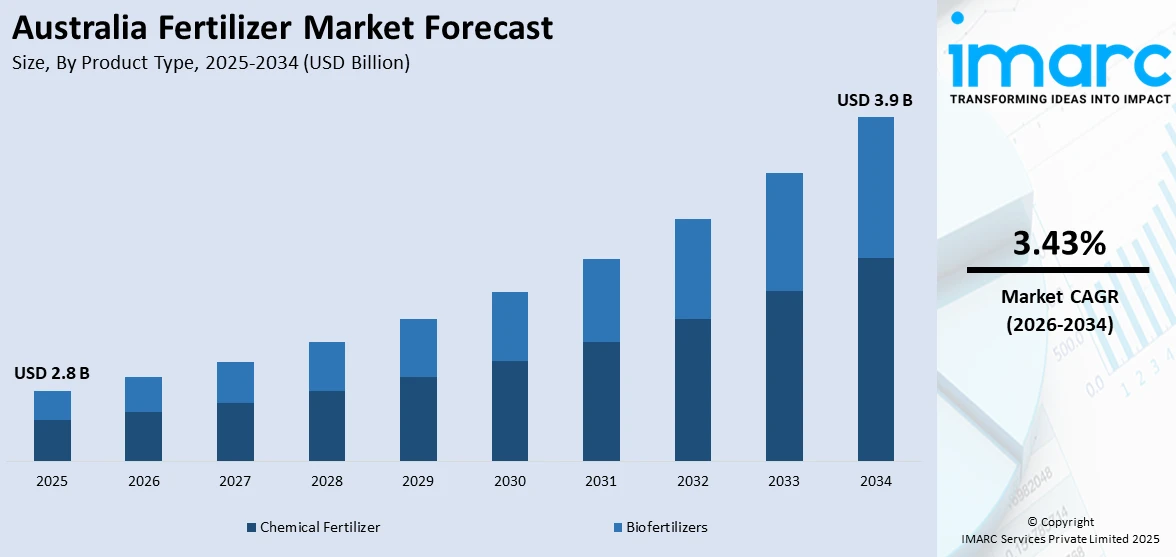

Australia Fertilizer Market Report by Product Type (Chemical Fertilizer, Biofertilizers), Product (Straight Fertilizers, Complex Fertilizers), Product Form (Dry, Liquid), Crop Type (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Flowers and Ornamentals, and Others), and Region 2026-2034

Market Overview:

Australia fertilizer market size reached USD 2.8 Billion in 2025. Looking forward, the market is expected to reach USD 3.9 Billion by 2034, exhibiting a growth rate (CAGR) of 3.43% during 2026-2034. The increasing preferences among farmers across the country towards organic product variants that promote soil health and minimize ecological impact are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2034 | USD 3.9 Billion |

| Market Growth Rate (2026-2034) | 3.43% |

Fertilizer is a chemical substance applied to land or soil to increase crop yield. The main purpose is to enhance the growth and productivity of plants by supplying essential nutrients. These nutrients, such as nitrogen, potassium, phosphorus, etc., are crucial for plant development. Additionally, it improves the soil's ability to retain water. Fertilizer is broadly categorized into organic and inorganic types. Organic fertilizers, derived from plants and animals, are natural and contribute to an increase in organic matter in the soil. They stimulate microbial reproduction and bring about changes in the soil's physical and chemical composition. In contrast, inorganic fertilizers are synthetic chemicals produced through artificial methods. Fertilizers are easy to transport, store, apply, etc. They readily dissolve in the soil. In line with this, these substances are also known for their predictability, reliability, and swift impact on crops. Consequently, they play a vital role in fostering plant health and maximizing agricultural output.

To get more information on this market Request Sample

Key Trends of Australia Fertilizer Market:

Precision Farming and Digital Farming Solutions

One of the emerging trends in Australia's fertilizer market is the growth of precision agriculture and digital farming solutions. Farmers throughout regions such as the Murray‑Darling Basin and Western Australia are adopting soil-mapping technology, field monitoring through drones, and yield data analysis to maximize fertilizer application. These technologies assist in aligning nutrient inputs with requirements of crops, reducing wastage and environmental loss while increasing productivity. Online platforms facilitate site-specific recommendation of fertilizers according to soil fertility, moisture levels, and previous yield performance. Such a trend resonates with sustainable farming objectives and is attractive for large-scale producers of grain, cotton, and horticultural crops concerned with cost-effectiveness and environmental care. Fertilizer formulators are, in turn, responding by providing customized blends and low-rate-of-application products that complement these precision systems. Overall, the trend toward data-driven nutrient management is transforming the Australia fertilizer market share, promoting innovation and improved resource use in various cropping regions.

Expansion of Controlled-Release and Specialty Fertilizers

Another new trend in Australia's fertilizer industry is increasing demand for controlled release and specialty fertilizer formulations. Conventional fertilizers are being complemented or substituted by slow- and controlled-release fertilizers that release nutrients over a period, lessening nitrogen volatilization and phosphorus fixation in Australian soils, particularly in sandy, acidic, or calcareous soils. This is especially beneficial where there is a risk of nutrient leaching or alkalinity in soils prevalent in certain areas of Queensland and South Australia. Specialty fertilizers, such as micronutrient mixtures specific to iron and zinc deficiencies, are becoming popular among vineyards, orchards, and specialty vegetable businesses in Victoria and Tasmania. Fertilizer manufacturers are increasing their product lines to incorporate polymer-coated granules, efficiency-enhanced nitrogen products, and colloidal or foliar-applied micronutrient solutions. These technologies aid sustainable farm systems, enhance nutrient use efficiency, and address demands of environmentally aware farmers for lower input losses and improved crop quality, which further contributes to the growth of Australia fertilizer market demand.

Emerging Demand for Organic and Bio-based Fertilizer Solutions

Due to consumer trends as well as regenerative agriculture practices, Australia's fertilizer industry is seeing increasing demand for organic and bio-based nutrient offerings. With a healthy local organic food industry and exporter image, especially from areas such as New South Wales and Victoria where livestock and horticulture farming exist together, there is increasing demand for fertilizers produced through composting, microbial inoculants, and plant-based nutrient amendments. These environmentally friendly products promote soil health, microbial function, and long-term fertility, which are consistent with Australian regenerative farming programs and cover cropping systems. Bio-fertilizers are also becoming more acceptable in South Australian and Tasmanian wine regions, where viticulturists look for low-impact, eco-certified inputs. Soil-friendly products made from seaweed extracts, nitrogen from manure, and inoculants specifically designed for the Australian biomes of the soil are creating new market niches. Suppliers are meeting the demand through traceable, locally manufactured organic fertilizers acceptable to certified organic growers as well as to mainstream farmers looking for sustainable, consumer-acceptance-approved nutrient solutions.

Growth Drivers of Australia Fertilizer Market:

Growing Agricultural Production and Crop Diversification

One of the primary growth drivers for Australia's fertilizer industry is growing agricultural production across a range of cropping systems. From broadacre grain and pulse farming in Western Australia and New South Wales to high-value horticulture in states such as Victoria and Queensland, agriculture in Australia remains dynamic with increased focus on productivity and crop diversification. The drive to raise yields on irrigated as well as dryland farms generates regular demand for various fertilizers designed specifically for various soil types and crop requirements. The nation's extensive export-oriented production consisting of wheat, barley, canola, and cotton, is also pushing producers to invest in fertilizers that are capable of sustaining quantity and quality standards demanded by overseas consumers. Moreover, the emergence of new crops such as avocados and almonds in areas such as South Australia and the Murray-Darling Basin has brought in new nutrient management issues, further fueling demand for specialist fertilizer products that promote root development, flowering, and fruit growth.

Soil Health Issues and Nutrient Deficiency

Another key driver of the Australia fertilizer market growth is the pervasive problem of soil nutrient deficiency and heterogeneity. Most Australian soils, particularly in areas such as Western Australia and Northern Territory, are inherently poor in essential nutrients like nitrogen, phosphorus, and potassium. Nutrient imbalances have been further accentuated by years of intensive farming without balanced replenishment, rendering the application of fertilizers a necessary step to keep the soil fertile. Growers are increasingly turning towards soil testing and agronomic recommendations to identify the best fertilizers and doses to apply. On sandy and acidic soils, prevalent in much of southern and coastal Australia, specialized nutrient programs are necessary to counteract leaching and low nutrient retention. This creates demand for traditional NPK fertilizers and products supplemented with micronutrients such as zinc, boron, and manganese. With increased awareness surrounding long-term soil health, farmers are also spending on organic conditioners and amendments for the soil, further broadening the base of the fertilizer market within the country.

Government Support and Climate Resilience Strategies

Governmental programs and climate resilience requirements are also driving expansion in Australia's fertilizer market. Via rural development grants, soil improvement initiatives, and agricultural extension programs, federal and state governments encourage appropriate fertilizer utilization to maximize farm productivity and environmental sustainability. Farmers are helped to implement precision agriculture, conservation tillage, and best fertilization practices to counteract soil erosion, salinity, and drought tolerance, which are issues widespread throughout Australia's diverse climate regions. Additionally, with climate change promoting irregular rainfalls and weather extremes, the value of effective use of fertilizer is even more significant. Farmers are increasingly looking for fertilizer products that enhance water-use efficiency, enhance stress tolerance in plants, and increase nutrient acquisition under changing environmental conditions. This demand for climate-smart agriculture is stimulating the development of new-age fertilizers and catalyzing the collaboration of manufacturers, agronomists, and the government to make Australian farms productive and competitive under a shifting climate.

Government Support of Australia Fertilizer Market:

Federal and State-Level Agricultural Financing Initiatives

Government assistance forms the cornerstone of fertilizer industry development and sustainability in Australia. The federal government has numerous agricultural initiatives and rural development grants that offer financial support for soil improvement and nutrient management schemes. The initiatives aim to promote sustainable agriculture while guaranteeing high productivity for domestic as well as export markets. State governments, especially those in agriculturally intensive states like Victoria, New South Wales, and Queensland, also operate focused funding programs that assist farmers in embracing state-of-the-art fertilization techniques. Some of these are subsidies on precision agriculture equipment, incentives for soil testing services, and financing for trials of new fertilizer products. By these programs, the government promotes the transition from bulk fertilizer applications to targeted uses that enhance soil quality and nutrient use efficiency. This organized support system is particularly critical in making advanced solutions accessible to small and medium-sized farmers that would otherwise be too expensive, facilitating extensive adoption across farm sizes and crops.

Encouraging Sustainable Fertilizer Practices

According to the Australia fertilizer market analysis, the government has grown to emphasize the promotion of environmentally friendly fertilizer practices to address climatic challenges as well as public anxiety regarding land degradation. Initiatives by organizations like the Department of Agriculture, Water and the Environment focus on the necessity of minimizing runoff and leaching of nutrients—concerns most critical in ecologically sensitive areas like the catchment regions of the Great Barrier Reef. The initiatives tend to include cooperative ventures with universities, research centers, and manufacturers of fertilizers to establish best practices as well as enhance the performance of their products. Government-sponsored campaigns also seek to inform people about balanced fertilization, the importance of micronutrients, and substitutes like organic and bio-based fertilizers. Extension programs and workshops funded by local municipalities and state agriculture ministries provide on-ground training and education, particularly in rural communities. This practical training enhances farmer knowledge and practice of prudent fertilization techniques, connecting environmental stewardship to long-term farm productivity objectives. These policies shape market demand and guide future product direction.

Encouragement for Innovation and Research in Fertilizer Technologies

Research and innovation in fertilizer technology are strongly supported by the Australian government, who acknowledge the necessity of locally adapted options in the context of climate variability and soil heterogeneity. Fundings like the Rural Research and Development Corporations (RDCs), grains, cotton, and horticulture, fund resources into fertilizer research and field testing. This funding promotes the development of new products, including controlled-release fertilizers and biofertilizers, that fit Australian climates and soils. In difficult soils such as those of Western Australia's sandy soils or South Australia's alkaline soils, research funded by the government is essential to determine nutrient requirements and enhance fertilizer utilization. Such initiatives are also part of overall agricultural goals aimed at increased yield, soil sustainability, and carbon sequestration. By promoting cooperation among research centers, industry players, and farmers, the Australian government actively fosters the culture that encourages innovation and drives growth in the fertilizer industry.

Australia Fertilizer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, product, product form, and crop type.

Product Type Insights:

- Chemical Fertilizer

- Biofertilizers

The report has provided a detailed breakup and analysis of the market based on the product type. This includes chemical fertilizer and biofertilizers.

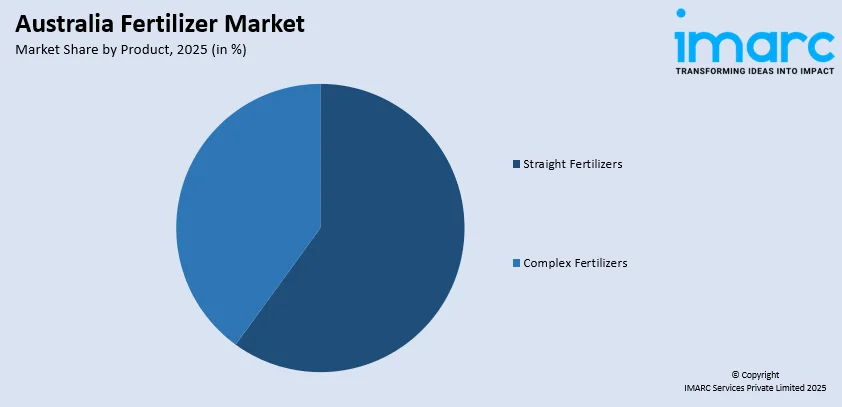

Product Insights:

Access the comprehensive market breakdown Request Sample

- Straight Fertilizers

- Nitrogenous Fertilizers

- Urea

- Calcium Ammonium Nitrate

- Ammonium Nitrate

- Ammonium Sulfate

- Anhydrous Ammonia

- Others

- Phosphatic Fertilizers

- Mono-Ammonium Phosphate (MAP)

- Di-Ammonium Phosphate (DAP)

- Single Super Phosphate (SSP)

- Triple Super Phosphate (TSP)

- Others

- Potash Fertilizers

- Muriate of Potash (MoP)

- Sulfate of Potash (SoP)

- Secondary Macronutrient Fertilizers

- Calcium Fertilizers

- Magnesium Fertilizers

- Sulfur Fertilizers

- Micronutrient Fertilizers

- Zinc

- Manganese

- Copper

- Iron

- Boron

- Molybdenum

- Others

- Nitrogenous Fertilizers

- Complex Fertilizers

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes straight fertilizers [nitrogenous fertilizers (urea, calcium ammonium nitrate, ammonium nitrate, ammonium sulfate, anhydrous ammonia, and others), phosphatic fertilizers (mono-ammonium phosphate (MAP), di-ammonium phosphate (DAP), single super phosphate (SSP), triple super phosphate (TSP), and others), potash fertilizers (muriate of potash (MoP) and sulfate of potash (SoP)), secondary macronutrient fertilizers (calcium fertilizers, magnesium fertilizers, and sulfur fertilizers), micronutrient fertilizers (zinc, manganese, copper, iron, boron, molybdenum, and others)], and complex fertilizers.

Product Form Insights:

- Dry

- Liquid

The report has provided a detailed breakup and analysis of the market based on the product form. This includes dry and liquid.

Crop Type Insights:

- Grains and Cereals

- Pulses and Oilseeds

- Fruits and Vegetables

- Flowers and Ornamentals

- Others

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes grains and cereals, pulses and oilseeds, fruits and vegetables, flowers and ornamentals, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fertilizer Market News:

- In December 2024, Agfert Fertilizers in Australia said that in order to meet the demands of the approaching fertilizer application season, it plans to complete its new 20,000t fertilizer storage and distribution plant on the Eyre Peninsula in South Australia by February or March 2025. Three major stockpiles and eight smaller sections will make up the new facility's roughly 10,000m² of covered storage. Triple road trains will be able to load at the location because to the facility's five multi-hoppers, which can carry goods onto an 80-meter weighbridge. After it is finished, Agfert Fertilizers will have about 80,000 t of fertilizer storage space spread over Southern Australia. Agfert's facilities in Cowell and Balaklava will store urea, phosphates, and other fertilizers; a total throughput of more than 100,000 t/yr is expected.

- In February 2025, Incitec Pivot Fertilisers (IPF) enhanced farmer access to fertilisers in the Murrumbidgee Irrigation Area (MIA) of New South Wales after finishing a USD 2.5 Million investment in its Whitton EASY Liquids facility. The newly enhanced Whitton facility was inaugurated yesterday, with attendance from growers, IPF clients, and representatives from the agricultural sector. IPF President, Scott Bowman, stated that IPF's investment in the Whitton EASY Liquids facility involved setting up an on-site tank farm, boosting capacity by roughly 30% to 5 million liters.

- In August 2024, Incitec Pivot Fertilisers (IPF) launched its revamped fertiliser import and distribution facility in Portland, regional Victoria, after investing USD 20 million in the location. As the primary fertiliser provider on Australia’s East Coast, IPF’s substantial investment in this strategically vital facility will improve its operational efficiency and storage capabilities, providing advantages for growers. IPF President, Scott Bowman, inaugurated the cutting-edge facility yesterday, accompanied by growers, IPF clients, and representatives from the agricultural sector.

Australia Fertilizer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chemical Fertilizer, Biofertilizers |

| Products Covered |

|

| Product Forms Covered | Dry, Liquid |

| Crop Types Covered | Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Flowers and Ornamentals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fertilizer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fertilizer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia fertilizer market was valued at USD 2.8 Billion in 2025.

The Australia fertilizer market is projected to exhibit a CAGR of 3.43% during 2026-2034.

The Australia fertilizer market is expected to reach a value of USD 3.9 Billion by 2034.

The Australia fertilizer market trends include the rise of precision agriculture and data-led nutrient management, emphasizing targeted application based on soil and crop needs. There is growing uptake of controlled-release and specialty fertilizers tailored to regional soil limitations. Additionally, interest in organic and bio-based fertilizer solutions is increasing within regenerative and sustainable farming ecosystems.

The Australia fertilizer market is driven by expanding agricultural production, diverse cropping systems, and increasing soil nutrient depletion. Government support for sustainable farming, adoption of precision agriculture, and rising demand for high-value crops further boost fertilizer use. Climate variability also encourages efficient nutrient management to maintain productivity across varied regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)