Australia Fire Resistant Clothing Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Application, End User, and Region, 2025-2033

Australia Fire Resistant Clothing Market Overview:

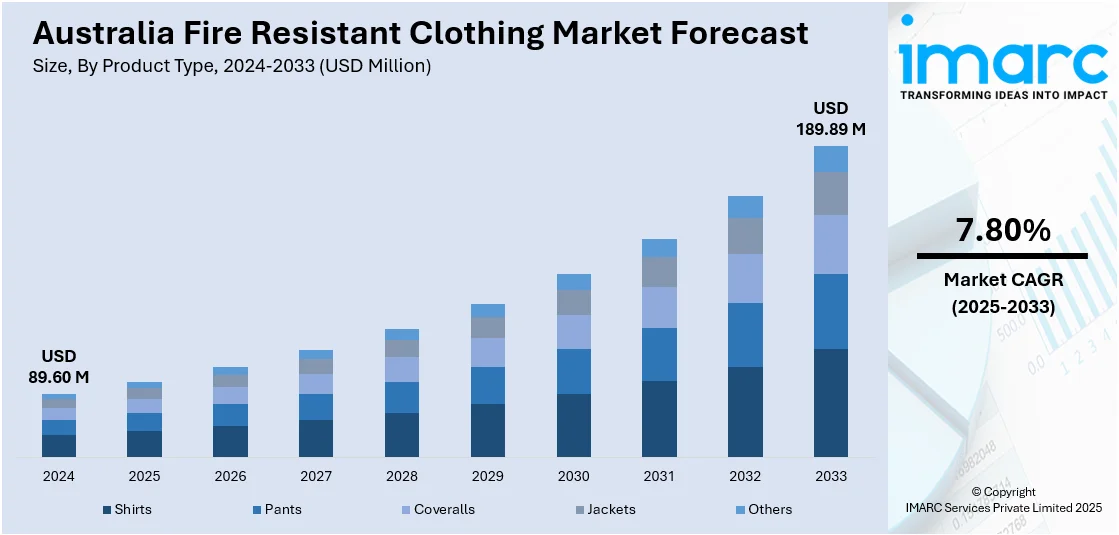

The Australia fire resistant clothing market size reached USD 89.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 189.89 Million by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. The market is growing with new developments in cutting-edge fabric technology, an increasing need for industry-specific bespoke apparel, and a strong emphasis on sustainable, environmentally friendly materials. These drivers promote greater safety, comfort, and environmental stewardship among various industries. As manufacturers remain innovative and responsive, the market can expect consistent growth from changing regulations and consumer tastes. This active evolution strongly influences the Australia fire resistant clothing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 89.60 Million |

| Market Forecast in 2033 | USD 189.89 Million |

| Market Growth Rate 2025-2033 | 7.80% |

Australia Fire Resistant Clothing Market Trends:

Increasing Demand for Novel Fabric Technologies

The market is propelling significantly by advancements in fabric technology to improve safety and comfort. For instance, in August 2023, TenCate Protective Fabrics released its next-generation fire-resistant outer shell, PBI® Peak5, at AFAC Brisbane, providing light comfort and increased durability with Enforce technology for APAC firefighters. Moreover, new flame-retardant fabrics now integrate excellent heat resistance with durability and ventilation, filling essential gaps in high-risk sectors like mining, oil and gas, and electrical utilities. Such fabrics typically incorporate naturally flame-resistant materials or sophisticated chemical treatments, which give protection from severe heat and fire without dampening the wearer's mobility by being light, flexible. Stricter safety standards necessitate the use of protective clothing that is of high standards but still not compromising on mobility. This compels producers to invest money in the research and development of new materials and blends of such materials that best balance performance and comfort. Consequently, employees are afforded protection and durability through the clothes, while businesses enjoy the assurance of compliance. Such innovation continues to drive the Australia fire resistant apparel sector further through the satisfaction of changing market needs.

To get more information on this market, Request Sample

Growing Use of Personalized and Sector-Specific Solutions

The Australia fire resistant clothing market growth is also driven by increasing demand for personalized protective clothing formulated to meet the special needs of diverse industry segments. Various industries like firefighting, electrical utilities, construction, and manufacturing need different levels of flame protection, garment types, and other protective features. This has shifted away from the generic towards customized fire protective clothing with specific features such as chemical resistance, high-visibility panels, moisture-wicking properties, and anti-static. Personalization guarantees garments to be as safe and functional as possible for specific occupational hazards. Furthermore, industry-specific standards and legislation are increasingly affecting procurement decisions, pushing employers towards seeking customized solutions guaranteeing compliance while maximizing worker comfort. This trend encourages higher uptake of fire resistant apparel across industries, underpinning long-term market growth in Australia by meeting the specific needs of end users through focused product development.

Heightening Focus on Sustainable and Environmentally Friendly Materials

Sustainability is highly emerging as a powerful driver for the growth in the Australia fire resistant apparel market, with manufacturers and consumers alike increasingly looking towards environment friendly materials and production processes. The industry is embracing recycled fibers, organic materials, and environmentally friendly flame-retardant processes to minimize environmental impacts. This emphasis runs alongside broader corporate social responsibility efforts and regulatory pressures to adopt sustainable sourcing and manufacturing processes. Environmentally friendly fire-resistant clothing reduces not only landfill waste during use but also energy and chemical use in the manufacturing process. Furthermore, sustainable products are attractive to organizations that want to enhance their green credentials, which is now a significant consideration in procurement. The use of sustainable materials does not compromise protective capability, but rather adds to greater brand value and differentiation in the market. Growing environmental awareness promotes ongoing growth of the Australia fire resistant clothing market by bridging safety and environmental stewardship.

Australia Fire Resistant Clothing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, distribution channel, application, and end user.

Product Type Insights:

- Shirts

- Pants

- Coveralls

- Jackets

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes shirts, pants, coveralls, jackets, and others.

Material Type Insights:

- Treated FR Fabric

- Inherent FR Fabric

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes treated FR fabric and inherent FR fabric.

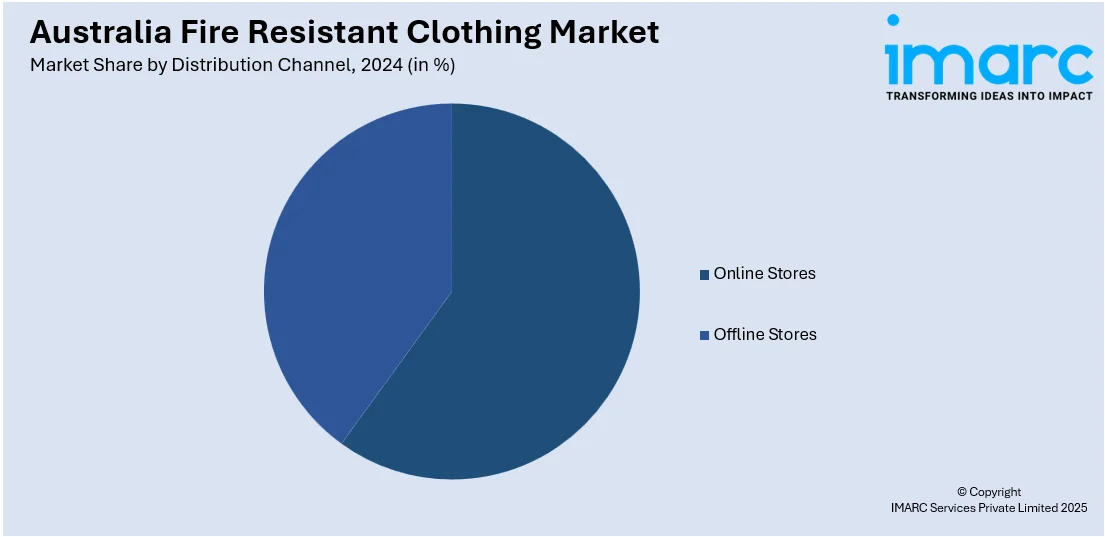

Distribution Channel Insights:

- Online Stores

- Offline Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online stores and offline stores.

Application Insights:

- Oil and Gas

- Construction

- Manufacturing

- Mining

- Military

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas, construction, manufacturing, mining, military, and others.

End User Insights:

- Industrial

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the end user. This includes industrial, commercial, and residential.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Fire Resistant Clothing Market News:

- In April 2024, Workwear Group Uniforms introduces new Wildlands Firefighting range, with KingGee Hi Vis TENCATE Tecasafe 700 flame-resistant fabric coats and trousers. These BSI-approved garments offer frontline firefighters better protection, comfort, and durability for wildland firefighting operations.

Australia Fire Resistant Clothing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shirts, Pants, Coveralls, Jackets, Others |

| Material Types Covered | Treated FR Fabric, Inherent FR Fabric |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Applications Covered | Oil And Gas, Construction, Manufacturing, Mining, Military, Others |

| End Users Covered | Industrial, Commercial, Residential |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia fire resistant clothing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia fire resistant clothing market on the basis of product type?

- What is the breakup of the Australia fire resistant clothing market on the basis of material type?

- What is the breakup of the Australia fire resistant clothing market on the basis of distribution channel?

- What is the breakup of the Australia fire resistant clothing market on the basis of application?

- What is the breakup of the Australia fire resistant clothing market on the basis of end user?

- What is the breakup of the Australia fire resistant clothing market on the basis of region?

- What are the various stages in the value chain of the Australia fire resistant clothing market?

- What are the key driving factors and challenges in the Australia fire resistant clothing?

- What is the structure of the Australia fire resistant clothing market and who are the key players?

- What is the degree of competition in the Australia fire resistant clothing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia fire resistant clothing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia fire resistant clothing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia fire resistant clothing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)