Australia Feed Additives Market Size, Share, Trends and Forecast by Source, Product Type, Livestock, Form, and Region, 2025-2033

Australia Feed Additives Market Overview:

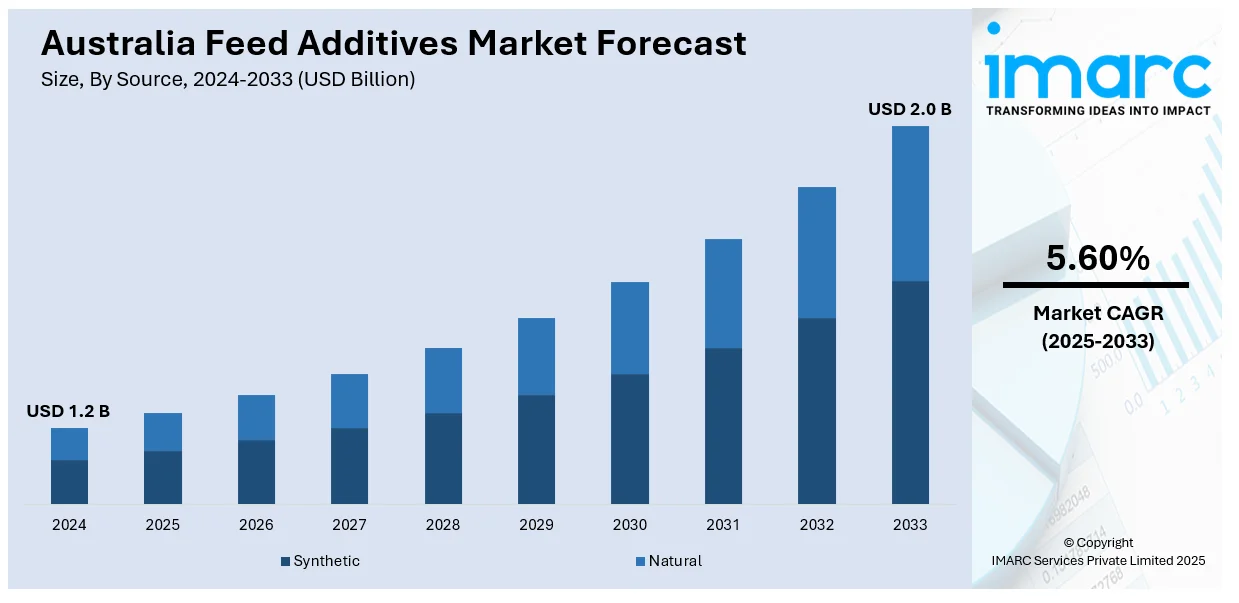

The Australia feed additives market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. The market is driven by an increase in the demand for high-quality animal products, rise in interest in animal health and welfare among protein manufacturers, and innovations and the creation of new additives that bring specific advantages to livestock nutrition.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Market Growth Rate 2025-2033 | 5.60% |

Australia Feed Additives Market Trends:

Increasing Demand for High-Quality Animal Protein Products

The rising population is contributing to the heightened consumption of protein from animals, especially in Australia, where consumption of meat, dairy, and eggs is becoming popular. The increased demand for high-quality animal products is driving the need to improve the quality of animal feed nutritionally through the use of superior feed additives. Feed additives like amino acids, vitamins, minerals, and enzymes are critical to improving growth rates in livestock, feed conversion, and general health. Optimizing the formulation of feed is facilitated through these additives, enabling animals to achieve their market weight more effectively while having the intended quality of meat and milk. As consumers are increasingly favoring high-quality animal products, attention on enhancing the productivity of livestock using advanced feed additives is becoming more prominent, positioning it as a key driver for the Australian market. According to the Australian Bureau of Statistics, consumption of meat and poultry increased by 2.3% in 2023-2024.

To get more information on this market, Request Sample

Rising Awareness About Animal Health

There is a rise in the interest in animal health and welfare among protein manufacturers in Australia. Moreover, concerns among regulators and consumers about the application of antibiotics and other growth promoters as feed additives, resulting in an increasing interest in safe and natural feed additives. Consequently, there is a heightened need for feed products that will promote immunity, disease prevention, and optimal growth at no cost to the health of animals. Feed additives such as probiotics, prebiotics, and organic acids are highly involved in reinforcing animal health through enhanced gut health, minimal disease occurrence, and overall productivity boost. The move towards cleaner, safer, and more sustainable agricultural practices is creating a demand for high-quality feed additives that reflect these values. Consequently, animal health-focused feed additives are becoming progressively more vital in the Australian marketplace. In 2024, CH4 Global Inc. and CirPro Australia declared that the first batch of cattle to have been fed commercial levels of CH4 Global's methane-reducing feed additive, Methane Tamer™, have been processed. Having passed all applicable welfare and quality standards, the reduced-methane beef from these first animals is headed for the domestic Australian market.

Advancements in Feed Additive Technology

The continued innovations in feed additives are positively influencing the Australian market. Feed formulation innovations and the creation of new additives that bring specific advantages to livestock nutrition are improving feed efficiency and animal performance. For example, enzymes and probiotics are developed to address particular regions of animal health, including enhancing digestion or immune stimulation. Furthermore, the implementation of precision farming methods, such as the use of digital tools to track animal health, is catalyzing the demand for value-added feed additives that can support these new-style farming systems. With advances in technology, the Australian market is seeing growing uptake of advanced feed additives that enhance feed conversion efficiency, save on waste, and are sustainable. These innovations are propelling the market growth as farmers and producers look for creative means of increasing productivity and decreasing costs. In 2024, NOVUS announced its plans of expanding nutritional feed solutions and expertise to the dairy sector in Oceania.

Australia Feed Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, product type, livestock, and form.

Source Insights:

- Synthetic

- Natural

The report has provided a detailed breakup and analysis of the market based on the source. This includes synthetic and natural.

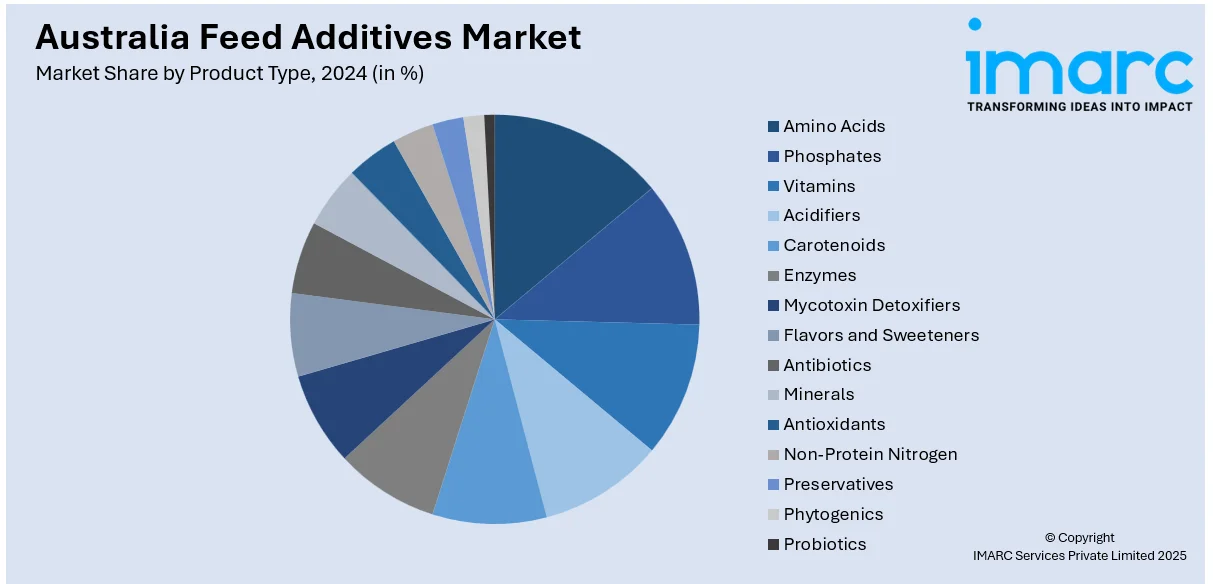

Product Type Insights:

- Amino Acids

- Lysine

- Methionine

- Threonine

- Tryptophan

- Phosphates

- Monocalcium Phosphate

- Dicalcium Phosphate

- Mono-Dicalcium Phosphate

- Defluorinated Phosphate

- Tricalcium Phosphate

- Others

- Vitamins

- Fat-Soluble

- Water-Soluble

- Acidifiers

- Propionic Acid

- Formic Acid

- Citric Acid

- Lactic Acid

- Sorbic Acid

- Malic Acid

- Acetic Acid

- Others

- Carotenoids

- Astaxanthin

- Canthaxanthin

- Lutein

- Beta-Carotene

- Enzymes

- Phytase

- Protease

- Others

- Mycotoxin Detoxifiers

- Binders

- Modifiers

- Flavors and Sweeteners

- Antibiotics

- Tetracycline

- Penicillin

- Others

- Minerals

- Potassium

- Calcium

- Phosphorus

- Magnesium

- Sodium

- Iron

- Zinc

- Copper

- Manganese

- Others

- Antioxidants

- BHA

- BHT

- Ethoxyquin

- Others

- Non-Protein Nitrogen

- Urea

- Ammonia

- Others

- Preservatives

- Mold Inhibitors

- Anticaking Agents

- Phytogenics

- Essential Oils

- Herbs and Spices

- Oleoresin

- Others

- Probiotics

- Lactobacilli

- Streptococcus Thermophilus

- Bifidobacteria

- Yeast

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes amino acids (lysine, methionine, threonine, and tryptophan), phosphates (monocalcium phosphate, dicalcium phosphate, mono-dicalcium phosphate, defluorinated phosphate, tricalcium phosphate, and others), vitamins (fat-soluble and water-soluble), acidifiers (propionic acid, formic acid, citric acid, lactic acid, sorbic acid, malic acid, acetic acid, and others), carotenoids (astaxanthin, canthaxanthin, lutein, and beta-carotene), enzymes (phytase, protease, and others), mycotoxin detoxifiers (binders and modifiers), flavors and sweeteners, antibiotics (tetracycline, penicillin, and others), minerals (potassium, calcium, phosphorus, magnesium, sodium, iron, zinc, copper, manganese, and others), antioxidants (BHA, BHT, ethoxyquin, and others), non-protein nitrogen (urea, ammonia, others), preservatives (mold inhibitors and anticaking agents), phytogenics (essential oils, herbs and spices, oleoresin, and others), probiotics (lactobacilli, streptococcus thermophilus, bifidobacteria, and yeast).

Livestock Insights:

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Breeders

- Swine

- Starters

- Growers

- Sows

- Aquatic Animal

- Others

A detailed breakup and analysis of the market based on the livestock have also been provided in the report. This includes ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, and breeders), swine (starters, growers, and sows), aquatic animal, and others.

Form Insights:

- Dry

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes dry and liquid.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Feed Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Synthetic, Natural |

| Product Types Covered |

|

| Livestocks Covered |

|

| Forms Covered | Dry, Liquid |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia feed additives market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia feed additives market on the basis of source?

- What is the breakup of the Australia feed additives market on the basis of product type?

- What is the breakup of the Australia feed additives market on the basis of livestock?

- What is the breakup of the Australia feed additives market on the basis of form?

- What is the breakup of the Australia feed additives market on the basis of region?

- What are the various stages in the value chain of the Australia feed additives market?

- What are the key driving factors and challenges in the Australia feed additives market?

- What is the structure of the Australia feed additives market and who are the key players?

- What is the degree of competition in the Australia feed additives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia feed additives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia feed additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia feed additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)