Australia Fiber Cement Market Size, Share, Trends and Forecast by Raw Material, Construction Type, End Use, and Region, 2025-2033

Australia Fiber Cement Market Overview:

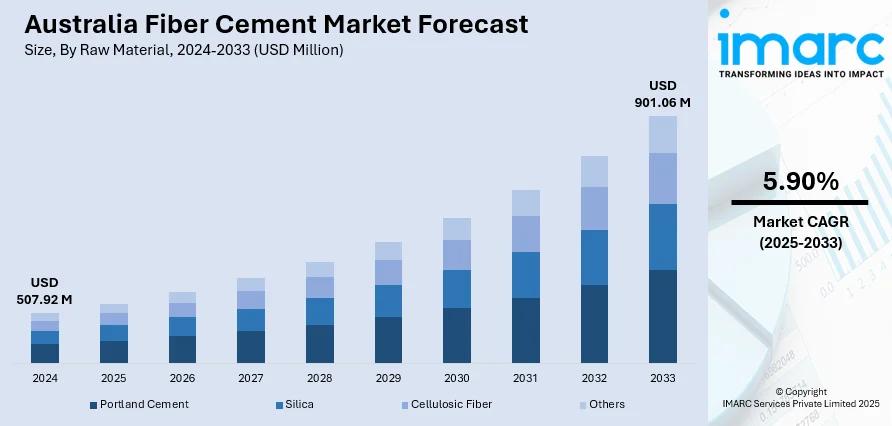

The Australia fiber cement market size reached USD 507.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 901.06 Million by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. The market is expanding due to rising demand for durable, low-maintenance construction materials and increased urban development. Moreover, strategic acquisitions and financial disclosures from key players continue to shape growth, directly influencing Australia fiber cement market share across residential and commercial segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 507.92 Million |

| Market Forecast in 2033 | USD 901.06 Million |

| Market Growth Rate 2025-2033 | 5.90% |

Australia Fiber Cement Market Trends:

Market Consolidation Through Strategic Acquisitions

The Australian fiber cement market has been shaped by a trend of consolidation, where established global firms are acquiring local operations to deepen their presence and improve supply chain efficiency. This consolidation helps reduce operational redundancies, improve logistics, and broaden market access across growing urban and regional zones. It also reflects the industry’s shift towards integrated operations that can rapidly meet local construction needs. By acquiring existing businesses, companies benefit from built infrastructure, trained staff, and existing customer relationships—factors critical in reducing entry barriers. For instance, in October 2023, Etex signed an agreement to acquire BGC’s fiber cement and plasterboard businesses in Australia. The deal included a 56,000-square-metre plant in Perth and a strong network of nine warehouses across Australia and New Zealand. This gave Etex a solid distribution and manufacturing base, allowing it to meet regional demand more efficiently. The acquisition also brought in 200 skilled employees, further strengthening local capacity. With this move, Etex positioned itself as a top three player in Australia’s fibre cement market. This trend of market consolidation is expected to continue as global players look to expand through acquisition, increasing competition, optimizing costs, and improving product availability throughout Australia’s growing residential and commercial construction sectors.

To get more information on this market, Request Sample

Investor Attention on Financial and Strategic Outlooks

A noticeable trend in the Australia fiber cement market growth is the growing influence of corporate financial disclosures and earnings announcements in guiding market sentiment and strategy. Stakeholders including developers, contractors, and investors—are closely watching these updates to interpret future market movements, pricing strategies, and innovation pipelines. These insights help industry participants understand how leaders plan to handle cost pressures, sustainability goals, and changing demand patterns. For instance, in April 2025, James Hardie, the global leader in fiber cement, announced the upcoming release of its Q4 FY25 results, scheduled for May 20 in the U.S. and May 21 in Australia. This announcement was significant not just for investors but also for competitors and buyers in the region. As the company holds a large share in Australia’s fiber cement space through its Hardie® branded products, any financial update signals a broader industry direction. These announcements often include data on product uptake, regional performance, and margin outlooks—factors that influence procurement decisions and project timelines. The increasing importance of such updates points to a market that values transparency, performance metrics, and forward-looking strategies. This trend has made corporate earnings a key driver in shaping expectations, boosting planning accuracy, and reinforcing trust in fiber cement as a stable construction material.

Australia Fiber Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on raw material, construction type, and end use.

Raw Material Insights:

- Portland Cement

- Silica

- Cellulosic Fiber

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes Portland cement, silica, cellulosic fiber, and others.

Construction Type Insights:

- Siding

- Roofing

- Molding and Trim

- Others

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes siding, roofing, molding and trim, and others.

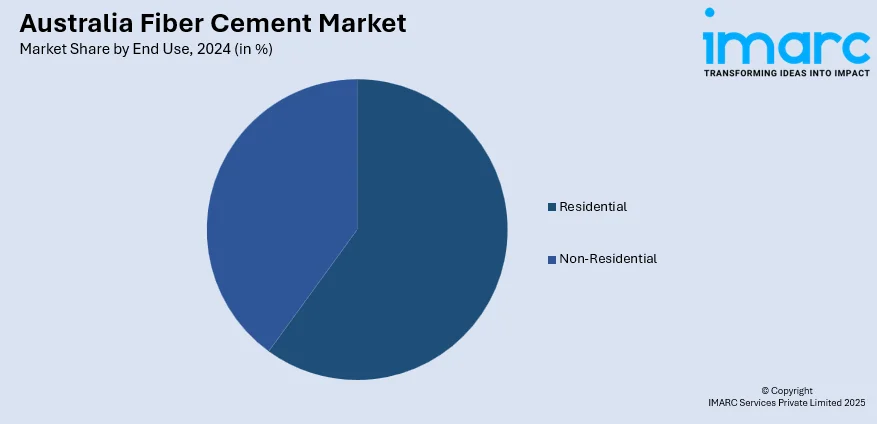

End Use Insights:

- Residential

- Non-Residential

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential and non-residential.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fiber Cement Market News:

- March 2024: Etex completed the acquisition of BGC’s fibre cement and plasterboard businesses, including a Perth plant and nine warehouses. This move expanded Etex’s footprint in Australia and New Zealand, boosted its sustainable fibre cement offerings, and elevated it to a top-three market position.

- February 2024: HVG Facades launched Vetérro, a high-density fibre cement cladding product in Australia. Vetérro offered fire resistance, durability, and design flexibility. Its nationwide release expanded material choices, supporting market growth in architectural applications across residential, commercial, education, and healthcare sectors.

Australia Fiber Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Portland Cement, Silica, Cellulosic Fiber, Others |

| Construction Types Covered | Siding, Roofing, Molding and Trim, Others |

| End Uses Covered | Residential, Non-Residential |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia fiber cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia fiber cement market on the basis of raw material?

- What is the breakup of the Australia fiber cement market on the basis of construction type?

- What is the breakup of the Australia fiber cement market on the basis of end use?

- What is the breakup of the Australia fiber cement market on the basis of region?

- What are the various stages in the value chain of the Australia fiber cement market?

- What are the key driving factors and challenges in the Australia fiber cement market?

- What is the structure of the Australia fiber cement market and who are the key players?

- What is the degree of competition in the Australia fiber cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fiber cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fiber cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fiber cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)