Australia Environmental Monitoring Market Size, Share, Trends and Forecast by Component, Product Type, Sampling Method, Application, and Region, 2025-2033

Australia Environmental Monitoring Market Overview:

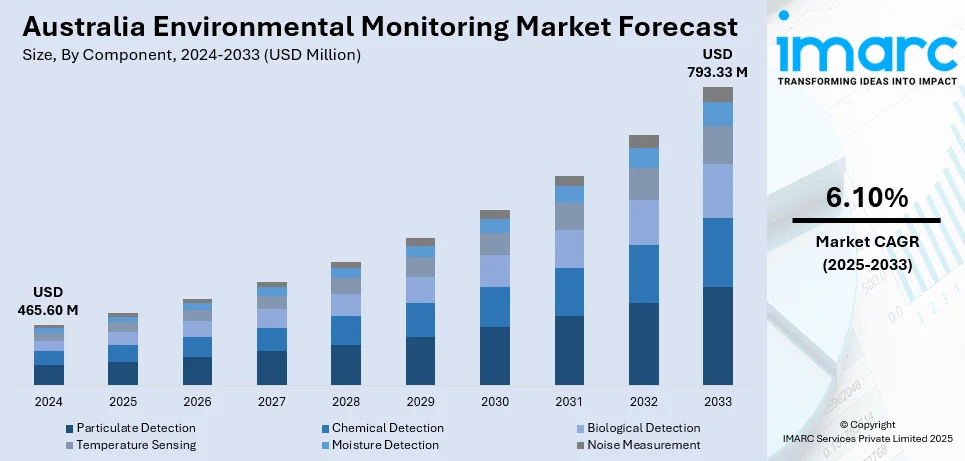

The Australia environmental monitoring market size reached USD 465.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 793.33 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The increasing government regulations on sustainability, heightened awareness of environmental issues, technological advancements like Internet of Things (IoT) and artificial intelligence (AI), and the need for industries to comply with severer environmental standards is aiding the Australia environmental monitoring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 465.60 Million |

| Market Forecast in 2033 | USD 793.33 Million |

| Market Growth Rate 2025-2033 | 6.10% |

Australia Environmental Monitoring Market Trends:

Government Regulations and Sustainability Initiatives

Australia's increasing interest in environmental sustainability has seen the government impose stricter regulations, with policies directed at minimizing carbon emissions and furthering biodiversity conservation. A chief initiative is the National Biodiversity Strategy, which targets the protection and conservation of at least 30% of Australia's land, inland water, marine, and coastal ecosystems by 2030. These regulatory strategies are fueling demand for high-end environmental monitoring technologies to promote compliance and monitor environmental well-being. With businesses and industries coming under greater pressure to fulfill ecological standards, they are embracing monitoring systems in order to quantify their footprint and enhance sustainability measures. The move is creating a greener economy, leading to organizations embracing responsible environmental behavior and helping secure Australia's natural resources and biodiversity for generations to come.

To get more information on this market, Request Sample

Integration of IoT and AI in Monitoring Systems

The Australian environment monitoring market is increasingly leveraging Internet of Things (IoT) devices and Artificial Intelligence (AI) to help augment data capture and analysis. IoT sensors enable real-time monitoring of a broad array of environmental conditions, while AI systems interpret this data to identify trends, forecast future events, and detect potential issues in the environment. This convergence enhances monitoring effectiveness and accuracy, allowing early intervention and effective management of environmental issues. Combining these technologies also facilitates the development of more resilient and adaptive monitoring systems that can assist in regulatory compliance as well as sustainability across industries.

Rise of Local Innovation and Market Expansion

Australia is home to a thriving ecosystem of 247 IoT applications startups, with companies like LiXiA leading the way in developing affordable, low-power IoT sensors specifically designed for flood monitoring. These innovations are central to Australia's growing role in advancing environmental monitoring solutions. The sector is driven by the need for cost-effective, high-performance technologies that cater to local industries, addressing challenges such as flood monitoring, air quality control, and environmental data collection. Startups and tech companies are focusing on creating solutions tailored to the specific needs of sectors like agriculture, mining, and urban management. This local innovation not only meets domestic needs but also strengthens Australia's position in the global environmental technology market. As these technologies gain recognition, Australian companies are expanding internationally, collaborating on global environmental monitoring initiatives and contributing to the Australia environmental monitoring market growth.

Australia Environmental Monitoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, product type, sampling method, and application.

Component Insights:

- Particulate Detection

- Chemical Detection

- Biological Detection

- Temperature Sensing

- Moisture Detection

- Noise Measurement

The report has provided a detailed breakup and analysis of the market based on the component. This includes particulate detection, chemical detection, biological detection, temperature sensing, moisture detection, and noise measurement.

Product Type Insights:

- Environmental Monitoring Sensors

- Environmental Monitors

- Environmental Monitoring Software

- Wearable Environmental Monitors

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes environmental monitoring sensors, environmental monitors, environmental monitoring software, and wearable environmental monitors.

Sampling Method Insights:

- Continuous Monitoring

- Active Monitoring

- Passive Monitoring

- Intermittent Monitoring

The report has provided a detailed breakup and analysis of the market based on the sampling method. This includes continuous monitoring, active monitoring, passive monitoring, and intermittent monitoring.

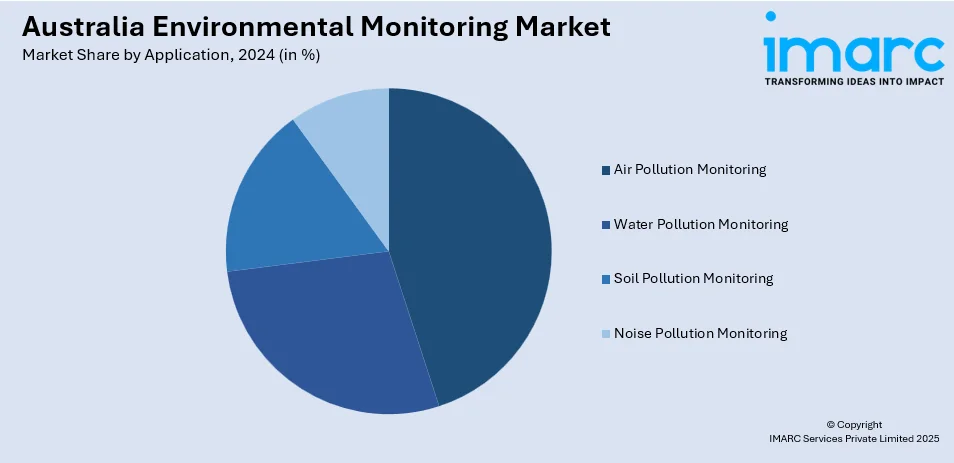

Application Insights:

- Air Pollution Monitoring

- Water Pollution Monitoring

- Soil Pollution Monitoring

- Noise Pollution Monitoring

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes air pollution monitoring, water pollution monitoring, soil pollution monitoring, and noise pollution monitoring.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Environmental Monitoring Market News:

- In March 2025, SGS expanded its presence in Australia by acquiring Independent Metallurgical Operations Pty Ltd (IMO), a leading provider of metallurgical consulting, testing, and technical services based in Perth. This acquisition enhances SGS’s position in the mining sector, offering a broader range of expertise across the mining value chain. SGS now welcomes 48 new employees, further solidifying its global leadership in testing, inspection, and certification services.

- In September 2024, For $10 million AUD, Hitachi Construction Machinery became the largest shareholder in Envirosuite Ltd. by purchasing a 12% equity holding in the company. Hitachi's approach to tackling the worldwide ESG and greenhouse gas issues in mining is reinforced by this investment. Envirosuite provides real-time environmental monitoring and predictive technology solutions, which, combined with Hitachi's mining expertise and Wenco's fleet management solutions, aims to optimize mine operations and reduce environmental impact.

- In February 2024, Montrose Environmental Group acquired Epic Environmental Pty Ltd, expanding its environmental consultancy and engineering services in Australia. Based in Brisbane, Epic Environmental specializes in areas like contaminated land management, waste management, and environmental audits. This acquisition enhances Montrose's capabilities, relationships, and service offerings in the Australian market, supporting its growth and commitment to addressing environmental challenges, particularly in water contamination and PFAS removal.

Australia Environmental Monitoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Particulate Detection, Chemical Detection, Biological Detection, Temperature Sensing, Moisture Detection, Noise Measurement |

| Product Types Covered | Environmental Monitoring Sensors, Environmental Monitors, Environmental Monitoring Software, Wearable Environmental Monitors |

| Sampling Methods Covered | Continuous Monitoring, Active Monitoring, Passive Monitoring, Intermittent Monitoring |

| Applications Covered | Air Pollution Monitoring, Water Pollution Monitoring, Soil Pollution Monitoring, Noise Pollution Monitoring |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia environmental monitoring market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia environmental monitoring market on the basis of component?

- What is the breakup of the Australia environmental monitoring market on the basis of product type?

- What is the breakup of the Australia environmental monitoring market on the basis of sampling method?

- What is the breakup of the Australia environmental monitoring market on the basis of application?

- What is the breakup of the Australia environmental monitoring market on the basis of region?

- What are the various stages in the value chain of the Australia environmental monitoring market?

- What are the key driving factors and challenges in the Australia environmental monitoring market?

- What is the structure of the Australia environmental monitoring market and who are the key players?

- What is the degree of competition in the Australia environmental monitoring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia environmental monitoring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia environmental monitoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia environmental monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)