Australia Enterprise Content Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, End Use industry, and Region, 2025-2033

Australia Enterprise Content Management Market Overview:

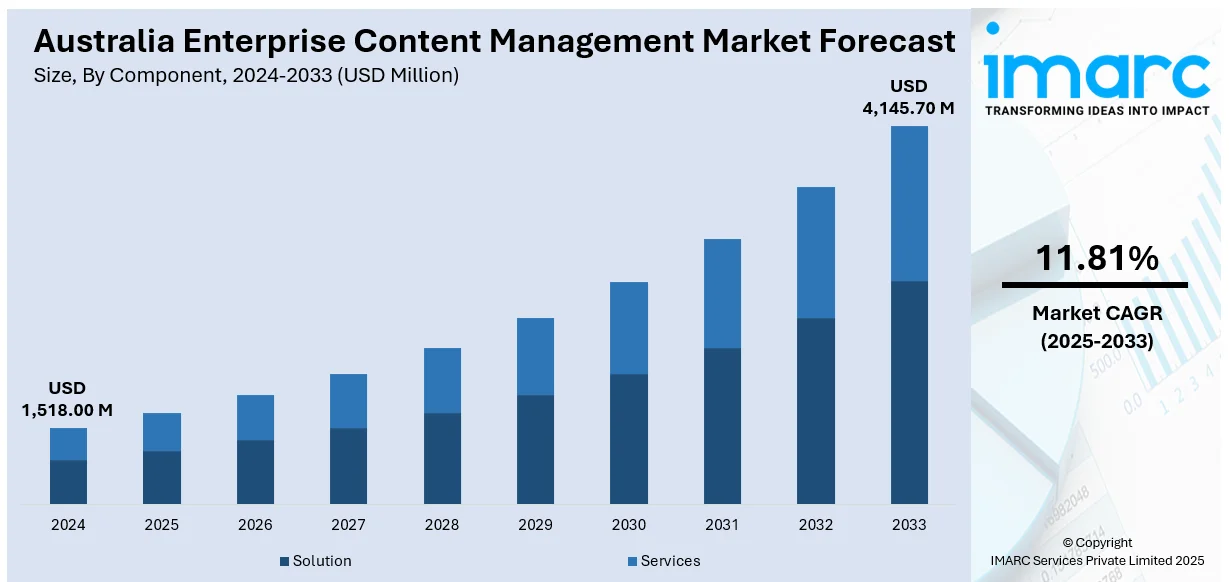

The Australia enterprise content management market size reached USD 1,518.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,145.70 Million by 2033, exhibiting a growth rate (CAGR) of 11.81% during 2025-2033. The market is primarily fueled by accelerating digital transformation, heightened regulatory compliance requirements, the demand for robust information governance, and the widespread adoption of remote work models. Organizations are increasingly adopting ECM solutions to optimize document workflows, improve data accessibility, and maintain consistent content lifecycle management, factors that are directly influencing Australia enterprise content management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,518.00 Million |

| Market Forecast in 2033 | USD 4,145.70 Million |

| Market Growth Rate 2025-2033 | 11.81% |

Australia Enterprise Content Management Market Trends:

Increased Focus on AI-Driven Content Classification and Metadata Management

Artificial intelligence (AI) is playing a revolutionary part in the development of ECM systems in Australia. One of the most important developments is the use of AI and machine learning to make content classification, tagging, and metadata enrichment automatic. As more and more unstructured data has to be managed by organizations, automated metadata generation enhances content findability, compliance with regulations, and archival speed. AI-powered algorithms are increasingly applied to discover sensitive content, flag anomalies, and offer context-appropriate document categorizations. These functions dramatically eliminate manual labor workloads, enhance data governance, and enhance search capabilities within ECM platforms. Australian companies, particularly in finance and government, are implementing AI-powered ECM platforms to comply with strict data privacy laws and enable accelerated decision-making with better information retrieval. For instance, in July 2024, NCS launched a new suite of AI and digital resilience solutions designed to help organisations adopt AI securely and at scale across the Asia-Pacific region. Unveiled at the 2024 NCS Impact Forum, the initiative includes the AI+DR Matrix framework, Polaris DR resilience assessment tool, and industry-specific AI accelerators. Strategic partnerships with AWS and Dell support generative AI adoption, while NCS is also building a 3,000-strong AI-certified talent base. The initiative aims to boost innovation, cybersecurity, and sustainable digital transformation.

To get more information on this market, Request Sample

Rising Demand for Industry-Specific ECM Solutions

Another emerging trend in the Australia enterprise content management market growth is the increasing demand for industry-specific content management solutions tailored to verticals such as healthcare, legal, construction, and public sector. Each of these sectors faces unique regulatory, operational, and content governance challenges. As a result, generic ECM platforms are giving way to industry-customized offerings that support specialized workflows—such as patient records management, contract lifecycle management, or building project documentation. Vendors are developing ECM systems with built-in templates, compliance features, and role-based access controls suited to sector-specific requirements. This trend is driven by the need for faster deployment, reduced customization efforts, and alignment with industry standards. It highlights a shift from one-size-fits-all platforms to niche, compliance-ready content ecosystems. For instance, in October 2024, Elcom successfully launched a redesigned website for Sydney Church of England Grammar School (Shore), enhancing its digital presence with a user-friendly, visually immersive experience. The site improves engagement and decision-making for prospective parents and staff while supporting international accessibility. Features include simplified navigation, virtual campus tours, streamlined enrolments, and expanded career insights. The project reflects Elcom's expertise in delivering tailored digital solutions. As a leader in the Australia Enterprise Content Management market, Elcom continues to empower organizations through its robust digital experience platform.

Australia Enterprise Content Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment mode, enterprise size, and end use industry.

Component Insights:

- Solution

- Document Management System (DMS)

- Web Content Management (WCM)

- Document-Centric Collaboration (DCC)

- Records Management

- Document Imaging

- Business Process Management (BPM)

- Others

- Services

- Professional

- Managed

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (document management system (DMS), web content management (WCM), document-centric collaboration (DCC), records management, document imaging, business process management (BPM), and others) and services (professional and managed).

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

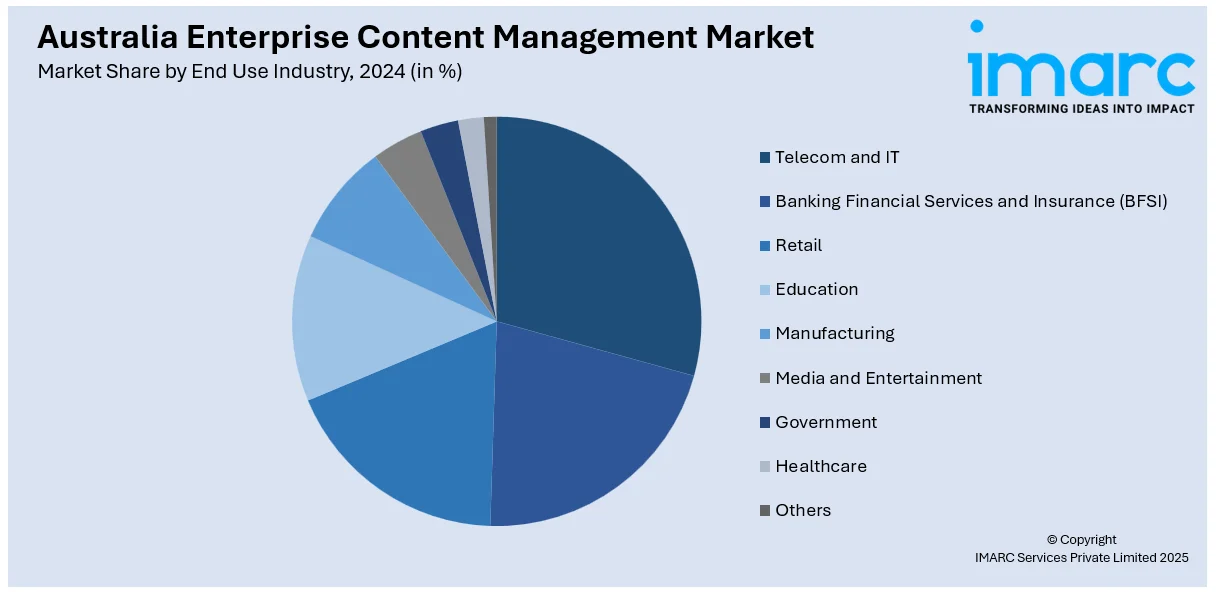

End Use Industry Insights:

- Telecom and IT

- Banking Financial Services and Insurance (BFSI)

- Retail

- Education

- Manufacturing

- Media and Entertainment

- Government

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes telecom and IT, banking financial services and insurance (BFSI), retail, education, manufacturing, media and entertainment, government, healthcare, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Enterprise Content Management Market News:

- In April 2024, Elcom launched the Open AI Connector within its Digital Experience Platform to streamline content creation for publishers. This tool enables AI-powered writing, editing, summarising, tone adjustment, and multilingual support. It also offers customisable settings and reporting for administrators. The connector aims to improve content quality, consistency, and efficiency, helping organisations engage wider audiences more effectively. This move reflects Elcom’s continued commitment to digital transformation, supporting clients across industries with scalable, AI-enhanced content strategies and enterprise content management solutions in Australia.

- In March 2024, Objective Corporation partnered with Maptionnaire to enhance community engagement for Local Planning Authorities (LPAs) through interactive, map-based consultation. This integration allows residents to participate directly in urban planning by viewing and marking up local development areas. The partnership supports Objective’s digital planning tool, Objective Keyplan, and reflects the company's broader mission to provide secure, effective content and process management solutions for regulated industries. The collaboration improves decision-making, strengthens public trust, and aligns with Objective’s ECM-driven digital transformation goals.

Australia Enterprise Content Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Enterprise Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| End Use Industries Covered | Telecom and IT, Banking Financial Services and Insurance (BFSI), Retail, Education, Manufacturing, Media and Entertainment, Government, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia enterprise content management market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia enterprise content management market on the basis of component?

- What is the breakup of the Australia enterprise content management market on the basis of deployment mode?

- What is the breakup of the Australia enterprise content management market on the basis of enterprise size?

- What is the breakup of the Australia enterprise content management market on the basis of end use industry?

- What is the breakup of the Australia enterprise content management market on the basis of region?

- What are the various stages in the value chain of the Australia enterprise content management market?

- What are the key driving factors and challenges in the Australia enterprise content management market?

- What is the structure of the Australia enterprise content management market and who are the key players?

- What is the degree of competition in the Australia enterprise content management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia enterprise content management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia enterprise content management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia enterprise content management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)