Australia Facility Management Market Report by Type (Inhouse, Outsourced), Offering (Hard FM, Soft FM), End User (Commercial, Institutional, Public/Infrastructure, Industrial, and Others), and Region 2025-2033

Australia Facility Management Market Overview:

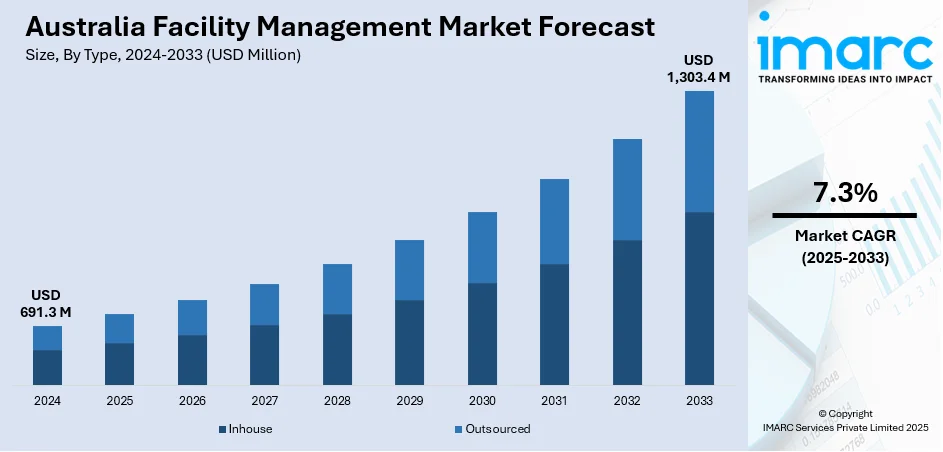

The Australia facility management market size reached USD 691.3 Million in 2024. Looking forward, the market is expected to reach USD 1,303.4 Million by 2033, exhibiting a growth rate (CAGR) of 7.3% during 2025-2033. The growing adoption of advanced technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and building information modeling (BIM), increasing demand for sustainable services, and rising focus on environmental responsibility among businesses are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 691.3 Million |

| Market Forecast in 2033 | USD 1,303.4 Million |

| Market Growth Rate 2025-2033 | 7.3% |

Key Trends of Australia Facility Management Market:

Growth of Sustainable Facility Management Practices

Sustainability is becoming a crucial factor in facility management across Australia. This is driven by increasing regulatory requirements and a growing focus on environmental responsibility among businesses. In the Australian Building Codes Board's National Construction Code 2025, several changes are proposed to develop ways for buildings to move towards a net zero future. Additionally, according to the Green Building Council Australia, green star certifications increased by more than 80% in the 2022-2023 financial year, with over 800 certifications issued across Australia. This shift towards sustainable practices is not only helping companies comply with regulations but also attracting environmentally conscious tenants and customers, thereby impelling the market growth.

To get more information on this market, Request Sample

Technological Advancements and Integration

The adoption of advanced technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and building information modeling (BIM), is propelling the market growth in Australia. These technologies enable more efficient management of facilities by automating routine tasks, improving predictive maintenance, and enhancing energy management. According to a report published by PrefabAus in 2023, the number of smart buildings in Australia was expected to increase and the penetration of prefabrication to cover 80% of ever new building elements. Moreover, several facility management companies in Australia launched integrated IoT platforms that allow real-time monitoring and control of building systems. This has led to an increase in energy efficiency and a reduction in operational costs for facilities adopting these technologies. Additionally, AI-driven solutions introduced are streamlining maintenance schedules and reducing downtime, highlighting the market's shift towards smart, data-driven facility management practices. These advancements are making facilities more sustainable and cost-effective, thereby driving the demand for modern facility management services across various sectors, including commercial, healthcare, and retail.

Increasing Demand for Integrated Facility Management (IFM) Services

The rising demand for integrated facility management (IFM) services is supporting the market growth in Australia. IFM provides a one-stop solution for managing multiple services, such as cleaning, maintenance, security, and catering, under a single contract, which helps businesses reduce costs and streamline operations. According to an article by JLL published in 2023, across the Asia Pacific region, Australia is one of the most mature IFM outsourced markets, with several businesses into their third, fourth, or even fifth cycle, or generation, of outsourcing. There is a rise in contracts for integrated services, with numerous large-scale commercial facilities opting for IFM solutions, reflecting an increase. In response to this growing demand, leading companies launched new IFM packages, offering customized solutions tailored to specific industry needs. As more organizations recognize the value of bundled services, the shift towards IFM is growing.

Growth Drivers of Australia Facility Management Market:

Rising Commercial Real Estate and Infrastructure Investments

Australia’s ongoing urban development and infrastructure expansion are significantly driving the demand for professional facility management services. The rise in commercial construction, including office complexes, shopping centers, data centers, and hospitality facilities, requires efficient operations, maintenance, and energy management to meet performance expectations. On the same note, an increasingly high level of investment in healthcare and education infrastructures introduces intricate service requirements with considerations of safety, hygiene, and regulatory restrictions to be considered. The facility management providers are essential to realizing a functional, secure, and well-maintained version of these buildings in their entire lifecycle. Outsourced FM is necessary as real estate developers and other public institutions will focus on their operational efficiency as well as the satisfaction of their users. This is already gaining pace because Australia is constantly investing in smart cities, transport hubs, and green infrastructure, broadening the potential of unified FM solutions.

Regulatory Compliance and Workplace Safety Mandates

Stringent government regulations across Australia, particularly concerning occupational health, safety, and environmental standards, are pushing organizations to adopt structured and professional facility management services. Companies must comply with a broad range of legislation, from fire safety and hazardous materials handling to ventilation standards and disability access, which is expected to drive the Australia facility management market demand. Failure to meet these standards can lead to legal liabilities, operational disruptions, and reputational damage. As a result, businesses increasingly rely on FM providers to ensure consistent compliance through routine inspections, preventive maintenance, training, and documentation. Moreover, evolving guidelines around employee well-being, post-pandemic hygiene protocols, and ESG (Environmental, Social, and Governance) frameworks add layers of complexity to building management. Facility managers equipped with compliance knowledge and digital tools are becoming vital partners in maintaining safe, healthy, and regulation-compliant workplaces.

Aging Building Stock and Maintenance Demand

A significant portion of Australia’s public and commercial infrastructure, especially in urban centers, consists of aging buildings that require ongoing maintenance and system upgrades. Many structures built several decades ago now face issues related to outdated HVAC systems, deteriorating plumbing, and energy inefficiency. These factors create a continuous need for lifecycle management, refurbishment, and retrofitting services, which facility management firms are uniquely positioned to provide. In addition to extending the life of assets, professional FM ensures these buildings meet modern safety codes, environmental standards, and occupant comfort expectations. The cost of neglecting maintenance is high, often resulting in system failures, downtime, and legal risks. Therefore, building owners and operators increasingly invest in proactive FM strategies to preserve asset value, optimize operations, and prevent costly emergency repairs.

Opportunities of Australia Facility Management Market:

Expansion into Regional and Remote Markets

Australia’s regional and remote areas represent a largely underexplored yet promising opportunity for facility management providers. These locations house extensive infrastructure, including industrial plants, mining operations, healthcare centers, and government institutions that require ongoing maintenance, safety checks, and operational efficiency. However, the availability of professional FM services in these areas remains limited, creating a service gap. Companies with the capability to deliver scalable, responsive, and high-quality facility management across long distances can secure valuable contracts and long-term partnerships. By investing in mobile teams, regional hubs, and remote monitoring technologies, FM firms can overcome geographic barriers and meet rising demand. As infrastructure development continues outside major cities, regional markets will become a critical growth frontier for both local and national service providers.

Customization and Sector-Specific Services

The growing complexity and regulatory requirements of various industries have led to increased demand for facility management services tailored to specific sectors, which is a major factor driving the Australia facility management market growth. Industries such as aged care, mining, defense, education, and pharmaceuticals all have unique compliance standards, operational protocols, and safety requirements. Delivering sector-specific solutions allows FM providers to position themselves as experts rather than generalists, fostering trust and long-term relationships with clients. Customization may include specialized equipment servicing, workforce certifications, 24/7 support, and data-driven maintenance aligned with industry expectations. By addressing the precise needs of each sector, companies enhance client satisfaction and create distinct competitive advantages. This approach not only improves retention but also enables providers to charge premium rates for specialized services, thus boosting profitability and market presence.

Growth of Outsourcing Trends in SMEs

Small and medium-sized enterprises (SMEs) across Australia are increasingly turning to outsourcing for non-core facility functions such as cleaning, maintenance, security, and waste management. This shift is largely driven by the desire to streamline operations, reduce costs, and focus internal resources on core business activities, which is further fueling the Australia facility management market share. Unlike large corporations that may have in-house FM teams, SMEs often lack the expertise and capacity to manage facilities efficiently. This creates an ideal opportunity for mid-tier FM service providers to offer flexible, scalable, and affordable packages tailored to SME needs. By building strong relationships with smaller businesses and providing value through cost savings and performance reliability, FM companies can tap into a growing client base. As outsourcing becomes more normalized among SMEs, this segment will offer consistent and long-term growth potential.

Challenges of Australia Facility Management Market:

Workforce Skill Shortages and Labor Costs

The Australia facility management market faces a significant challenge due to the shortage of qualified and skilled professionals, particularly in technical areas such as electrical maintenance, HVAC systems, and building automation. This talent gap not only limits the industry’s ability to scale effectively but also places upward pressure on labor costs as companies compete to attract and retain talent. High wage demands, especially in urban centers, add to operational costs and reduce profitability. Moreover, the process of onboarding and training new employees demands considerable time and resources, placing additional pressure on operational efficiency and the overall quality of service delivery. For providers, balancing service excellence while managing workforce shortages and cost pressures is increasingly difficult, making talent acquisition and retention a critical priority in the evolving facility management landscape.

Fragmented Market and Intense Price Competition

Australia’s facility management sector is highly fragmented, with many small and mid-sized players competing for market share across various service segments. According to the Australia facility management market analysis, this intense competition often shifts focus from service innovation to price-based bidding, leading to compressed profit margins and undercutting. As providers strive to remain competitive, differentiation becomes a major hurdle, especially when clients prioritize cost savings over value-added services. The result is a commoditized market where smaller companies struggle to scale, and larger firms face pressures to maintain profitability while delivering consistent quality. This fragmentation limits strategic collaboration and standardization across the sector, hindering the development of long-term client relationships and robust service models. Sustained consolidation and service innovation are essential to overcome these challenges.

Complex Contract Management and Client Expectations

Managing facility services across multiple sites with varied client requirements poses a significant operational challenge. Contracts often encompass a wide range of deliverables, from maintenance and cleaning to compliance monitoring and sustainability reporting. As client expectations rise, service providers must offer real-time updates, digital transparency, and swift resolution of issues, requiring integrated systems and trained personnel. The need for consistent performance across dispersed locations further complicates logistics and resource allocation. Failure to meet service-level agreements (SLAs) can lead to reputational damage and financial penalties. Additionally, clients increasingly demand customization, flexibility, and proactive solutions tailored to their industries. Navigating this complexity while ensuring service excellence, cost-efficiency, and compliance makes contract management a growing challenge in the evolving FM landscape.

Australia Facility Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, offering, and end user.

Type Insights:

- Inhouse

- Outsourced

- Single FM

- Bundled FM

- Integrated FM

The report has provided a detailed breakup and analysis of the market based on the type. This includes inhouse and outsourced (single FM, bundled FM, and integrated FM).

Offering Insights:

- Hard FM

- Soft FM

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes hard FM and soft FM.

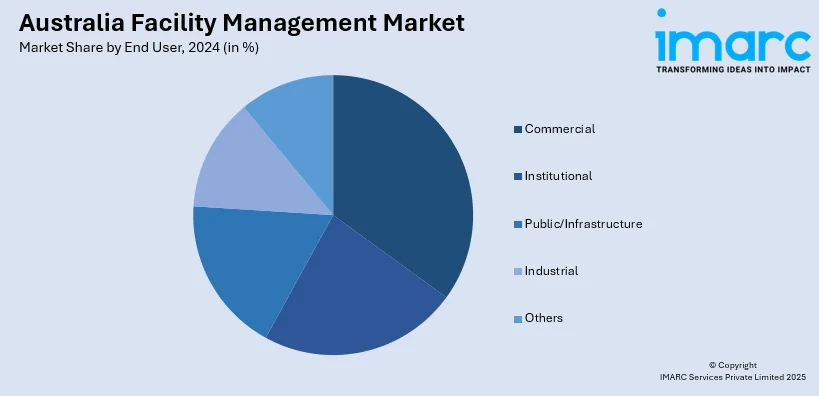

End User Insights:

- Commercial

- Institutional

- Public/Infrastructure

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes commercial, institutional, public/infrastructure, industrial, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Facility Management Market News:

- September 2023: ABB Cylon announced the launch of the Cylon Building Management System in the Australian market. This will help customers in Australia to fulfill their energy management goals.

- July 2024: JLL partnered with Pacific Services Group Holdings (PSGH) to catalyze Indigenous empowerment and autonomous growth in the facility management industry.

Australia Facility Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Offerings Covered | Hard FM, Soft FM |

| End Users Covered | Commercial, Institutional, Public/Infrastructure, Industrial, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia facility management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia facility management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia facility management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The facility management market in Australia was valued at USD 691.3 Million in 2024.

The Australia facility management market is projected to exhibit a CAGR of 7.3% during 2025-2033.

The Australia facility management market is projected to reach a value of USD 1,303.4 Million by 2033.

Key trends in Australia's facility management market include increasing adoption of digital technologies like IoT, AI, and predictive maintenance for operational efficiency. There's a strong focus on sustainability and ESG compliance, driving demand for green building practices. Outsourcing of FM services is growing, and integrated facility management (IFM) is gaining traction for streamlined operations.

The Australian facility management market is driven by increasing outsourcing for operational efficiency, a strong focus on digital transformation (IoT, AI), growing demand for sustainable and ESG-compliant solutions, and significant infrastructure development and government investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)