Australia Fermented Food and Beverage Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Australia Fermented Food and Beverage Market Overview:

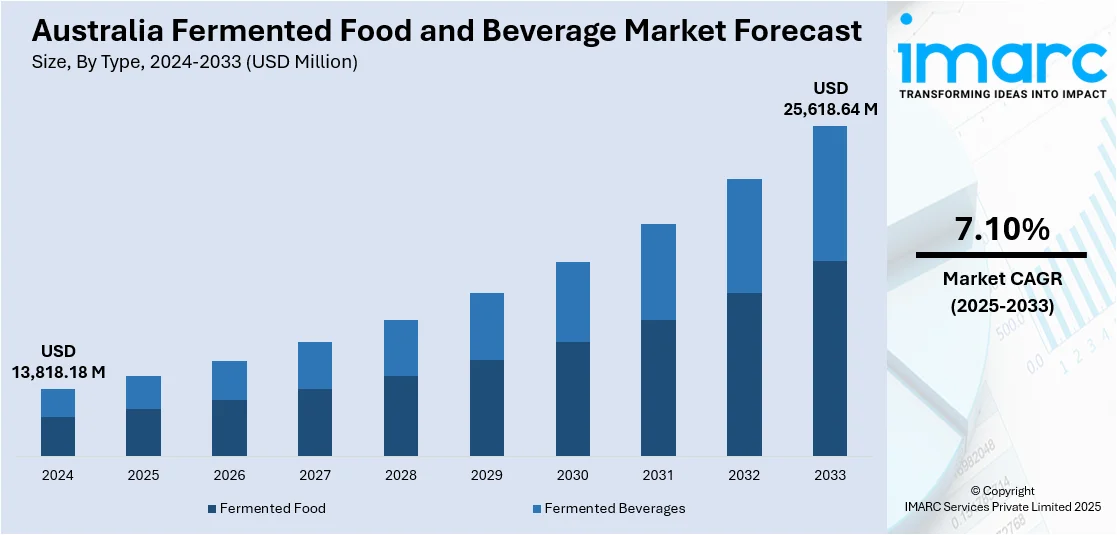

The Australia fermented food and beverage market size reached USD 13,818.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 25,618.64 Million by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033. The demand for healthier food and beverages is growing across Australia, with consumers increasingly seeking products that offer nutritional benefits. This, along with the focus on sustainability and a desire for natural, clean-label ingredients, is bolstering the market growth. Moreover, the heightened popularity of vegan and plant-based diets is expanding the Australia fermented food and beverage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13,818.18 Million |

| Market Forecast in 2033 | USD 25,618.64 Million |

| Market Growth Rate 2025-2033 | 7.10% |

Australia Fermented Food and Beverage Market Trends:

Increasing Consumer Demand for Healthier Products

The demand for healthier food and beverages is growing across Australia, with consumers increasingly seeking products that offer nutritional benefits. This trend is driven by a broader shift towards wellness, with more people prioritizing digestive health, immune system support, and overall well-being. Fermented food products like yogurt, kombucha and kimchi, are gaining popularity for their probiotic content, which is believed to enhance gut health. Consumers are also becoming more conscious about the connection between diet and health, which is rising the consumption of fermented products. Brands are responding by launching new and innovative products that cater to this health conscious demographic, incorporating organic ingredients and emphasizing their functional health benefits. As more Australians embrace healthy living, the industry is experiencing sustained growth, with ongoing research and development (R&D) efforts focused on meeting evolving consumer preferences. In 2024, Australia’s major healthy drinks company, Remedy Drinks, launched a limited-edition festive batch kombucha, comprising two unique flavors, Merry Cherry and Pavlova.

To get more information on this market, Request Sample

Increasing Awareness About Sustainable and Natural Ingredients

Both sustainability and a desire for natural, clean-label ingredients are becoming increasingly critical to Australian consumers. This trend is impelling the Australia fermented food and beverage market growth. Fermentation tends to use minimal processing and natural microbial cultures. Consumers are keenly looking for products that are compliant with their values, for example, products that support local agriculture, have a reduced environmental footprint, and do not use artificial additives and preservatives. Fermented foods, especially those produced through traditional processes, are being marketed as more sustainable choices to processed foods. At the same time, natural ingredients and fermentation processes are being promoted as a means of cutting down on food waste, with some brands highlighting their utilization of by-products or surplus crops. This growing demand for plant-based and vegan diets is playing a key role in bolstering the market growth in Australia.

Increased Popularity of Vegan and Plant-Based Diets

Increased popularity of vegan and plant-based diets is transforming the food market in Australia, providing new opportunities for the fermented food and beverage industry. As more Australians lead plant-based diets, they are looking for alternatives that are in line with their eating habits, and fermented plant-based foods are meeting this demand. Fermented plant-based foods such as non-dairy kefir, kombucha, and tempeh are going mainstream and appealing to consumers both on the nutrition front and the flavor front. This is owing to the growing awareness about animal welfare, the environment, and health-related benefits that come with consuming plant-based foods. Producers are countering by diversifying their product lines to serve this increasing market segment. As plant-based eating continues to gain popularity, fermented food and beverage companies are developing new products that not only qualify as vegan and vegetarian but also provide improved taste and texture profiles. The IMARC Group predicts that the Australian vegan food market size will attain USD 844.51 Million by 2033.

Australia Fermented Food and Beverage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Fermented Food

- Yogurt

- Tofu

- Tempeh

- Sauerkraut/Fermented Veggies and Pickles

- Cheese

- Others

- Fermented Beverages

- Yogurt Drink/Smoothies

- Kombucha

- Kefir

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fermented food (yogurt, tofu, tempeh, sauerkraut/fermented veggies and pickles, cheese, and others) and fermented beverages (yogurt drink/smoothies, kombucha, kefir, and others).

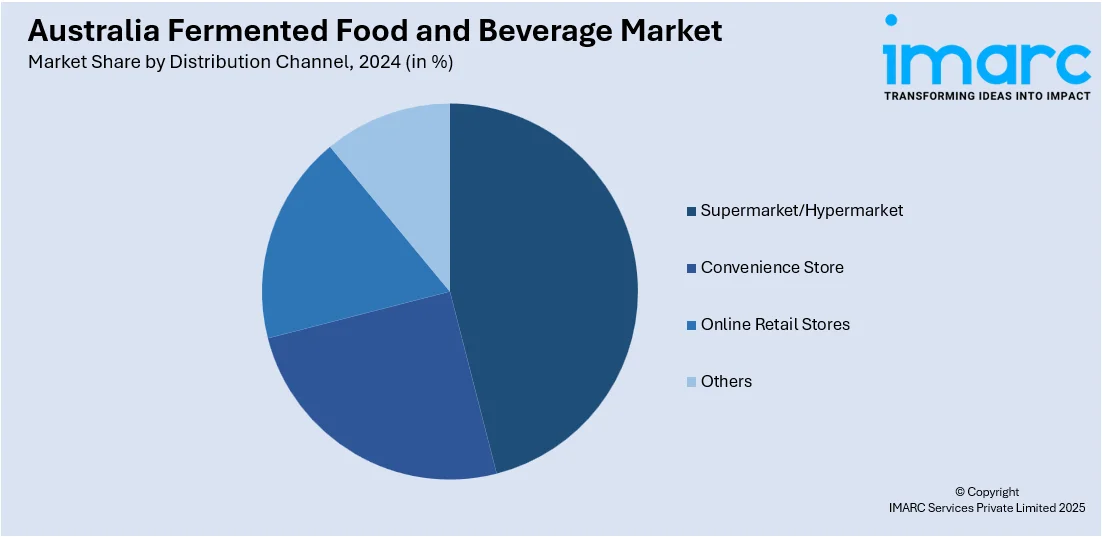

Distribution Channel Insights:

- Supermarket/Hypermarket

- Convenience Store

- Online Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarket/hypermarket, convenience store, online retail stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fermented Food and Beverage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Distribution Channels Covered | Supermarket/Hypermarket, Convenience Store, Online Retail Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia fermented food and beverage market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia fermented food and beverage market on the basis of type?

- What is the breakup of the Australia fermented food and beverage market on the basis of distribution channel?

- What is the breakup of the Australia fermented food and beverage market on the basis of region?

- What are the various stages in the value chain of the Australia fermented food and beverage market?

- What are the key driving factors and challenges in the Australia fermented food and beverage market?

- What is the structure of the Australia fermented food and beverage market and who are the key players?

- What is the degree of competition in the Australia fermented food and beverage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fermented food and beverage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fermented food and beverage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fermented food and beverage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)