Australia Extended Warranty Market Size, Share, Trends and Forecast by Coverage, Application, Distribution Channel, End User, and Region, 2025-2033

Australia Extended Warranty Market Overview:

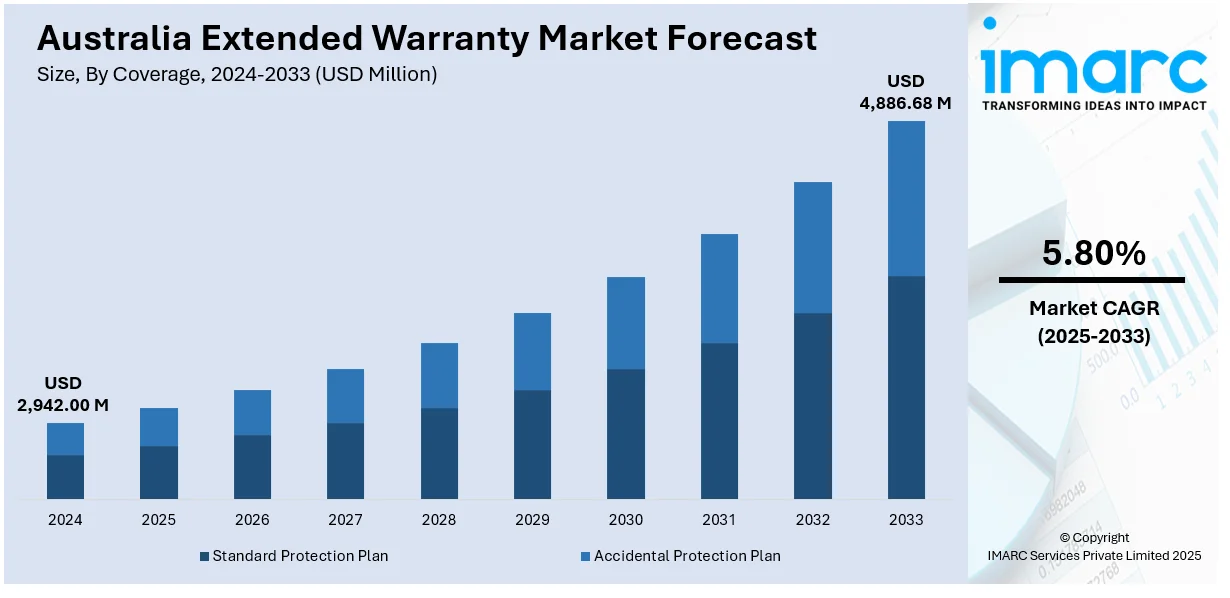

The Australia extended warranty market size reached USD 2,942.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,886.68 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The sector is propelled by growing demand from consumers for long-term car protection and intensified competition in the auto industry. As more auto makers provide extended coverage, including 10-year warranties, Australia extended warranty market share is expanding, indicating increased consumer confidence and the importance of full service packages.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,942.00 Million |

| Market Forecast in 2033 | USD 4,886.68 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Extended Warranty Market Trends:

Increased Warranty Offers Boost Consumer Confidence

The extended warranties have emerged as a significant decision driver for consumers in Australia, particularly as consumers are looking for long-term value and security. Increased demand for electric vehicles (EVs) has made consumers even more wary about the reliability and durability of new technology. In response, automakers have begun to introduce extended warranty packages as a means to establish consumer confidence and differentiate products from the competition. In February 2025, Xpeng reintroduced a 10-year extended warranty for its G6 electric SUV in Australia, offering coverage on key components and the entire vehicle. Worth USD 4,980, this prolonged warranty was a major component of Xpeng's strategy for increasing demand for the G6 in the face of increasing competition in the EV segment. The warranty gave confidence to would-be customers who were reluctant to adopt electric mobility. By providing such a long warranty, Xpeng not only gave buyers confidence in the reliability of the vehicle but also met the increasingly high expectation from the market for full protection. Therefore, Xpeng is positioned to gain a larger share of the Australian EV market, which is becoming increasingly competitive with the entry of new players and mainstream automotive companies widening their EV presence. Collectively, these factors are propelling Australia extended warranty market growth.

To get more information on this market, Request Sample

Enhanced Warranty Packages Responding to Market Demands

The market in a state of constant change, providing extended warranties has become a necessary tactic for manufacturers to win consumer trust and gain market share. Extended warranties assure customers, particularly those investing in new technologies such as electric vehicles (EVs), which are subject to distinctive long-term durability concerns. In order to stay competitive, automobile makers are seeing the necessity of providing more extensive warranty packages in response to the growing expectations of Australian consumers. For instance, in April 2025, BYD made a significant change to its warranty offerings in Australia by expanding its coverage to a six-year/150,000 km bumper-to-bumper warranty and an eight-year/160,000 km battery warranty. This new structure, dated August 2022, was announced due to increasing market demand and intended to solidify the company's position in a fast-growing market. With more than 40,000 sales in Australia, BYD's dedication to further expanding its warranty coverage further enhanced consumer confidence. The extended warranty alleviated concerns regarding the lifespan of electric vehicle parts, most notably the battery, and differentiated BYD from other competitors. As more customers choose EVs, particularly as environmental consciousness becomes increasingly important, companies such as BYD are demonstrating that the provision of extended warranties can be a strong point of differentiation, building customer retention and drawing in new customers to the brand,

Australia Extended Warranty Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on coverage, application, distribution channel, and end user.

Coverage Insights:

- Standard Protection Plan

- Accidental Protection Plan

The report has provided a detailed breakup and analysis of the market based on the coverage. This includes standard protection plan and accidental protection plan.

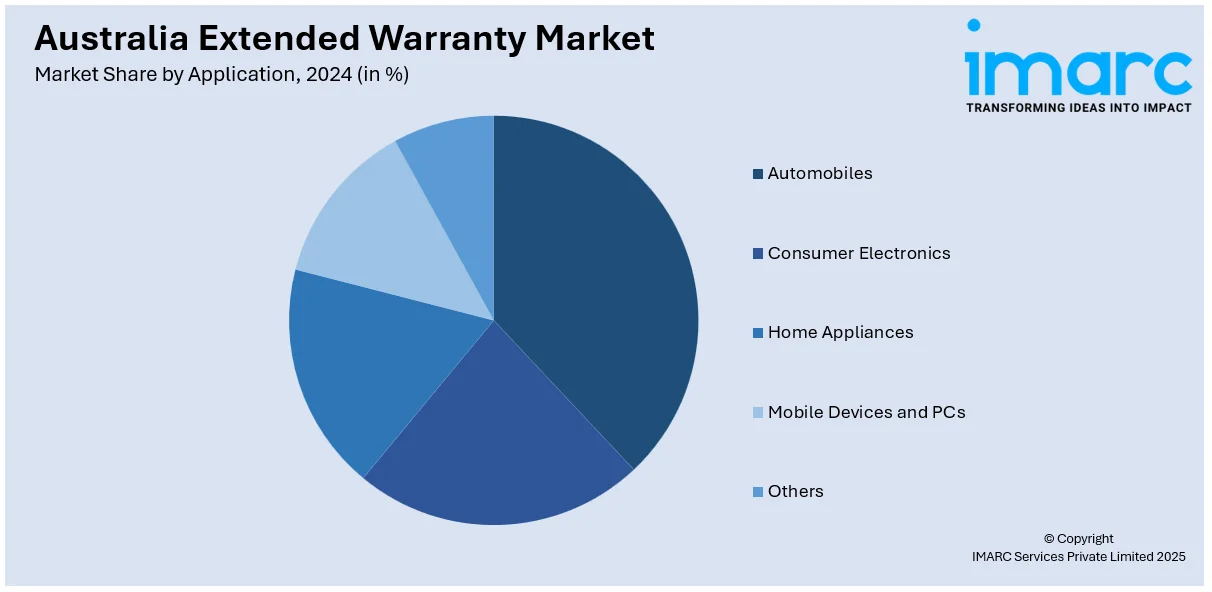

Application Insights:

- Automobiles

- Consumer Electronics

- Home Appliances

- Mobile Devices and PCs

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automobiles, consumer electronics, home appliances, mobile devices and PCs, and others.

Distribution Channel Insights:

- Manufacturers

- Retailers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes manufacturers, retailers, and others.

End User Insights:

- Individuals

- Business

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individuals and business.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Extended Warranty Market News:

- March 2025: Jaecoo launched in Australia with an eight-year/unlimited-kilometre warranty, surpassing the typical five-year offerings in the market. This move, exceeding Chery’s seven-year warranty, is expected to influence the extended warranty industry by setting new industry standards and encouraging other brands to enhance coverage.

- February 2025: Nissan launched a 10-year/186,000-mile warranty in Australia, significantly extending its coverage from the previous five-year plan. The extended warranty, requiring dealership servicing, set a new benchmark in the Australian market, influencing competitors like Mitsubishi and enhancing consumer confidence in long-term vehicle reliability.

Australia Extended Warranty Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Standard Protection Plan, Accidental Protection Plan |

| Applications Covered | Automobiles, Consumer Electronics, Home Appliances, Mobile Devices and PCs, Others |

| Distribution Channels Covered | Manufacturers, Retailers, Others |

| End Users Covered | Individuals, Business |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia extended warranty market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia extended warranty market on the basis of coverage?

- What is the breakup of the Australia extended warranty market on the basis of application?

- What is the breakup of the Australia extended warranty market on the basis of distribution channel?

- What is the breakup of the Australia extended warranty market on the basis of end user?

- What is the breakup of the Australia extended warranty market on the basis of region?

- What are the various stages in the value chain of the Australia extended warranty market?

- What are the key driving factors and challenges in the Australia extended warranty market?

- What is the structure of the Australia extended warranty market and who are the key players?

- What is the degree of competition in the Australia extended warranty market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia extended warranty market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia extended warranty market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia extended warranty industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)