Australia Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2025-2033

Australia Family Offices Market Size and Share:

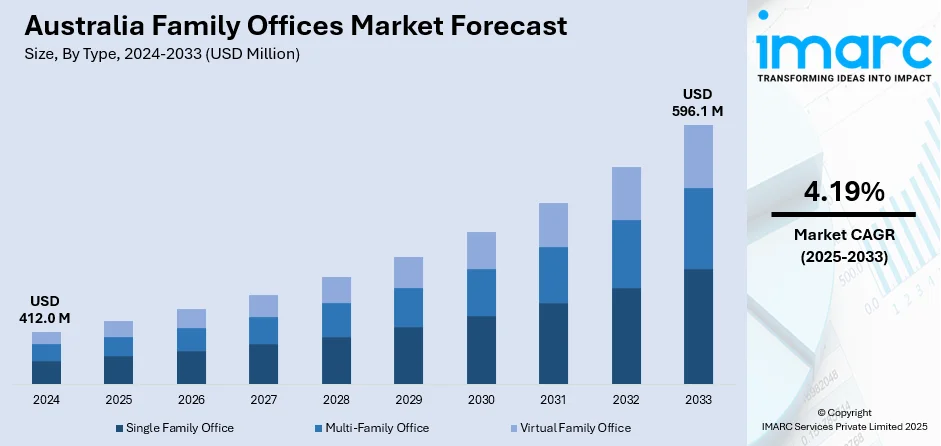

The Australia family offices market size reached USD 412.0 Million in 2024. Looking forward, the market is expected to reach USD 596.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.19% during 2025-2033. The market is increasingly influenced by generational wealth transfer, with younger members prioritizing ESG and impact investing. Market volatility is driving diversification into private equity, venture capital, and real estate. Regulatory pressures, technological advancements, and demand for higher returns further shape investment strategies, and are further expanding the Australia family offices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 412.0 Million |

| Market Forecast in 2033 | USD 596.1 Million |

| Market Growth Rate 2025-2033 | 4.19% |

Key Trends of Australia Family Offices Market:

Growing Adoption of Digital Assets and Blockchain Technology

Australian family offices are increasingly exploring digital assets, including cryptocurrencies, tokenized securities, and blockchain-based investments, as part of their diversification strategies. Thus, this is majorly favoring the Australia family offices market growth. The Independent Reserve Cryptocurrency Index (IRCI) 2025 shows that 95% of Australians are aware of cryptocurrencies, while 31% are investing in them, with Bitcoin (70%) being the most popular. This increase to 54 sheds light on the rising adoption and investor confidence around digital assets, suggesting that Australian family offices are well placed to strengthen their portfolios with digital assets. This move hints at a shift towards integrating cryptocurrencies into wealth management strategies as we adapt to the changing financial landscape. While still considered high-risk, these assets offer potential for outsized returns and exposure to innovative financial technologies. Some family offices are allocating a small percentage of their portfolios to Bitcoin and Ethereum as a hedge against inflation, while others are investing in blockchain startups or decentralized finance (DeFi) projects. Regulatory clarity from Australian authorities has provided more confidence in this space, though due diligence remains critical. Additionally, family offices are leveraging blockchain for operational efficiencies, such as smart contracts in real estate transactions and digital identity verification. This trend reflects a broader shift toward tech-driven investment strategies, particularly among next-gen family members who are more comfortable with digital assets. However, risk management and education remain key priorities as adoption grows.

To get more information on this market, Request Sample

Diversification into Alternative Assets and Private Markets

Australian family offices are increasingly diversifying their portfolios by expanding into alternative assets, including private equity, venture capital, and real estate. A research report released by the IMARC Group indicates that the real estate market in Australia is expected to experience a compound annual growth rate (CAGR) of 3.99% from 2025 to 2033. With traditional markets facing volatility, family offices are seeking higher returns and lower correlation to public equities by investing in unlisted companies, startups, and infrastructure projects. Private markets offer longer-term growth potential, appealing to multi-generational wealth preservation strategies. Notably, many family offices are co-investing with institutional players or forming syndicates to access exclusive deals. There is also a rising interest in niche sectors including agribusiness, healthcare innovation, and fintech, where Australia has strong growth prospects. Additionally, family offices are leveraging their networks to identify off-market opportunities, reducing reliance on traditional asset managers. This trend highlights a strategic shift toward more hands-on, flexible investment approaches, enabling family offices to capitalize on emerging opportunities, and creating a positive Australia family offices market outlook.

Growth Drivers of Australia Family Offices Market:

Intergenerational Wealth Transfer and Succession Planning

Australia is witnessing a significant shift in wealth distribution, as baby boomers transition their wealth to younger generations. According to the Australia family offices market analysis, this intergenerational transfer is driving the expansion of family offices, which offer structured solutions to preserve, grow, and responsibly pass on wealth. Younger beneficiaries tend to prefer professional governance models, clear succession strategies, and alignment with personal values such as sustainability or impact investing. Family offices provide a centralized mechanism to manage complex financial portfolios, estate planning, tax optimization, and philanthropic goals. As families become more globally connected and financially sophisticated, the demand for tailored succession planning, legal structuring, and risk management services increases, making family offices a preferred vehicle for long-term wealth stewardship in Australia’s evolving economic landscape.

Rising Demand for Personalized Financial and Lifestyle Services

Unlike traditional investment firms, family offices offer a high degree of customization, blending wealth management with personal, legal, and lifestyle services. In Australia, the demand for such bespoke support is growing, especially among ultra-high-net-worth families seeking integrated solutions for real estate, tax compliance, education planning, and global mobility. Family offices act as a single point of contact, providing confidential and concierge-style services tailored to each family’s legacy, culture, and long-term objectives, which is driving the Australia family offices market demand. This level of personalization is particularly appealing in an environment where privacy, control, and long-term vision are paramount. As more wealthy families prioritize a holistic, values-aligned approach to managing their affairs, the role of family offices as trusted, multi-disciplinary advisors continues to grow in relevance and scale.

Increasing Interest in Impact and Philanthropic Investing

Australian family offices are increasingly aligning wealth strategies with social responsibility by allocating capital to impact-driven and philanthropic ventures. This shift is often led by younger family members who place a higher value on measurable environmental and social returns alongside financial performance. Family offices enable targeted investment in sectors like education, renewable energy, Indigenous business development, and healthcare. Additionally, structured giving through foundations or donor-advised funds is on the rise, allowing families to institutionalize their philanthropic legacies. This values-based investment trend not only strengthens family unity but also enhances reputational standing in both local and global communities. As ESG norms become mainstream and reporting becomes more sophisticated, family offices are uniquely positioned to lead in purpose-driven wealth deployment across generations.

Australia Family Offices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, office type, asset class, and service type.

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes single family office, multi-family office, and virtual family office.

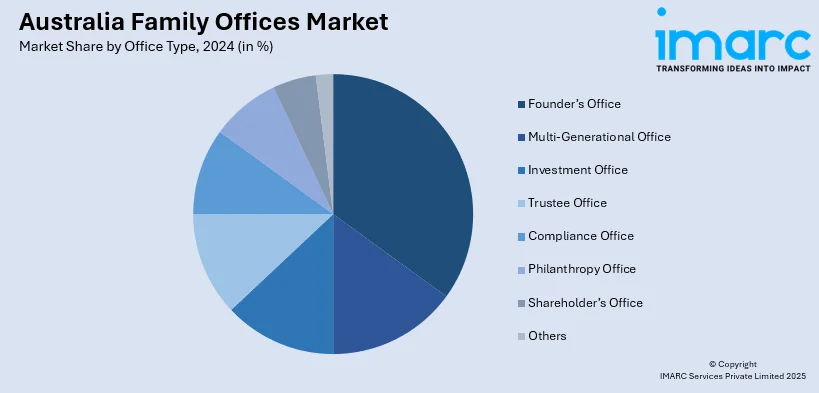

Office Type Insights:

- Founder’s Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

A detailed breakup and analysis of the market based on the office type have also been provided in the report. This includes founder’s office, multi-generational office, investment office, trustee office, compliance office, philanthropy office, shareholder’s office, and others.

Asset Class Insights:

- Bonds

- Equities

- Alternatives Investments

- Commodities

- Cash or Cash Equivalents

The report has provided a detailed breakup and analysis of the market based on the asset class. This includes bonds, equities, alternatives investments, commodities, and cash or cash equivalents.

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes financial planning, strategy, governance, advisory, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Family Offices Market News:

- 05 July 2024: TMF Group, a global administrative services and family office management provider, has acquired Vasco Trustees, a major Australian fund services provider, expanding its services in domestic and international markets.

Australia Family Offices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Family Office, Multi-Family Office, Virtual Family Office |

| Office Types Covered | Founder’s Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder’s Office, Others |

| Asset Classes Covered | Bonds, Equities, Alternatives Investments, Commodities, Cash or Cash Equivalents |

| Service Types Covered | Financial Planning, Strategy, Governance, Advisory, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia family offices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia family offices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia family offices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The family offices market in Australia was valued at USD 412.0 Million in 2024.

The Australia family offices market is projected to exhibit a CAGR of 4.19% during 2025-2033.

The Australia family offices market is projected to reach a value of USD 596.1 Million by 2033.

Key trends include a strong shift toward private assets (equity, debt, real estate), a heightened focus on ESG and impact investing, and significant adoption of technology for efficiency and sophisticated portfolio management. Succession planning and professionalization of services are also major priorities.

The Australian family offices market is booming due to significant wealth creation from tech exits and private equity. An increasing number of ultra-high-net-worth individuals, coupled with intergenerational wealth transfers, fuels demand for sophisticated, tailored wealth management. A growing focus on alternative assets and ESG investing also drives this expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)