Australia Extruded Snack Food Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Australia Extruded Snack Food Market Overview:

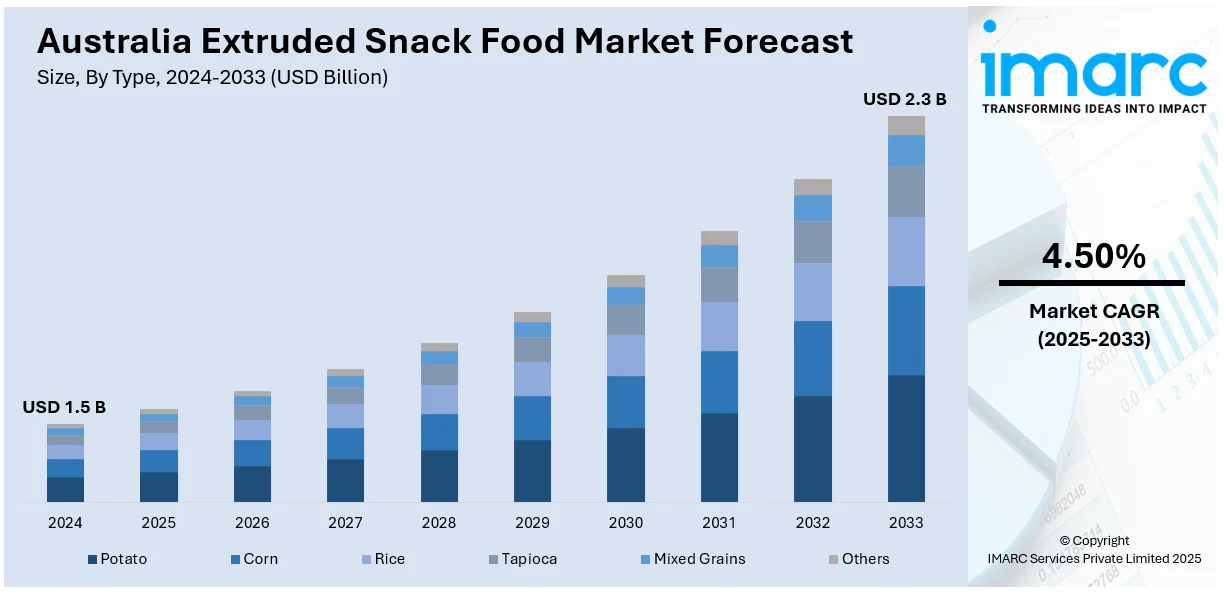

The Australia extruded snack food market size reached USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. Health-conscious consumer preferences, expanding retail access, and rising demand for fitness-oriented snacking are driving the transformation of the extruded snack market in Australia. Brands are consequently responding with innovative, nutrient-rich products that align with evolving lifestyle priorities and increasingly health-driven purchasing decisions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Market Growth Rate 2025-2033 | 4.50% |

Australia Extruded Snack Food Market Trends:

Health-Conscious Consumer Trends

Health-conscious consumption patterns are reshaping the extruded snack food market in Australia, as more consumers are moving away from traditional high-fat, high-sugar options toward snacks that align with their wellness goals. This shift is driven by a desire for cleaner labels and functional benefits, with a growing demand for products that are low in calories and free from artificial additives yet rich in protein, fiber, and plant-based nutrients. Manufacturers are responding by reformulating existing lines and launching new products tailored to dietary trends, such as gluten-free, low-glycemic index (GI), and high-protein snacks. Functional snacking is also gaining ground, with offerings that support gut health, energy levels, and cognitive focus seeing increased shelf presence. Younger demographics and urban shoppers are particularly attentive to ingredient transparency, encouraging brands to adopt minimalist formulations. In line with this behavioral shift, health data supports the urgency of change. According to the Australian Burden of Disease Study 2024, 8.3% of the nation’s total disease burden in 2024 was due to overweight and obesity, followed by 7.6% from tobacco use, 4.8% from dietary risks, and 4.4% from high blood pressure. These figures highlight the public health impact of lifestyle choices and reinforce why reformulation and innovation in the snack food sector are more than trend responses. With wellness now a consistent purchase driver, extruded snacks in Australia are evolving into everyday options that balance taste, convenience, and nutritional value.

To get more information on this market, Request Sample

Expansion of Retail Channels

The increasing reach of retail outlets, particularly online shopping and convenience stores, is supporting the growth of the industry. With shopping preferences moving towards efficiency and convenience, buyers are relying on online platforms and local stores to meet their snacking demands. E-commerce is becoming a significant distribution channel, providing consumers with a wider variety of extruded snacks that might not be available in conventional grocery stores. The capability to evaluate choices, review feedback, and obtain items swiftly is turning online shopping into a preferred choice, particularly for health-focused and busy consumers. Furthermore, the growth of convenience stores and specialized snack areas in grocery chains provides consistent in-person exposure for both new and existing snack brands. The frequency and availability of these touchpoints are promoting additional impulse and habitual purchases, aiding in consistent volume growth. Supporting this trend, the Australian Bureau of Statistics revealed that total online retail sales hit $4,507.8 million in February 2025 (seasonally adjusted), reflecting a 1.7% growth from the prior month and a 12.2% rise compared to the previous year. These figures emphasize the growing trend of online shopping and its impact on how Australians obtain packaged food. As retail infrastructure evolves and accelerates, extruded snacks are increasingly becoming a staple in household shopping, bolstered by their prominent availability in both online and brick-and-mortar stores.

Growth of Meal Replacement and Fitness Snacking Trends

The growing interest in health and fitness is leading to a rise in meal replacement and fitness-oriented snacking trends. Consumers who lead active lifestyles are seeking convenient snacks that offer quick energy, muscle recovery, and nutritional support without compromising on portability. To meet this demand, manufacturers are incorporating ingredients like protein, electrolytes, and other performance-enhancing nutrients into their extruded snacks. These products are marketed as meal replacements or pre-workout and post-workout snacks, providing a nutritious alternative to traditional meals. The popularity of fitness-focused snacks is driven by the desire of consumers to optimize workout performance, maintain a balanced diet, and manage weight. As more people focus on health and wellness, the demand for such snacks continues to rise. According to the IMARC Group, Australia's health and wellness market is projected to grow at a compound annual growth rate (CAGR) of 6.75% from 2025 to 2033, reflecting the increasing consumer interest in products that support a healthy lifestyle. This trend is further catalyzing the demand for extruded snacks that cater to the wellness and fitness market, contributing to the overall expansion of the healthier snack segment. As fitness-conscious eating habits become more widespread, the extruded snack market is evolving, offering more nutritious options for those focused on improving their health and performance.

Australia Extruded Snack Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Potato

- Corn

- Rice

- Tapioca

- Mixed Grains

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes potato, corn, rice, tapioca, mixed grains, and others.

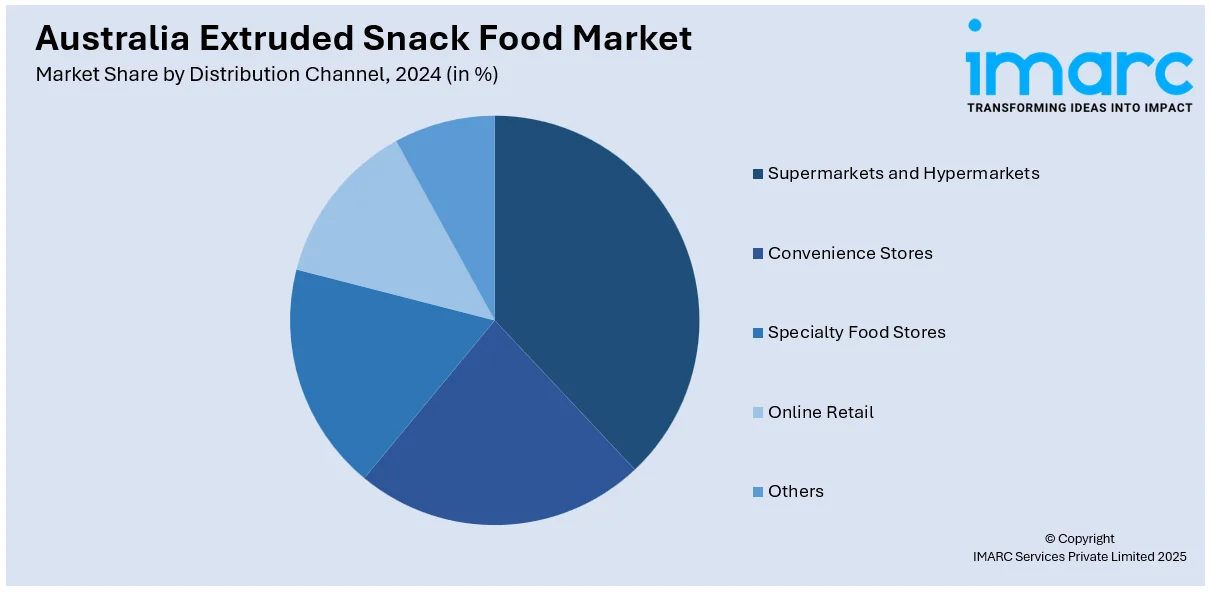

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty food stores, online retail, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Extruded Snack Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Potato, Corn, Rice, Tapioca, Mixed Grains, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia extruded snack food market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia extruded snack food market on the basis of type?

- What is the breakup of the Australia extruded snack food market on the basis of distribution channel?

- What is the breakup of the Australia extruded snack food market on the basis of region?

- What are the various stages in the value chain of the Australia extruded snack food market?

- What are the key driving factors and challenges in the Australia extruded snack food?

- What is the structure of the Australia extruded snack food market and who are the key players?

- What is the degree of competition in the Australia extruded snack food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia extruded snack food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia extruded snack food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia extruded snack food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)