlined permitting processes to accelerate deployment. The trend reflects evolving market dynamics where dispatchable renewable energy commands premium value in electricity markets.

Market Outlook 2026-2034:

The Australia energy storage market is poised for substantial revenue growth throughout the forecast period, driven by accelerating renewable energy deployment and evolving grid requirements. Continued government support through policy frameworks and financial incentives will sustain investment momentum across all market segments. Technological advancements are expected to further reduce costs while improving system performance, expanding the addressable market. The utility-scale segment will continue generating significant revenue as large projects reach completion, while residential and commercial segments will contribute increasingly to overall market expansion through cumulative installations. The market size was estimated at 4.72 GW in 2025 and is expected to reach 19.81 GW by 2034, reflecting a compound annual growth rate of 17.28% over the forecast period 2026-2034.

Australia Energy Storage Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Battery Energy Storage System (BESS) | 70.08% |

| End User | Utility Scale | 50.12% |

| Region | Australia Capital Territory & New South Wales | 26% |

Type Insights:

- Battery Energy Storage System (BESS)

- Pumped-storage Hydroelectricity (PSH)

- Others

Battery energy storage system (BESS) dominates with a market share of 70.08% of the total Australia energy storage market in 2025.

Battery energy storage system (BESS) has established clear market leadership within the Australia energy storage market, commanding the dominant revenue share. The technology's versatility enables seamless deployment across residential rooftops, commercial facilities, and large-scale utility installations throughout the country. BESS solutions offer rapid response times essential for frequency regulation and peak demand management services across the grid. As per sources, in September 2025, RWE Renewables Australia registered the country’s first eight-hour BESS at the Limondale Solar Farm, integrating 144 Tesla Megapacks to enhance grid stability and support renewable energy. Moreover, continuous improvements in lithium-ion technology are extending operational lifespans while reducing per-kilowatt-hour costs, significantly enhancing investment attractiveness for diverse stakeholders.

The growing solar photovoltaic installation base across Australian households and businesses creates natural demand for battery storage integration solutions. BESS enables consumers to maximize self-consumption of generated electricity while providing reliable backup power during grid outages. Commercial and industrial users are increasingly adopting battery systems for demand charge management and energy arbitrage opportunities in wholesale markets. The technology's modular nature allows scalable implementations matching specific capacity requirements and budget constraints across diverse customer segments seeking energy independence.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial and Industrial

- Utility Scale

Utility scale leads with a share of 50.12% of the total Australia energy storage market in 2025.

Utility scale represents the largest end user segment in the Australia energy storage market, generating substantial market revenue through major projects. These large-capacity systems provide essential grid services including frequency control, voltage support, and transmission congestion relief across the national network. Energy storage at utility scale enables seamless integration of variable renewable generation while maintaining system reliability standards. As per sources, in July 2025, Fluence was selected by AGL to deliver the 500 MW / 2000 MWh Tomago Battery Energy Storage System in New South Wales, marking one of Australia’s largest utility-scale BESS projects. Furthermore, strategic deployment near renewable energy zones maximizes value capture from abundant solar and wind resources available across Australian territories.

Government policies mandating renewable energy targets are driving utility-scale storage deployment as essential grid infrastructure across all states. Network operators and energy retailers are investing significantly in large battery installations to manage wholesale market exposure and optimize asset utilization effectively. The segment benefits from economies of scale in procurement and installation while attracting institutional investors seeking stable long-term returns from infrastructure assets. Continued grid modernization initiatives will sustain utility-scale storage growth as traditional thermal generation assets retire.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales dominates with a market share of 26% of the total Australia energy storage market in 2025.

Australia Capital Territory and New South Wales collectively represent the leading regional market for energy storage installations across the country. The region benefits from progressive renewable energy policies, substantial population concentration, and well-developed grid infrastructure supporting deployment. Strong solar irradiation levels combined with supportive government incentive programs encourage widespread residential storage adoption among homeowners. According to sources, in April 2025, over 7,800 solar batteries were installed in NSW (New South Whales) homes and businesses through the government’s household battery incentive, enhancing residential energy storage adoption and supporting grid stability. Further, industrial and commercial sectors in Sydney and surrounding metropolitan areas drive robust demand for behind-the-meter storage solutions addressing high electricity costs.

The region's energy market structure creates favorable conditions for storage deployment, with time-of-use pricing encouraging load shifting behaviors among consumers. Network operators are actively procuring storage services to defer costly infrastructure upgrades in congested distribution areas throughout the region. Australia Capital Territory's strong commitment to renewable energy leadership positions the jurisdiction as a testing ground for innovative storage applications. Continued urbanization and expanding industrial activity will sustain regional market growth and expansion throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Australia Energy Storage Market Growing?

Accelerating Renewable Energy Integration Requirements

The rapid expansion of solar and wind generation capacity across Australia is creating unprecedented demand for energy storage solutions capable of managing intermittency challenges. As per sources, in July 2025, Envision Energy and FERA Australia partnered to develop up to 1 GW of wind generation and 1.5 GWh of battery storage across Australia’s National Electricity Market. As renewable sources contribute increasing proportions of total electricity generation, storage systems become essential for maintaining grid stability and ensuring reliable power supply. Energy storage enables temporal shifting of renewable generation to match consumption patterns, maximizing the value captured from clean energy investments. Network operators increasingly rely on storage assets to provide essential grid services previously delivered by conventional thermal generators, supporting the orderly transition toward a decarbonized electricity system.

Supportive Government Policies and Financial Incentives

Federal and state government initiatives are providing substantial support for energy storage deployment across residential, commercial, and utility-scale segments. Policy frameworks establishing renewable energy targets create market certainty encouraging long-term investment decisions. Financial incentives including rebates, low-interest loans, and tax benefits reduce upfront installation costs, improving project economics for consumers and developers. In July 2025, the NSW and Australian Governments doubled incentives for households and small businesses to install solar batteries and connect them to a Virtual Power Plant, providing nearly $5,000 upfront benefits. Moreover, regulatory reforms enabling storage participation in wholesale electricity and ancillary service markets unlock additional revenue streams enhancing investment returns. Continued policy support signals government commitment to energy storage as critical infrastructure for achieving national emission reduction objectives.

Declining Battery Technology Costs and Performance Improvements

Continuous advancements in battery manufacturing processes and supply chain optimization are driving significant reductions in energy storage system costs. Economies of scale from global production expansion combined with technological innovations are lowering per-kilowatt-hour pricing across all market segments. Improved battery chemistry delivers enhanced energy density, longer operational lifespans, and better performance under Australian climatic conditions. These cost and performance improvements are expanding the economically viable application range for storage technology, enabling adoption across previously marginal use cases and accelerating market penetration across diverse customer categories.

Market Restraints:

What Challenges the Australia Energy Storage Market is Facing?

High Initial Capital Investment Requirements

Energy storage systems, despite declining costs, still demand significant upfront investment, which can deter potential adopters. Long payback periods complicate financing for residential and commercial projects, while utility-scale developments face complex funding needs, multiple stakeholders, and extended timelines. These financial barriers can slow adoption and limit participation, especially among smaller or resource-constrained entities.

Grid Connection and Regulatory Complexity

Energy storage project developers face challenges navigating grid connection processes and regulatory frameworks. Lengthy approval procedures and evolving technical standards create delays, increase costs, and add operational uncertainty. Compliance requirements often necessitate ongoing investment, disproportionately affecting smaller participants. These complexities can hinder project execution, reduce market efficiency, and limit timely integration of storage solutions into the grid.

Supply Chain Constraints and Raw Material Availability

Global competition for battery production capacity and critical raw materials exerts pressure on supply chains, impacting project schedules and costs. Dependence on geographically concentrated mineral sources raises supply security and price volatility concerns. Logistics challenges, equipment lead times, and potential material shortages further complicate project planning, affecting deployment timelines and overall economic feasibility of energy storage installations.

Competitive Landscape:

The Australia energy storage market features a dynamic competitive landscape characterized by participation from international technology providers, regional energy infrastructure developers, and specialized system integrators. Market participants are pursuing diverse strategies including vertical integration, technology partnerships, and geographic expansion to strengthen competitive positioning. Innovation in system design, software platforms, and service offerings differentiates leading providers while continuous cost optimization remains essential for maintaining market relevance. Strategic acquisitions and joint ventures are reshaping market structure as participants seek to capture emerging opportunities across residential, commercial, and utility-scale segments while building capabilities to address evolving customer requirements.

Recent Developments:

-

In October 2025, German energy storage specialist SMA Altenso launched its Australian subsidiary, aiming at a gigawatt scale battery pipeline and hydrogen projects. It is partnering on two 120 MW 480 MWh BESS in NSW Moree and Deniliquin with construction expected by mid-2026, focusing on battery integration and system development under Julien Tissandier.

Australia Energy Storage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | GW |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Battery Energy Storage System (BESS), Pumped-storage Hydroelectricity (PSH), Others |

| End Users Covered | Residential, Commercial and Industrial, Utility Scale |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia energy storage market reached a volume of 4.72 GW in 2025.

The Australia energy storage market is expected to grow at a compound annual growth rate of 17.28% from 2026-2034 to reach 19.81 GW by 2034.

Battery energy storage systems (BESS) held the largest market, owing to their efficiency, declining costs, and flexibility. Their widespread deployment across residential, commercial, and utility-scale projects enables effective grid management, ensuring reliable energy supply and market leadership.

Key factors driving the Australia energy storage market include accelerating renewable energy integration requirements, supportive government policies and incentives, declining battery technology costs, increasing electricity prices, and growing consumer demand for energy independence.

Major challenges include high upfront capital investment requirements, complex grid connection and regulatory approval processes, supply chain constraints affecting equipment availability, extended project development timelines, and evolving technical standards requiring ongoing compliance investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)