Australia Faucet Market Size, Share, Trends and Forecast by Type, Application, Technology, Material, Distribution Channel, End User, and Region, 2026-2034

Australia Faucet Market Summary:

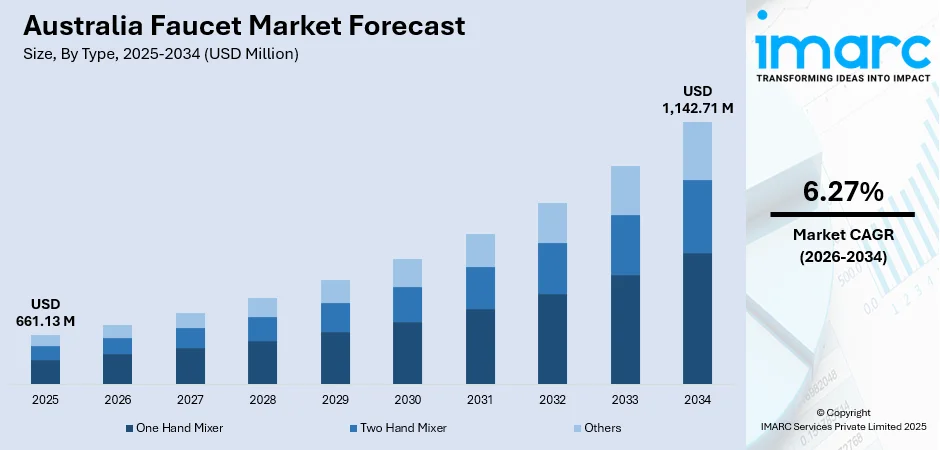

The Australia faucet market size was valued at USD 661.13 Million in 2025 and is projected to reach USD 1,142.71 Million by 2034, growing at a compound annual growth rate of 6.27% from 2026-2034.

The Australia faucet market is experiencing robust expansion driven by rising residential and commercial construction activity, increasing demand for water-efficient fixtures, and growing home renovation and improvement projects. Smart plumbing technologies and supportive government sustainability regulations are further accelerating market growth. Additionally, consumer preference for premium bathroom and kitchen fixtures combined with expanding hospitality sector investments is strengthening the Australia faucet market share across various applications and end-user segments.

Key Takeaways and Insights:

-

By Type: One hand mixer dominates the market with a share of 54% in 2025, attributed to its user-friendly operation, space-saving design, contemporary aesthetics, and water conservation capabilities that appeal to both residential and commercial consumers.

-

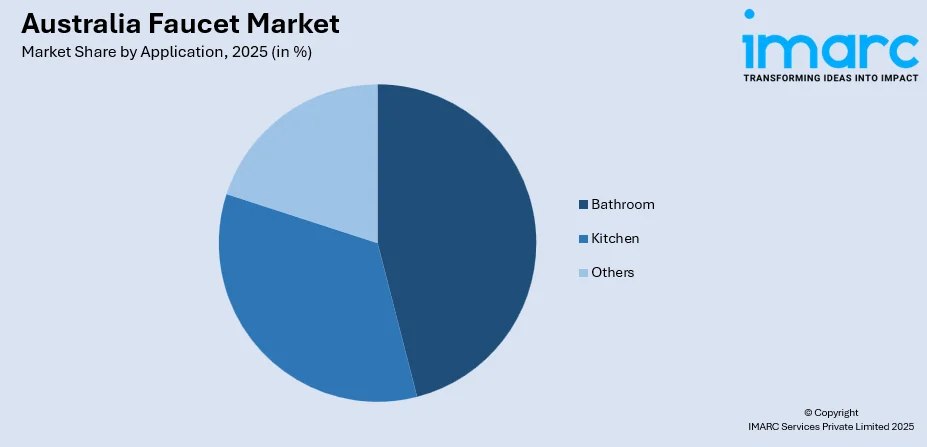

By Application: Bathroom dominates the market with a share of 46% in 2025, underpinned by higher frequency of faucet usage for daily hygiene activities, growing bathroom renovation trends, and increasing consumer demand for aesthetically pleasing and functional fixtures.

-

By Technology: Cartridge leads the market with a share of 40% in 2025, reflecting its advanced mechanisms, durability, low maintenance requirements, and ability to provide precise temperature and water flow control across residential and commercial applications.

-

By Material: Metal dominates the market with a share of 67% in 2025, driven by superior durability, corrosion resistance, premium aesthetic appeal, and consumer preference for long-lasting brass, stainless steel, and chrome-finished faucet fixtures.

-

By Distribution Channel: Offline leads the market with a share of 61% in 2025, fueled by consumer preference for physical product inspection, professional consultation at plumbing showrooms, and established relationships with plumbing contractors and retailers.

-

By End User: Residential dominates with 64% market share in 2025, reflecting substantial home improvement investments, new housing construction, bathroom and kitchen renovation activities, and growing consumer awareness of water-efficient fixtures.

-

By Region: Australia Capital Territory & New South Wales leads the market with a share of 30% in 2025, propelled by the concentration of population and construction activities in Sydney metropolitan area, robust real estate development, and substantial commercial infrastructure investments.

-

Key Players: The Australia faucet market features a competitive mix of international and domestic brands, with companies competing through product innovation, water-efficient technologies, modern design aesthetics, and extended warranty offerings to appeal to residential and commercial consumers.

To get more information on this market Request Sample

The Australia faucet market is undergoing significant transformation driven by sustainability initiatives, smart home technology integration, and shifting consumer preferences toward premium bathroom and kitchen fixtures. In 2025, Zip Water’s eco-friendly HydroTap G5 earned the Australian Good Design Award, showcasing innovative design and underscoring the industry’s push toward sustainable, smart water solutions. Stringent water conservation regulations and compliance with the Water Efficiency Labelling and Standards (WELS) scheme are strongly influencing product design, material selection, and purchasing decisions. Growing urbanization, residential construction, and renovation activity are supporting steady demand. The expanding middle class, rising disposable incomes, and increased awareness of hygiene and aesthetics are accelerating adoption of designer, touchless, and smart faucets. Additionally, infrastructure and housing development across major cities and regional centers is expanding market penetration beyond traditional metropolitan areas.

Australia Faucet Market Trends:

Rising Demand for Water-Efficient Faucet

Australia is experiencing strong growth in water-efficient faucet adoption due to environmental awareness, government sustainability initiatives, and strict water conservation requirements. In 2025, the federal WELS scheme celebrated its 20th anniversary and announced new minimum water efficiency standards, ensuring only highly efficient products are sold and boosting demand for water-saving fixtures. Residential and commercial users increasingly prefer high-WELS-rated fixtures that reduce consumption without compromising performance. In response, manufacturers are introducing advanced aerators and flow-control technologies. Ongoing drought concerns and long-term water management strategies are reinforcing water-efficient faucets as standard components in modern Australian buildings.

Smart and Touchless Faucet Technology Adoption

Smart and touchless faucet adoption is accelerating in Australia, supported by rising smart home penetration and heightened hygiene awareness. In May 2024, Delta Faucet launched Touch2O® with Touchless™ Technology, offering motion-activated and manual control, highlighting major manufacturers’ push for advanced touchless solutions in kitchens. Sensor-based and IoT-enabled faucets offer hands-free operation, precise temperature control, and water usage monitoring. Demand is particularly strong across healthcare, hospitality, and commercial spaces seeking improved hygiene and reduced contamination risks. This trend is reshaping consumer expectations toward connected, automated bathroom and kitchen environments.

Premiumization and Designer Faucet Solutions

Premium and designer faucets are gaining traction across Australia as consumers increasingly prioritize aesthetics alongside functionality. Faucets are viewed as key interior design elements, driving demand for contemporary styles, distinctive finishes, and durable materials. According to reports, Meir partnered with designer Darren Palmer to launch the Lustre Bronze collection, highlighting the trend of designer tapware as a stylish focal point in luxury homes. Manufacturers are expanding portfolios with matte black, brushed gold, and gunmetal options. Strong renovation activity among middle- and high-income households continues to support demand for visually striking, high-end fixtures.

Market Outlook 2026-2034:

The Australia faucet market is poised for sustained growth throughout the forecast period, driven by expanding residential and commercial construction activities, stringent water efficiency regulations, and rising consumer preference for premium bathroom and kitchen fixtures. The market outlook remains positive, supported by renovation demand, urbanization trends, and increasing awareness of sustainable living. Expanding opportunities in smart plumbing solutions, water-saving technologies, and designer products are expected to further strengthen market momentum. The market generated a revenue of USD 661.13 Million in 2025 and is projected to reach a revenue of USD 1,142.71 Million by 2034, growing at a compound annual growth rate of 6.27% from 2026-2034.

Australia Faucet Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

One Hand Mixer |

54% |

|

Application |

Bathroom |

46% |

|

Technology |

Cartridge |

40% |

|

Material |

Metal |

67% |

|

Distribution Channel |

Offline |

61% |

|

End User |

Residential |

64% |

|

Region |

Australia Capital Territory & New South Wales |

30% |

Type Insights:

- One Hand Mixer

- Two Hand Mixer

- Others

The one hand mixer dominates with a market share of 54% of the total Australia faucet market in 2025.

One hand mixer faucet represent the preferred choice across Australian residential and commercial applications owing to their user-friendly single-lever operation, space-saving design, and contemporary aesthetic appeal. The mechanism allows convenient temperature and flow adjustment with one hand, making them particularly practical for kitchen and bathroom environments where multitasking is common. Australian brand Dorf’s Flickmixer single‑lever taps remain in strong demand, reflecting their enduring popularity and practical appeal in both residential and commercial settings.

Modern one hand mixers incorporate water-saving technologies that contribute to environmental sustainability while meeting WELS compliance requirements.The segment's dominance is reinforced by competitive pricing compared to more complex faucet configurations while delivering reliable performance. Manufacturers offer one hand mixers in diverse styles ranging from minimalist contemporary designs to traditional aesthetics catering to varied consumer preferences. The versatility and practicality of single-lever operation continue driving preference among builders, renovators, and homeowners across Australian markets.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bathroom

- Kitchen

- Others

The bathroom leads with a share of 46% of the total Australia faucet market in 2025.

Bathroom applications dominate faucet demand owing to higher frequency of fixture usage for daily hygiene activities including handwashing, grooming, and bathing compared to other application areas. Multiple faucet requirements per bathroom including basin, shower, and bath fixtures contribute to higher cumulative demand. In response to updated National Construction Code regulations mandating lead‑free tapware by May 2026, major Australian bathroom brands such as Caroma are transitioning their faucet ranges to meet the stricter lead‑free safety standards well ahead of the deadline, enhancing product safety and consumer confidence in residential and commercial installations.

Additionally, technological advancements in bathroom faucets are strengthening demand, as consumers increasingly prefer touchless, sensor-based, and thermostatic fixtures that enhance hygiene, safety, and convenience. Growing awareness of water conservation is also driving adoption of low-flow and smart faucets that optimize water usage without compromising comfort. In commercial spaces such as hotels, offices, and healthcare facilities, frequent replacement cycles and compliance with hygiene standards further support bathroom faucet demand, reinforcing bathrooms as the primary revenue-generating application segment.

Technology Insights:

- Cartridge

- Compression

- Ceramic Disc

- Ball

The cartridge dominates with a market share of 40% of the total Australia faucet market in 2025.

Cartridge technology dominates the Australian faucet market due to its dependable performance, user-friendly maintenance, and long-lasting reliability. Its self-contained design makes repair and replacement straightforward, lowering maintenance costs for both homeowners and property managers. Modern cartridge systems also deliver accurate temperature and flow control, ensuring consistent functionality. With enhanced durability and efficiency, these mechanisms have become the preferred choice for residential and commercial faucets, meeting growing expectations for convenience, performance, and cost-effective upkeep.

Additionally, regulatory standards and consumer preferences in Australia further support cartridge-based faucets, as these mechanisms align well with WELS requirements for water efficiency and controlled flow rates. Cartridge systems are compatible with ceramic disc technology, which minimizes leakage and enhances longevity under varying water pressure conditions. Their adaptability across single-lever and dual-handle designs allows manufacturers to offer a wide product range, supporting strong adoption in both residential renovations and commercial construction projects.

Material Insights:

- Metal

- Plastics

The metal leads with a share of 67% of the total Australia faucet market in 2025.

Metal faucets command market preference owing to superior durability, corrosion resistance, and premium aesthetic appeal that consumers associate with quality and longevity. Brass remains the predominant base material for faucet bodies providing excellent machinability and corrosion resistance while supporting diverse surface finishes. Stainless steel is gaining traction particularly in kitchen applications where lead-free requirements and contemporary aesthetics drive adoption. Melbourne-based Sussex Taps invested in LUXPVD® technology to provide durable, scratch-resistant finishes, becoming Australia’s first carbon-neutral tapware brand with extended warranties and high-performance metal coatings.

In addition, metal faucets align well with Australia’s regulatory and sustainability expectations, as brass and stainless steel offer long service life and recyclability. Manufacturers increasingly apply advanced coatings such as PVD and chrome plating to enhance scratch resistance and maintain visual appeal over time. In commercial and hospitality environments, metal faucets are favored for their ability to withstand heavy usage and cleaning chemicals, reinforcing their dominance across residential and non-residential installations.

Distribution Channel Insights:

- Online

- Offline

The offline dominates with a market share of 61% of the total Australia faucet market in 2025.

Traditional offline distribution channels remain the preferred choice for Australian faucet buyers. Plumbing showrooms, hardware stores, and specialty bathroom retailers allow consumers to physically inspect products, access expert advice, and leverage trusted relationships with plumbing contractors who often influence purchase decisions. Additionally, trade channels catering to builders and renovation contractors continue to generate significant sales through dedicated plumbing supply networks, ensuring consistent market volumes while supporting professional installation and project requirements.

Moreover, offline channels also benefit from strong after-sales support and installation assurance, which are critical considerations for faucet purchases. Consumers often rely on in-store expertise for compatibility guidance, warranty clarification, and maintenance advice, reducing perceived purchase risk. For large renovation and construction projects, bulk procurement, negotiated pricing, and reliable supply timelines offered by established distributors further reinforce offline dominance, particularly in residential upgrades and commercial developments across Australia.

End User Insights:

- Residential

- Commercial

- Industrial

The residential leads with a share of 64% of the total Australia faucet market in 2025.

Residential applications are the key driver of faucet demand in Australia, fueled by strong home improvement spending, new housing projects, and bathroom and kitchen renovations. Homeowners increasingly seek high-quality fixtures that combine aesthetic appeal, functional performance, and value enhancement. Rising awareness of water efficiency and smart home technologies is further shaping purchasing decisions, with many consumers gravitating toward premium faucet categories that offer advanced features, sustainability, and long-term durability.

Furthermore, changing household demographics and lifestyle preferences are supporting residential faucet demand across Australia. Rising urbanization and smaller household sizes are encouraging compact yet multifunctional fixture designs suited to modern apartments. Homeowners are also showing greater interest in customization, with finishes, colors, and ergonomic designs tailored to interior themes. Additionally, higher disposable incomes and access to home renovation financing are enabling consumers to invest in long-lasting, branded faucets, sustaining steady demand in the residential segment.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales exhibits a clear dominance with a 30% share of the total Australia faucet market in 2025.

The Australia Capital Territory (ACT) and New South Wales lead national faucet demand, driven by population concentration and extensive construction in Sydney and surrounding growth corridors. The region experiences significant residential, commercial, and renovation activity, creating strong demand for varied faucet solutions. Well-established distribution networks and proximity to major plumbing suppliers further improve product accessibility, supporting both urban and suburban markets while enabling timely supply to meet the needs of homeowners, contractors, and commercial projects.

Beyond population concentration, the ACT and New South Wales region benefits from sustained infrastructure and urban renewal initiatives that continue to stimulate faucet demand. Ongoing redevelopment of inner-city precincts and expansion of suburban housing estates generate consistent requirements for modern plumbing fixtures. Strong demand from hospitality, healthcare, and education projects further broadens application scope. In addition, well-established logistics networks and close ties with national distributors ensure timely availability of a wide range of faucet products across the region.

Market Dynamics:

Growth Drivers:

Why is the Australia Faucet Market Growing?

Rising Residential and Commercial Construction

Australia's expanding construction sector is generating substantial demand for faucet fixtures across residential housing developments, apartment complexes, and commercial building projects. Population growth and urbanization are driving new housing requirements particularly in major metropolitan areas and growth corridors. In 2025, ABS data revealed total dwelling approvals surged, with private sector approvals up 26% year-on-year, highlighting renewed residential construction momentum and driving demand for faucets in new builds and renovations. Commercial construction including office buildings, retail centers, and hospitality venues creates consistent demand for quality plumbing fixtures meeting building code requirements and aesthetic specifications.

Water Efficiency Regulations and Sustainability Focus

Government water efficiency initiatives including the WELS scheme are compelling manufacturers and consumers toward water-saving faucet technologies. Australia's environmental consciousness and drought awareness drive demand for fixtures that minimize water consumption while maintaining performance. In 2025, the Australian Government’s WELS scheme reported nearly 25,000 registered products and over 1,800 gigalitres of water saved, underscoring its long-term impact on efficient fixture design and consumer adoption. Sustainability certifications and green building requirements are influencing specification decisions across residential and commercial construction projects. The regulatory emphasis on water conservation positions efficient faucets as essential building components.

Home Renovation and Improvement Activities

The robust renovation market across Australian housing stock is generating substantial replacement demand for bathroom and kitchen faucets. Homeowners invest in upgrading fixtures to enhance property value, improve aesthetics, and incorporate modern functionality. The Australia home improvement services market reached USD 10.40 Billion in 2024, reflecting strong investment in renovations, and is projected to grow to USD 15.24 Billion by 2033, underscoring ongoing opportunities for faucet upgrades and replacement cycles. The aging housing stock combined with changing consumer preferences creates ongoing replacement cycles. Television renovation programs and social media design inspiration are influencing consumer expectations and driving demand for premium fixture upgrades.

Market Restraints:

What Challenges the Australia Faucet Market is Facing?

Price Sensitivity and Import Competition

Price sensitivity among budget-conscious consumers and builders creates competitive pressure particularly from lower-cost imported faucets. Value engineering practices in construction projects may prioritize cost reduction over premium fixture specifications. The availability of budget alternatives from overseas manufacturers constrains market growth for established premium brands requiring differentiation through quality and warranty offerings.

Plumbing Standard Compliance Requirements

Australian plumbing standards and WaterMark certification requirements create barriers for product importation and market entry. Compliance costs and testing requirements add to product pricing particularly for specialized or innovative faucet technologies. The regulatory framework while ensuring quality and safety may slow introduction of advanced international products to the Australian market.

Housing Market Volatility

Fluctuations in Australian housing market conditions including construction activity levels and property prices impact faucet demand across new build and renovation segments. Interest rate movements and lending conditions influence consumer spending on home improvement projects. Economic uncertainty may defer discretionary renovation expenditure affecting premium fixture segments more significantly than essential replacement purchases.

Competitive Landscape:

The Australia faucet market is characterized by a diverse and competitive landscape where international plumbing fixture manufacturers operate alongside well-established domestic brands and regional distributors. Global participants rely on strong brand recognition, advanced design capabilities, and broad product portfolios to appeal to premium and mid-range consumer segments. Local players compete effectively by leveraging in-depth understanding of regional preferences, long-standing distribution networks, and products tailored to Australian building standards, climate conditions, and water-efficiency requirements. Competition across the market drives continuous innovation in aesthetics, functionality, water-saving technologies, and pricing strategies. Additionally, collaborations between overseas manufacturers and local distributors enhance market penetration and strengthen competitiveness across residential, commercial, and renovation-focused application segments.

Recent Developments:

-

In November 2025, Australian tapware innovator GalvinAssist launched a new high‑contrast tapware range designed to boost safety and independence in aged care, dementia care, and healthcare settings. The ergonomic, lead‑free fittings feature clear hot/cold indicators to reduce accident risk for vision‑impaired users.

Australia Faucet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | One Hand Mixer, Two Hand Mixer, Others |

| Applications Covered | Bathroom, Kitchen, Others |

| Technologies Covered | Cartridge, Compression, Ceramic Disc, Ball |

| Materials Covered | Metal, Plastics |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia faucet market size was valued at USD 661.13 Million in 2025.

The Australia faucet market is expected to grow at a compound annual growth rate of 6.27% from 2026-2034 to reach USD 1,142.71 Million by 2034.

One hand mixer dominates the Australia faucet market with a 54% share, driven by user-friendly single-lever operation, space-saving design, contemporary aesthetics, and water conservation capabilities.

Key factors driving the Australia faucet market include rising residential and commercial construction activity, water efficiency regulations and sustainability focus, home renovation and improvement activities, and growing demand for smart and touchless faucet technologies.

Major challenges include price sensitivity and competition from imported products, plumbing standard compliance and WaterMark certification requirements, housing market volatility affecting construction and renovation activity, and the need for continuous product innovation to meet evolving consumer expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)