Australia Factory Ventilation Systems Market Size, Share, Trends and Forecast by Component, Type of Ventilation System, Application, End Use Industry, and Region, 2025-2033

Australia Factory Ventilation Systems Market Overview:

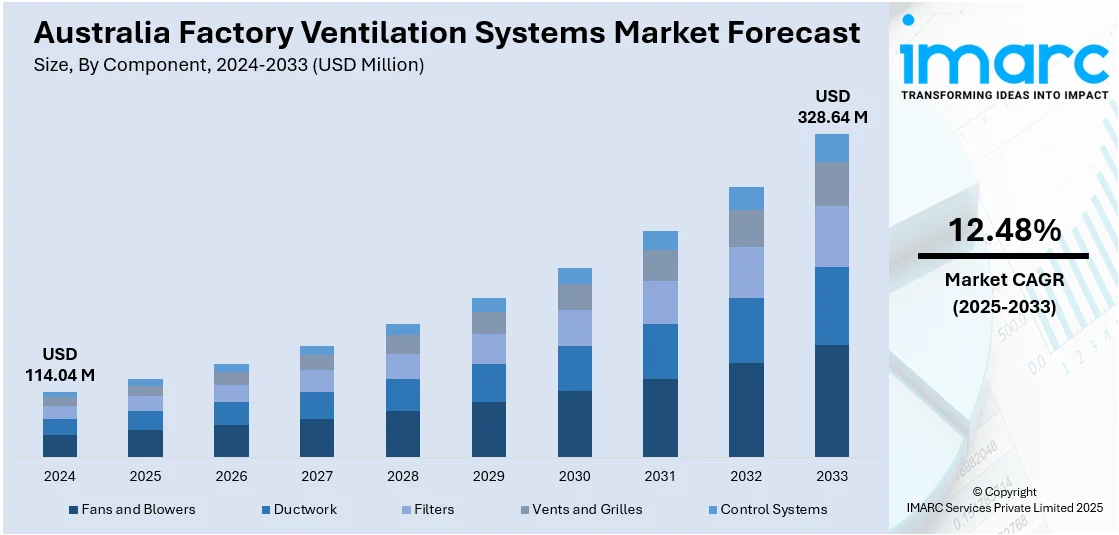

The Australia factory ventilation systems market size reached USD 114.04 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 328.64 Million by 2033, exhibiting a growth rate (CAGR) of 12.48% during 2025-2033. At present, as the demand for packaged food products and beverages is rising, factories are adopting advanced ventilation technologies that support consistent airflow and filtration to maintain item quality. Besides this, the growing usage of the Internet of Things (IoT) is contributing to the expansion of the Australia factory ventilation systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 114.04 Million |

| Market Forecast in 2033 | USD 328.64 Million |

| Market Growth Rate 2025-2033 | 12.48% |

Australia Factory Ventilation Systems Market Trends:

Expansion of food and beverage (F&B) processing units

The expansion of F&B processing units is fueling the market growth in Australia. As more facilities are opening and scaling up to meet rising user demand, the need for clean, regulated, and contaminant-free air is becoming critical. These processing units require high air quality to maintain hygiene, prevent cross-contamination, and ensure food safety standards. Ventilation systems play a significant role in maintaining temperature and humidity control, which helps preserve product quality and extends shelf life. As operations are expanding, factories are adopting advanced ventilation technologies that support consistent airflow and filtration. The thriving Australian foodservice industry is also following stringent regulatory standards that mandate efficient air handling systems, further driving the demand. As per industry reports, the size of the Australia foodservice market was expected to grow by USD 35.92 Billion at a CAGR of 12.3% during the period from 2024 to 2029. Additionally, automated and energy-optimized ventilation systems aid in reducing operational costs while ensuring compliance. The growing expectations for clean and safe food products are encouraging manufacturers to upgrade infrastructure, including air systems. The rising trend of ready-to-eat (RTE) and packaged food items is adding to this need, as such items require controlled environments.

To get more information on this market, Request Sample

Increasing demand for pharmaceutical products

Rising demand for pharmaceutical products is impelling the Australia factory ventilation systems market growth. Pharmaceutical manufacturing requires stringent air quality standards to prevent contamination and ensure product safety. Ventilation systems help maintain sterile conditions, control humidity, and regulate temperature, which are essential for drug stability. As the pharmaceutical industry is expanding to meet healthcare needs, production facilities are being built, driving the demand for advanced ventilation solutions. Regulatory compliance also plays a significant role, as Australian standards require pharmaceutical plants to follow stringent air handling protocols. The rise in the requirement for vaccines, over-the-counter (OTC) medications, and specialty drugs is leading manufacturers to maintain optimal conditions. Overall, the burgeoning pharmaceutical sector is supporting the growth of the market across the country. According to industry reports, the pharmaceuticals market in Australia was expected to generate revenue of USD 10.16 Billion in 2024.

Growing adoption of IoT

Rising adoption of IoT is offering a favorable market outlook in Australia. According to the IMARC group, the Australia IoT market size reached USD 30.5 Billion in 2024. IoT sensors monitor temperature, humidity, and air pollutants in real time, helping factories maintain optimal working conditions. These systems automatically adjust airflow and ventilation as per the collected data, improving energy efficiency and reducing operational costs. IoT technology also allows remote monitoring and predictive maintenance, which minimizes downtime and ensures consistent performance. As more factories are adopting digital solutions to streamline operations, the demand for IoT-enabled ventilation systems is increasing. This shift aids industries in complying with safety regulations and enhancing worker comfort. The growing trend of smart manufacturing in Australia is further supporting the integration of the IoT into ventilation infrastructure.

Australia Factory Ventilation Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, type of ventilation system, application, and end use industry.

Component Insights:

- Fans and Blowers

- Ductwork

- Filters

- Vents and Grilles

- Control Systems

The report has provided a detailed breakup and analysis of the market based on the component. This includes fans and blowers, ductwork, filters, vents and grilles, and control systems.

Type of Ventilation System Insights:

- Natural Ventilation Systems

- Mechanical Ventilation Systems

- Hybrid Ventilation Systems

A detailed breakup and analysis of the market based on the type of ventilation system have also been provided in the report. This includes natural ventilation systems, mechanical ventilation systems, and hybrid ventilation systems.

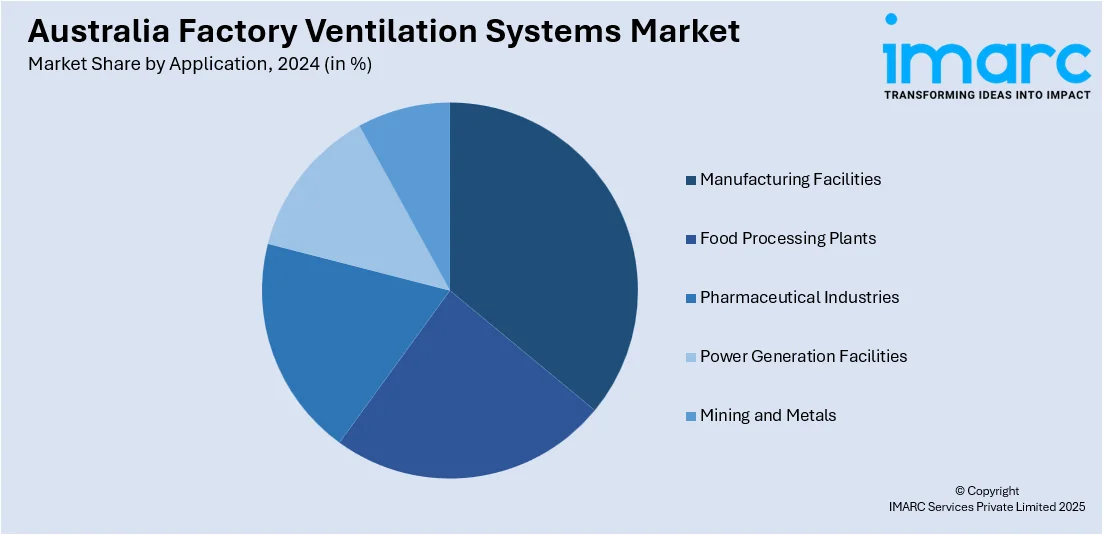

Application Insights:

- Manufacturing Facilities

- Food Processing Plants

- Pharmaceutical Industries

- Power Generation Facilities

- Mining and Metals

The report has provided a detailed breakup and analysis of the market based on the application. This includes manufacturing facilities, food processing plants, pharmaceutical industries, power generation facilities, and mining and metals.

End Use Industry Insights:

- Manufacturing and Heavy Industries

- Food and Beverage Processing

- Pharmaceuticals and Healthcare

- Electronics and Semiconductor Plants

- Chemical and Petrochemical Industries

- Automotive and Aerospace

- Textiles and Garments

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes manufacturing and heavy industries, food and beverage processing, pharmaceuticals and healthcare, electronics and semiconductor plants, chemical and petrochemical industries, automotive and aerospace, textiles and garments, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Factory Ventilation Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Fans and Blowers, Ductwork, Filters, Vents and Grilles, Control Systems |

| Type of Ventilation Systems Covered | Natural Ventilation Systems, Mechanical Ventilation Systems, Hybrid Ventilation Systems |

| Applications Covered | Manufacturing Facilities, Food Processing Plants, Pharmaceutical Industries, Power Generation Facilities, Mining and Metals |

| End Use Industries Covered | Manufacturing and Heavy Industries, Food and Beverage Processing, Pharmaceuticals and Healthcare, Electronics and Semiconductor Plants, Chemical and Petrochemical Industries, Automotive and Aerospace, Textiles and Garments, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia factory ventilation systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia factory ventilation systems market on the basis of component?

- What is the breakup of the Australia factory ventilation systems market on the basis of type of ventilation system?

- What is the breakup of the Australia factory ventilation systems market on the basis of application?

- What is the breakup of the Australia factory ventilation systems market on the basis of end use industry?

- What is the breakup of the Australia factory ventilation systems market on the basis of region?

- What are the various stages in the value chain of the Australia factory ventilation systems market?

- What are the key driving factors and challenges in the Australia factory ventilation systems market?

- What is the structure of the Australia factory ventilation systems market and who are the key players?

- What is the degree of competition in the Australia factory ventilation systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia factory ventilation systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia factory ventilation systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia factory ventilation systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)