Australia Express Cargo Market Size, Share, Trends and Forecast by Service Type, Mode of Transportation, Cargo Type, Customer Type, End-User Industry, and Region, 2025-2033

Australia Express Cargo Market Overview:

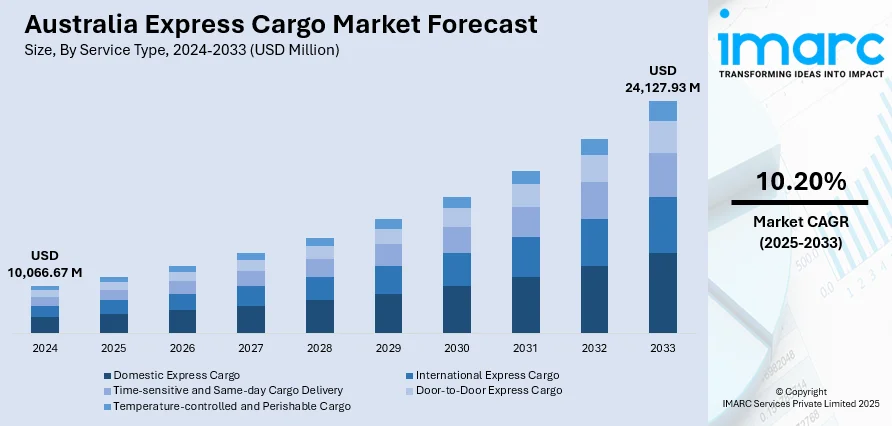

The Australia express cargo market size reached USD 10,066.67 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 24,127.93 Million by 2033, exhibiting a growth rate (CAGR) of 10.20% during 2025-2033. The market is driven by the rapid expansion of e-commerce, with rising online retail sales fueling demand for faster, last-mile delivery solutions, including same-day and cross-border services. Sustainability initiatives, such as electric fleets and carbon-neutral shipping, are gaining traction as consumers and regulators push for greener logistics. Additionally, technological advancements in tracking and automation enhance operational efficiency, further augmenting the Australia express cargo market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10,066.67 Million |

| Market Forecast in 2033 | USD 24,127.93 Million |

| Market Growth Rate 2025-2033 | 10.20% |

Australia Express Cargo Market Trends:

Growth in E-Commerce Driving Demand for Express Cargo Services

The rapid expansion of e-commerce in Australia is significantly propelling the market. Australia's e-commerce sector is expected to reach AUD 56.07 Billion (approximately USD 36.41 Billion) by 2024, with 17.08 million individuals shopping online every month, and is expected to grow to 23.14 million by 2029. The Courier, Express, and Parcel (CEP) market, which is crucial for express freight, is expected to grow to USD 11.75 Billion by 2025, driven by the need for faster deliveries and continued e-commerce expansion. Customers care most about free shipping (66.5%) and sustainable practices, and artificial intelligence will improve logistics and customer experiences in this fast-paced market. With online retail sales increasing year-on-year, consumers and businesses demand faster, more reliable delivery options. Major players are investing in last-mile delivery solutions, including same-day and next-day services, to meet customer expectations. Additionally, the rise of cross-border e-commerce has heightened the need for efficient international express cargo solutions, particularly in the Asia-Pacific region. Companies are leveraging advanced tracking systems and automation to enhance efficiency and reduce transit times. As online shopping continues to grow, fueled by convenience and a post-pandemic shift in consumer behavior, the express cargo sector is expected to see sustained demand, prompting further innovation in logistics and supply chain management.

To get more information on this market, Request Sample

Sustainability Initiatives Shaping the Future of Express Cargo

Environmental concerns are driving a major shift toward sustainable practices in the market. Therefore, this is also positively influencing the Australia express cargo market growth. Companies are adopting eco-friendly measures such as electric delivery vehicles, carbon-neutral shipping options, and optimized route planning to reduce emissions. Australia's express freight industry continues to be largely reliant on traditional internal combustion engine (ICE) vans, which accounted for 97.39% of new van sales in the first quarter of 2025, with Battery Electric Vehicles (BEVs) accounting for just 2.61%. While the total new light vehicle market reported 17,914 BEV sales during Q1 2025, their share of total vehicle sales fell to 6.30% from 7.42% during Q4 2024. This is indicative of a slow uptake of electric delivery vans, even amidst the industry's focus on efficiency and cost reduction, highlighting a significant potential for electric vehicle inclusion in the Australian express cargo and logistics sector. Australia Post, for example, has introduced electric vans and bicycles for urban deliveries, while other logistics providers are exploring alternative fuels and energy-efficient warehousing. Consumers and businesses increasingly prefer green logistics solutions, pushing the industry to prioritize sustainability. Government regulations and corporate sustainability goals are further accelerating this trend. As a result, the express cargo market is changing to balance speed and efficiency with environmental responsibility, making sustainability a key competitive differentiator in the years ahead.

Australia Express Cargo Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, mode of transportation, cargo type, customer type, and end-user industry.

Service Type Insights:

- Domestic Express Cargo

- International Express Cargo

- Time-sensitive and Same-day Cargo Delivery

- Door-to-Door Express Cargo

- Temperature-controlled and Perishable Cargo

The report has provided a detailed breakup and analysis of the market based on the service type. This includes domestic express cargo, international express cargo, time-sensitive and same-day cargo delivery, door-to-door express cargo, and temperature-controlled and perishable cargo.

Mode of Transportation Insights:

- Air Express Cargo

- Road Express Cargo

- Rail Express Cargo

- Sea and Inland Waterways Express Cargo

A detailed breakup and analysis of the market based on the mode of transportation have also been provided in the report. This includes air express cargo, road express cargo, rail express cargo, and sea and inland waterways express cargo.

Cargo Type Insights:

- General Cargo

- High-value and Secured Cargo

- Hazardous Materials (HAZMAT)

- Perishable Goods

- Documents and Parcels

The report has provided a detailed breakup and analysis of the market based on the cargo type. This includes general cargo, high-value and secured cargo, hazardous materials (HAZMAT), perishable goods, and documents and parcels.

Customer Type Insights:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Individual Consumers

A detailed breakup and analysis of the market based on the customer type have also been provided in the report. This includes small and medium enterprises (SMEs), large enterprises, and individual consumers.

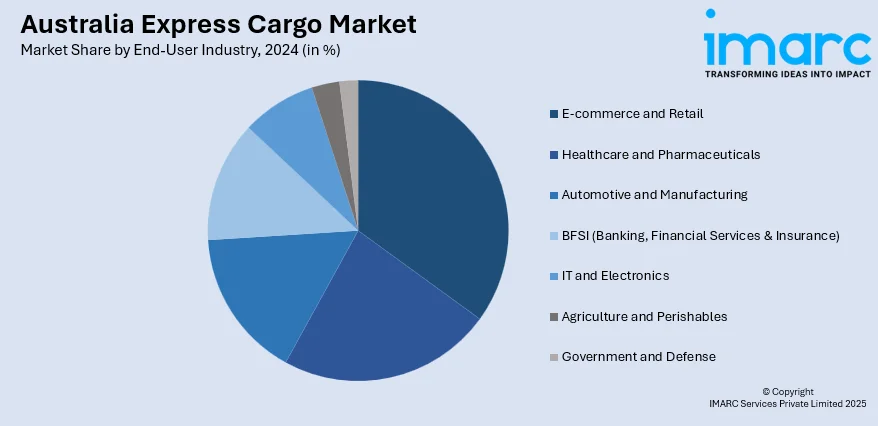

End-User Industry Insights:

- E-commerce and Retail

- Healthcare and Pharmaceuticals

- Automotive and Manufacturing

- BFSI (Banking, Financial Services & Insurance)

- IT and Electronics

- Agriculture and Perishables

- Government and Defense

The report has provided a detailed breakup and analysis of the market based on the end-user industry. This includes e-commerce and retail, healthcare and pharmaceuticals, automotive and manufacturing, BFSI (banking and financial services and insurance), IT and electronics, agriculture and perishables, government and defense.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Express Cargo Market News:

- June 24, 2024: Team Global Express launched a seven-year AUD 480 Million (approximately USD 311.71 Million) deal with Texel Air Australasia that will add four Boeing 737-800 BCF freighters to enhance Australian express cargo capacity by 20%. The addition of the new planes is designed to improve speed and efficiency, particularly for regional deliveries, thus enhancing Team Global Express's e-commerce capability.

- June 09, 2024: Hong Kong Air Cargo launched a new chartered freighter service three times weekly using an Airbus A330-200F linking Hong Kong and Sydney, enhancing express cargo links to Australia. This step is designed to maximize cargo volumes and further consolidate Hong Kong's role as a leading international air cargo hub.

Australia Express Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Domestic Express Cargo, International Express Cargo, Time-sensitive and Same-day Cargo Delivery, Door-to-Door Express Cargo, Temperature-controlled and Perishable Cargo |

| Modes of Transportation Covered | Air Express Cargo, Road Express Cargo, Rail Express Cargo, Sea and Inland Waterways Express Cargo |

| Cargo Types Covered | General Cargo, High-value and Secured Cargo, Hazardous Materials (HAZMAT), Perishable Goods, Documents and Parcels |

| Customer Types Covered | Small and Medium Enterprises (SMEs), Large Enterprises, Individual Consumers |

| End-User Industries Covered | E-commerce and Retail, Healthcare and Pharmaceuticals, Automotive and Manufacturing, BFSI (Banking, Financial Services & Insurance), IT and Electronics, Agriculture and Perishables, Government and Defense |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia express cargo market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia express cargo market on the basis of service type?

- What is the breakup of the Australia express cargo market on the basis of mode of transportation?

- What is the breakup of the Australia express cargo market on the basis of cargo type?

- What is the breakup of the Australia express cargo market on the basis of customer type?

- What is the breakup of the Australia express cargo market on the basis of end-user industry?

- What is the breakup of the Australia express cargo market on the basis of region?

- What are the various stages in the value chain of the Australia express cargo market?

- What are the key driving factors and challenges in the Australia express cargo market?

- What is the structure of the Australia express cargo market and who are the key players?

- What is the degree of competition in the Australia express cargo market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia express cargo market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia express cargo market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia express cargo industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)