Australia Engine Oils Market Size, Share, Trends and Forecast by Grade, Sales Channel, Engine Type, Vehicle Type, and Region, 2025-2033

Australia Engine Oils Market Overview:

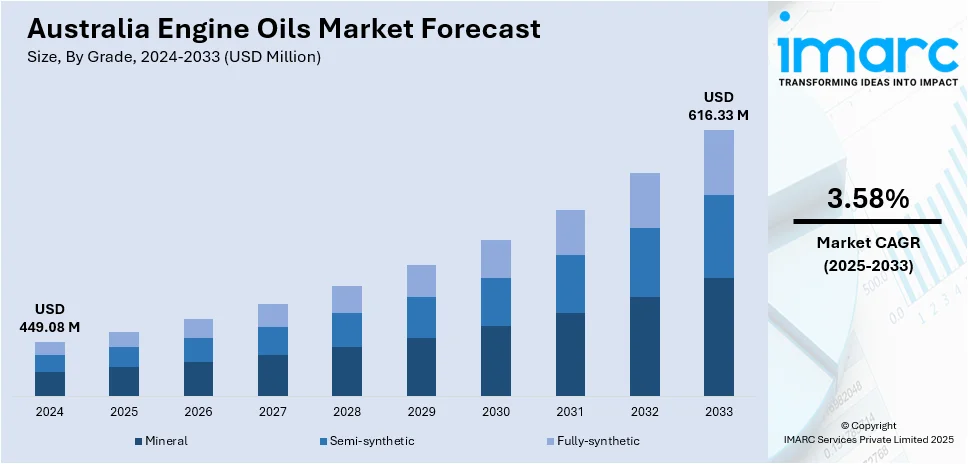

The Australia engine oils market size reached USD 449.08 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 616.33 Million by 2033, exhibiting a growth rate (CAGR) of 3.58% during 2025-2033. The market is driven by the growing automotive sector, increasing vehicle ownership, and rising demand for high-performance lubricants. Urban expansion and improved road infrastructure support regular vehicle maintenance, while the shift toward synthetic oils continues to shape product preferences. These dynamics collectively influence the evolving landscape of the Australia engine oils market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 449.08 Million |

| Market Forecast in 2033 | USD 616.33 Million |

| Market Growth Rate 2025-2033 | 3.58% |

Australia Engine Oils Market Trends:

High Vehicle Ownership and Aging Fleet

Australia has one of the world’s highest vehicle ownership rates, contributing significantly to the demand for engine oils. A large portion of these vehicles are aging, which requires more frequent maintenance and oil changes to ensure engine reliability and efficiency. Older engines tend to consume or degrade oil more quickly, especially under varied operating conditions, thus boosting the need for lubricants. Consumers often rely on thicker or specially formulated oils for wear protection in older vehicles. Additionally, high ownership of diesel and petrol-powered vehicles across urban and rural areas sustains the regular use of both mineral and semi-synthetic oils. This factor ensures a steady lubricant consumption rate and supports a diverse market offering in terms of viscosity grades and oil types.

To get more information on this market, Request Sample

Growth in Synthetic and Premium Lubricants

The Australian engine oils market is steadily shifting toward synthetic and premium-grade lubricants due to their enhanced performance benefits. Synthetic oils provide longer drain intervals, better engine protection, improved fuel efficiency, and stronger resistance to oxidation and thermal breakdown. These advantages are particularly important in Australia’s diverse climate, where temperatures can range from extreme heat to cold. Automakers are increasingly recommending synthetic oils for new vehicles, prompting consumers and service centers to adopt higher-grade lubricants. Furthermore, growing environmental awareness is driving preference for synthetic oils due to their lower emissions and reduced waste from less frequent changes. Premium oils are also promoted through dealership service plans and aftermarket workshops, reinforcing their uptake. This shift reflects a broader trend toward quality and performance in engine maintenance.

Strong Automotive Aftermarket and Service Culture

Australia’s well-developed automotive aftermarket and strong service culture are major contributors to sustained engine oil demand. Car owners routinely engage with service providers—ranging from dealership workshops to independent garages and quick lube centers—for maintenance, including oil changes. Regular servicing is a deeply ingrained habit among Australian drivers, supported by manufacturer guidelines and service interval reminders. These touchpoints create consistent opportunities for engine oil sales across various product tiers. Additionally, service centers often promote specific brands and upsell premium oils through loyalty programs and value-added packages. The aftermarket’s reach across urban and rural areas ensures broad access to lubricant products, maintaining strong distribution and brand visibility. This robust service network is critical in supporting both consumer education and steady product demand, which is driving the Australia engine oils market growth.

Australia Engine Oils Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on grade, sales channel, engine type, and vehicle type.

Grade Insights:

- Mineral

- Semi-synthetic

- Fully-synthetic

The report has provided a detailed breakup and analysis of the market based on the grade. This includes mineral, semi-synthetic, and fully-synthetic.

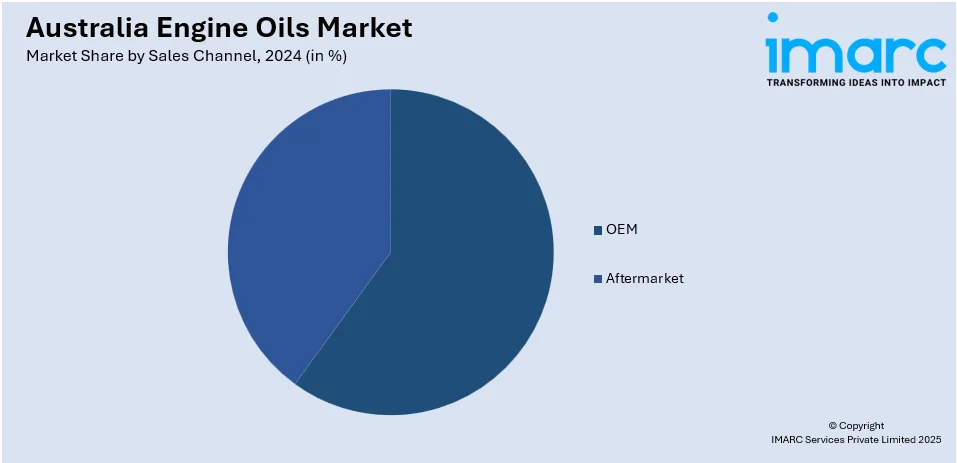

Sales Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on sales channel have also been provided in the report. This includes OEM and aftermarket.

Engine Type Insights:

- Gasoline

- Diesel

A detailed breakup and analysis of the market based on the engine type have also been provided in the report. This includes gasoline and diesel.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Two Wheelers

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles, heavy commercial vehicles, and two wheelers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Engine Oils Market News:

- In December 2024, LIQUI MOLY, a well-known provider of high-end lubricants, additives, and car care products, announced the release of its new generalist motor oils for the Australian market. These oils were designed and formulated in Germany and are currently proudly made in Thailand, following nearly three years of rigorous research and development.

Australia Engine Oils Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Mineral, Semi-synthetic, Fully-synthetic |

| Sales Channels Covered | OEM, Aftermarket |

| Engine Types Covered | Gasoline, Diesel |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two Wheelers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia engine oils market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia engine oils market on the basis of grade?

- What is the breakup of the Australia engine oils market on the basis of sales channel?

- What is the breakup of the Australia engine oils market on the basis of engine type?

- What is the breakup of the Australia engine oils market on the basis of vehicle type?

- What is the breakup of the Australia engine oils market on the basis of region?

- What are the various stages in the value chain of the Australia engine oils market?

- What are the key driving factors and challenges in the Australia engine oils market?

- What is the structure of the Australia engine oils market and who are the key players?

- What is the degree of competition in the Australia engine oils market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia engine oils market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia engine oils market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia engine oils industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)