Australia Enzymes Market Size, Share, Trends and Forecast by Type, Source, Reaction Type, Application, and Region, 2025-2033

Australia Enzymes Market Overview:

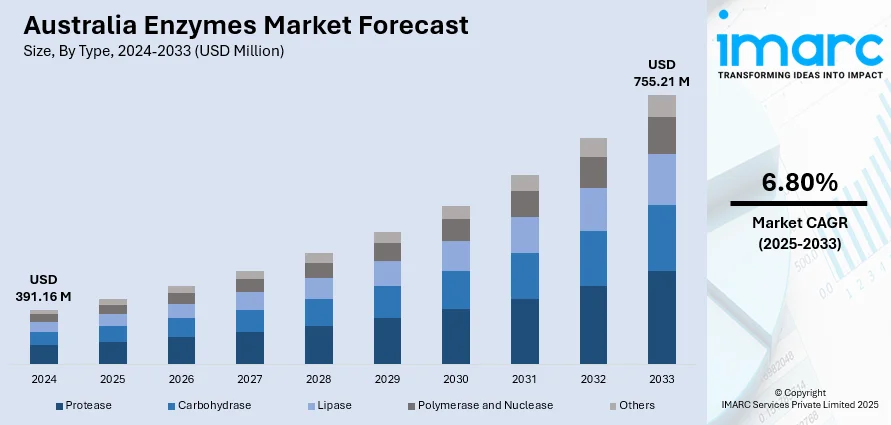

The Australia enzymes market size reached USD 391.16 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 755.21 Million by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The government incentives for biotech innovation are driving the market, coupled with increasing consumer demand for natural and clean-label products, technology improvement in the manufacture of enzymes, and increasing applications in industries such as food, pharmaceuticals, and agriculture. These drivers are majorly fueling the Australia enzymes market share expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 391.16 Million |

| Market Forecast in 2033 | USD 755.21 Million |

| Market Growth Rate 2025-2033 | 6.80% |

Australia Enzymes Market Trends:

Advancements in Enzyme Production Technologies

Recent technological innovations are significantly enhancing enzyme production processes in Australia. Advancements in enzyme engineering, fermentation technology, and bioprocessing methods are improving the efficiency, specificity, and scalability of enzyme production. These developments enable the creation of more effective and cost-efficient enzymes, expanding their applicability across various industries, including food processing, pharmaceuticals, and agriculture. As a result, Australian manufacturers can offer higher-quality enzymes that meet the evolving demands of the market. This trend is contributing to the Australia enzymes market growth, as companies leverage these technological advancements to stay competitive and meet the increasing demand for specialized enzyme products. For instance, in May 2024, Australian researchers from ANU and the University of Newcastle identified a key enzyme, carboxysomal carbonic anhydrase, in cyanobacteria that could enhance carbon dioxide capture. These “tiny carbon superheroes” absorb 12% of global CO₂ annually via photosynthesis. The enzyme boosts their ability to convert CO₂ into sugars, a mechanism scientists aim to engineer into crops. This innovation could help develop climate-resilient plants, improve yields, and support global efforts to lower greenhouse gases.

To get more information on this market, Request Sample

Rising Consumer Demand for Natural and Clean-Label Products

Increasing consumer demand in Australia for natural and clean-label products is fuelling the need for natural source enzymes. For instance, as per industry reports, the Australian clean label ingredient market is projected to expand at a compound annual growth rate (CAGR) of more than 8.4% between 2024 and 2029. Consumers are now demanding food and beverage items with no artificial additives or preservatives, causing manufacturers to introduce natural enzymes in their production process. This movement follows the clean-label trend where transparency and simplicity of ingredients take precedence. Accordingly, enzyme companies in Australia are emphasizing the construction of natural and clean-label enzyme products to satisfy consumer demand and increase their market base in the food and beverage sector.

Australia Enzymes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, source, reaction type, and application.

Type Insights:

- Protease

- Carbohydrase

- Lipase

- Polymerase and Nuclease

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes protease, carbohydrase, lipase, polymerase and nuclease, and others.

Source Insights:

- Microorganisms

- Plants

- Animals

The report has provided a detailed breakup and analysis of the market based on the source. This includes microorganisms, plants, and animals.

Reaction Type Insights:

- Hydrolase

- Oxidoreductase

- Transferase

- Lyase

- Others

The report has provided a detailed breakup and analysis of the market based on the rection type. This includes hydrolase, oxidoreductase, transferase, lyase, and others.

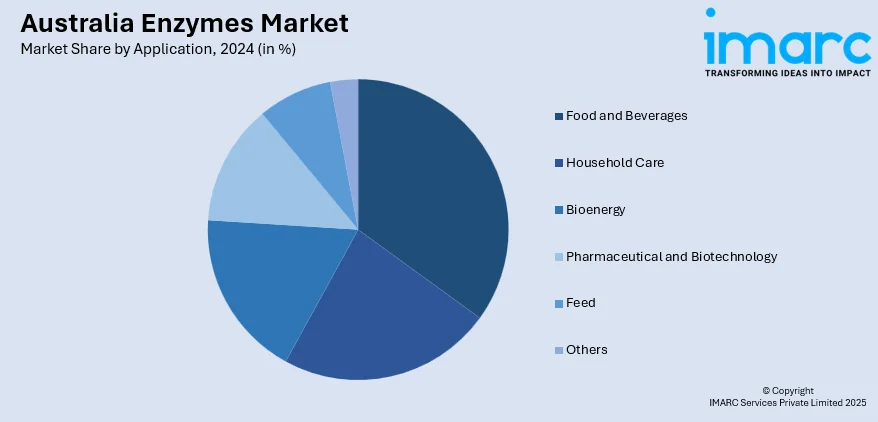

Application Insights:

- Food and Beverages

- Household Care

- Bioenergy

- Pharmaceutical and Biotechnology

- Feed

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages, household care, bioenergy, pharmaceutical and biotechnology, feed, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Enzymes Market News:

- In March 2025, Allozymes and Bonumose announced promising early results from their collaboration to enhance enzyme-based production of healthy food and supplement ingredients. Bonumose’s innovative enzyme combinations convert starch into high-yield, high-purity monosaccharides, while Allozymes applies its microfluidics-based protein engineering to optimize key enzymes. Capable of analyzing up to 20 million variants daily, Allozymes significantly shortens development timelines. This partnership aims to scale sustainable, cost-effective ingredient production and set new standards in the food and supplement industries through enzyme innovation.

- In August 2024, ADAMA partnered with U.S.-based Elemental Enzymes to launch a new bio-fungicide in Australia by 2026. Targeting foliar diseases in cereals, canola, and turf, the product uses patented peptide technology to activate plants’ natural defenses. It offers a novel mode of action against fungal diseases like septoria, complementing chemical fungicides and supporting resistance management.

- In July 2024, Samsara Eco, an Australian company developing plastic-eating enzymes, raised USD 65 Million to scale its recycling technology across Southeast Asia. Backed by investors like Lululemon and Temasek, the funding will support the establishment of two recycling facilities for nylon and polyester by 2027. Samsara’s AI-designed enzymes break down mixed plastics into reusable monomers, enabling infinite recycling without sorting. This innovation promotes circular economy practices and positions Samsara as a leader in sustainable plastic waste management and enzyme technology.

Australia Enzymes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Protease, Carbohydrase, Lipase, Polymerase and Nuclease, Others |

| Sources Covered | Microorganisms, Plants, Animals |

| Reaction Types Covered | Hydrolase, Oxidoreductase, Transferase, Lyase, Others |

| Applications Covered | Food and Beverages, Household Care, Bioenergy, Pharmaceutical and Biotechnology, Feed, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia enzymes market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia enzymes market on the basis of type?

- What is the breakup of the Australia enzymes market on the basis of source?

- What is the breakup of the Australia enzymes market on the basis of rection type?

- What is the breakup of the Australia enzymes market on the basis of application?

- What is the breakup of the Australia enzymes market on the basis of region?

- What are the various stages in the value chain of the Australia enzymes market?

- What are the key driving factors and challenges in the Australia enzymes market?

- What is the structure of the Australia enzymes market and who are the key players?

- What is the degree of competition in the Australia enzymes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia enzymes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia enzymes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia enzymes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)