Australia Enterprise Data Management Market Size, Share, Trends and Forecast by Component, Deployment, Enterprise Size, Industries, and Region, 2025-2033

Australia Enterprise Data Management Market Overview:

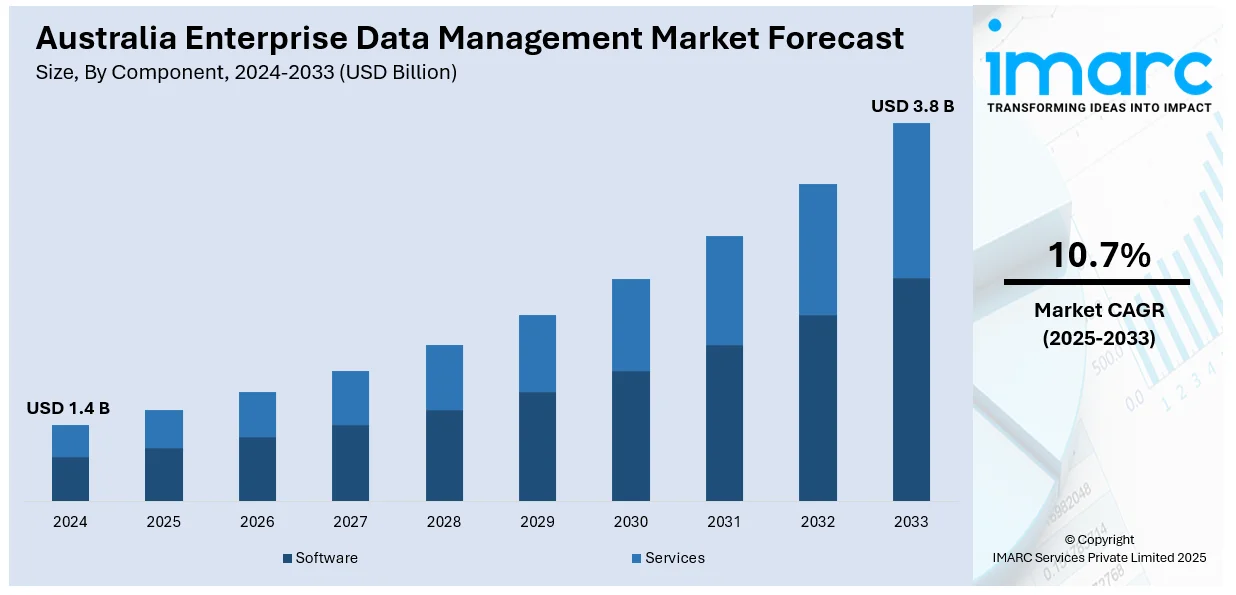

The Australia enterprise data management market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.8 Billion by 2033, exhibiting a growth rate (CAGR) of 10.7% during 2025-2033. The growing adoption of cloud-based data management platforms, introduction of better data integration capabilities for managing multiple data sources and business units, and increasing focus on adhering to strict data protection laws are expanding the Australia enterprise data management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Market Growth Rate 2025-2033 | 10.7% |

Australia Enterprise Data Management Market Trends:

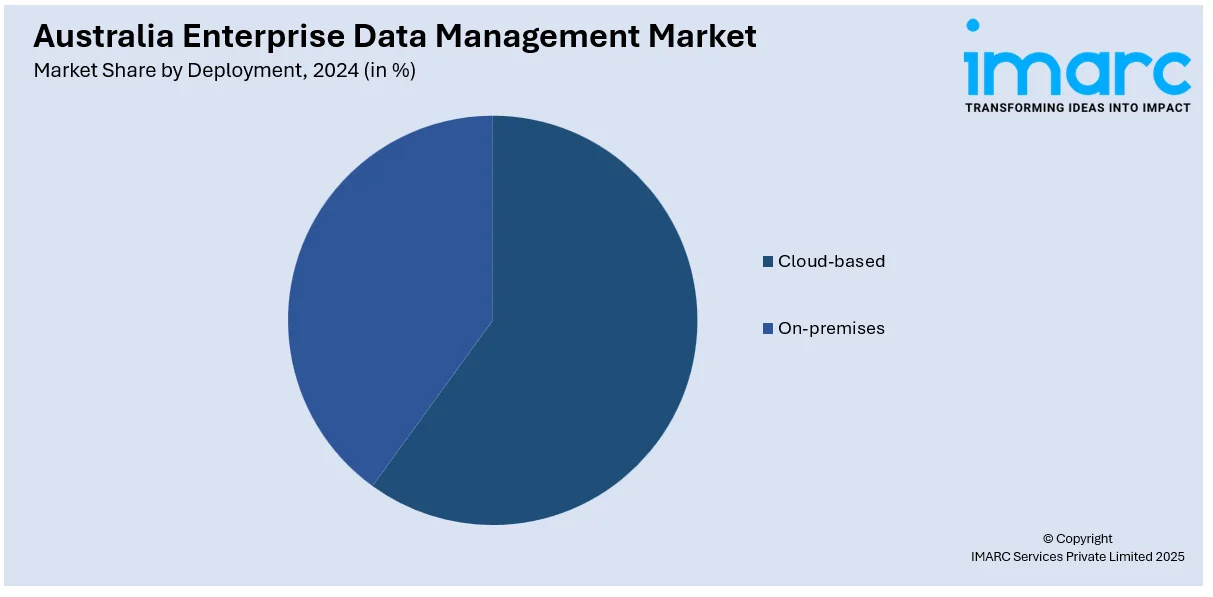

Increasing Adoption of Cloud-Based Data Management Solutions

The Australian business community is increasingly adopting cloud-based data management platforms, a trend that is playing a crucial role in impelling the market growth. Businesses across sectors are actively shifting from conventional on-premise infrastructures to cloud-based solutions because of their intrinsic scalability, cost-effectiveness, and operational flexibility. This shift is allowing businesses to manage increasing amounts of structured and unstructured data more efficiently while providing real-time accessibility and collaboration among geographically distributed teams. Cloud-based enterprise data management (EDM) platforms are also introducing better data integration capabilities, ease of managing multiple data sources, and business units. Additionally, vendors are actively evolving with artificial intelligence (AI)- and machine learning (ML)-driven capabilities for enhanced data accuracy, governance, and compliance to further enhance the value proposition in cloud deployments. With Australian organizations driving digital transformation strategies, cloud investments are also taking center stage as they support strategic decision-making and long-term data-driven growth. The IMARC Group predicts that Australia cloud computing market size is expected to reach USD 30.24 Billion by 2033.

To get more information on this market, Request Sample

Heightened Prominence on Regulatory Compliance and Data Governance

Australian businesses are increasingly focusing on adhering to strict data protection laws, and this is a key driver of the faster pace of adoption for EDM solutions. Data protection regulatory mechanisms like the Australian Privacy Principles (APPs) under the Privacy Act 1988, and revisions that adhere to global standards, are encouraging companies to implement stringent data governance principles and be transparent in handling data. This regulatory environment is motivating companies to adopt end-to-end EDM systems that enable data lineage tracking, audit trails, access control, and real-time compliance reporting. The Australian Government Data Forum on 14 November 2024 was an event to motivate and enthuse leaders in data, policy, and technology to come together and discuss how data is shaping the future of Australia. Organized by the Australian Government Graduate Data Network, the forum focused on the power of data to transform public policy, drive innovation, and deliver improved results for Australians. Companies are also emphasizing ensuring data quality, integrity, and security to avoid reputational loss and financial penalties for non-compliance.

Rising Demand for Business Intelligence and Data-Driven Decision Making

Australian businesses are increasingly utilizing business intelligence (BI) tools and advanced analytics, resulting in a heightened need for strong EDM systems. As organizations collect data from a broad range of sources, including customer interactions, Internet of Things (IoT) sensors, and internal systems, the capability to turn this information into actionable insights is turning into a key business imperative. EDM solutions are central to the process of bringing order, cleansing, and integrating data so that it is accurate, accessible, and ready for analytics. This increasing emphasis on data-driven decision making is fueling investment in EDM solutions that enable predictive analytics, real-time reporting, and machine learning (ML) abilities, thereby propelling the Australia enterprise data management market growth. Organizations are trying to create a competitive advantage by analyzing market trends, customer actions, and internal inefficiencies through high-end analytics. As a result, enterprise managers are implementing EDM platforms not just to control data but also to map data to key performance indicators (KPIs) and business goals. In 2024, Cloud technology solution provider intelliflo unveiled its new business intelligence dashboards to its Australian financial advice firms. Intelliflo's dashboards, which are powered by Amazon Quicksight, aimed to equip advisers with tools to assist them in addressing data quality and workflow management issues.

Australia Enterprise Data Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment, enterprise size, and industries.

Component Insights:

- Software

- Data Security

- Master Data Management

- Data Integration

- Data Migration

- Data Warehousing

- Data Governance

- Data Quality

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software (data security, master data management, data integration, data migration, data warehousing, data governance, data quality, and others) and services (managed services and professional services).

Deployment Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes cloud-based and on-premises.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

Industries Insights:

- IT and Telecom

- Banking, Financial Services, and Insurance

- Retail and Consumer Goods

- Healthcare

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the industries. This includes IT and telecom, banking, financial services, and insurance, retail and consumer goods, healthcare, manufacturing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Enterprise Data Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployments Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industries Covered | IT and Telecom, Banking, Financial Services, and Insurance, Retail and Consumer Goods, Healthcare, Manufacturing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia enterprise data management market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia enterprise data management market on the basis of component?

- What is the breakup of the Australia enterprise data management market on the basis of deployment?

- What is the breakup of the Australia enterprise data management market on the basis of enterprise size?

- What is the breakup of the Australia enterprise data management market on the basis of industries?

- What is the breakup of the Australia enterprise data management market on the basis of region?

- What are the various stages in the value chain of the Australia enterprise data management market?

- What are the key driving factors and challenges in the Australia enterprise data management market?

- What is the structure of the Australia enterprise data management market and who are the key players?

- What is the degree of competition in the Australia enterprise data management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia enterprise data management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia enterprise data management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia enterprise data management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)