Australia Fiberglass Market Size, Share, Trends and Forecast by Glass Product Type, Glass Fiber Type, Resin Type, Application, End User, and Region, 2025-2033

Australia Fiberglass Market Overview:

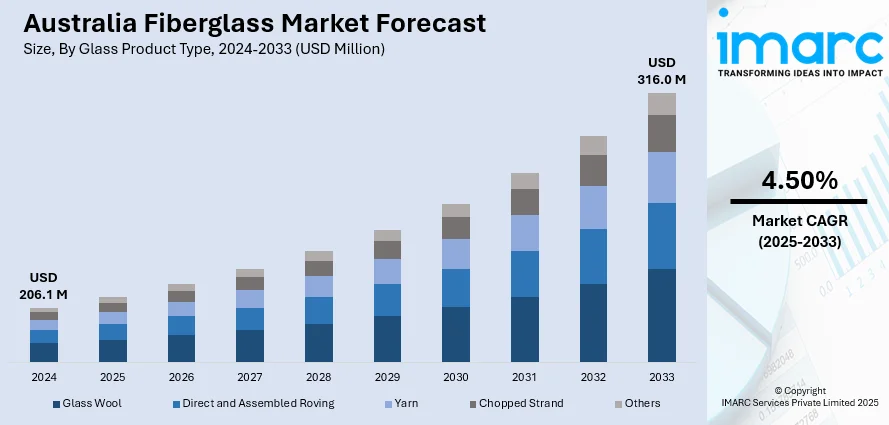

The Australia fiberglass market size reached USD 206.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 316.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is witnessing steady growth due to demand from a range of industries including construction, automotive, and marine. The material's light weight, strength, and corrosion resistance make it a favorite among both commercial and residential users. Moreover, technological improvements in production are improving fiberglass efficiency. As industries look for sustainable and cost-efficient solutions, fiberglass continues to hold a significant Australia fiberglass market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 206.1 Million |

| Market Forecast in 2033 | USD 316.0 Million |

| Market Growth Rate 2025-2033 | 4.50% |

Australia Fiberglass Market Trends:

Growing Demand from Renewable Energy Industry

The Australia fiberglass industry is seeing significant traction with the growing take-off in renewable energy infrastructure, especially in wind energy generation. Fiberglass finds extensive application in the production of wind turbine blades because of its low weight and high strength-to-weight ratio as well as its ability to resist corrosion. As Australia increases its investment in renewable energy to achieve emission reduction goals and shift toward a low-carbon economy, the need for high-performance composite materials like fiberglass is likely to boost substantially. This is backed by government incentives as well as the construction of offshore wind farms along Australia's long coastline. Australia fiberglass market outlook is positive, with growth fueled by steady amplifies in applications that contribute to sustainability and clean energy programs. The sector's association with these goals places fiberglass at a strategic position in realizing long-term energy and environmental targets, contributing to the development of industry and the environment as well.

To get more information on this market, Request Sample

Infrastructure Upgrades and Construction Development

Australia's continuous investments in infrastructure and urban growth are playing an important role in the accelerating usage of fiberglass in construction applications. Fiberglass is being highly adopted due to its strength, minimal maintenance, and light weight, which enable it to be utilized in pipes, tanks, panels, and structural elements. For instance, in December 2024, Latham's new fiberglass Plunge Pools was awarded "Most Innovative Product for Retailers" for providing customizable, space-saving designs with energy efficiency, quick installation, and full-sized enjoyment. Moreover, the corrosion and environmental resistance of the material guarantees extended service life, particularly in coastal and industrial areas where conventional materials experience accelerated degradation. Urban growth, especially in cities such as Melbourne, Sydney, and Brisbane, has required the use of sophisticated materials to comply with contemporary building codes and sustainability standards. The construction material for Australia fiberglass market share is highly growing as developers and engineers choose composite solutions to increase project durations and minimize lifecycle expenses. This shift highlights a larger transition in the building sector toward more efficient and performance-driven material solutions that match Australia's infrastructural vision.

Adoption in Automotive and Transport Sectors

Growing focus on weight-reduced materials across the automotive and transport industries has resulted in a wider adoption of fiberglass for use in car production and government-backed infrastructure projects. Fiberglass brings with it excellent benefits of reduced weight, greater fuel efficiency, and advanced safety features, for which there is a strong value in vehicle body panel production, interior parts production, and carriage system construction within railways. For example, in January 2024, Collins Marine announced the Australian release of Navan Boats' new S30 and C30 models—luxury boats boasting ergonomic helm technology, luxe interior, and high-powered Mercury engine configurations. Furthermore, while Australia is targeting its own indigenous vehicle manufacturing expertise and building transportation infrastructure within its regional base, the role of advanced composites is gaining ground. This development is consistent with worldwide trends moving toward sustainable and energy-efficient transportation systems. The Australia fiberglass market growth is supported by technology advances and the intensifying focus on material innovation for regulatory compliance and excellence in performance. Such convergence marks a lasting change in the materials environment, with fiberglass as a foundation of lightweight design and strength in contemporary transportation uses.

Australia Fiberglass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on glass product type, glass fiber type, resin type, application, and end user.

Glass Product Type Insights:

- Glass Wool

- Direct and Assembled Roving

- Yarn

- Chopped Strand

- Others

The report has provided a detailed breakup and analysis of the market based on the glass product type. This includes glass wool, direct and assembled roving, yarn, chopped strand, and others.

Glass Fiber Type Insights:

- E-Glass

- A-Glass

- S-Glass

- AR-Glass

- C-Glass

- R-Glass

- Others

A detailed breakup and analysis of the market based on the glass fiber type have also been provided in the report. This includes E-glass, A-glass, S-glass, AR-glass, C-glass, R-glass, and others.

Resin Type Insights:

- Thermoset Resin

- Thermoplastic Resin

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes thermoset resin and thermoplastic resin.

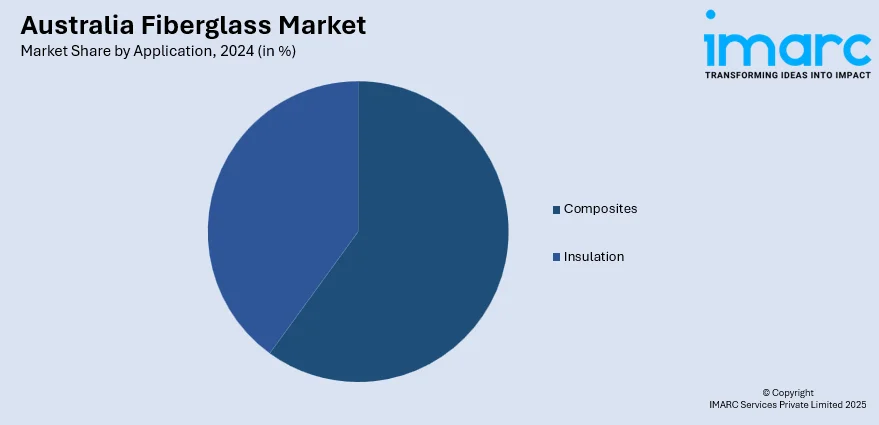

Application Insights:

- Composites

- Insulation

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes composites and insulation.

End User Insights:

- Construction

- Automotive

- Wind Energy

- Aerospace and Defense

- Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes construction, automotive, wind energy, aerospace and defense, electronics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fiberglass Market News:

- In June 2024, Grand Inflatable Boats will launch its luxury fiberglass rigid inflatable boats (RIBs) in Australia. The brand, with its reputation for excellent fiberglass hulls and UV-stabilized materials, enters the Australian market with luxury yacht tenders, family leisure boats, and commercial offerings, focusing on high performance and comfort.

- In January 2023, Latham Group, Inc. (NASDAQ: SWIM) launched two new fiberglass pool models, Tuscan and Enchantment, with contemporary geometric designs, swim-up seating, and splash decks. The upcoming launch, in the first half of 2023, reinforces Latham's leadership position in North America, Australia, and New Zealand.

Australia Fiberglass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Glass Product Types Covered | Glass Wool, Direct and Assembled Roving, Yarn, Chopped Strand, Others |

| Glass Fiber Types Covered | E-Glass, A-Glass, S-Glass, AR-Glass, C-Glass, R-Glass, Others |

| Resin Types Covered | Thermoset Resin, Thermoplastic Resin |

| Applications Covered | Composites, Insulation |

| End Users Covered | Construction, Automotive, Wind Energy, Aerospace and Defense, Electronics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia fiberglass market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia fiberglass market on the basis of product type?

- What is the breakup of the Australia fiberglass market on the basis of glass fiber type?

- What is the breakup of the Australia fiberglass market on the basis of resin type?

- What is the breakup of the Australia fiberglass market on the basis of application?

- What is the breakup of the Australia fiberglass market on the basis of end user?

- What is the breakup of the Australia fiberglass market on the basis of region?

- What are the various stages in the value chain of the Australia fiberglass market?

- What are the key driving factors and challenges in the Australia fiberglass?

- What is the structure of the Australia fiberglass market and who are the key players?

- What is the degree of competition in the Australia fiberglass market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fiberglass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fiberglass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fiberglass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)