Australia Fashion and Apparel Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2026-2034

Australia Fashion and Apparel Market Size and Share:

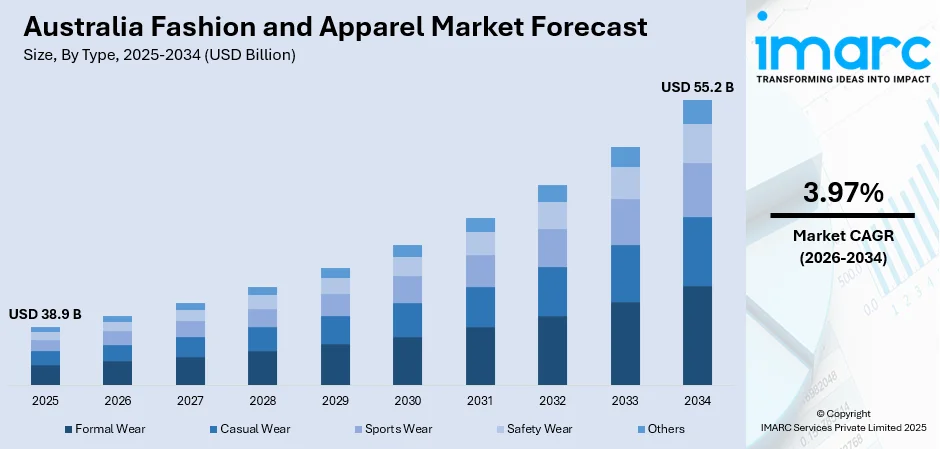

The Australia fashion and apparel market size reached USD 38.9 Billion in 2025. Looking forward, the market is expected to reach USD 55.2 Billion by 2034, exhibiting a growth rate (CAGR) of 3.97% during 2026-2034. Key market drivers include increasing disposable incomes, consumer interest in sustainable fashion, and the growing influence of digital shopping platforms. The rise of social media influencers and celebrities also drives demand, alongside a focus on customization and inclusive sizing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 38.9 Billion |

| Market Forecast in 2034 | USD 55.2 Billion |

| Market Growth Rate (2026-2034) | 3.97% |

Key Trends of Australia Fashion and Apparel Market:

Sustainable Fashion

As consumer demand for ethically and environmentally produced clothes grows, sustainability is emerging as a major subject in the Australian fashion and apparel industry. Sustainable materials including organic cotton, recycled polyester, and biodegradable textiles are being used by brands in response to environmental concerns. Brands are also encouraging transparency in their production processes by providing consumers with information on labor practices, carbon footprints, and sourcing. For instance, in May 2024, the Australian Fashion Council (AFC) launched Social & Environmental Toolkits at Australian Fashion Week to assist clothing and textile businesses in improving their sustainability efforts. Supported by the City of Sydney and The Growth Activists, the toolkits provide resources for setting goals aligned with the UN Sustainable Development Goals. They help businesses navigate challenges, foster transparency, and encourage collective action to create a sustainable and circular economy. The push for sustainability is not limited to product design; many brands are also exploring circular fashion models, such as garment recycling and resale platforms, aiming to reduce waste. The Australian market has seen an increase in the popularity of brands with clear sustainability goals, reflecting consumer values and contributing to a broader global trend. In another instance, RCYCL, a clothing recycling initiative, offers an easy solution for clothing recycling through direct-to-consumer return satchels. Garments are repurposed into new yarn or carpet underlay. Recognized as a runner-up in eBay's 2024 Circular Fashion Fund, RCYCL aims to break down sustainability challenges into manageable steps, encouraging collective action.

To get more information on this market, Request Sample

Digital Transformation and E-commerce Growth

The shift toward digital platforms is reshaping the Australian fashion and apparel market, with online shopping becoming the preferred method of purchasing for many consumers. The rapid growth of e-commerce has been accelerated by the pandemic, pushing retailers to enhance their digital offerings. Australian consumers are increasingly seeking convenience, allowing for the growth of online stores, mobile shopping apps, and virtual try-on technologies. Brands are leveraging data analytics and AI to personalize shopping experiences, recommending products based on browsing history and preferences. For instance, in March 2023, the AFC’s FashTech Lab pilot program helped Australian fashion brands transition from physical to digital sampling, reducing costs by 50%, shortening sampling time from 12 to 4 weeks, and eliminating 225 meters of textile waste. Brands like Bianca Spender and Matteau participated, benefiting from faster time-to-market and the ability to test multiple sizes without physical samples. Additionally, omnichannel retail strategies are being implemented, integrating physical stores with online platforms, providing seamless customer experiences. E-commerce growth is also driving innovations like direct-to-consumer models and subscription-based services.

Development of Innovative Fabrics

The development of innovative fabrics, such as those designed to combat urban heat, represents a significant driver for Australia's fashion and apparel market. As cities experience rising temperatures due to climate change, there is increasing demand for textiles that provide cooling effects and energy efficiency. For instance, in October 2024, a team of researchers from Zhengzhou University and the University of South Australia developed a natural fabric designed to combat urban heat. This fabric reflects sunlight, allows heat to escape, and uses a three-layer structure for enhanced cooling. The fabric is up to 6.2°C cooler than the surrounding environment and offers an energy-efficient alternative to air conditioning. The adoption of these materials by Australian brands could lead to a market shift towards performance-driven, environmentally conscious products, opening opportunities for innovation and growth within the apparel sector while promoting sustainability.

Growth Drivers of Australia Fashion and Apparel Market:

Influencer-Driven Consumer Behavior

Social media influencers and fashion content creators play a crucial role in shaping consumer preferences in Australia's fashion and apparel market. These personalities have a huge following on social media channels, including Instagram, TikTok, and YouTube, and can drive buying behavior, particularly among younger consumer groups, including Gen Z and millennials. They can display new styles, emphasize trends, and create brand awareness with real-time brand and product adoption, increasing customer engagement. Influencers not only increase brand recognition but also allow the establishment of emotional bonding between buyers and fashion brands. Their promotions contribute to viral tendencies and an instant rise in sales. Due to the growing impact of digital content in marketing initiatives, the use of influencers to build brands and obtain customers in the Australian fashion industry is emerging as a primary part of the strategy.

Rising Urbanization and Disposable Income

Australia’s growing urban population and increasing disposable income levels are driving the Australia fashion and apparel market demand. As more Australians relocate to metropolitan areas, there is a cultural shift toward fashion-conscious lifestyles that emphasize individuality and personal style. This trend is supported by rising middle-class earnings, which allow consumers to spend more on clothing and accessories across various categories, from luxury labels to affordable fast fashion. The urban environment also offers greater exposure to fashion trends, physical stores, and promotional events. Combined with enhanced access to online platforms, this urban migration fosters a dynamic market landscape where style and spending intersect. The growing affluence and urban concentration of consumers continue to fuel fashion consumption and market diversification across Australia.

Global Brand Penetration

The increasing presence of international fashion brands in Australia is reshaping the competitive landscape of the domestic market. Global labels are entering through both direct investment and strategic partnerships with local distributors and retailers. This influx provides Australian consumers with greater access to international trends, a wider variety of styles, and competitive pricing. It also raises the standard for local brands to innovate and differentiate themselves in a crowded market. The availability of renowned global names in physical stores and online platforms appeals to fashion-savvy shoppers seeking the latest collections and designer aesthetics. This brand diversification not only meets evolving consumer expectations but also contributes to overall market growth by attracting a broader audience and encouraging cross-border retail engagement.

Opportunities of Australia Fashion and Apparel Market:

Expansion into Regional and Niche Markets

As major urban fashion markets in Australia become increasingly saturated, significant opportunities are emerging in regional and underserved areas. These regions often lack access to diverse fashion choices and modern retail experiences. Expanding into these markets allows brands to reach new customer bases while fostering community engagement. Additionally, there is growing demand for niche segments such as plus-size fashion, adaptive apparel for people with disabilities, and maternity wear. These categories remain underrepresented yet are essential for promoting inclusivity in the industry. By offering specialized and thoughtfully designed collections, fashion companies can meet the needs of overlooked consumers, build stronger brand loyalty, and position themselves as advocates for diversity. This strategic expansion supports both commercial growth and social responsibility, which is fueling the Australia fashion and apparel market share.

Resale and Rental Fashion Models

The shift toward circular fashion is gaining traction in Australia through the rise of clothing rental platforms and secondhand marketplaces. These models cater to environmentally conscious and budget-aware consumers who value style without long-term ownership. Rental services offer access to premium or designer clothing for short-term use, making high fashion more accessible and reducing textile waste. Similarly, resale platforms encourage customers to buy and sell pre-owned garments, extending the lifecycle of apparel and promoting sustainability. These business models also enable brands to maintain engagement with consumers post-purchase, fostering loyalty and a sense of community. As the circular economy gains momentum, adopting resale and rental strategies allows fashion brands to meet evolving ethical demands while unlocking new revenue streams and customer segments.

Cultural and Indigenous Design Integration

Australia’s fashion industry is witnessing growing appreciation for cultural authenticity and Indigenous storytelling through clothing. Consumers are increasingly drawn to garments that reflect Indigenous Australian heritage, featuring traditional patterns, artwork, and narratives. Collaborating with Indigenous designers enables fashion brands to create unique, meaningful collections that honor cultural identity and creativity. These partnerships not only bring new perspectives to design but also support the visibility and economic empowerment of Indigenous communities. When approached respectfully, such initiatives contribute to cultural preservation and education while offering commercially viable products that resonate with socially conscious shoppers. This trend presents a valuable opportunity for fashion brands to merge artistic integrity with ethical collaboration, deepening their impact across both the cultural and commercial dimensions of the industry.

Challenges of Australia Fashion and Apparel Market:

High Operational and Logistics Costs

Australia’s geographical location, being far from major global manufacturing hubs, combined with its vast internal landscape, leads to high operational and logistical expenses. Transporting goods across long domestic routes or importing from overseas adds significant cost burdens, especially for smaller or emerging fashion brands. These elevated costs affect various aspects of business, from inventory management and warehousing to final-mile delivery. Online retailers also face challenges in offering competitive shipping rates and timely deliveries, which can influence customer satisfaction and retention. In addition, fluctuations in fuel prices and labor shortages in logistics further exacerbate the issue. Managing these complexities while maintaining affordable pricing and service efficiency remains a critical hurdle for fashion brands striving to compete in a highly demanding and dispersed market.

Changing Consumer Expectations

Modern Australian consumers are becoming increasingly selective, seeking fashion experiences that align with their values, lifestyles, and need for immediacy. They prioritize personalization, ethical sourcing, transparency, and fast delivery, all while expecting affordability and consistent quality. According to the Australia fashion and apparel market analysis, these evolving expectations create significant pressure on fashion brands to balance cost-efficiency with innovation and sustainability. Meeting these demands often requires investment in technologies such as AI-powered personalization engines, responsive supply chains, and transparent material sourcing. Additionally, consumers now expect brands to engage meaningfully on social and environmental issues, not just deliver products. For companies, the challenge lies in adapting quickly to these shifting preferences without compromising profitability or brand integrity. Staying relevant in this environment demands agility, consumer insight, and a continuous commitment to elevating customer experience.

Intense Market Competition

Australia’s fashion market has become increasingly competitive with the growing presence of global fast fashion giants and direct-to-consumer brands entering through e-commerce. International players often benefit from economies of scale, sophisticated marketing, and aggressive pricing strategies, making it difficult for smaller local brands to compete. These global brands flood the market with frequent new collections, speed, and affordability, setting high benchmarks for customer expectations. Meanwhile, independent Australian labels may struggle with limited production capacity, constrained budgets, and smaller marketing reach. As consumers gain access to a broader array of choices, brand loyalty becomes harder to maintain. To survive and thrive, local brands must find ways to differentiate, through storytelling, quality, ethical practices, or niche targeting, while also navigating the pressures of operating in an oversaturated market.

Australia Fashion and Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Formal Wear

- Casual Wear

- Sports Wear

- Safety Wear

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes formal wear, casual wear, sports wear, safety wear, and others.

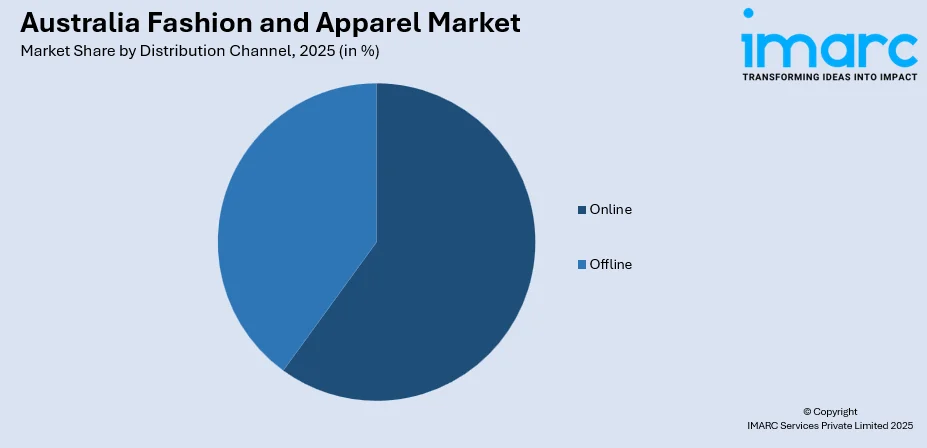

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End User Insights:

- Men

- Women

- Kids

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and kids.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Acler

- APG & Co

- Camilla and Marc

- Cotton On Group

- Country Road Group Pty Ltd

- Lorna Jane

- R.M.Williams

- The Aje Collective

- The Iconic

- Zimmermann

Australia Fashion and Apparel Market News:

- In July 2025, M&S officially entered the Australian market through its inaugural international wholesale fashion partnership with retailer David Jones. A curated range of the iconic British brand’s top-selling womenswear, lingerie, and sleepwear collections is now offered both online and across 24 David Jones department stores throughout the country.

- In May 2025, SHEIN, the global online fast fashion giant, launched Aralina, a new label influenced by Australian culture. Aralina aims to redefine casual wear with a focus on simplicity and sustainability. The brand offers a fresh take on loungewear, swimwear, athleisure, and everyday apparel, all designed to embody comfort, confidence, and authenticity.

- In May 2025, R.M. Williams and the Australian Fashion Council (AFC) unveiled a groundbreaking alliance to create the country’s first National Manufacturing Strategy dedicated to the fashion and textile sector. This pivotal partnership aims to spearhead a nationwide initiative focused on revitalizing and securing the industry's future. By harnessing cutting-edge technology, fostering innovation, and cultivating next-generation talent, the strategy seeks to enhance Australia’s local manufacturing capabilities and establish a globally competitive, resilient fashion industry.

- In September 2024, Country Road partnered with Melbourne-based streetwear label HoMie for a limited-edition collection, reimagining past-season garments into unique designs at ABMT facility. This collaboration supports HoMie’s REBORN program, which upcycles garments to reduce waste.

- In September 2023, the Sussan Group, which owns Sussan, Sportsgirl, and Suzanne Grae, has joined the Seamless Foundation, Australia's national clothing stewardship scheme. This initiative aims to create a circular fashion industry in Australia by 2030, addressing the 200,000 tonnes of clothing sent to landfill annually. The scheme focuses on sustainable design, recycling, and circular business models, encouraging behaviors such as repair, reuse, and rental.

- In September 2023, eBay launched an AUD 200,000 Circular Fashion Fund to support Australian start-ups focused on circular fashion solutions. The initiative aims to address the 27kg of new clothing Australians buy annually, with 23kg discarded. The fund supports emerging technologies and innovative solutions that promote sustainable customer behavior and circular economy practices in fashion.

Australia Fashion and Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Formal Wear, Casual Wear, Sports Wear, Safety Wear, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Acler, APG & Co, Camilla and Marc, Cotton On Group, Country Road Group Pty Ltd, Lorna Jane, R.M.Williams, The Aje Collective, The Iconic, Zimmermann, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fashion and apparel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fashion and apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fashion and apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fashion and apparel market in Australia was valued at USD 38.9 Billion in 2025.

The Australia fashion and apparel market is projected to exhibit a CAGR of 3.97% during 2026-2034.

The Australia fashion and apparel market is projected to reach a value of USD 55.2 Billion by 2034.

Australia’s fashion market is embracing sustainability, with growing demand for eco-friendly materials and ethical production. Digital transformation through virtual fitting rooms and AI-driven personalization is also enhancing online retail. Streetwear, gender-neutral clothing, and Indigenous-inspired designs are further gaining popularity, reflecting evolving consumer values and a shift toward inclusive, tech-enabled fashion.

The market growth is driven by rising e-commerce adoption, increasing consumer awareness about sustainable fashion, and a tech-savvy youth population. Strong social media influence, especially from fashion influencers and celebrities, is also accelerating demand. Additionally, higher disposable incomes and innovation in textile manufacturing are further supporting both domestic sales and global expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)