Australia Environmental Consulting Services Market Report by Service (Investment Assessment and Auditing, Permitting and Compliance, Project and Information Management, Monitoring and Testing, and Others), Medium Technology (Water Management, Waste Management), Vertical (Energy and Utilities, Chemical and Petroleum, Manufacturing and Process Industry, Transportation and Construction Industries, and Others), and Region 2026-2034

Australia Environmental Consulting Services Market Overview:

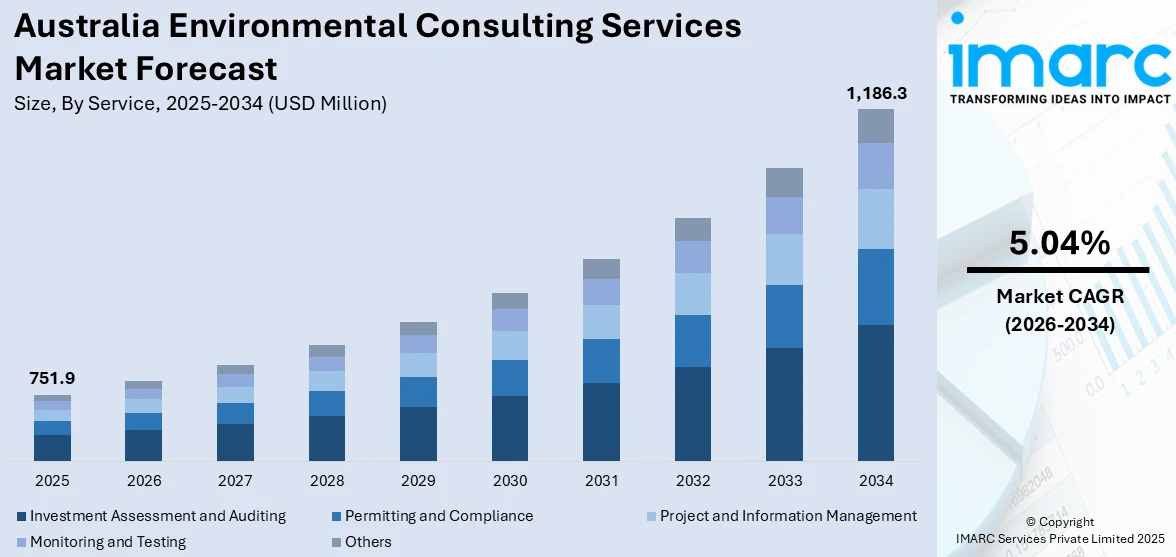

The Australia environmental consulting services market size reached USD 751.9 Million in 2025. Looking forward, the market is expected to reach USD 1,186.3 Million by 2034, exhibiting a growth rate (CAGR) of 5.04% during 2026-2034. The market is expanding as businesses and governments focus on sustainability, regulatory compliance, and climate resilience. Firms provide expertise in environmental assessments, waste management, and ecological restoration, helping industries reduce environmental impact and meet evolving standards, which strengthens competitiveness and drives long-term growth in the Australia environmental consulting services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 751.9 Million |

| Market Forecast in 2034 | USD 1,186.3 Million |

| Market Growth Rate 2026-2034 | 5.04% |

Key Trends of Australia Environmental Consulting Services Market:

Stringent Environmental Regulations and Policies

The Australia environmental consulting services market is significantly driven by stringent environmental regulations and policies. In response to growing environmental concerns and climate change, the Government of Australia has implemented a comprehensive regulatory framework to ensure sustainable practices across various industries. This includes regulations related to emissions control, waste management, water conservation, and habitat protection. For instance, Companies are being forced to seek out expertise in compliance and mitigation strategies as a result of the National Greenhouse and Energy Reporting Act, which mandates that organizations report their energy consumption and greenhouse gas (GHG) emissions. Furthermore, local and state-level regulations add another layer of complexity, necessitating specialized consulting services to navigate these requirements effectively, which is contributing to the Australia environmental consulting services market growth.

To get more information on this market Request Sample

Rising Public and Corporate Awareness of Sustainability

Increasing public and corporate awareness of environmental sustainability is a major trend driving the growth of the environmental consulting services market in Australia. An increased need for sustainable business practices due to worries about pollution, biodiversity loss, and climate change is fostering market expansion. Public pressure and consumer preferences are pushing companies to adopt greener practices and demonstrate their commitment to environmental responsibility. Corporations are integrating sustainability into their core strategies to enhance their brand image and gain a competitive edge. This shift is reflected in the increased demand for environmental impact assessments, sustainability reporting, and green certification services. Moreover, the rising focus on corporate social responsibility (CSR) and environmental, social, and governance (ESG) criteria is further bolstering the Australia environmental consulting services market demand.

Growth in Infrastructure and Urban Development Projects

The expansion of infrastructure and urban development projects in Australia is another key driver of the environmental consulting services market. As Australia continues to experience population growth and urbanization, there is a surge in construction and infrastructure projects such as roads, bridges, residential and commercial buildings, and industrial facilities. These projects often have significant environmental implications, including land use changes, pollution, and resource consumption. To address these concerns and ensure that development projects adhere to environmental regulations, developers and construction firms turn to environmental consultants for expertise. These experts conduct extensive environmental impact assessments, manage site remediation, and provide strategies for minimizing ecological disruptions, thereby providing an impetus to market growth.

Growth Drivers of Australia Environmental Consulting Services Market:

Government Investment in Environmental Protection Infrastructure

The Australian government's substantial investment in environmental protection and nature-positive initiatives is significantly driving market expansion. These investments create sustained demand for specialized consulting services across policy development, environmental assessments, and compliance monitoring. The establishment of new regulatory frameworks and national environmental standards requires extensive consultant expertise to guide businesses through complex approval processes. This government commitment to environmental protection creates long-term revenue opportunities for consulting firms while ensuring consistent market expansion through public sector engagement.

Corporate ESG Compliance and Sustainability Mandates

Mandatory climate-related financial disclosure requirements, which commenced in January 2025 under the Treasury Laws Amendment Act, are driving unprecedented demand for environmental consulting services. Large corporations must now report on climate risks, emissions across their value chains, and sustainability strategies in their annual reports. According to the Australia environmental consulting services market analysis, this regulatory requirement, combined with investor pressures for ESG compliance, creates continuous demand for specialized consulting expertise in carbon accounting, environmental risk assessment, and sustainability reporting. Companies require ongoing support to meet evolving disclosure standards, implement nature-positive strategies, and navigate complex regulatory frameworks. The mandatory nature of these requirements ensures stable, long-term demand for consulting services across multiple industry sectors.

Digital Transformation and Technology Integration in Environmental Management

The integration of advanced digital technologies, including AI, IoT sensors, satellite monitoring, and blockchain for environmental data management, is revolutionizing consulting service delivery and creating new market opportunities. Environmental consultants are increasingly leveraging drone surveys, remote sensing technologies, real-time monitoring systems, and predictive analytics to enhance service quality and operational efficiency. This technological advancement allows consultants to offer more comprehensive solutions, including automated compliance monitoring, predictive environmental modeling, and real-time reporting systems. The adoption of digital environmental management platforms enables consultants to serve more clients efficiently while providing enhanced data accuracy and faster decision-making capabilities, thereby expanding market reach and service capabilities.

Australia Environmental Consulting Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service, medium, and vertical.

Service Insights:

- Investment Assessment and Auditing

- Permitting and Compliance

- Project and Information Management

- Monitoring and Testing

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes investment assessment and auditing, permitting and compliance, project and information management, monitoring and testing, and others.

Medium Insights:

- Water Management

- Waste Management

A detailed breakup and analysis of the market based on the medium have also been provided in the report. This includes water management and waste management.

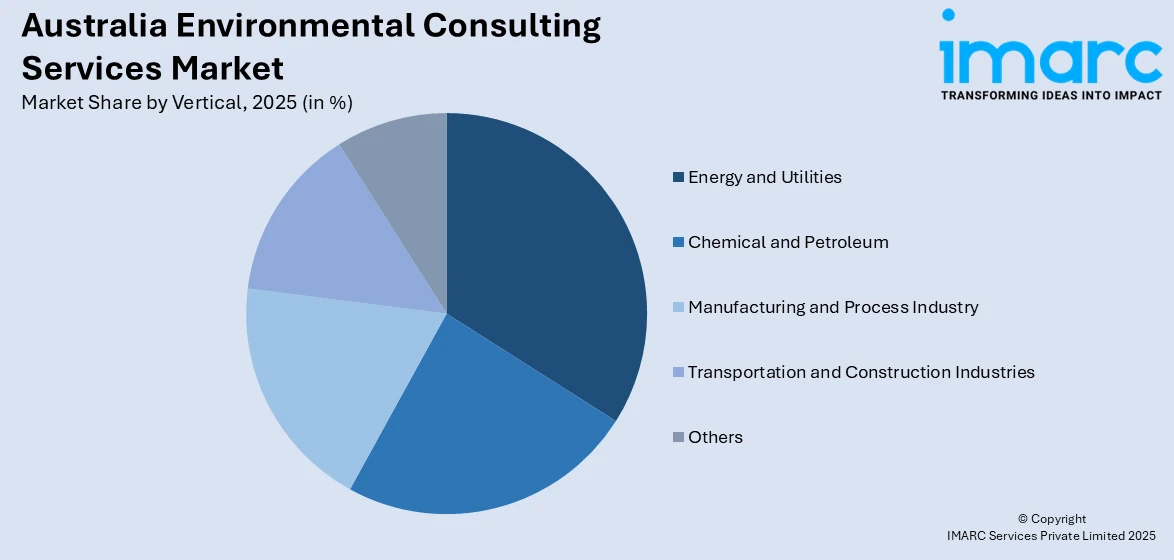

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Energy and Utilities

- Chemical and Petroleum

- Manufacturing and Process Industry

- Transportation and Construction Industries

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes energy and utilities, chemical and petroleum, manufacturing and process industry, transportation and construction industries, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Environmental Consulting Services Market News:

- In January 2024, Tata Consultancy Services and Macquarie University launched the TCS GoZero Hub, a new sustainability research and innovation center in Sydney. This initiative aims to assist Australian organizations in reducing emissions by combining academic expertise with industry insights. The center will adopt a multi-disciplinary approach to support the transition to net zero, enhancing efforts to address climate change and sustainability challenges.

- In April 2024, the Australian Government announced plans to establish Environment Protection Australia, the nation's first independent environmental protection agency with enhanced enforcement powers. The agency will have authority to issue stop-work orders and impose fines up to $780 million for environmental breaches, significantly strengthening regulatory oversight and compliance requirements across industries.

- In May 2024, the Australian Government introduced legislation in Parliament to establish Environment Protection Australia and Environment Information Australia, marking the second stage of the Nature Positive Plan reforms. Nearly $100 million was allocated to accelerate environmental approval processes while maintaining environmental protection standards for sustainable development projects.

- In June 2024, APEM Group, a leading global environmental consultancy, acquired Biosis, an Australian ecology and heritage consulting firm based in Melbourne. This strategic acquisition marks APEM's first expansion into the Australian market, establishing a permanent presence to serve the Asia Pacific region's growing environmental consulting demands.

Australia Environmental Consulting Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Investment Assessment and Auditing, Permitting and Compliance, Project and Information Management, Monitoring and Testing, Others |

| Medium Technologies Covered | Water Management, Waste Management |

| Verticals Covered | Energy and Utilities, Chemical and Petroleum, Manufacturing and Process Industry, Transportation and Construction Industries, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia environmental consulting services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia environmental consulting services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia environmental consulting services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The environmental consulting services market in Australia was valued at USD 751.9 Million in 2025.

The Australia environmental consulting services market is projected to exhibit a CAGR of 5.04% during 2026-2034.

The Australia environmental consulting services market is projected to reach a value of USD 1,186.3 Million by 2034.

The market is experiencing robust growth driven by stringent environmental regulations, heightened corporate sustainability awareness, and expanding infrastructure development projects. Government initiatives, including the establishment of Environment Protection Australia and mandatory climate-related financial disclosures, are creating sustained demand for specialized consulting expertise across multiple industry sectors.

The Australia environmental consulting services market is driven by substantial government investment in environmental protection infrastructure, mandatory ESG compliance and sustainability reporting requirements, and digital transformation enabling advanced environmental management solutions. Integration of AI, IoT monitoring systems, and regulatory frameworks further accelerates adoption across diverse industry sectors nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)