Australia EV Battery Cooling Systems Market Size, Share, Trends and Forecast by Cooling Technology, Battery Type, Vehicle Type, Propulsion Type, End User, and Region, 2025-2033

Australia EV Battery Cooling Systems Market Overview:

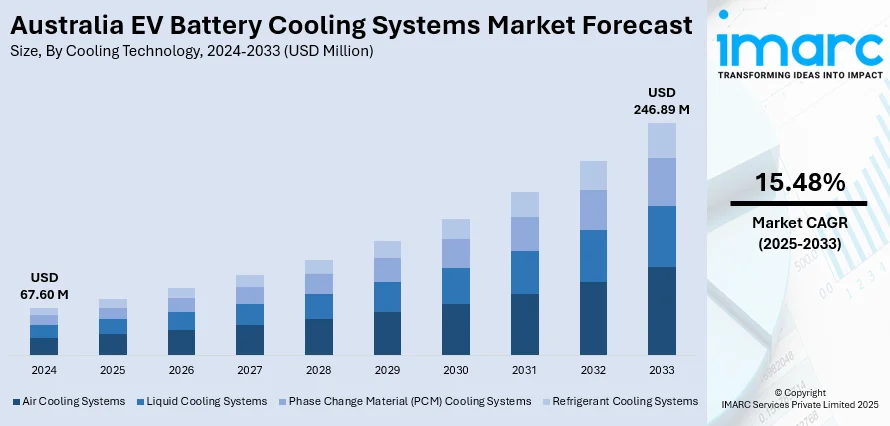

The Australia EV battery cooling systems market size reached USD 67.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 246.89 Million by 2033, exhibiting a growth rate (CAGR) of 15.48% during 2025-2033. The market is rising electric vehicle (EVs) adoption due to environmental concerns and government policies promoting clean energy. The need for efficient thermal management to enhance battery performance, safety, and lifespan also fuels demand. Technological advancements like liquid and immersion cooling improve cooling efficiency. Additionally, growing investments in domestic battery production and sustainability goals push manufacturers to develop eco-friendly cooling solutions, bolstering the Australia EV battery cooling systems market share and supporting country’s transition to a greener transport sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 67.60 Million |

| Market Forecast in 2033 | USD 246.89 Million |

| Market Growth Rate 2025-2033 | 15.48% |

Australia EV Battery Cooling Systems Market Trends:

Technological Innovation Driving Efficiency

Australia's EV battery cooling industry is transforming at a fast pace with ongoing developments in technology. Technologies such as liquid cooling, phase-change materials, and immersion cooling are transforming the manner in which batteries dissipate heat. These technologies optimize battery performance, increase lifespan, and provide safety through optimal operating temperatures. Smart cooling systems with sensors and real-time data analytics are also becoming increasingly prevalent, enabling accurate temperature control. This integration prevents overheating and increases overall vehicle efficiency. As the take-up of EVs continues, automakers are placing a high value on these innovative cooling technologies in order to address growing demand for robust, high-performance batteries capable of withstanding Australia's varying climate conditions. The emphasis on leading-edge thermal management systems is evidence of the industry's dedication to making the driving experience better and realizing the shift to electric mobility more quickly.

To get more information on this market, Request Sample

Strong Government Support and Policy Initiatives

Government initiatives play a vital role in shaping Australia’s EV battery cooling systems market. Policies promoting clean energy and zero-emissions transport are driving innovation in battery technologies, particularly in safety, performance, and sustainability. The $500 million Australian Government's Driving the Nation Fund, which promotes EV charging infrastructure and fleet electrification, is a prime example. While not directly focused on cooling, these investments create a supportive environment for the development of advanced thermal management systems. By encouraging research, local manufacturing, and collaboration across sectors, these strategies help commercialize innovative cooling solutions. They also reduce reliance on imports and aim to position Australia EV battery cooling systems market growth. Together, these national efforts accelerate EV adoption and ensure that battery systems including cooling technologies are optimized for Australia’s unique climate, reinforcing the broader goals of environmental sustainability and energy transition.

Focus on Sustainability and Eco-Friendly Solutions

Sustainability is a major trend influencing Australia’s EV battery cooling systems industry. There is increasing demand for environmentally friendly cooling methods that minimize waste and reduce carbon footprints. Manufacturers are exploring biodegradable coolants, recyclable materials, and closed-loop cooling systems to lessen environmental impact. Innovative approaches like phase-change materials and immersion cooling enhance energy efficiency while aligning with global sustainability targets. This focus ensures that EV battery cooling systems contribute positively to environmental goals, addressing consumer preferences for green technology. By integrating sustainable practices, the industry supports Australia’s broader commitment to clean energy and climate action, making EVs not only a practical but also an eco-conscious choice for consumers and businesses alike.

Australia EV Battery Cooling Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on cooling technology, battery type, vehicle type, propulsion type, and end user.

Cooling Technology Insights:

- Air Cooling Systems

- Liquid Cooling Systems

- Phase Change Material (PCM) Cooling Systems

- Refrigerant Cooling Systems

The report has provided a detailed breakup and analysis of the market based on the cooling technology. This includes air cooling systems, liquid cooling systems, phase change material (PCM) cooling systems, and refrigerant cooling systems.

Battery Type Insights:

- Lithium-Ion Batteries

- Nickel-Metal Hydride Batteries

- Solid-State Batteries

- Others

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion batteries, nickel-metal hydride batteries, solid-state batteries, and others.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Three-Wheelers

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles, commercial vehicles, two-wheelers, and three-wheelers.

Propulsion Type Insights:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs).

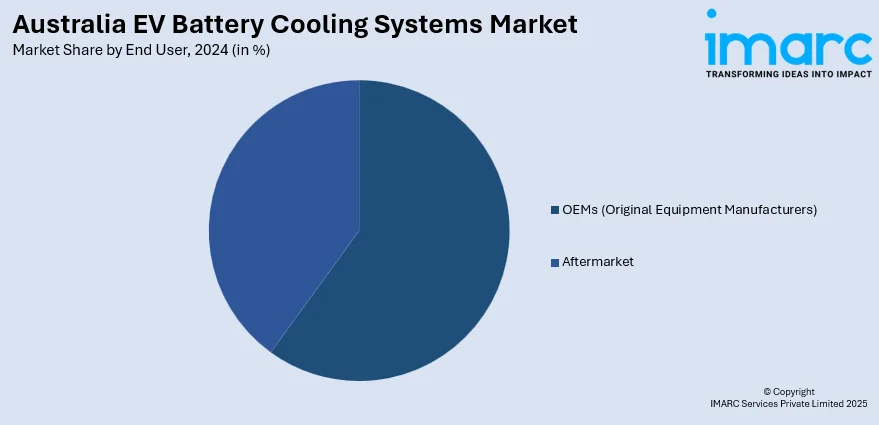

End User Insights:

- OEMs (Original Equipment Manufacturers)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the end user. This includes OEMs (original equipment manufacturers) and aftermarket.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia EV Battery Cooling Systems Market News:

- In September 2024, Hanwha Aerospace and SK Enmove launched the world’s first immersion cooling energy storage system (ESS), pioneering safer, non-flammable battery technology. Using advanced thermal fluid to isolate each lithium-ion cell, the system prevents thermal runaway and enhances protection against environmental hazards like dust and salt. This innovation marks a major leap in ESS safety and sustainability, reinforcing South Korea’s leadership in green energy storage solutions.

Australia EV Battery Cooling Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cooling Technologies Covered | Air Cooling Systems, Liquid Cooling Systems, Phase Change Material (PCM) Cooling Systems, Refrigerant Cooling Systems |

| Battery Types Covered | Lithium-Ion Batteries, Nickel-Metal Hydride Batteries, Solid-State Batteries, Others |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Three-Wheelers |

| Propulsion Types Covered | Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs) |

| End Users Covered | OEMs (Original Equipment Manufacturers), Aftermarket |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia EV battery cooling systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia EV battery cooling systems market on the basis of cooling technology?

- What is the breakup of the Australia EV battery cooling systems market on the basis of battery type?

- What is the breakup of the Australia EV battery cooling systems market on the basis of vehicle type?

- What is the breakup of the Australia EV battery cooling systems market on the basis of propulsion type?

- What is the breakup of the Australia EV battery cooling systems market on the basis of end user?

- What is the breakup of the Australia EV battery cooling systems market on the basis of region?

- What are the various stages in the value chain of the Australia EV battery cooling systems market?

- What are the key driving factors and challenges in the Australia EV battery cooling systems market?

- What is the structure of the Australia EV battery cooling systems market and who are the key players?

- What is the degree of competition in the Australia EV battery cooling systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia EV battery cooling systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia EV battery cooling systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia EV battery cooling systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)