Australia EV Battery Components Market Size, Share, Trends and Forecast by Component Type, Battery Type, Vehicle Type, Propulsion Type, End User, and Region, 2025-2033

Australia EV Battery Components Market Overview

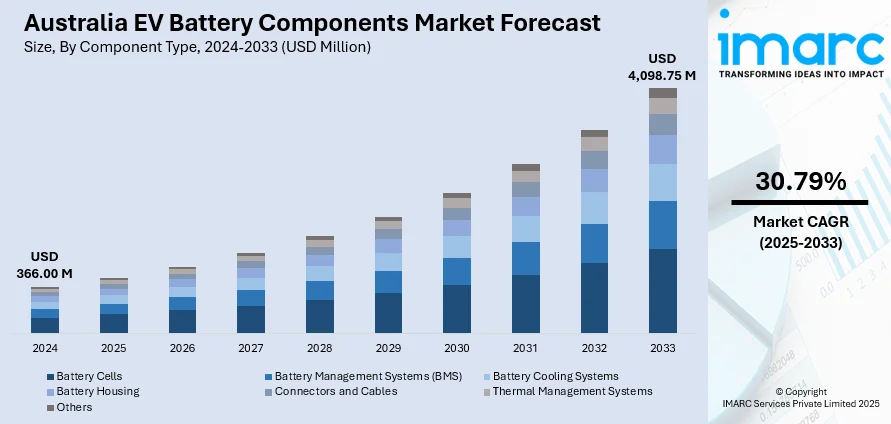

The Australia EV battery components market size reached USD 366.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,098.75 Million by 2033 exhibiting a growth rate (CAGR) of 30.79% during 2025-2033. The market is spurred by expanding electric vehicle uptake, technology evolution in batteries, government incentives for clean mobility, and rising demand from consumers for performance-oriented, energy-efficient vehicles. Increasing emphasis on thermal safety, smart battery management, and battery chemistry diversification also drives component innovation more swiftly. Infrastructure development and sustainability efforts also play a pivotal role in determining demand. These factors collectively contribute to the growth of the Australia EV battery components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 366.00 Million |

| Market Forecast in 2033 | USD 4,098.75 Million |

| Market Growth Rate 2025-2033 | 30.79% |

Australia EV Battery Components Market Trends:

Development of Battery Thermal Management Systems

Battery thermal management systems are fast becoming an essential part of Australia's electric vehicle (EV) system. Due to the variable climatic conditions in the nation, temperature control plays a critical role in guaranteeing battery safety, performance, and longevity. New developments focus on the application of liquid cooling, thermoelectric components, and phase-change materials to achieve battery operating temperatures that are optimal. Such innovations mitigate overheating and thermal runaway risks, making both efficiency and consumer confidence better. Furthermore, smart thermal sensors facilitate accurate monitoring and control, leading to energy conservation and system responsiveness. Thermal performance attention is not only confined to passenger cars; commercial and two-wheeler segments are also experiencing equivalent improvements. With increasing adoption of EVs, especially in cities, there will be increased demand for intelligent and dependable thermal management solutions. This emphasis greatly drives Australia EV battery components market growth, reflecting on government intentions for nation-wide electrification and sustainability.

To get more information on this market, Request Sample

Increasing Integration of Battery Management Systems (BMS)

The electric vehicle industry in Australia is experiencing increasing integration of Battery Management Systems (BMS) due to increased needs for superior control, efficiency, and security. BMS are responsible for monitoring the state-of-charge, voltage, temperature, and general well-being of battery cells. BMS are moving from simple protection functions to sophisticated, intelligent units with real-time diagnostic and predictive maintenance capabilities. The use of BMS guarantees electric vehicles to run at optimal efficiency throughout their lifetime. In Australia, connectivity and data-oriented thinking are driving more adaptive and scalable BMS architectures. That entails wireless communication, over-the-air updates, and AI-based performance analytics. Modern BMS enable improved thermal balancing and energy balancing, leading directly to longer battery lifespan and improved driving performance. With changing regulatory schemes and consumer preferences, the integration of BMS is likely to be a key anchor in future EV design and technology platforms.

Diversification of Battery Cell Technologies

The Australia electric vehicle market is diversifying battery cell technologies, showing a trend toward improved performance and material versatility. Although lithium-ion battery cells are still the strongest, solid-state options are increasingly popular for their better energy density and safer profiles. These new-generation batteries show promise of extended driving range and shorter charging times. Moreover, nickel-metal hydride and other new chemistries are being looked at for use in hybrids and specialty vehicles, widening the range of functions for battery technologies. Diversification benefits energy security by limiting dependence on individual raw materials and encouraging domestic innovation. For instance, in October 2024, Himadri Speciality Chemical collaborated with Australian company Sicona to commercialize next-gen silicon-composite anode technology, leading the Australia EV battery parts market forward through international collaboration and innovation. Moreover, researchers and developers are examining region-specific options customized to Australia's transport behavior and environmental concerns. The shift towards diverse battery chemistries also fits within wider sustainability goals. This technology diversification is crucial to fueling the development of Australia's EV battery components industry, enabling a robust supply chain and improving Australia's competitive standing in the international energy transition.

Australia EV Battery Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component type, battery type, vehicle type, propulsion type, and end user.

Component Type Insights:

- Battery Cells

- Battery Management Systems (BMS)

- Battery Cooling Systems

- Battery Housing

- Connectors and Cables

- Thermal Management Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes battery cells, battery management systems (BMS), battery cooling systems, battery housing, connectors and cables, thermal management systems, and others.

Battery Type Insights:

- Lithium-Ion Batteries

- Nickel-Metal Hydride Batteries

- Solid-State Batteries

- Lead-Acid Batteries

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion batteries, nickel-metal hydride batteries, solid-state batteries, and lead-acid batteries.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Three-Wheelers

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles, commercial vehicles, two-wheelers, and three-wheelers.

Propulsion Type Insights:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs).

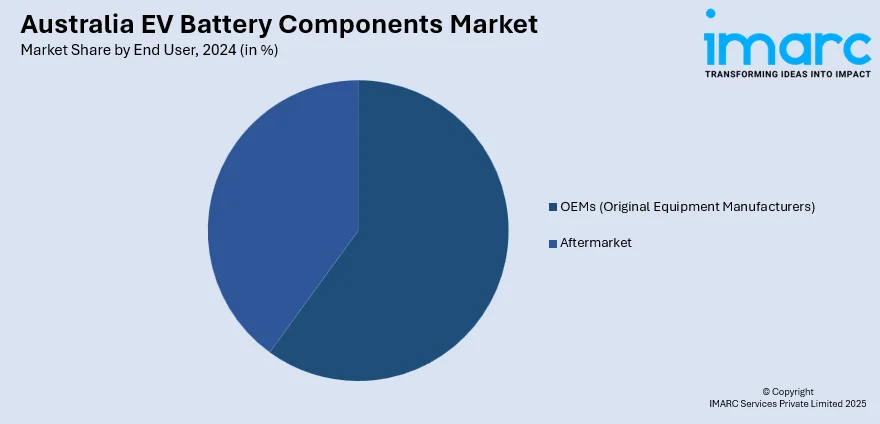

End User Insights:

- OEMs (Original Equipment Manufacturers)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the end user. This includes OEMs (original equipment manufacturers) and aftermarket.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia EV Battery Components Market News:

- In October 2024, eLumina launched Australia's first factory that makes community lithium batteries and EV chargers in Yatala, Gold Coast. The US$20 million factory will make 300 units a year, employ 300 people, and contribute to clean energy targets by providing innovative, rapid-charging EV solutions for urban and rural communities.

Australia EV Battery Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Battery Cells, Battery Management Systems (BMS), Battery Cooling Systems, Battery Housing, Connectors and Cables, Thermal Management Systems, Others |

| Battery Types Covered | Lithium-Ion Batteries, Nickel-Metal Hydride Batteries, Solid-State Batteries, Lead-Acid Batteries |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Three-Wheelers |

| Propulsion Types Covered | Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs) |

| End Users Covered | OEMs (Original Equipment Manufacturers), Aftermarket |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia EV battery components market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia EV battery components market on the basis of component type?

- What is the breakup of the Australia EV battery components market on the basis of battery type?

- What is the breakup of the Australia EV battery components market on the basis of vehicle type?

- What is the breakup of the Australia EV battery components market on the basis of propulsion type?

- What is the breakup of the Australia EV battery components market on the basis of end user?

- What is the breakup of the Australia EV battery components market on the basis of region?

- What are the various stages in the value chain of the Australia EV battery components market?

- What are the key driving factors and challenges in the Australia EV battery components?

- What is the structure of the Australia EV battery components market and who are the key players?

- What is the degree of competition in the Australia EV battery components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia EV battery components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia EV battery components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia EV battery components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)