Australia Extended Reality Market Size, Share, Trends and Forecast by Component, Type, Organization Size, Application, End User Industry, and Region, 2025-2033

Australia Extended Reality Market Overview:

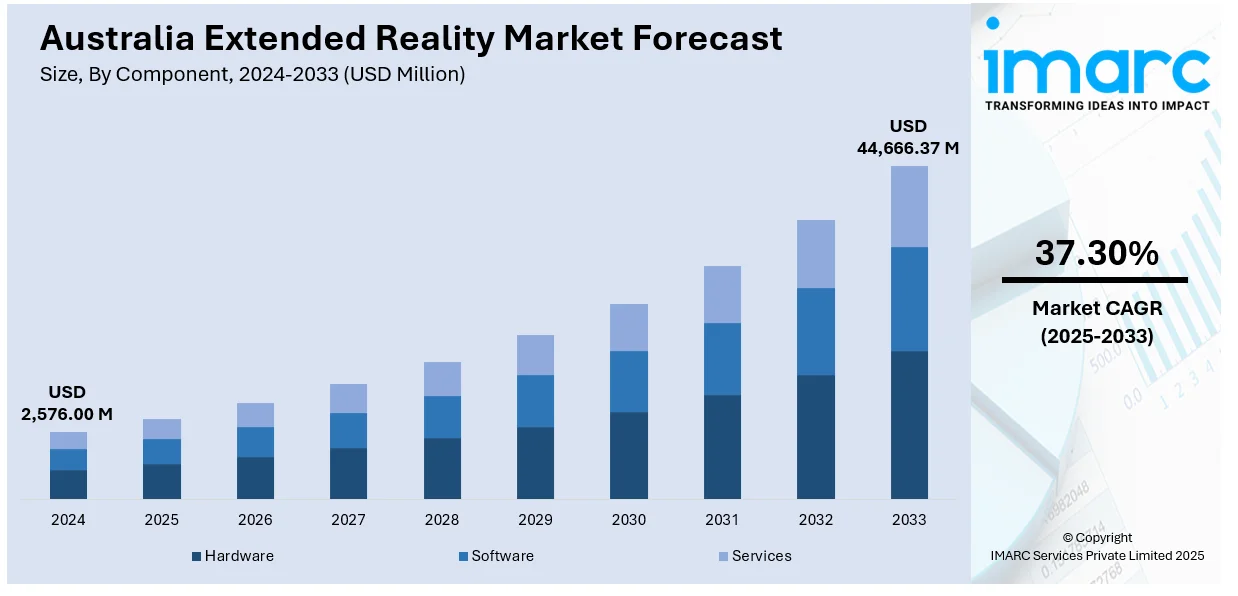

The Australia extended reality market size reached USD 2,576.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 44,666.37 Million by 2033, exhibiting a growth rate (CAGR) of 37.30% during 2025-2033. Surging virtual reality (VR)-based vocational training, incorporation of augmented reality (AR) in gaming, AR-enabled retail engagement, growing use of mixed reality (MR) for remote collaboration, surging adoption of VR in mental health therapy, cultural tourism experiences, nationwide fifth-generation (5G) network expansion, and growing investment in local extended reality (XR) focused startups are factors propelling the Australia extended reality market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,576.00 Million |

| Market Forecast in 2033 | USD 44,666.37 Million |

| Market Growth Rate 2025-2033 | 37.30% |

Australia Extended Reality Market Trends:

Integration of XR in Vocational Training and Simulated Learning

The adoption of extended reality technologies in Australia’s vocational training and simulation-based education sectors has increased significantly, particularly in industries requiring precision and safety, such as mining, healthcare, and defense. XR tools, including virtual and augmented reality (AR) platforms, are being deployed to simulate real-world scenarios without exposing learners to actual risks. In mining, VR simulators allow operators to practice machinery handling in a controlled environment. The healthcare sector leverages XR for surgical training and diagnostics, offering high-fidelity simulations that improve skills retention. Similarly, defense institutions are adopting immersive training modules for combat readiness and mission rehearsals. These technologies reduce dependency on physical infrastructure, streamline the training lifecycle, and enable real-time performance assessment.

To get more information on this market, Request Sample

Expansion of XR in Entertainment, Gaming, and Immersive Events

Australia’s entertainment sector is becoming a major adopter of XR technologies, driven by evolving consumer preferences and advances in content delivery. The gaming industry, in particular, is witnessing strong momentum as XR-based gaming platforms attract a tech-savvy audience seeking immersive, interactive experiences. In line with this, developers are investing in story-driven VR titles and mixed reality experiences that blur the line between digital and physical gameplay, which is driving the Australia extended reality market growth. Furthermore, major media companies are experimenting with AR to enhance storytelling and fan engagement. The trend aligns with the growing acceptance of virtual platforms for content consumption and event participation, especially post-COVID.

Virtual Retail and Property Viewing Experiences

The retail and real estate sectors in Australia are leveraging XR technologies to elevate customer engagement and decision-making processes. In retail, augmented reality is enabling shoppers to visualize products, such as furniture, fashion, or makeupin their own environment before purchase, improving buyer confidence and reducing returns. Several Australian retailers have integrated AR into their online platforms and mobile apps to offer “try-before-you-buy” features. For instance, in 2024, IKEA launched Kreativ, an AI-powered interior design tool in Australia, enabling users to scan their rooms, remove existing furniture, and visualize IKEA products in 3D. This tool enhances home planning and shopping by blending AI with AR, offering a more personalized and immersive furniture-buying experience. In real estate, virtual tours powered by VR are transforming property marketing, allowing prospective buyers or tenants to explore multiple listings remotely with immersive walkthroughs. This has proven particularly effective in high-value urban markets and during pandemic-driven travel restrictions.

Australia Extended Reality Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on component, type, organization size, application, and end user industry.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Type Insights:

- Consumer Engagement

- Business Engagement

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes consumer engagement and business engagement.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises and large enterprises.

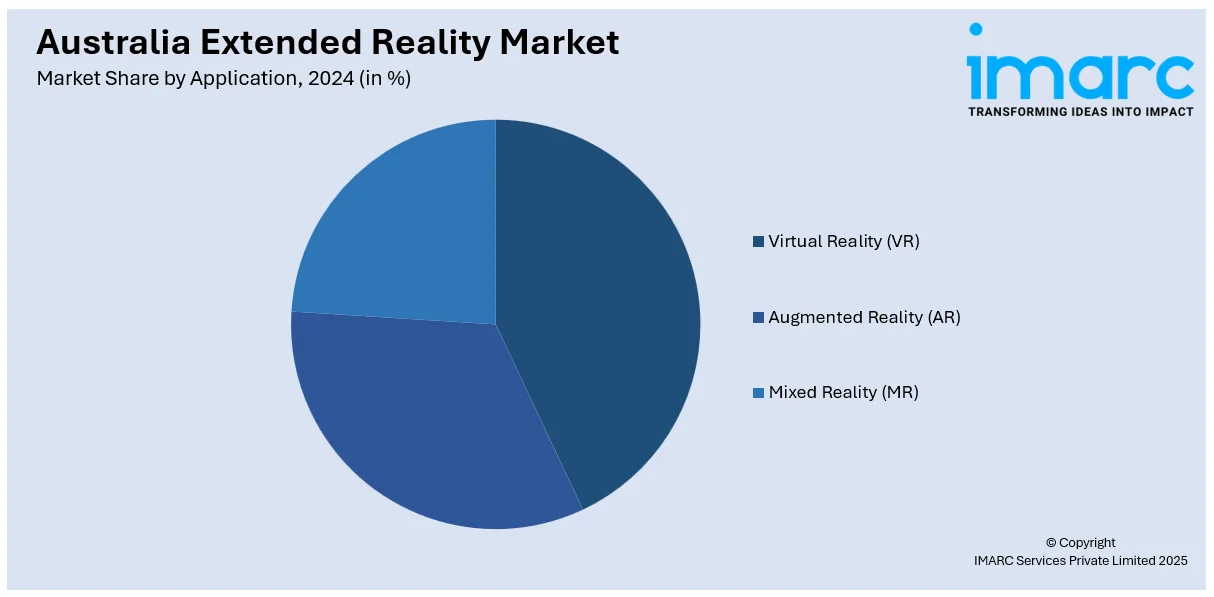

Application Insights:

- Virtual Reality (VR)

- Augmented Reality (AR)

- Mixed Reality (MR)

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes virtual reality (VR), augmented reality (AR), and mixed reality (MR).

End User Industry Insights:

- Education

- Retail

- Industrial and Manufacturing

- Healthcare

- Media and Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the end user industry. This includes education, retail, industrial and manufacturing, healthcare, media and entertainment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Extended Reality Market News:

- In 2024, Australian start-up XReality Group expanded its VR training systems, such as Operator XR, to police and military organizations in both Australia and the US. These systems allow personnel to train in high-risk scenarios within controlled virtual environments, enhancing preparedness without real-world risks.

Australia Extended Reality Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Types Covered | Consumer Engagement, Business Engagement |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Virtual Reality (VR), Augmented Reality (AR), Mixed Reality (MR) |

| End-Use Industries Covered | Education, Retail, Industrial and Manufacturing, Healthcare, Media and Entertainment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia extended reality market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia extended reality market on the basis of component?

- What is the breakup of the Australia extended reality market on the basis of type?

- What is the breakup of the Australia extended reality market on the basis of organization size?

- What is the breakup of the Australia extended reality market on the basis of application?

- What is the breakup of the Australia extended reality market on the basis of end user industry?

- What is the breakup of the Australia extended reality market on the basis of region?

- What are the various stages in the value chain of the Australia extended reality market?

- What are the key driving factors and challenges in the Australia extended reality?

- What is the structure of the Australia extended reality market and who are the key players?

- What is the degree of competition in the Australia extended reality market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia extended reality market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia extended reality market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia extended reality industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)