Australia False Ceiling Market Size, Share, Trends and Forecast by Material, Cost Range, Installation, Application, and Region, 2026-2034

Australia False Ceiling Market Summary:

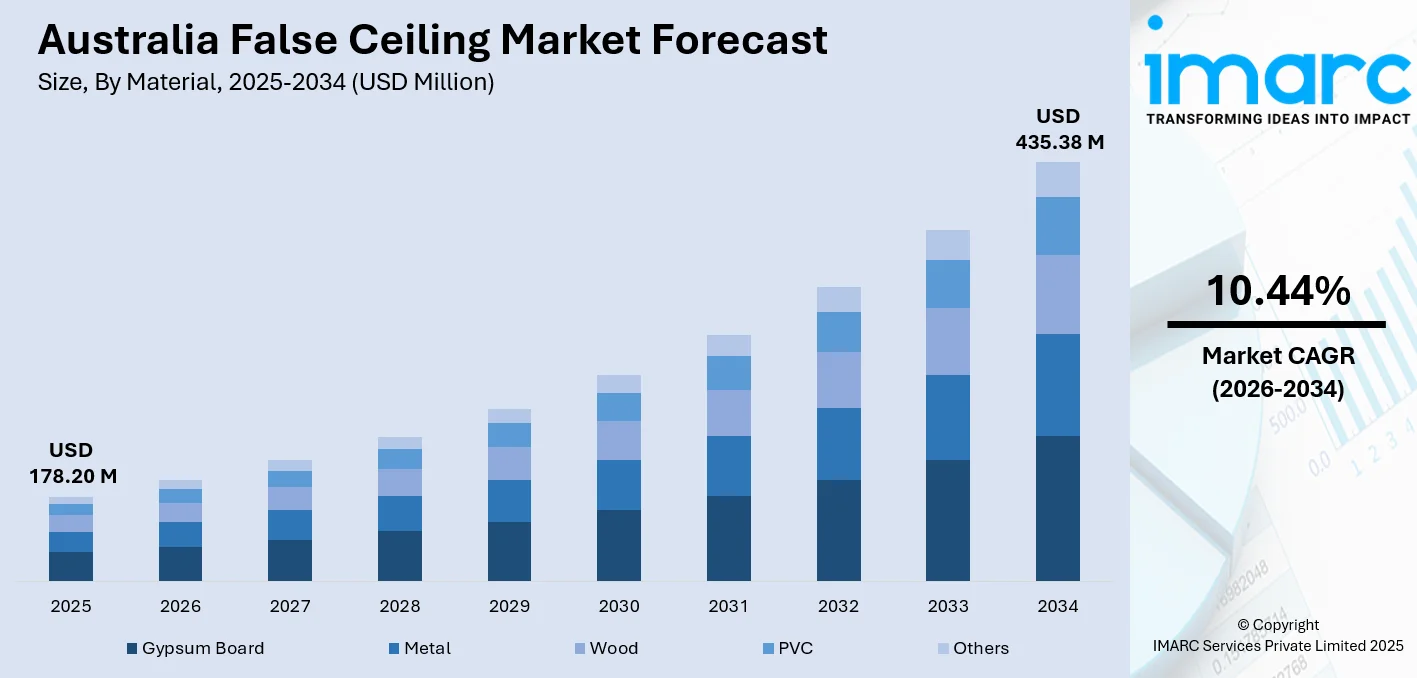

The Australia false ceiling market size was valued at USD 178.20 Million in 2025 and is projected to reach USD 435.38 Million by 2034, growing at a compound annual growth rate of 10.44% from 2026-2034.

The Australia false ceiling market is experiencing robust growth, driven by expanding commercial construction activities, rising demand for aesthetic and functional interior solutions, and increasing emphasis on energy efficiency in buildings. The market benefits from growing renovation and refurbishment activities across office spaces, retail establishments, and hospitality venues. Advancements in acoustic ceiling technologies, coupled with stringent green building regulations and sustainability certifications, are reshaping demand patterns.

Key Takeaways and Insights:

- By Material: Gypsum board dominates the market with a share of 45.06% in 2025, owing to its cost-effectiveness, fire-resistant properties, versatility in design applications, and ease of installation. Rising demand for sustainable building materials further fuels market expansion.

- By Cost Range: Medium-cost leads the market with a share of 44.1% in 2025, This dominance is driven by optimal balance between quality and affordability, making it the preferred choice for commercial office fitouts and residential renovations across Australia.

- By Installation: Suspended comprises the largest segment with a market share of 56.08% in 2025, reflecting widespread adoption in commercial buildings for concealing essential services, enabling easy maintenance access, and improving acoustic performance throughout workspaces.

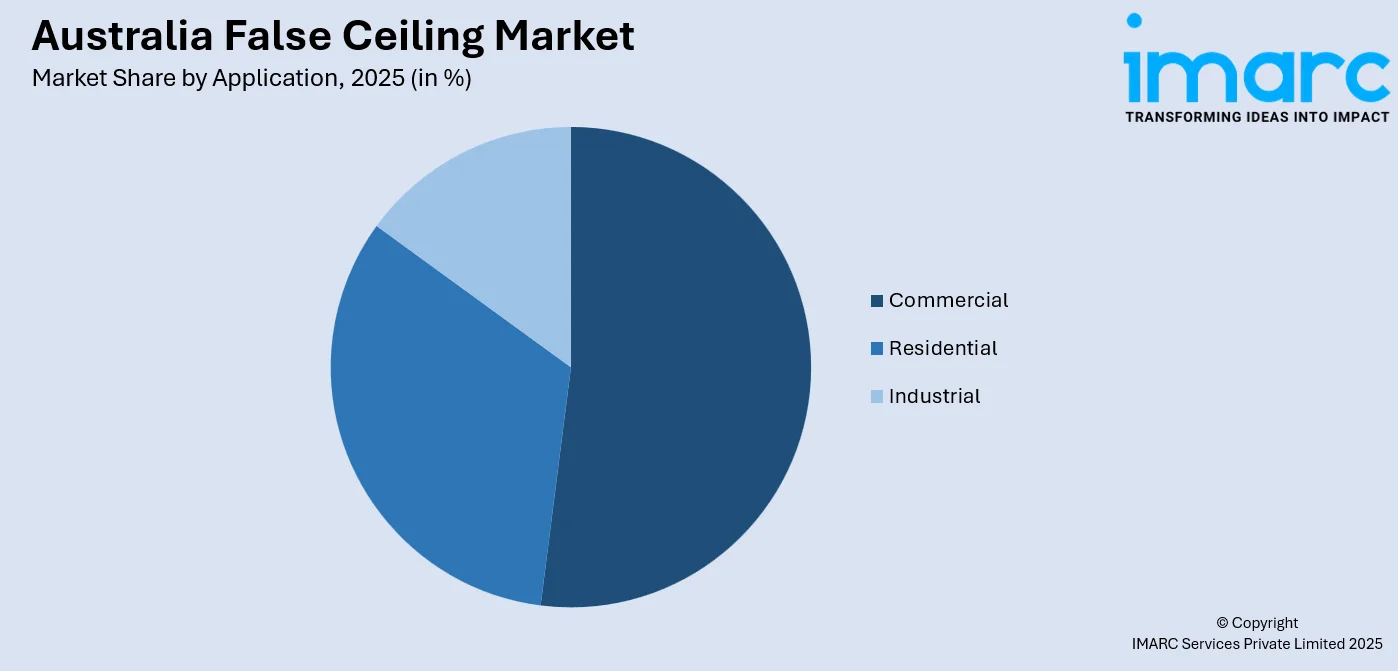

- By Application: Commercial exhibits a clear dominance in the market with 52.04% share in 2025, driven by robust office construction activities, retail expansion, and growing hospitality sector investments across major metropolitan centers in Australia.

- By Region: Australia Capital Territory & New South Wales represent the largest region with 26% share in 2025, driven by concentration of commercial construction activities in Sydney CBD, government infrastructure projects in Canberra, and substantial office fitout demand.

- Key Players: Key players drive the Australia false ceiling market by expanding product portfolios, improving acoustic and thermal performance technologies, and strengthening nationwide distribution networks. Their investments in sustainable solutions, green certifications, and partnerships with construction firms boost awareness and accelerate adoption across diverse commercial and residential segments.

To get more information on this market Request Sample

The Australia false ceiling market is advancing, as architects, developers, and building owners increasingly prioritize interior solutions that combine aesthetics with functionality and sustainability. Growing awareness about acoustic comfort in open-plan office environments is driving the demand for high-performance suspended ceiling systems that reduce noise levels and enhance productivity. The commercial construction sector remains the primary growth engine, with major cities like Sydney, Melbourne, and Brisbane witnessing substantial office development and retail expansion projects. Australia's dwelling commencements rose by 4.6% to reach 43,247 units in September 2024, signaling a robust pipeline of residential projects where false ceilings are gaining traction for improved insulation and design flexibility. The market is also benefiting from the renovation wave sweeping through existing commercial properties, as businesses seek to create modern, flexible workspaces that attract and retain talent.

Australia False Ceiling Market Trends:

Rising Demand for Sustainable and Eco-Friendly Ceiling Solutions

Environmental sustainability is reshaping the Australia false ceiling market as developers increasingly adopt eco-friendly materials and manufacturing processes. The Green Building Council of Australia has been promoting sustainable construction practices through its various programs, driving the demand for low-emission ceiling products. Manufacturers are introducing recyclable gypsum boards, wood wool acoustic panels, and products made from rapidly renewable materials like bamboo. Siniat’s Opt2Act program offered certified carbon neutral plasterboard products, enabling projects to reduce embodied carbon by up to 7% while pursuing Green Star certification, thereby fueling Australia false ceiling market growth.

Integration of Advanced Acoustic Technologies in Commercial Spaces

Acoustic performance has become a critical consideration in false ceiling selection as businesses recognize the impact of noise control on employee productivity and wellbeing. Modern commercial spaces, particularly open-plan offices and co-working environments, require sophisticated sound absorption solutions to manage noise levels. The trend of adopting human-centered and biophilic design principles is accelerating the use of perforated panels and specialized acoustic ceiling tiles that enhance speech intelligibility while creating comfortable working environments.

Shift Towards Diverse Material Options Beyond Traditional Tiles

Australian design trends are evolving beyond traditional mineral fiber ceiling tiles towards diverse suspended ceiling materials, including metal, timber, and wood wool panels. This shift is linked to increasing focus on design strategies that create environments encouraging return-to-work initiatives following hybrid working arrangements. Metal ceiling systems offer durability and modern aesthetics for high-traffic commercial areas, while timber and wood wool options provide natural warmth aligned with biophilic design principles. Architects are specifying custom-designed perforated plasterboard ceilings for premium applications in reception areas, boardrooms, and showrooms where exceptional acoustic absorption combined with design freedom is essential.

Market Outlook 2026-2034:

The Australia false ceiling market outlook remains positive, supported by sustained infrastructure investments, urbanization trends, and growing emphasis on building performance and occupant comfort. The commercial construction sector continues to drive primary demand, with major office developments, healthcare facilities, and educational institutions specifying advanced ceiling systems. The market generated a revenue of USD 178.20 Million in 2025 and is projected to reach a revenue of USD 435.38 Million by 2034, growing at a compound annual growth rate of 10.44% from 2026-2034. Government initiatives promoting sustainable building practices are expected to accelerate adoption of high-performance ceiling solutions. The residential segment presents emerging opportunities, as homeowners increasingly recognize the benefits of false ceilings for thermal insulation, acoustic control, and aesthetic enhancement in renovation projects.

Australia False Ceiling Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Material | Gypsum Board | 45.06% |

| Cost Range | Medium-Cost | 44.1% |

| Installation | Suspended | 56.08% |

| Application | Commercial | 52.04% |

| Region | Australia Capital Territory & New South Wales | 26% |

Material Insights:

- Gypsum Board

- Metal

- Wood

- PVC

- Others

Gypsum board dominates with a market share of 45.06% of the total Australia false ceiling market in 2025.

Gypsum board false ceilings have established themselves as the preferred choice across Australian construction projects due to their exceptional combination of performance characteristics and cost-effectiveness. The material offers superior fire resistance ratings, excellent sound absorption properties, and smooth finishing capabilities that meet stringent building code requirements. The Australia gypsum board market reached USD 634.00 Million in 2024, reflecting strong demand from both residential and commercial construction sectors. Manufacturers continue to expand their product portfolios with specialized offerings, including moisture-resistant variants for wet areas and acoustic-rated boards for commercial applications.

The versatility of gypsum board ceilings extends to their design flexibility, enabling architects to create curved, coffered, and multi-level ceiling configurations that enhance interior aesthetics. The material's lightweight nature facilitates quick installation using established metal framing systems from suppliers, reducing labor costs and project timelines. Growing emphasis on sustainable construction has positioned gypsum boards favorably, as the material is recyclable and contributes to energy efficiency through improved thermal insulation properties when combined with appropriate backing materials.

Cost Range Insights:

- Low-Cost

- Medium-Cost

- High-Cost

Medium-cost leads with a share of 44.1% of the total Australia false ceiling market in 2025.

Medium-cost false ceiling solutions have emerged as the dominant segment, striking an optimal balance between quality, performance, and affordability that appeals to the majority of Australian commercial and residential projects. This category encompasses standard gypsum board systems, mineral fiber acoustic tiles, and basic metal ceiling options that deliver satisfactory performance without premium pricing. These medium-cost solutions also offer ease of installation and maintenance, making them a practical choice for widespread adoption.

The preference for medium-cost solutions reflects practical decision-making among Australian property developers and building owners who seek reliable performance without excessive capital expenditure. These products typically feature standard acoustic ratings, adequate fire resistance, and conventional design options that satisfy most project specifications. The segment benefits from robust supply chains established by major manufacturers, ensuring consistent availability and competitive pricing. Growing renovation activities across existing commercial buildings further support demand, as medium-cost solutions enable cost-effective workspace modernization while maintaining professional appearance and functional performance.

Installation Insights:

- Drywall

- Suspended

- Stretch Ceilings

- Others

Suspended exhibits a clear dominance with a 56.08% share of the total Australia false ceiling market in 2025.

Suspended represents the most widely adopted installation method across Australian commercial buildings, offering unparalleled flexibility for concealing essential services while maintaining easy maintenance access. The system comprises a metal grid framework suspended from the structural ceiling using steel rods, with panels or tiles fitted into the grid, creating a plenum space for ductwork, cabling, and fire protection systems. Additionally, suspended ceilings provide acoustic benefits by dampening noise within large open-plan areas.

The popularity of suspended ceilings stems from their numerous practical advantages that align with modern building design requirements. By effectively lowering ceiling height, these systems reduce room air volume requiring temperature control, thereby improving energy efficiency and thermal comfort in commercial spaces. They also offer aesthetic flexibility, enabling integration of lighting and decorative elements. Furthermore, suspended systems facilitate future retrofitting or upgrades of mechanical and electrical services with minimal structural impact.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Industrial

Commercial comprises the leading segment with a 52.04% share of the total Australia false ceiling market in 2025.

Commercial applications dominate the Australia false ceiling market, driven by robust office construction activities, retail expansion, and hospitality sector growth across major metropolitan centers. The Australia commercial property market was valued at USD 33.0 Billion in 2024 and is projected to reach USD 78.5 Billion by 2033, supporting sustained demand for high-quality ceiling solutions in new developments and refurbishment projects. Major cities, including Sydney, Melbourne, and Brisbane, continue to attract significant investment in office towers, shopping centers, and mixed-use developments that require sophisticated false ceiling systems for acoustic control, thermal management, and aesthetic enhancement.

The commercial segment benefits from stringent requirements for workplace environments that prioritize employee productivity and occupant wellbeing. Green building practices have become standard in commercial construction, with Green Star certification driving specification of sustainable ceiling products with low volatile organic compound (VOC) emissions and recycled content. Modern office design emphasizes open-plan layouts with acoustic ceiling solutions that manage noise levels while facilitating collaboration. Premium office buildings in CBD locations increasingly specify concealed grid ceiling systems with high-performance acoustic tiles to attract quality tenants seeking professional working environments.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represent the largest region with a share of 26% of the total Australia false ceiling market in 2025.

Australia Capital Territory & New South Wales command the leading position in the false ceiling market, driven by the concentration of commercial construction activities in Sydney CBD and government infrastructure projects in Canberra. The region benefits from sustained demand for office fitouts, retail renovations, and hospitality refurbishments across established commercial precincts and emerging growth corridors. Government investments in healthcare facilities, educational institutions, and public infrastructure further support ceiling product demand throughout the region.

The commercial property market, supported by increasing tourism activities, continues to attract significant domestic and international investment across the region, creating ongoing demand for high-quality ceiling solutions in new developments and building upgrades. During the September quarter of 2025, Sydney hosted 16.1 Million domestic tourists, who collectively spent USD 5.1 Billion in the region. Major office fitout specialists operate extensively throughout the region, delivering turnkey solutions that incorporate sophisticated suspended ceiling systems compliant with stringent fire, acoustic, and sustainability requirements mandated by local building codes and tenant specifications.

Market Dynamics:

Growth Drivers:

Why is the Australia False Ceiling Market Growing?

Expansion of Commercial Construction Sector Across Major Cities

The Australian commercial construction sector is experiencing sustained growth, creating substantial demand for false ceiling solutions across office developments, retail establishments, and hospitality venues. Major cities, including Sydney, Melbourne, Brisbane, and Perth, continue to attract significant investment in commercial property, with developers recognizing the value of high-quality interior finishes that attract premium tenants and command superior rental yields. Government-funded infrastructure projects, including the Western Sydney Airport and Melbourne Metro Tunnel, are generating substantial spillover demand for commercial ceiling products in associated developments and surrounding precincts. The commercial construction sector remains resilient in Australia, with the value of non-residential buildings increasing by 15.0% to USD 7.23 Billion in June 2025, resulting in enhanced demand for high-quality, sustainable false ceiling solutions.

Rising Investments in Green Building Practices and Sustainability Certifications

Sustainability has emerged as a central focus in Australian construction, with false ceiling manufacturers responding by developing eco-friendly products that support green building certification requirements. The Australia green building industry is thriving, reflecting growing emphasis on environmentally responsible construction practices. The Green Building Council of Australia has been instrumental in promoting sustainable design through its Green Star certification program, which evaluates buildings based on energy efficiency, indoor environment quality, and material sustainability. False ceiling products contribute to green certification by improving thermal insulation, reducing energy consumption for heating and cooling, and incorporating recycled materials. The National Construction Code 2025 includes tightened commercial energy-efficiency thresholds, driving specification of high-performance ceiling systems that contribute to building compliance while enhancing occupant comfort through improved acoustic and thermal performance.

Growing Renovation and Refurbishment Activities Across Existing Buildings

Renovation and refurbishment activities are contributing significantly to false ceiling demand, as building owners upgrade existing properties to meet contemporary standards and tenant expectations. The commercial property sector is witnessing substantial refurbishment investment as landlords seek to maintain competitiveness against newer developments with superior sustainability credentials and modern amenities. Office fitout specialists across Sydney, Melbourne, and Brisbane report strong demand for ceiling upgrades as businesses reconfigure workspaces following the shift toward hybrid working arrangements. The renovation market benefits from the practical advantages of false ceiling systems, which enable concealment of upgraded electrical, data, and heating, ventilation, and air conditioning (HVAC) infrastructure without extensive structural modifications. Refurbishment projects are driving adoption of sustainable ceiling products, with developers seeking to improve building environmental ratings while minimizing operational costs through enhanced energy efficiency. The ability to achieve substantial interior transformation with relatively limited disruption makes false ceiling replacement an attractive component of building modernization programs.

Market Restraints:

What Challenges the Australia False Ceiling Market is Facing?

Rising Construction Costs and Material Price Inflation

The Australia construction industry continues to face rising material costs that affect project budgets and ceiling product specifications. Key materials, such as steel, concrete, and gypsum board, have experienced significant price increases, putting pressure on developers to carefully manage expenditures. These cost challenges often lead to the selection of more economical ceiling solutions over premium options to stay within budget. Additionally, ongoing price volatility creates uncertainty in project planning and tendering, requiring developers and contractors to adopt flexible strategies and cost-optimization measures throughout the construction process.

Skilled Labor Shortages Affecting Installation Capacity

Labor shortages continue to pose a significant challenge for the Australia false ceiling market, limiting the ability to complete construction projects efficiently. Major cities face gaps in skilled trades, including plasterers and ceiling installers, as demand for construction and housing projects grows faster than workforce development. The shortfall in qualified personnel extends project timelines, raises labor costs, and can compromise installation quality and overall project outcomes. Despite efforts in training programs and immigration initiatives, the sector still struggles to meet workforce requirements, creating ongoing pressure on developers and contractors.

Regulatory Complexity and Building Code Compliance Requirements

Navigating Australia’s regulatory landscape adds further complexity for false ceiling manufacturers and installers. Frequent updates to the National Construction Code introduce new requirements for fire safety, acoustic performance, and sustainability standards. Seismic compliance regulations vary by region, imposing additional design and installation specifications. These obligations increase project planning complexity, necessitate specialized expertise, and may restrict the range of suitable false ceiling products for specific applications.

Competitive Landscape:

The Australia false ceiling market exhibits moderate concentration, with several established international and domestic players competing on product innovation, quality, sustainability credentials, and distribution network strength. Major global building materials companies maintain significant market presence through local manufacturing facilities and established distribution partnerships. Competition is intensifying as manufacturers expand product portfolios to include sustainable and specialized acoustic solutions that address evolving customer requirements. Strategic acquisitions, distribution agreements, and technology partnerships are reshaping the competitive landscape as companies seek to strengthen market positions. Differentiation increasingly centers on sustainability certifications, technical support capabilities, and the ability to deliver comprehensive ceiling system solutions rather than individual product components.

Australia False Ceiling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Gypsum Board, Metal, Wood, PVC, Others |

| Cost Ranges Covered | Low-Cost, Medium-Cost, High-Cost |

| Installations Covered | Drywall, Suspended, Stretch Ceilings, Others |

| Applications Covered | Commercial, Residential, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia false ceiling market size was valued at USD 178.20 Million in 2025.

The Australia false ceiling market is expected to grow at a compound annual growth rate of 10.44% from 2026-2034 to reach USD 435.38 Million by 2034.

Gypsum board dominated the market with a share of 45.06%, owing to its cost-effectiveness, superior fire resistance, versatile design capabilities, and established supply chains across the Australia construction industry.

Key factors driving the Australia false ceiling market include expanding commercial construction activities, rising green building investments, growing renovation demand, acoustic performance requirements, and government infrastructure development initiatives.

Major challenges include rising construction material costs, skilled labor shortages affecting installation capacity, regulatory complexity around building codes, supply chain disruptions, and increasing competition from alternative ceiling solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)