Australia Ferroalloys Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Australia Ferroalloys Market Summary:

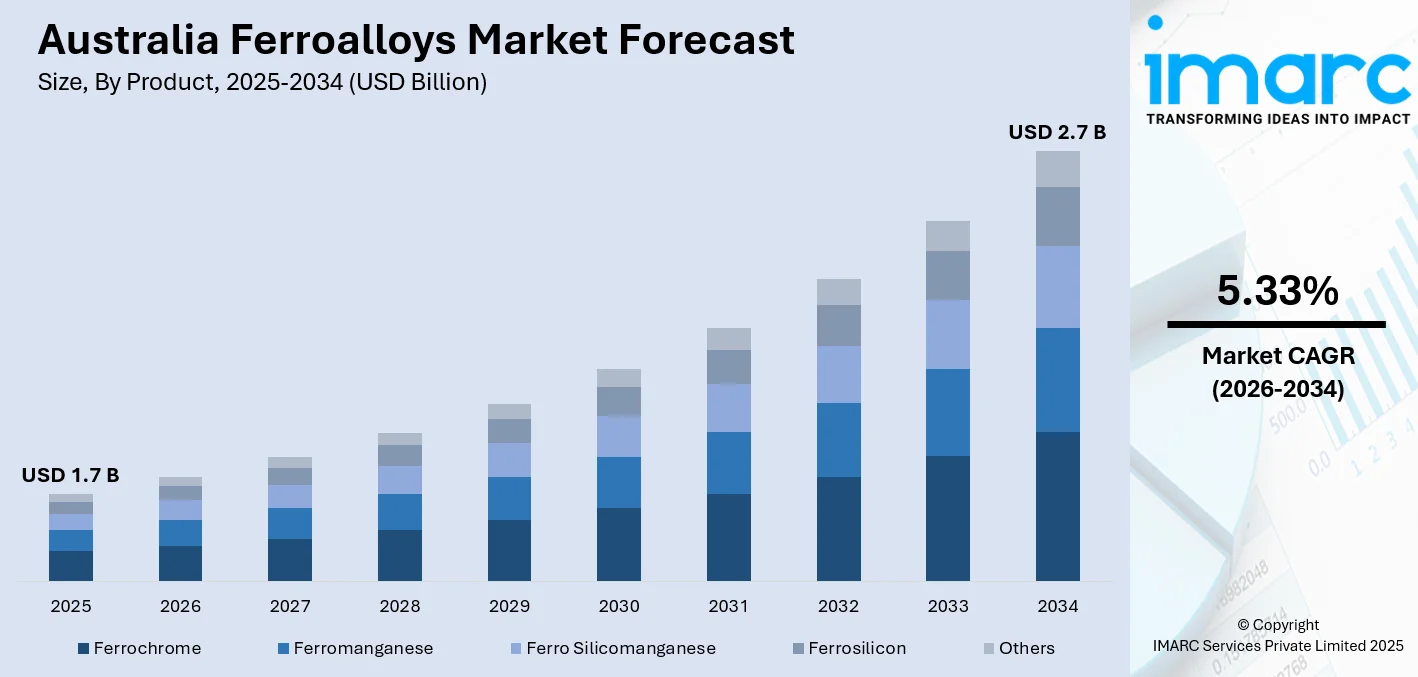

The Australia ferroalloys market size was valued at USD 1.7 Billion in 2025 and is projected to reach USD 2.7 Billion by 2034, growing at a compound annual growth rate of 5.33% from 2026-2034.

The Australia ferroalloys market is driven by robust steel manufacturing activities, expanding infrastructure development initiatives, and growing demand from the mining sector. The country's strategic position as a major manganese ore producer supports domestic ferroalloy production capabilities. Rising investments in green steel technologies and increasing applications across the construction and automotive sectors are further strengthening the Australia ferroalloys market share.

Key Takeaways and Insights:

- By Product: Ferromanganese dominates the market with a share of 32% in 2025, owing to its critical role as a deoxidizing and desulfurizing agent in steel production. The segment benefits from Australia's abundant manganese ore reserves and established production infrastructure, supporting consistent demand from domestic and export steel manufacturing operations.

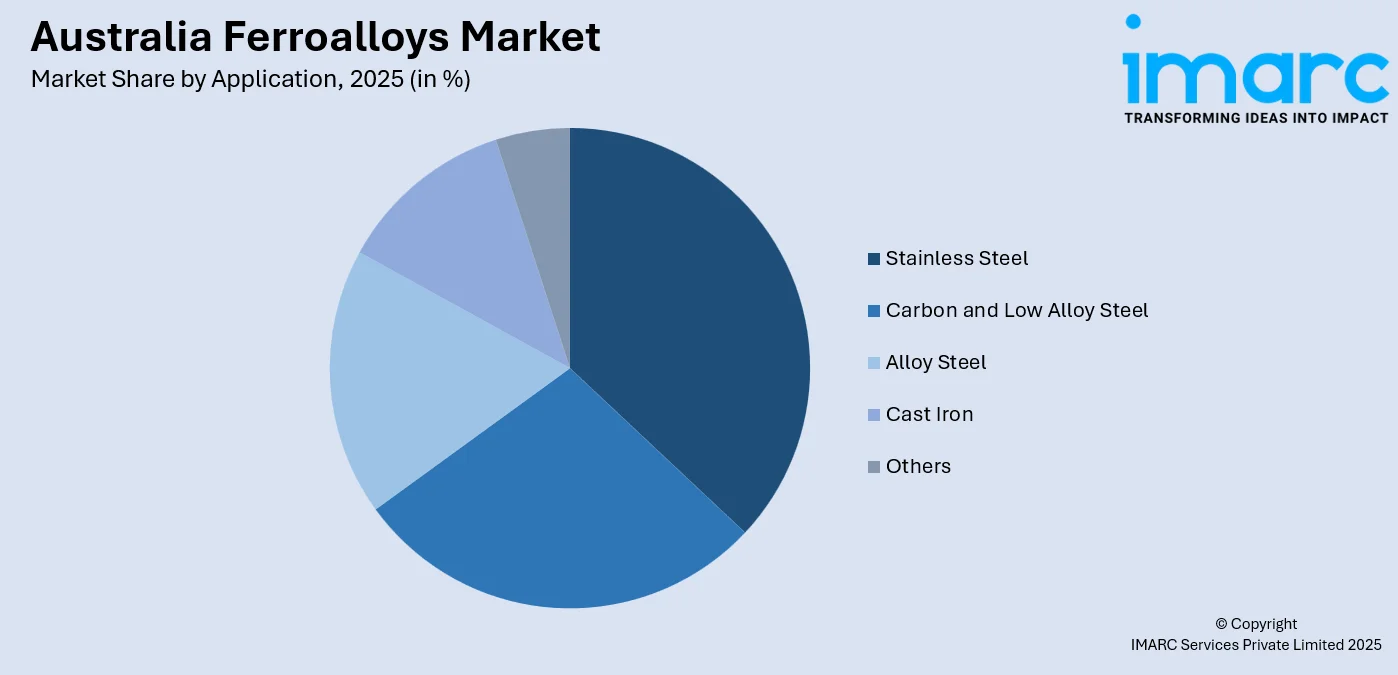

- By Application: Stainless steel leads the market with a share of 35% in 2025. This dominance is driven by increasing demand for corrosion-resistant materials across the construction, food processing, and medical equipment manufacturing sectors. The segment benefits from growing consumer preference for durable, hygienic, and aesthetically appealing stainless steel products.

- By Region: Western Australia represents the largest region with 40% share in 2025, driven by the concentration of major mining operations and ferroalloy production facilities. The region's abundant mineral resources, established infrastructure, and proximity to key export markets position it as the primary hub for ferroalloy manufacturing activities.

- Key Players: Key players drive the Australia ferroalloys market by expanding production capacities, investing in sustainable manufacturing technologies, and strengthening supply chain partnerships. Their strategic focus on operational efficiency, product diversification, and environmental compliance enhances market competitiveness and ensures reliable supply across domestic and international markets.

To get more information on this market Request Sample

The Australia ferroalloys market is experiencing sustained growth, driven by the country's robust steel industry and extensive mining sector requirements. The building and construction sector, contributing around USD 162 Billion annually to the Australian economy and accounting for approximately 10% of GDP as of January 2024, represents a primary end user segment. Government-led infrastructure expansion programs are further strengthening long-term demand for steel and related ferroalloys, particularly for transport and urban development projects. At the same time, the industry is undergoing a structural shift toward greener steel production, with policy support and targeted funding encouraging adoption of low-emission technologies. This transition is reshaping ferroalloy demand toward cleaner and more efficient inputs. Additionally, the automotive sector’s move towards electric vehicles (EVs) and lightweight materials is increasing the need for specialized ferroalloys.

Australia Ferroalloys Market Trends:

Transition Towards Sustainable Ferroalloy Production Methods

The Australia ferroalloys industry is witnessing a significant shift towards environmentally sustainable production processes, driven by decarbonization initiatives and regulatory compliance requirements. Manufacturers are increasingly adopting electric arc furnace technologies powered by renewable energy sources to reduce carbon emissions. In December 2024, a consortium, including BlueScope, Rio Tinto, and BHP, selected the Kwinana industrial zone, south of Perth, to build a pilot electric smelting furnace (ESF) facility, scheduled for commissioning in 2028. This transition aligns with national carbon neutrality targets and enhances industry competitiveness in environmentally conscious global markets.

Integration of Advanced Digital Technologies in Production Operations

Australian ferroalloy producers are embracing digital transformation through automation, artificial intelligence (AI), and data analytics to optimize manufacturing processes and enhance operational efficiency. These technological advancements enable precise quality control, predictive maintenance capabilities, and streamlined supply chain management, positioning Australian producers competitively against international suppliers while meeting increasingly stringent product specifications demanded by downstream steel manufacturers. Additionally, digital integration supports energy optimization and emissions monitoring, helping producers align with sustainability targets while reducing operating costs.

Expansion of Battery-Grade Manganese Processing Capabilities

Beyond traditional steelmaking applications, Australian ferroalloy producers are diversifying into battery-grade manganese production to capitalize on growing EV demand. Element 25's Butcherbird expansion project in Western Australia, approved in January 2025, proposes increasing manganese concentrate production to 1.1 Million Tons annually, serving both steel industry customers and providing feedstock for high-purity manganese sulfate monohydrate facilities. This diversification strategy enables producers to access premium market segments while leveraging existing mining infrastructure and technical expertise across manganese value chains.

Market Outlook 2026-2034:

The Australia ferroalloys market demonstrates promising growth prospects, driven by sustained infrastructure investments, expanding green steel initiatives, and increasing demand from diverse end-use sectors. The market generated a revenue of USD 1.7 Billion in 2025 and is projected to reach a revenue of USD 2.7 Billion by 2034, growing at a compound annual growth rate of 5.33% from 2026-2034. Government initiatives supporting domestic manufacturing capabilities and decarbonization efforts are creating favorable conditions for industry expansion. Strategic investments in hydrogen-based direct reduced iron technologies and electric arc furnace upgrades are enabling producers to meet evolving customer requirements for low-carbon steel inputs while maintaining cost competitiveness across regional and international markets.

Australia Ferroalloys Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

| Product | Ferromanganese |

32% |

| Application | Stainless Steel |

35% |

| Region | Western Australia |

40% |

Product Insights:

- Ferrochrome

- Ferromanganese

- Ferro Silicomanganese

- Ferrosilicon

- Others

Ferromanganese dominates with a market share of 32% of the total Australia ferroalloys market in 2025.

Ferromanganese holds a leading position in the market, due to its indispensable role in steelmaking, where it functions as a key deoxidizing and desulfurizing agent. The alloy significantly improves tensile strength, hardness, and wear resistance of steel while mitigating the adverse effects of sulfur during production. Australia’s abundant manganese resources provide a strong foundation for domestic ferromanganese manufacturing, supporting supply security and cost competitiveness. This resource advantage enables producers to meet consistent quality requirements of steelmakers while strengthening Australia’s position as a reliable supplier within the global ferroalloys value chain.

The ferromanganese segment is supported by established production infrastructure concentrated in major mining regions across the Northern Territory & Western Australia. Producers benefit from integrated operations that link manganese ore extraction directly with ferroalloy processing, enhancing efficiency and reducing logistical complexity. Strong trade relationships with Asian steel-producing nations continue to underpin demand, encouraging capacity utilization and operational stability. Ongoing investments in plant optimization and process improvements further reinforce the segment’s dominance, positioning ferromanganese as a cornerstone of the Australia ferroalloy industry.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Carbon and Low Alloy Steel

- Stainless Steel

- Alloy Steel

- Cast Iron

- Others

Stainless steel leads with a share of 35% of the total Australia ferroalloys market in 2025.

Stainless steel commands the largest market share, driven by extensive utilization across the construction, food processing, medical equipment, and consumer goods manufacturing sectors. Stainless steel's superior corrosion resistance, durability, and aesthetic appeal make it the preferred material for applications requiring long-term performance and minimal maintenance. Additionally, the compatibility of stainless steel with modern fabrication techniques and design flexibility supports wider adoption across both structural and decorative applications.

Growing consumer preference for hygienic, recyclable, and sustainable materials continues to strengthen stainless steel demand across residential and commercial applications. The food and beverage (F&B) processing industry represents a significant consumption segment where stainless steel equipment meets regulatory compliance requirements for sanitary manufacturing environments. Healthcare sector expansion, driven by population growth and aging demographics, further accelerates demand for surgical instruments, medical devices, and hospital equipment manufactured using high-quality stainless steel materials.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Western Australia exhibits a clear dominance with a 40% share of the total Australia ferroalloys market in 2025.

Western Australia commands the largest regional market share owing to its concentration of major mining operations, established ferroalloy processing infrastructure, and proximity to key export markets across Asia. The region hosts critical manganese mining projects, including the Woodie Woodie mine, which produced 600,000 Tons of manganese in 2023. Strategic government investments in renewable energy infrastructure support transition towards sustainable production methods, enhancing regional competitiveness across international ferroalloy markets.

In addition, well-developed port infrastructure and efficient logistics networks facilitate cost-effective export of ferroalloys to key steel-producing countries. The availability of skilled labor, mining expertise, and advanced processing technologies across the region further strengthens operational efficiency. Strong collaborations between mining companies, processors, and research institutions support innovations in low-emission production techniques. Together, these factors position Western Australia as a strategic hub for ferroalloy manufacturing, export growth, and long-term industry leadership.

Market Dynamics:

Growth Drivers:

Why is the Australia Ferroalloys Market Growing?

Expanding Infrastructure Development and Construction Activities

The Australia ferroalloys market experiences robust growth, driven by substantial infrastructure development initiatives across transportation, energy, and urban construction sectors. Steel remains the foundational material for bridges, roads, railways, and commercial buildings, creating sustained demand for ferroalloys essential in steel production processes. Australia's Major Public Infrastructure Pipeline is projected to be USD 242 Billion over the five-year period from financial years 2024–25 to 2028–29, reflecting a 14% increase compared to the forecast made 12 months prior for the equivalent period of 2023–24 to 2027–28. Major projects, including the Sydney to Newcastle High-Speed Rail and Melbourne Metro Tunnel Expansion, require significant steel quantities, directly benefiting ferroalloy producers. Growing urbanization in cities like Sydney, Melbourne, and Brisbane generates consistent residential and commercial construction activity requiring structural steel, reinforcement bars, and roofing materials.

Strong Mining Sector Requirements and Resource Extraction Activities

Australia’s status as a global mining powerhouse underpins sustained demand for ferroalloys through extensive equipment manufacturing, infrastructure development, and day-to-day operational needs across resource extraction activities. Continuous steel consumption in iron ore, gold, copper, and emerging critical mineral operations provides stability even when construction demand softens. Heavy-duty mining equipment, such as excavators, haul trucks, crushers, and processing plants, relies on high-strength, wear-resistant steel produced using ferroalloys to ensure durability in harsh operating environments. Ongoing expansion of lithium and other battery mineral projects further strengthens demand for specialized steels used in extraction, processing, and transport systems. As mining companies invest in productivity improvements, automation, and deeper resource development, ferroalloys remain essential inputs supporting reliable performance, safety, and long service life across Australia’s mining value chain.

Government Support and Green Steel Transition

Supporting government policies, ranging from manufacturing expansion plans within the country to the promotion of green steel production methods, are proving to be an important factor in enhancing the overall growth of the Australia ferroalloys market. Initiatives at both the government and state levels are facilitating investments in new production technologies and automation, in order to increase efficiency. Dedicated green steel and green metals programs signal long-term policy commitment to decarbonizing steelmaking while maintaining industrial capability within Australia. Incentives focused on innovations, infrastructure upgrades, and cleaner energy integration are enabling producers to modernize ferroalloy operations and reduce environmental impact. State-level strategies further reinforce regional manufacturing development, supporting job creation and localized value addition. Together, these policy frameworks create a stable investment environment, encourage technology adoption, and position Australia as a credible supplier of sustainable ferroalloys to both domestic and international steel markets.

Market Restraints:

What Challenges the Australia Ferroalloys Market is Facing?

High Energy Costs Impacting Production Competitiveness

Australian ferroalloy producers face significant challenges from elevated energy costs that impact manufacturing competitiveness against international suppliers operating in regions with lower electricity prices. Ferroalloy production represents an energy-intensive process where electricity expenses constitute a substantial portion of total operating costs. The wholesale cost of electricity in Australia is increasing, creating margin pressures across manufacturing operations and challenging producer profitability against imported alternatives from lower-cost production regions.

Import Competition from Low-Cost International Producers

Intensifying competition from low-cost ferroalloy imports, particularly from Southeast Asian producers, creates pricing pressures constraining domestic manufacturers' market share and revenue growth potential. China's dominant position in global ferroalloy production enables aggressive export pricing that challenges Australian producer competitiveness across both domestic consumption and regional export markets. Heightened competition has pressured manufacturers towards industry consolidation, reducing competitive dynamics while squeezing profit margins throughout the ferroalloy supply chain.

Production Disruptions from Extreme Weather Events

Australian ferroalloy production faces vulnerability to extreme weather events that disrupt mining operations, damage critical infrastructure, and interrupt supply chain continuity across key production regions. Tropical cyclone Megan in March 2024 caused widespread damage to the manganese operation on Groote Eylandt, suspending production activities and significantly impacting national ferroalloy output levels. Such weather-related disruptions create supply uncertainties, elevate operational costs through emergency repairs, and require substantial capital investment in infrastructure resilience measures.

Competitive Landscape:

The Australia ferroalloys market features a competitive landscape, characterized by established domestic producers, integrated mining companies, and international participants competing across production and distribution segments. Major players leverage vertical integration strategies connecting upstream mining operations with downstream processing facilities to achieve cost efficiencies and supply chain control. Companies increasingly invest in sustainable production technologies, automation systems, and capacity expansion projects to maintain competitiveness against imported alternatives. Strategic partnerships between Australian producers and international equipment suppliers facilitate technology transfer and operational upgrades enhancing product quality and manufacturing efficiency.

Australia Ferroalloys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Ferrochrome, Ferromanganese, Ferro Silicomanganese, Ferrosilicon, Others |

| Applications Covered | Carbon and Low Alloy Steel, Stainless Steel, Alloy Steel, Cast Iron, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia ferroalloys market size was valued at USD 1.7 Billion in 2025.

The Australia ferroalloys market is expected to grow at a compound annual growth rate of 5.33% from 2026-2034 to reach USD 2.7 Billion by 2034.

Ferromanganese dominated the market with a share of 32%, driven by its critical role as a deoxidizing and desulfurizing agent in steel production and Australia's substantial manganese ore reserves supporting domestic manufacturing capabilities.

Key factors driving the Australia ferroalloys market include expanding infrastructure development, robust mining sector requirements, government support for domestic manufacturing, and growing investments in green steel production technologies.

Major challenges include high energy costs impacting production competitiveness, intensifying import competition from low-cost international producers, production disruptions from extreme weather events, and supply chain vulnerabilities affecting raw material availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)