Australia Fiber Cement Roofing Market Size, Share, Trends and Forecast by Product Type, Material Composition, Application, End Use Sector, and Region, 2025-2033

Australia Fiber Cement Roofing Market Overview:

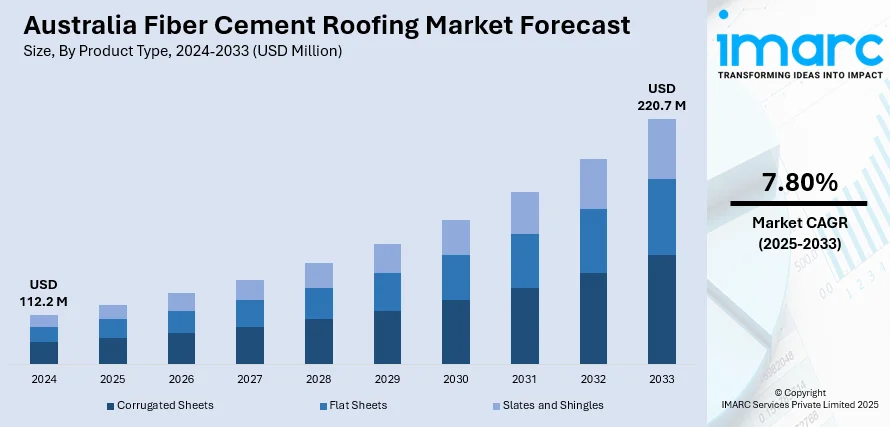

The Australia fiber cement roofing market size reached USD 112.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 220.7 Million by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. The market is majorly driven by the rising demand for fire-resistant and weather-durable roofing, especially in bushfire-prone regions with stringent safety regulations. In parallel, rapid urban housing expansion and affordable residential projects increase reliance on cost-efficient, low-maintenance materials, thereby fueling the market. Environmental mandates and energy standards are also driving the adoption of recyclable, thermally efficient roofing, further augmenting the Australia fiber cement roofing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 112.2 Million |

|

Market Forecast in 2033

|

USD 220.7 Million |

| Market Growth Rate 2025-2033 | 7.80% |

Australia Fiber Cement Roofing Market Trends:

Increasing Preference for Bushfire-Resistant and Durable Roofing

Australia’s frequent exposure to extreme weather events, particularly bushfires and hailstorms, has made fire-resistant and impact-tolerant materials essential for roofing. Since 2019, 84% of Australians have been directly affected by at least one climate-fueled disaster. Between 2008–09 and 2022–23, 240,828 displacements occurred due to extreme weather, with 68% of fire-related displacements from the Black Summer and 68% of flood-related ones from 2020–22. The Australian Government has responded to 226 disasters since 2019–20 to present day, affecting 80% of local government areas nationwide. Fiber cement roofing, classified as non-combustible, is widely preferred in bushfire-prone zones due to its ability to resist ignition from airborne embers and radiant heat. The material’s long lifespan, resistance to warping, and low maintenance requirements further increase its suitability for harsh Australian climates. In both rural and suburban settings, property owners are actively seeking compliant building materials as required by the Bushfire Attack Level (BAL) ratings. Roofing materials must now meet safety and performance benchmarks set by the Australian Standards (AS 3959), which fiber cement fulfills effectively. These regulatory expectations, combined with insurers’ growing emphasis on risk mitigation, are driving wider acceptance of fiber cement alternatives. Additionally, consumers are shifting away from flammable or high-maintenance roofing options toward solutions that meet long-term safety and environmental goals. These factors have become critical to Australia fiber cement roofing market growth, particularly in disaster-prone regions prioritizing resilient construction.

To get more information on this market, Request Sample

Urban Residential Development and Affordable Housing Initiatives

Urban growth in major cities such as Sydney, Melbourne, and Brisbane has led to expanding demand for high-density, affordable, and low-maintenance housing. At the end of March 2023, 56% of the 240,000 new dwellings under construction in Australia were high-density. Higher-density home commencements jumped by 44.8% in the first quarter of 2023, contributing to an overall 14% rise in new home builds. Fiber cement roofing appeals to residential developers for its cost-efficiency, aesthetic versatility, and structural compatibility with a wide range of architectural styles. As governments implement affordable housing programs, including public-private partnerships and regional development schemes, there is rising preference for materials that offer both durability and lower lifecycle costs. Builders appreciate the lightweight nature of fiber cement, which reduces structural load and expedites installation, thereby minimizing labor expenses. The product’s adaptability, available in various textures and finishes, also meets evolving design preferences without compromising performance. As duplexes, townhomes, and mid-rise apartments continue to dominate urban housing developments, roofing materials that balance appearance, cost, and regulatory compliance are in high demand. These factors are ensuring fiber cement’s continued relevance in large-scale construction and subdivision projects, particularly within infrastructure-backed residential zones supported by public policy and urban renewal agendas.

Australia Fiber Cement Roofing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material composition, application, and end use sector.

Product Type Insights:

- Corrugated Sheets

- Flat Sheets

- Slates and Shingles

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated sheets, flat sheets, and slates and shingles.

Material Composition Insights:

- Asbestos Fiber Cement

- Non-Asbestos Fiber Cement

The report has provided a detailed breakup and analysis of the market based on the material composition. This includes asbestos fiber cement and non-asbestos fiber cement.

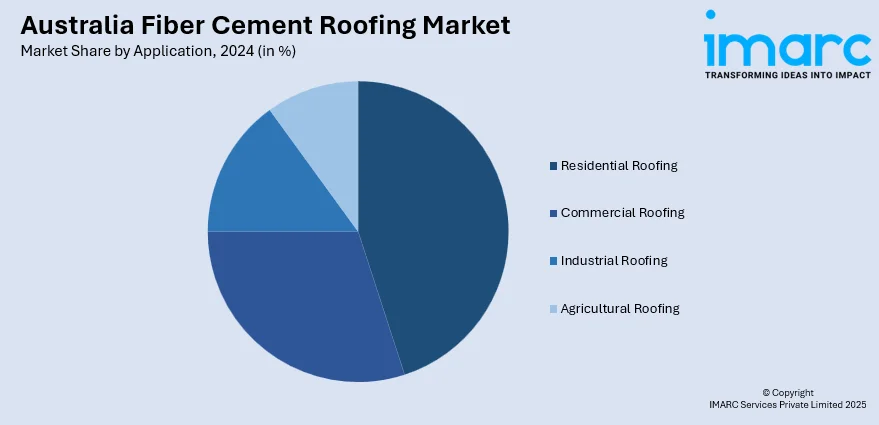

Application Insights:

- Residential Roofing

- Commercial Roofing

- Industrial Roofing

- Agricultural Roofing

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential roofing, commercial roofing, industrial roofing, and agricultural roofing.

End Use Sector Insights:

- New Construction

- Replacement and Renovation

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes new construction and replacement and renovation.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fiber Cement Roofing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Sheets, Flat Sheets, Slates and Shingles |

| Material Compositions Covered | Asbestos Fiber Cement, Non-Asbestos Fiber Cement |

| Applications Covered | Residential Roofing, Commercial Roofing, Industrial Roofing, Agricultural Roofing |

| End Use Sectors Covered | New Construction, Replacement and Renovation |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia fiber cement roofing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia fiber cement roofing market on the basis of product type?

- What is the breakup of the Australia fiber cement roofing market on the basis of material composition?

- What is the breakup of the Australia fiber cement roofing market on the basis of application?

- What is the breakup of the Australia fiber cement roofing market on the basis of end use sector?

- What is the breakup of the Australia fiber cement roofing market on the basis of region?

- What are the various stages in the value chain of the Australia fiber cement roofing market?

- What are the key driving factors and challenges in the Australia fiber cement roofing market?

- What is the structure of the Australia fiber cement roofing market and who are the key players?

- What is the degree of competition in the Australia fiber cement roofing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fiber cement roofing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fiber cement roofing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fiber cement roofing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)