Australia Excavators Market Size, Share, Trends and Forecast by Product, Mechanism Type, Power Range, Application, and Region, 2025-2033

Australia Excavators Market Overview:

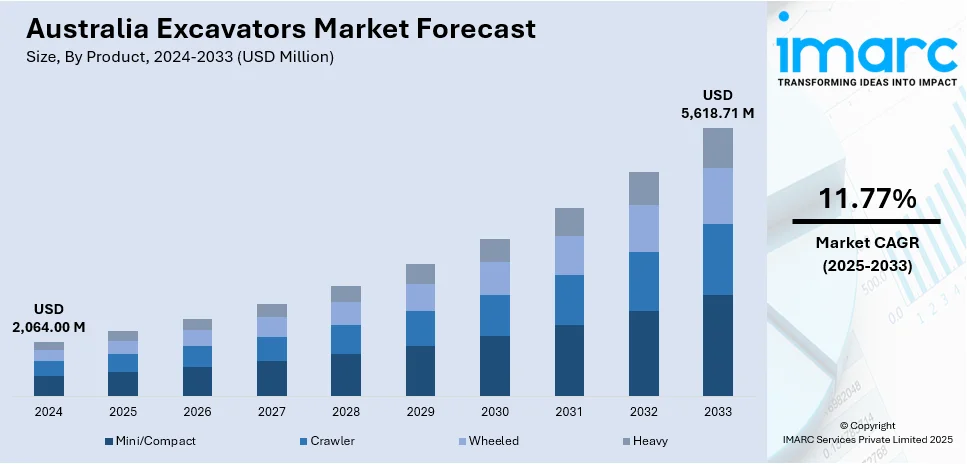

The Australia excavators market size reached USD 2,064.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,618.71 Million by 2033, exhibiting a growth rate (CAGR) of 11.77% during 2025-2033. The market is driven by ongoing infrastructure projects, urban expansion, and mining operations. Rising demand for compact models supports space-constrained construction needs, while sustainability and technology adoption shape buyer preferences. Strong competition among key players enhances innovation and service offerings, contributing to a dynamic landscape that continues to evolve the Australia excavators market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,064.00 Million |

| Market Forecast in 2033 | USD 5,618.71 Million |

| Market Growth Rate 2025-2033 | 11.77% |

Australia Excavators Market Trends:

Infrastructure Investment and Urban Development

Australia’s ongoing investment in infrastructure is a key driver of excavator demand. Large-scale government-backed projects in transport, energy, and public services continue to boost construction activity nationwide. Building new housing and business districts in cities also demands a lot of digging up the ground. Site preparation, trenching and transferring materials at these sites would be challenging without excavators. The infrastructure projects in the government’s long-term plan ensure demand never declines in various regions. Urban jobs often require compact excavators because they can move in small areas more easily. The constant investment gives manufacturers and rental companies chances to continue growing steadily. Overall, the scale and diversity of infrastructure and urban projects play a central role in fueling the Australia excavators market, supporting long-term market expansion and reinforcing equipment innovation tailored to evolving construction needs.

To get more information on this market, Request Sample

Mining Sector Expansion

Mining remains a cornerstone of the Australian economy, significantly influencing excavator demand. The sector’s reliance on heavy machinery for site development, overburden removal, and mineral extraction ensures a steady market for large, durable excavators. Continued global demand for commodities like iron ore, gold, and lithium drives mining activity, especially in regions like Western Australia and Queensland. Mining companies prioritize equipment with high efficiency, durability, and low operating costs, increasing investment in technologically advanced excavators. In addition, ongoing exploration and new project approvals expand the use of earthmoving equipment. As mining operations scale up or modernize, the need for robust, high-performance excavators grows accordingly. This industrial demand underpins market stability, positioning the mining sector as a fundamental force driving the Australia excavators market’s sustained momentum.

Technological Advancements and Sustainability Initiatives

Technological innovation plays a pivotal role in shaping Australia’s excavator market. New models feature advanced telematics, automation, GPS tracking, and hybrid or electric powertrains, improving operational efficiency while lowering emissions and fuel consumption. With rising environmental regulations and customer awareness, demand has shifted toward machines that support sustainability goals. Fleet operators benefit from lower lifecycle costs, improved diagnostics, and reduced environmental impact. These advancements also enhance safety and ease of use, which is particularly attractive in both construction and mining sectors. Manufacturers are actively investing in R&D to develop more efficient and eco-friendly models. As a result, companies increasingly adopt technology-driven excavators to meet environmental compliance and cost-effectiveness, making innovation and green initiatives core factor driving in the Australia excavators market growth.

Australia Excavators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, mechanism type, power range, and application.

Product Insights:

- Mini/Compact

- Crawler

- Wheeled

- Heavy

The report has provided a detailed breakup and analysis of the market based on the product. This includes mini/compact, crawler, wheeled, and heavy.

Mechanism Type Insights:

- Electric

- Hydraulic

- Hybrid

A detailed breakup and analysis of the market based on the mechanism type have also been provided in the report. This includes electric, hydraulic, and hybrid.

Power Range Insights:

- Up to 300 HP

- 301-500 HP

- 501 HP and Above

A detailed breakup and analysis of the market based on the power range have also been provided in the report. This includes up to 300 HP, 301-500 HP, and 501 HP and above.

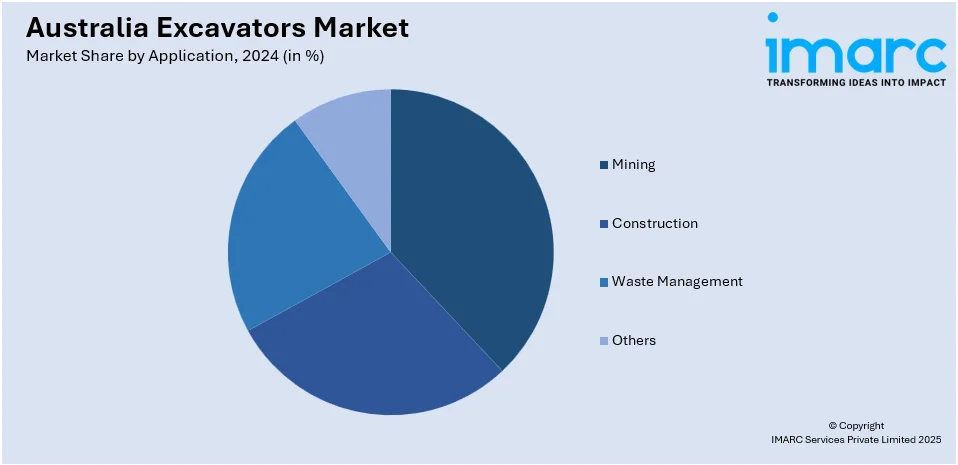

Application Insights:

- Mining

- Construction

- Waste Management

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes mining, construction, waste management, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Excavators Market News:

- In April 2024, in Australia and New Zealand, CASE Construction Equipment introduced the new D-Series mini-excavator line, which includes models weighing between one and six tons. With the newest technology, features, and attachments for every market and application, the D-Series mini-excavator models provide a comprehensive range of equipment to meet every customer's needs.

- In October 2024, Kobelco Australia introduced a pair of short-range excavators. In Australia, Kobelco expanded its fleet with two new short-range excavators equipped with Tier 3 engines. With the advantages of a Tier 3 engine, the new SK225SR-7 and SK235SR-7 weigh 23.3 and 25 tons, respectively.

Australia Excavators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Mini/Compact, Crawler, Wheeled, Heavy |

| Mechanism Types Covered | Electric, Hydraulic, Hybrid |

| Power Ranges Covered | Up to 300 HP, 301-500 HP, 501 HP and Above |

| Applications Covered | Mining, Construction, Waste Management, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia excavators market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia excavators market on the basis of product?

- What is the breakup of the Australia excavators market on the basis of mechanism type?

- What is the breakup of the Australia excavators market on the basis of power range?

- What is the breakup of the Australia excavators market on the basis of application?

- What is the breakup of the Australia excavators market on the basis of region?

- What are the various stages in the value chain of the Australia excavators market?

- What are the key driving factors and challenges in the Australia excavators market?

- What is the structure of the Australia excavators market and who are the key players?

- What is the degree of competition in the Australia excavators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia excavators market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia excavators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia excavators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)